Get the free Instructions for Form 1023-EZ (01/2025)

Get, Create, Make and Sign instructions for form 1023-ez

Editing instructions for form 1023-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 1023-ez

How to fill out instructions for form 1023-ez

Who needs instructions for form 1023-ez?

Instructions for Form 1023-EZ Form

Understanding Form 1023-EZ

Form 1023-EZ is a streamlined application for organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. Designed for smaller nonprofits, it simplifies the process, making it quicker and more accessible compared to the standard Form 1023. This easy-to-navigate form reduces paperwork and focuses on the essential requirements.

The primary purpose of Form 1023-EZ is to enable organizations with limited revenue and assets to efficiently establish their tax-exempt status. By utilizing this simplified form, applicants can avoid the extensive information required in the standard Form 1023, which is intended for larger organizations with complex structures.

Eligibility criteria for filing Form 1023-EZ

To utilize Form 1023-EZ, organizations must meet specific eligibility criteria. Only organizations with a maximum of $50,000 in gross receipts annually and total assets not exceeding $250,000 qualify for the simplified form. Furthermore, they must operate primarily for charitable, educational, religious, or scientific purposes.

Common qualifying entities include small charities, community programs, and religious groups. It is crucial to verify that your organization aligns with these guidelines to avoid unnecessary delays in obtaining tax-exempt status.

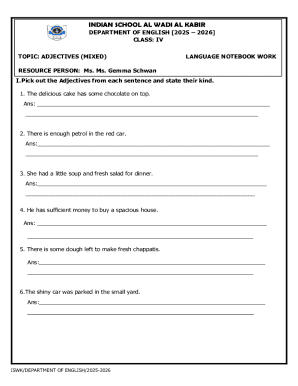

Step-by-step guide to completing Form 1023-EZ

Preparation before filling out Form 1023-EZ is vital for a successful application. Gather necessary documents, such as your organization’s governing documents, bylaws, and a clear mission statement. Additionally, a well-prepared business plan detailing your activities will enhance your application.

When navigating through the sections of Form 1023-EZ, pay close attention to each requirement. Below is a breakdown of the essential sections:

Common mistakes to avoid include incorrect or incomplete information in critical sections and failing to attach required documentation, which can lead to rejection. Double-checking your application for accuracy will significantly enhance your chances of approval.

Interactive tools for Form 1023-EZ

Using pdfFiller can significantly streamline the process of completing Form 1023-EZ. The platform allows for convenient PDF editing, eSigning, and collaboration options, making it easy for multiple team members to work together efficiently.

With features like real-time editing and validation checks, pdfFiller improves the accuracy of your application. Users can easily save, share, and manage documents, enhancing overall productivity.

Submitting your Form 1023-EZ

Preparation for submission involves conducting a thorough review of your completed form. Ensure that you have addressed all sections and attached necessary documents. Understanding the payment options, as the submission requires a user fee, is also crucial.

To submit electronically, follow these steps:

After submission, you can track your application status through the IRS website, ensuring that you stay informed of any updates regarding your nonprofit status.

Responding to IRS inquiries

In the event that the IRS reviews your application, understanding their review process is essential. IRS inquiries may focus on clarifications about your organization’s activities, governance, or financial details.

Preparation for these interactions involves maintaining organized records of all documentation submitted and developing clear, concise responses to potential questions from IRS representatives.

Best practices for nonprofit compliance post-application

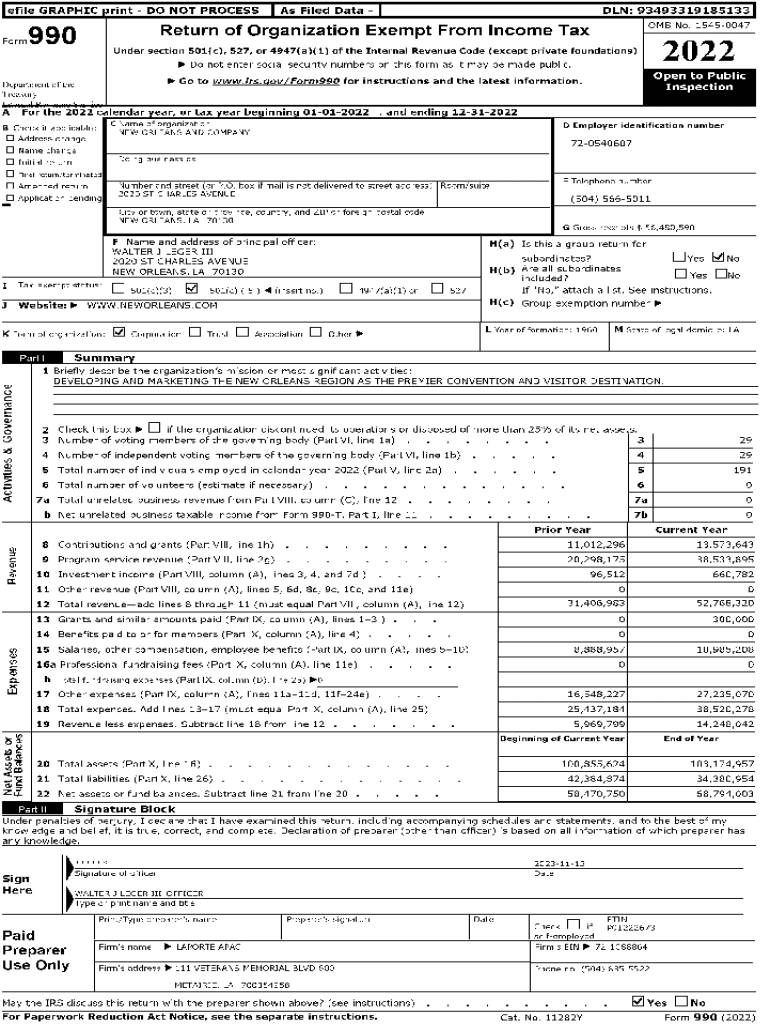

Once tax-exempt status is granted, understanding ongoing compliance requirements is vital. Nonprofits must file an annual Form 990, which provides transparency on financials and ensures accountability.

Additionally, maintaining meticulous records of all nonprofit activities and finances will support compliance and safeguard against the loss of tax-exempt status. Shifting focus to transparent operations aids in building trust and confidence with donors and stakeholders.

Leveraging pdfFiller beyond Form 1023-EZ

Exploring additional document management solutions offered by pdfFiller can further benefit your organization. Beyond Form 1023-EZ, the platform provides templates for other nonprofit forms and documents, catering to a range of administrative needs.

The benefits of utilizing pdfFiller do not stop with form completion. By engaging with the platform, organizations gain access to a supportive community of users and a wealth of learning resources, enhancing overall operational capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send instructions for form 1023-ez for eSignature?

How do I edit instructions for form 1023-ez in Chrome?

How do I complete instructions for form 1023-ez on an iOS device?

What is instructions for form 1023-ez?

Who is required to file instructions for form 1023-ez?

How to fill out instructions for form 1023-ez?

What is the purpose of instructions for form 1023-ez?

What information must be reported on instructions for form 1023-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.