Get the free NPCA 990 Forms

Get, Create, Make and Sign npca 990 forms

How to edit npca 990 forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out npca 990 forms

How to fill out npca 990 forms

Who needs npca 990 forms?

Comprehensive Guide to NPCA 990 Forms: Completion, Filing, and Management

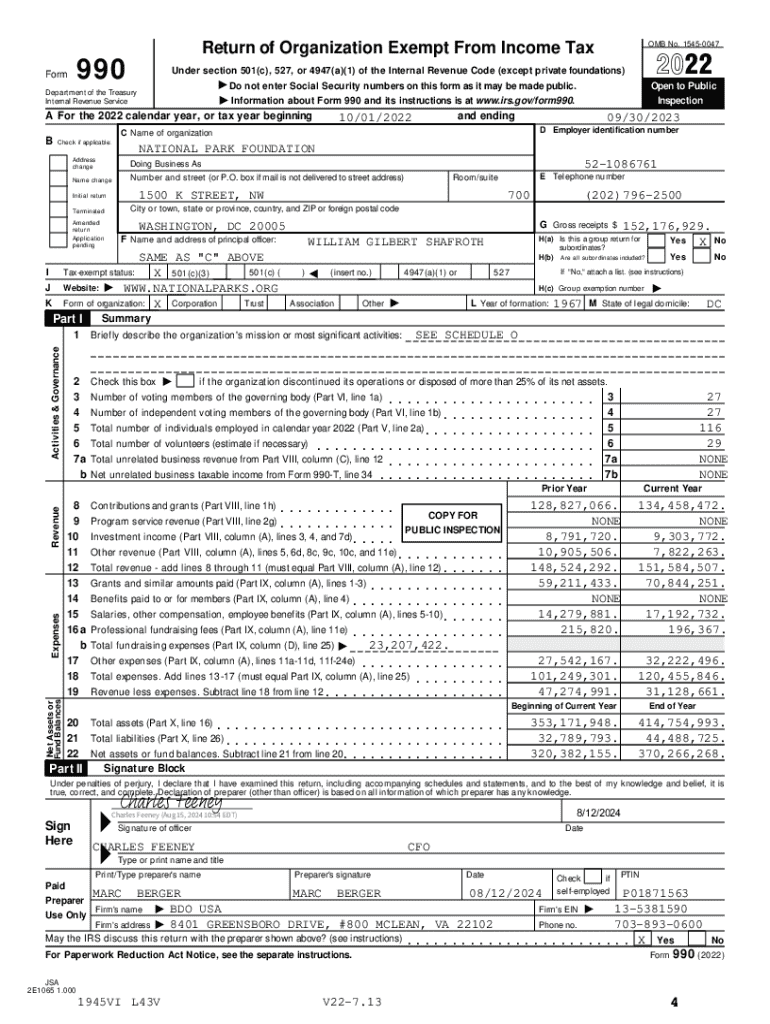

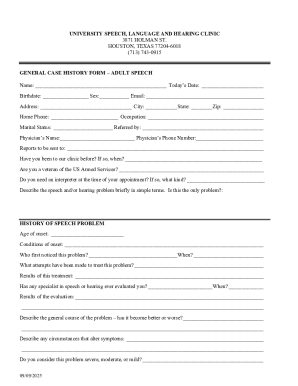

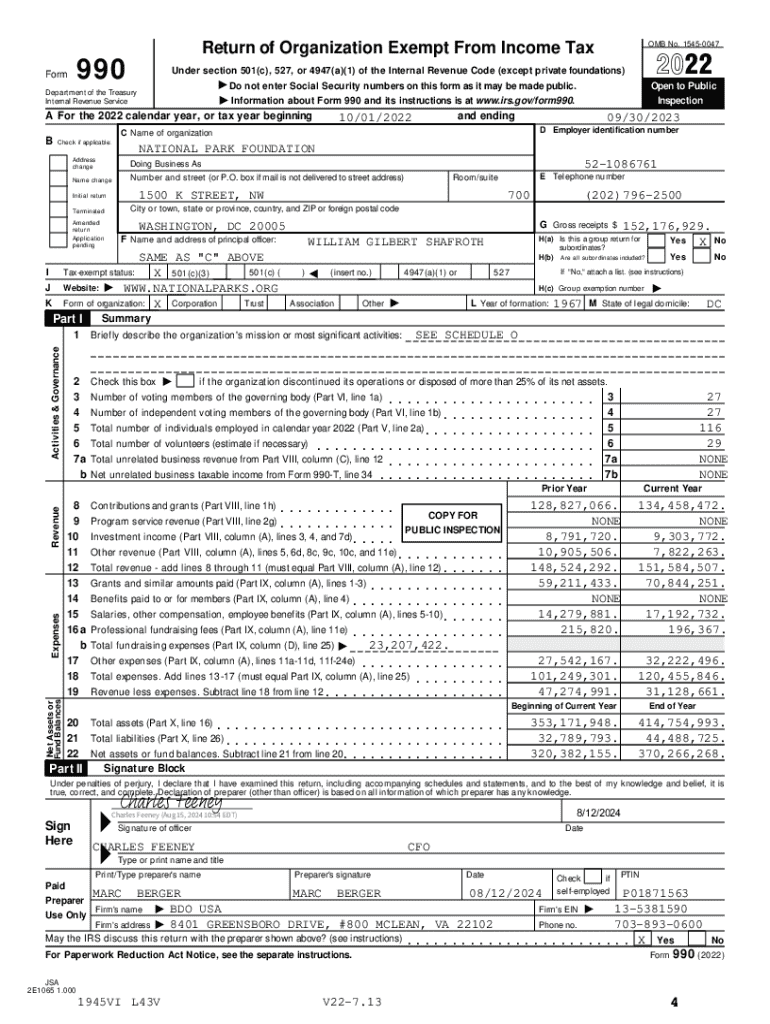

Understanding the NPCA 990 Form

The NPCA 990 Form is a crucial document for the National Parks Conservation Association (NPCA), a nonprofit organization dedicated to protecting and enhancing America's national parks. This form plays a pivotal role in ensuring transparency and accountability within the organization. Nonprofits like the NPCA are required to file Form 990 annually, outlining their financial activities, governance practices, and program accomplishments. The purpose of this form extends beyond mere compliance; it serves as a means to communicate the organization's impact and stewardship to stakeholders and the public.

For organizations, the NPCA 990 Form is vital not only for regulatory compliance but also for fostering trust among donors and the general public. Accurate reporting can prevent legal repercussions and financial mismanagement, while a well-presented image on the form can enhance credibility, attracting potential supporters. In essence, how an organization handles its NPCA 990 Form can significantly influence public perception and donor confidence.

Key components of the NPCA 990 Form

The NPCA 990 Form is structured in various sections, each capturing a unique aspect of the organization's performance. Understanding these components is essential for accurate completion and reporting.

Step-by-step guide to completing the NPCA 990 Form

Completing the NPCA 990 Form requires systematic preparation and diligent attention to detail. To ensure accuracy, organizations should gather necessary documentation before commencing the form.

As you complete each section, ensure clarity and consistency in the data provided. Check for common pitfalls, such as misreporting financial data or omitting critical accomplishments, which can lead to audit risks or donor distrust.

Editing and reviewing your NPCA 990 Form

Accuracy and clarity are paramount in presenting the NPCA 990 Form. Review processes should be instituted to validate the information before submission.

Collaborating with team members can provide additional insights and catch oversights. pdfFiller facilitates easy sharing, allowing teams to leave comments and feedback directly on the document, ensuring everyone is on the same page prior to filing.

eSigning the NPCA 990 Form

eSignatures have become the norm in the nonprofit sector. Understanding when these signatures are necessary is vital for legal compliance and accountability.

Maintaining signed copies is also essential for organizational history and future audits.

Filing the NPCA 990 Form

Once completed and reviewed, the NPCA 990 Form needs to be filed. Organizations have two primary options for submission: electronic and paper filing.

After submission, confirming successful filing is crucial. Keep copies of all filed forms and use tracking options available via pdfFiller to monitor the status of your submission with the IRS.

Managing your NPCA 990 Form post-filing

Post-filing responsibilities include maintaining records and reflecting on the organization's performance. Keeping accurate records for future reference is crucial for compliance and strategic planning.

Utilizing pdfFiller allows for easy document management and the creation of templates for future NPCA 990 Forms, ensuring your organization stays ahead in compliance.

Additional tools and resources through pdfFiller

pdfFiller provides a range of interactive features designed to streamline document management. These tools enhance the filing process, making it easier for nonprofits to navigate the requirements of the NPCA 990 Form.

User experiences indicate that many organizations have successfully streamlined their document management processes using pdfFiller, enhancing efficiency and compliance in the long run.

Exploring related documents for nonprofits

For many organizations, the NPCA 990 Form isn’t the only document required for compliance. Other essential forms include the Form 1023, which is the application for tax-exempt status, and Form 990-EZ for smaller organizations.

Staying compliant with state regulations and understanding related document requirements is essential for any nonprofit's longevity and effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send npca 990 forms to be eSigned by others?

How do I edit npca 990 forms online?

How do I fill out npca 990 forms on an Android device?

What is npca 990 forms?

Who is required to file npca 990 forms?

How to fill out npca 990 forms?

What is the purpose of npca 990 forms?

What information must be reported on npca 990 forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.