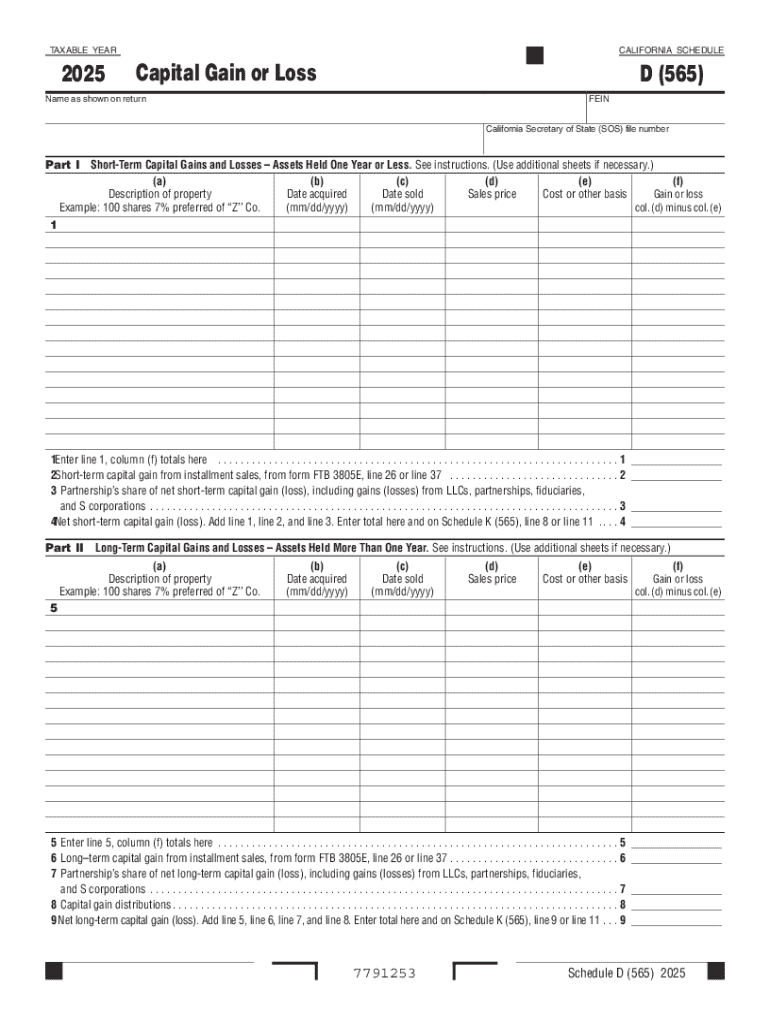

Get the free California Form 565 Schedule D (Capital Gain or Loss)

Get, Create, Make and Sign california form 565 schedule

Editing california form 565 schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california form 565 schedule

How to fill out 2025 schedule d 565

Who needs 2025 schedule d 565?

Understanding the 2025 Schedule 565 Form: A Comprehensive Guide

Overview of Schedule 565 Form

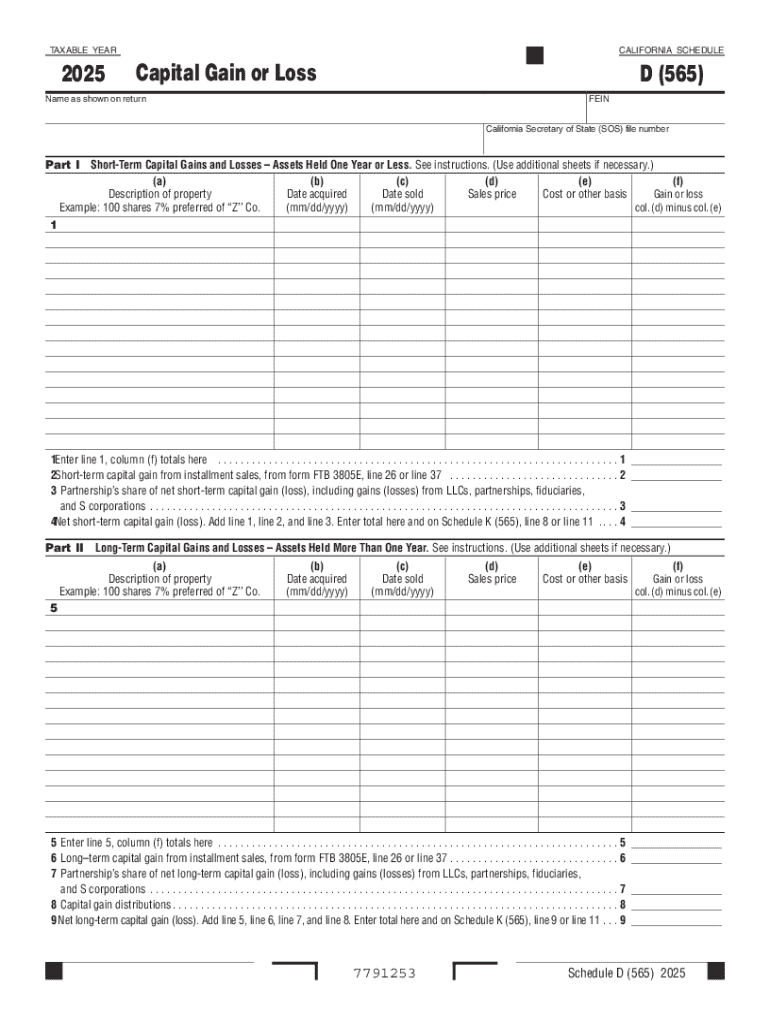

The Schedule D 565 form is a crucial document for partnerships operating in California. This form is specifically tailored for the reporting of income, deductions, and credits of partnerships and Limited Liability Companies (LLCs) taxed as partnerships. The primary purpose of the Schedule D 565 is to facilitate the accurate reporting of source income and to ensure compliance with both state and federal tax regulations.

Filing this form is essential for partnership entities, as it allows them to disclose important financial information and tax obligations. Proper completion and submission of the Schedule D 565 helps avoid potential penalties and ensures equitable distribution of income among partners. It serves as a tool for maintaining transparency in partnership operations and contributes significantly to their long-term success.

What’s new for the 2025 Schedule 565 Form

For the 2025 filing season, various updates and revisions have been made to the Schedule D 565 form. These changes are primarily aimed at improving the clarity and compliance with recent amendments to tax regulations. One notable update is the increased reporting requirements concerning source income from out-of-state transactions, which are now more comprehensively outlined. This shift necessitates partnerships to pay closer attention to their income sources and adhere strictly to the recommended documentation.

Additionally, the form now includes enhanced sections for reporting tax credits, enabling easier integration with partner-level reporting. These updates not only facilitate more accurate reporting but also aim to streamline the filing process, reducing common errors that might lead to audits or penalties. Staying informed about these changes is pivotal for partnerships in ensuring compliance and maximizing tax benefits.

General information about Schedule 565

The Schedule D 565 must be filed by any partnership entity that conducts business in California, including general partnerships, limited partnerships, and LLCs that opt to be taxed as partnerships. It is important for all partners to be aware of their filing obligations, as all income generated must be reported collectively by the partnership, affecting each partner's individual tax return. Partnerships must file Form 565, along with their Schedule D 565, to provide a comprehensive overview of their financial standing.

Filing deadlines for the Schedule D 565 coincide with the general partnership tax return deadline, which is typically March 15 for calendar year partnerships. Late submissions can result in significant penalties, including fines and potential interest on unpaid taxes. Therefore, it is recommended that partnership entities establish a filing schedule well in advance to ensure prompt submission of their forms.

Detailed instructions for completing Schedule 565

Completing the Schedule D 565 requires careful attention to detail. Start by gathering essential records related to the partnership’s income, expenses, and credits. This includes profit and loss statements, partner contributions, and prior year tax returns. Each partner should contribute their data regarding their share of partnership income and loss, as this information directly impacts their individual tax filings.

Common mistakes when filling out the Schedule D 565 can lead to audits or delays in processing. Make sure to double-check all entries for accuracy and consistency, particularly regarding partner percentages and income classifications. Utilizing electronic tools available through platforms like pdfFiller can aid in minimizing these errors, as they often include checks and balances that catch discrepancies early in the process.

Specific line instructions

The Schedule D 565 requires precise information across various lines, each designated for specific data. Line 1 is dedicated to partnership identification, where you’ll need to include the Employer Identification Number (EIN), the partnership's legal name, and any trade names. Line 2 pertains to partner information; report each partner's percentage interest and other key details to ensure accurate profit distribution.

Line 3 focuses on total income and deductions, which is integral for calculating the taxable income of the partnership. Lastly, Line 4 allows partnerships to report tax credits and other adjustments that may influence tax liability. Completing these lines with precision ensures that the tax responsibilities are fairly distributed among partners.

Schedule K federal/state line references

Understanding how the Schedule D 565 relates to the Schedule K is fundamental for partnerships. Schedule K is an integral part of the partnership tax return, detailing each partner's share of income, deductions, credits, and other tax attributes. The information reported on Schedule D 565 directly feeds into Schedule K, ensuring a comprehensive overview of the partnership's tax obligations and benefits.

Furthermore, the implications of the data reported in Schedule D 565 can vary at both federal and state levels. Accurate reporting is essential, as discrepancies could lead to audits, penalties, and unnecessary scrutiny from tax authorities. Therefore, partnerships should exercise due diligence when preparing their schedules, consulting tax professionals when necessary to navigate the complexities of the tax system.

Common issues when filing Schedule 565

Many partnerships encounter common issues when filing the Schedule D 565. These can range from incorrect calculations regarding partner shares to misunderstandings about which income should be reported. The IRS often flags discrepancies between partner submissions, leading to stressed examinations and potential penalties.

Addressing these challenges involves understanding the form's nuances and engaging with the appropriate resources. For instance, reaching out to the IRS for clarifications or seeking help from tax professionals can significantly mitigate problems. The frequency of audits for partnerships underscores the necessity for systematic record-keeping and collaboration among partners throughout the fiscal year.

Tools and resources for managing Schedule 565

Utilizing interactive tools when managing the Schedule D 565 is a smart approach for both accuracy and convenience. Platforms like pdfFiller offer editable templates specifically designed for Schedule D 565, simplifying the process of filling out and customizing forms. The ability to eSign documents directly within the platform also expedites the approval and storage process, providing a seamless experience for partnerships.

Moreover, features that enable easy sharing and secure storage are essential for maintaining document integrity and ensuring that all partners have access to the necessary information. Employing these tools assists in maintaining clarity and organization throughout the filing process, ultimately supporting a more efficient workflow.

Expert tips for a smooth filing process

To ensure a smooth filing process for the Schedule D 565, partnerships should establish best practices that promote organization and accuracy. Begin by setting up a centralized system for collecting all financial data and updates to minimize confusion and ensure all partners are informed. Engaging regularly in discussions about each partner's contributions and income can help align expectations and reduce discrepancies in reported data.

Additionally, utilizing tools such as those provided by pdfFiller can greatly enhance collaboration among partners. The interactive features allow for collective editing and real-time updates, meaning changes are visible and agreed upon immediately. This not only reduces errors but also cultivates a sense of teamwork as partners actively participate in the financial reporting process.

Additional insights

The timely submission of the Schedule D 565 can significantly impact the overall tax returns for partnerships. A properly completed Schedule D 565 ensures that each partner receives an accurate report of their share of income, minimizing the risk of underreporting and subsequent IRS scrutiny. Tax returns are often interlinked, and discrepancies can lead to complications not just for the partnership but also for each partner individually.

Looking towards the 2026 filings, partnerships should take proactive measures in enhancing their record-keeping practices. This preparation includes reviewing changes in tax legislation that may affect future filings and anticipating potential adjustments in reporting requirements. By staying ahead of these changes, partnerships can streamline future tax processes and reduce the likelihood of facing challenges down the road.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find california form 565 schedule?

How do I complete california form 565 schedule online?

How do I edit california form 565 schedule on an Android device?

What is 2025 schedule d 565?

Who is required to file 2025 schedule d 565?

How to fill out 2025 schedule d 565?

What is the purpose of 2025 schedule d 565?

What information must be reported on 2025 schedule d 565?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.