Get the free Michigaas 2021-2026 Form - Fill Out and Sign Printable ...

Get, Create, Make and Sign michigaas 2021-2026 form

Editing michigaas 2021-2026 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out michigaas 2021-2026 form

How to fill out 4884 2025 michigan retirement

Who needs 4884 2025 michigan retirement?

Your Complete Guide to the 4 Michigan Retirement Form

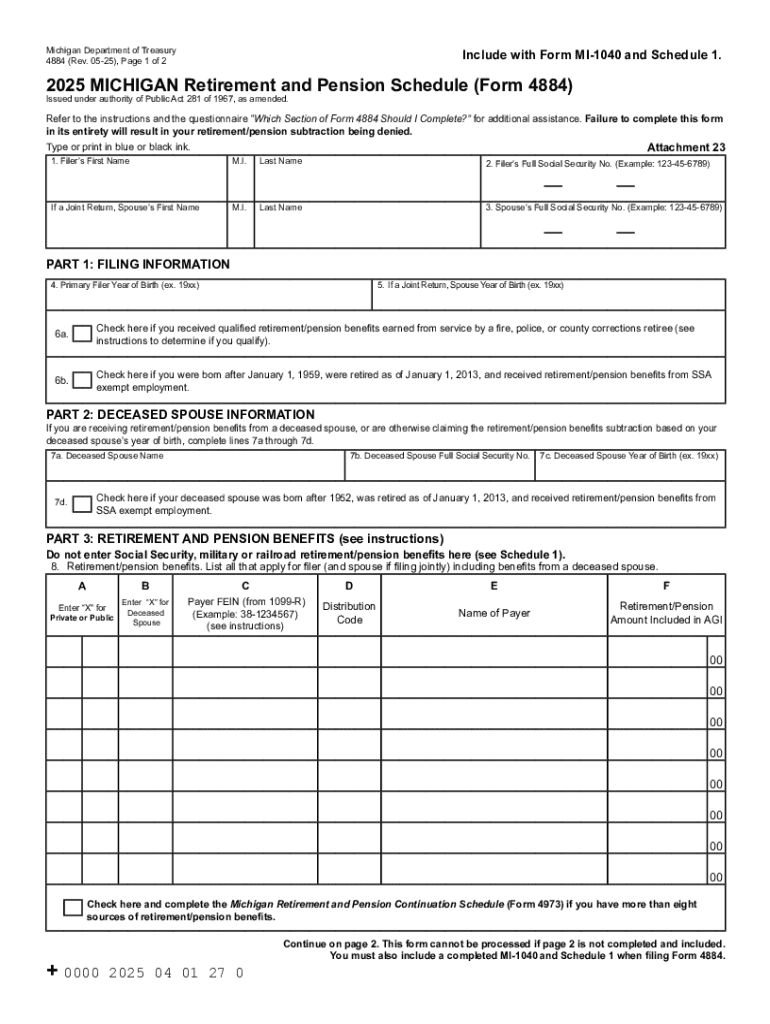

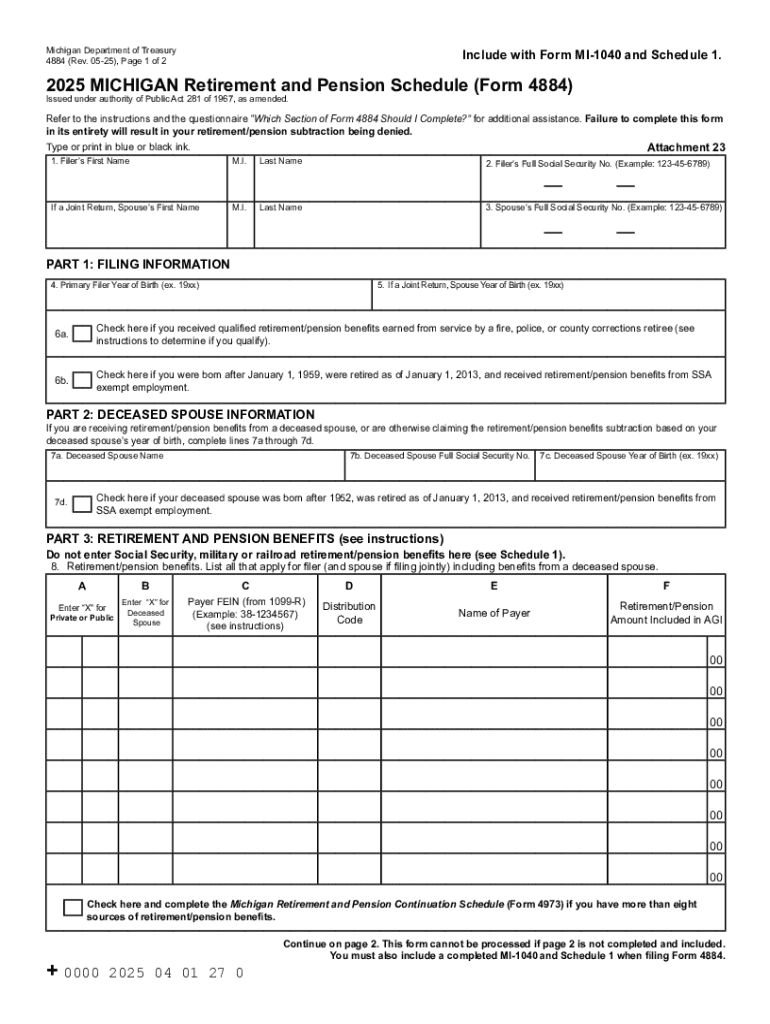

Understanding the 4884 form for Michigan retirement

The 4884 form serves as an essential tool for Michigan retirees, allowing them to officially record and report their retirement income while ensuring they benefit from applicable tax exemptions. This form is pivotal in the process of declaring pension benefits, ensuring compliance with state tax laws, and protecting one's financial future. By accurately completing the 4884 form, retirees can maximize their tax deductions and minimize liabilities, making it a critical aspect of retirement planning.

Individuals who are eligible to fill out the 4884 form typically include those receiving pension income from various retirement plans recognized by the state, including public sector and private sector pension schemes. Understanding eligibility is crucial, as it not only determines who must fill out this document but also what specific retirement plans are subject to Michigan's tax considerations.

Step-by-step guide to completing the 4884 form

Successfully completing the 4884 form requires careful preparation and organization of personal information alongside your retirement plan details. Gather the necessary documents, such as previous tax returns or retirement plan statements, as they will provide the information needed for accurate reporting.

The form comprises several sections, each requiring specific information, including your name, address, and retirement details. To ensure completeness and accuracy, it's beneficial to approach each section methodically.

Common mistakes to avoid when filling out the 4884 form

Completing the 4884 form can be straightforward, but there are pitfalls to avoid. Misunderstanding eligibility requirements is a common issue many filers face. This mistake can lead to omitted income or incorrect deductions, which may trigger an audit or impact tax filing accuracy.

Another frequent error is the miscalculation of tax deductions. Retirees may overlook specific pension benefits that qualify for deductions under Michigan law, resulting in unnecessary tax liabilities. Furthermore, failing to include required documentation can complicate the approval process and delay benefits.

Interactive tools for completing the 4884 form

Utilizing interactive tools can significantly enhance the experience of completing the 4884 form. pdfFiller provides robust PDF editor features that transform a standard form-filling process into a seamless experience. With inline editing options, users can directly manipulate form fields without any technical complications.

Moreover, the eSigning capabilities available in pdfFiller simplify the signing process, allowing retirees to complete necessary agreements virtually. Once finished, anyone can share their documents with advisors or family members for collaboration without the hassle of traditional paper-based processes.

FAQs about the 4884 form

When filing your 4884 form, it's essential to keep in mind the frequently asked questions surrounding this critical document. Firstly, the deadline for submitting the 4884 form typically aligns with tax filing dates, ensuring that retirees have adequate time to prepare and submit their information.

Understanding how the 2025 changes will impact retirement income is crucial as Michigan implements new rules that may enhance tax benefits or change qualification criteria for retirees. Additionally, filers may wonder if it's possible to amend a submitted form; typically, you can do so, but there may be specific protocols to follow.

Understanding the tax implications of the 2025 Michigan retirement changes

The 2025 changes to Michigan retirement laws bring notable implications for pension benefits. Retirees should familiarize themselves with new legislation, as it will influence tax structure and the overall treatment of retirement income. These modifications may potentially create opportunities for increased deductions or shifting eligibility for existing tax exemptions.

To accurately calculate your Michigan tax liability, you should factor in criteria such as total retirement income and the types of pensions received. Knowing which income qualifies for tax exceptions allows for optimized retirement planning, ensuring that retirees can retain more of their hard-earned benefits.

Related forms and documents

For Michigan retirees, being aware of related forms and documents is vital. Additionally to the 4884 form, there are several other important documents, such as the 2025 Pension Exemption Form, which modifies how pension income is treated for tax purposes. Understanding the state of Michigan’s income tax withholding forms also provides insights into what retirees should expect concerning their pension taxes.

Accessing and utilizing these additional resources can streamline the retirement planning process. Platforms like pdfFiller make obtaining and managing these documents straightforward and user-friendly, ensuring that retirees can remain focused on their financial well-being.

Additional support resources for the 4884 form

Providing extra support for retirees filling out the 4884 form is essential. Michigan Retirement Services offers dedicated contact information for inquiries, ensuring individuals have easy access to expert advice and clarification on retirement questions. Additionally, online support options available through pdfFiller provide fast response times, effectively assisting users in navigating the complexities of form preparation.

Whether through phone support or chatting online, retirees can seek help with any part of the form, making sure no detail is overlooked while filing. Such resources are invaluable for ensuring that filings align with state regulations and capture potential benefits.

Best practices for document management

Organizing retirement documents for easy access is imperative for all retirees, especially when preparing for critical submissions like the 4884 form. An efficient filing system, digital or physical, aids in keeping track of all necessary paperwork, including tax returns, retirement statements, and correspondence with financial advisers.

Additionally, securing these documents on cloud platforms, such as those offered by pdfFiller, not only protects sensitive information but also allows for easy access from anywhere. With document security measures in place, retirees can confidently manage their retirement paperwork, ensuring peace of mind in their financial affairs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find michigaas 2021-2026 form?

How do I edit michigaas 2021-2026 form in Chrome?

Can I edit michigaas 2021-2026 form on an iOS device?

What is 4884 2025 Michigan retirement?

Who is required to file 4884 2025 Michigan retirement?

How to fill out 4884 2025 Michigan retirement?

What is the purpose of 4884 2025 Michigan retirement?

What information must be reported on 4884 2025 Michigan retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.