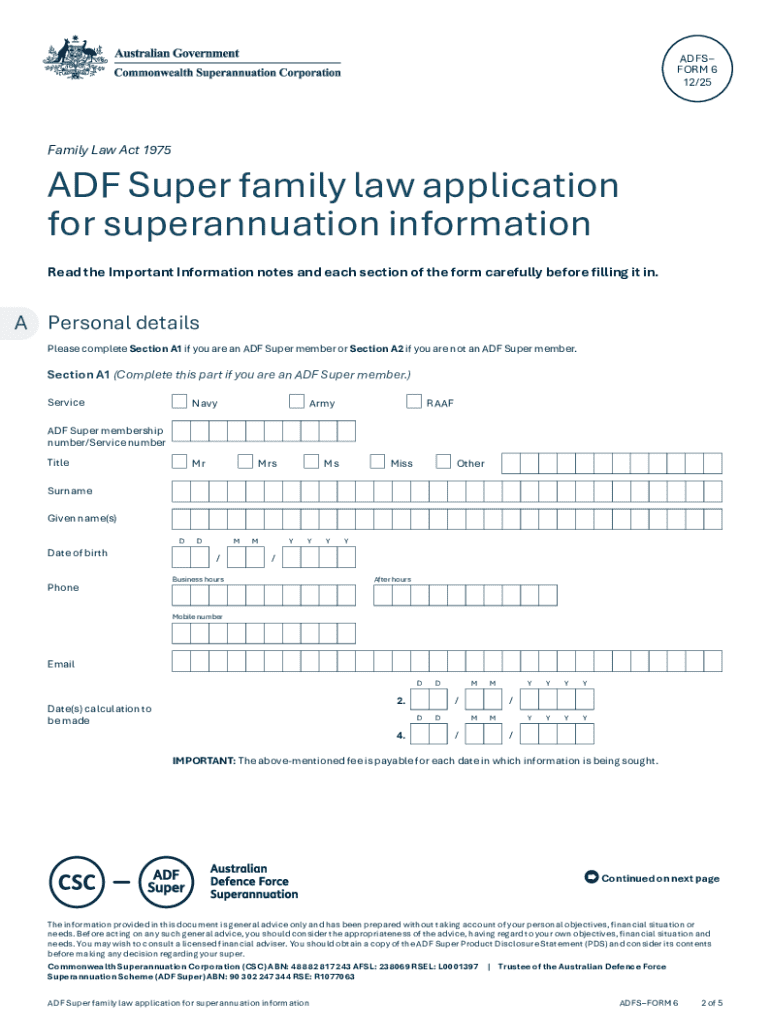

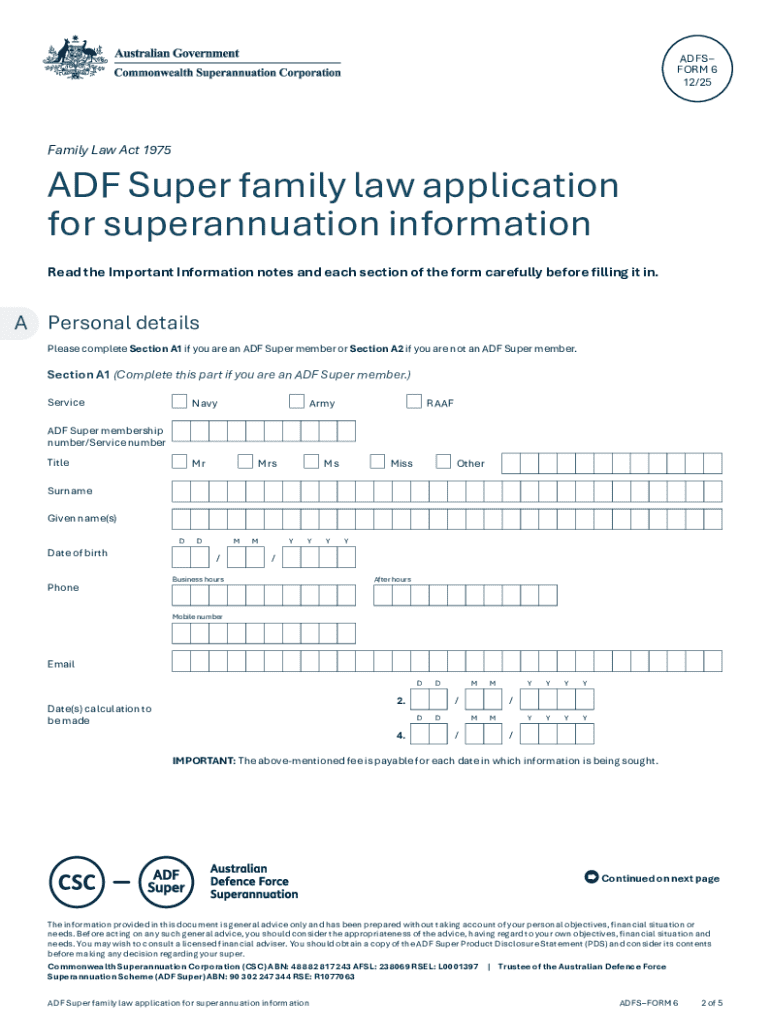

Get the free ADF Super family law application for superannuation information (ADFS-Form6)

Get, Create, Make and Sign adf super family law

Editing adf super family law online

Uncompromising security for your PDF editing and eSignature needs

How to fill out adf super family law

How to fill out adf super family law

Who needs adf super family law?

Navigating the ADF Super Family Law Form: A Comprehensive Guide

Understanding the ADF Super Family Law Form

The Australian Defence Force (ADF) Superannuation system plays a pivotal role in ensuring the financial security of ADF personnel and their families. Central to navigating this system, especially during separation or divorce, is the ADF Super Family Law Form. This form facilitates the splitting of superannuation entitlements which is essential for individuals undergoing family law proceedings.

The Family Law Form is not merely a bureaucratic document; it is a critical tool designed to ensure fairness and equity in the division of superannuation assets. Given the unique challenges associated with superannuation in the military context, understanding the form's importance becomes paramount for affected parties.

Key aspects of the ADF Super Family Law Form

Superannuation splitting refers to the process of dividing superannuation assets during a marriage or de facto relationship breakdown. Unlike general assets, superannuation can be complex, particularly in the ADF context due to distinct military superannuation schemes.

In the ADF, there are several military superannuation schemes, including the Military Superannuation and Benefits Scheme (MSBS) and the ADF Superannuation Scheme. The key differences between ADF superannuation and civilian superannuation include contribution rates, eligibility criteria, and the handling of benefits upon separation.

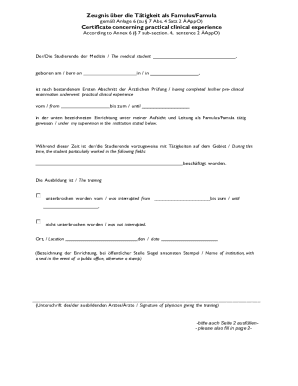

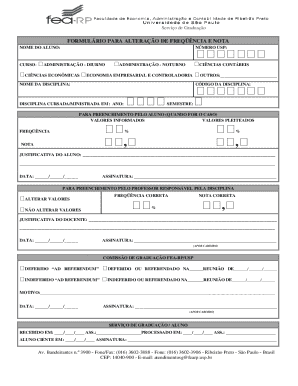

Steps to complete the ADF Super Family Law Form

Completing the ADF Super Family Law Form can be streamlined by following a structured approach. Here are the essential steps involved:

Submitting the ADF Super Family Law Form

The submission process for the ADF Super Family Law Form involves directing it to the appropriate ADF superannuation office or the legal representatives handling your case. Timeliness is crucial; therefore, be aware that processing times may vary depending on the complexity of the case and the workload of the office.

After submission, it is advisable to seek confirmation that the form has been received. Keeping records of submission and establishing a follow-up routine can help in managing your case and ensuring necessary actions are taken.

Managing your superannuation post-splitting

Once the superannuation has been split, it is crucial to understand the implications of any Splitting Orders. These orders dictate how each party's super will be managed going forward and can impact retirement planning and other financial considerations significantly.

To effectively manage your superannuation, utilizing tools like pdfFiller can streamline processes such as viewing, editing, and tracking your superannuation forms and agreements. Collaborative platforms empower you to share relevant documents with financial advisors so that you can ensure every decision aligns with your long-term financial goals.

Frequently asked questions (FAQs)

Filling out the ADF Super Family Law Form can come with its challenges. Some common questions include how to handle discrepancies in provided information, or what legal implications might arise from incorrectly filled forms. Many people also wonder where to seek help when navigating the complexities of superannuation splitting.

For individuals requiring clarification on legal aspects or specific procedures, there are various support resources available, including community legal services, family law solicitors, and online forums where others partake in knowledge-sharing.

Resources and tools

pdfFiller offers interactive features that allow users to manage and edit forms efficiently. With capabilities for eSigning, secure cloud storage, and templates specifically for ADF documentation, users can navigate the administrative aspects of their forms with ease.

Additionally, external resources for legal support and advice can be immensely beneficial. Knowing when to consult a lawyer is crucial, especially for intricate cases involving multiple assets and complex superannuation arrangements.

Who can assist with your ADF Super Family Law Form?

To efficiently navigate the process of completing the ADF Super Family Law Form, individuals often benefit from engaging with legal professionals who specialize in family law. These experts can provide guidance tailored to the unique intricacies of ADF superannuation.

pdfFiller also offers collaborative features that make it easy to share filled forms with advisors, ensuring that each party involved in the case is fully informed and engaged in the decision-making process. Seeking expert guidance can prevent missteps in the documentation process and ensure compliance with all legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the adf super family law in Chrome?

How do I edit adf super family law on an iOS device?

How do I fill out adf super family law on an Android device?

What is adf super family law?

Who is required to file adf super family law?

How to fill out adf super family law?

What is the purpose of adf super family law?

What information must be reported on adf super family law?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.