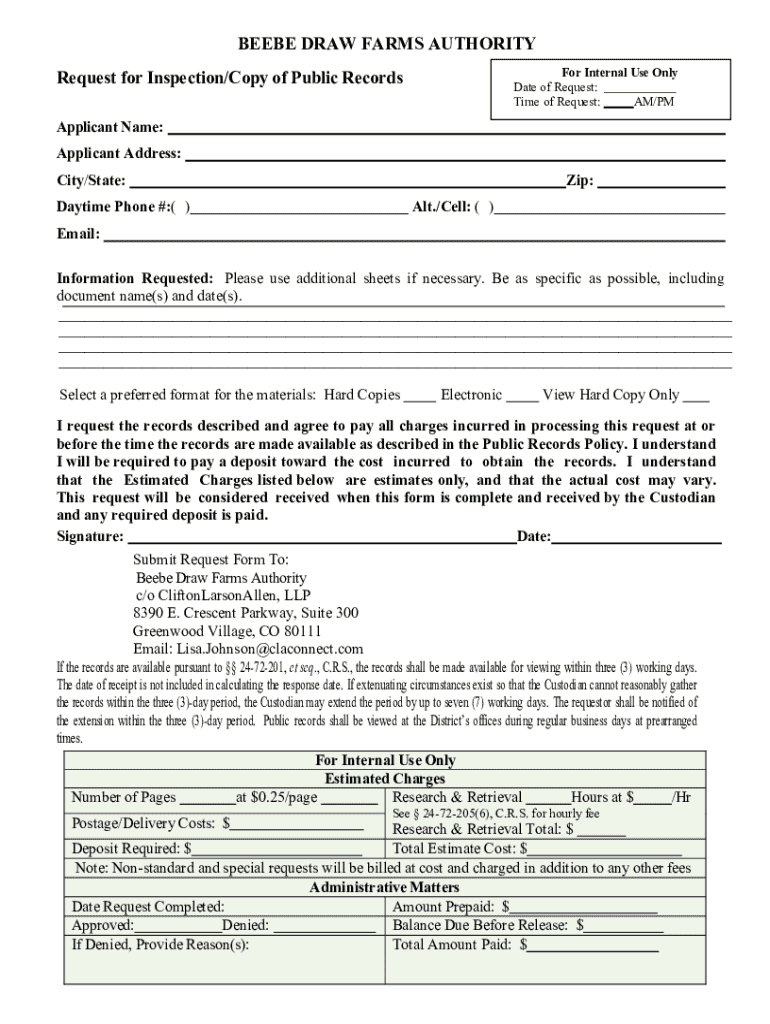

Get the free amending Policy on Colorado Open Records Request ( ...

Get, Create, Make and Sign amending policy on colorado

Editing amending policy on colorado online

Uncompromising security for your PDF editing and eSignature needs

How to fill out amending policy on colorado

How to fill out amending policy on colorado

Who needs amending policy on colorado?

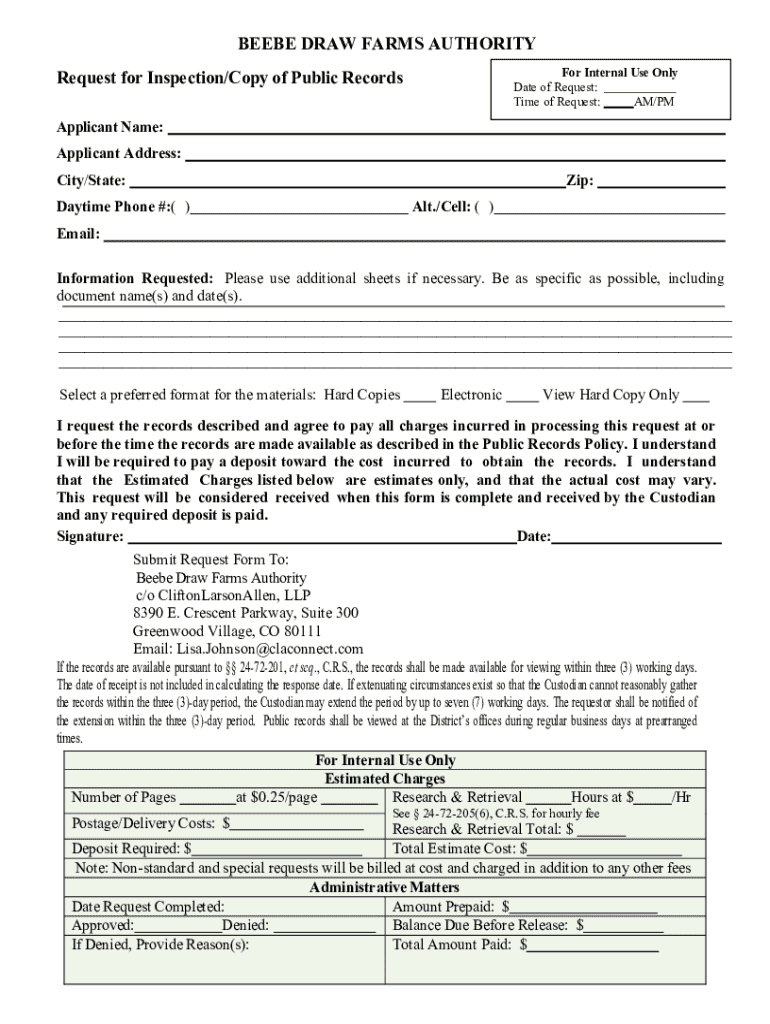

Amending policy on Colorado form: A comprehensive guide

Understanding the need for amending policies on Colorado forms

In Colorado, an amendment refers to a formal alteration of existing policy documents or forms. This process is critical for maintaining compliance with state regulations and ensuring that all information presented is accurate. Amending policies on Colorado forms is essential to reflect changes in laws, organizational structures, or even personal circumstances. By ensuring that these forms are current, individuals and businesses can avoid errors that may lead to legal issues or financial penalties.

Keeping forms accurate and up-to-date directly impacts the validity of submitted information, tax records, and legal documents. Furthermore, common reasons for amendments include changes in personal or business information, updates in tax laws, or corrections of previously reported errors. Regular amendments ensure that all parties are informed and protected under the latest guidelines.

Types of Colorado forms that may require amendments

Several forms in Colorado may require timely amendments. One significant category is individual income tax forms. It's essential for taxpayers to understand how to amend personal tax returns accurately. Guidelines include the use of the Colorado Form 104, and it is crucial to adhere to key deadlines and requirements to avoid penalties.

Step-by-step process for amending a policy on Colorado forms

When it comes to amending a policy on Colorado forms, following a systematic approach can yield effective results. Here’s a step-by-step guide.

Frequently asked questions about amending Colorado forms

The process of amending policies on Colorado forms often raises questions. One common query is, 'What happens if I make an error on my amended form?' Errors can lead to processing delays and the necessity for subsequent corrections. It is essential to double-check documents before submission.

Another frequently asked question revolves around 'How can I check the status of my amendment?' Typically, users can track their submissions through the Colorado Department of Revenue online portal or through confirmation emails.

Lastly, individuals often wonder if amendments are subject to review or penalties. While reviewing is standard procedure, avoiding penalties is possible with accurate submissions and timely responses to any requests for additional information.

Tools and resources available for document management

Utilizing technology can significantly streamline the process of amending policies on Colorado forms. One such tool is pdfFiller, a cloud-based platform that empowers users to edit PDFs, eSign, collaborate, and effectively manage documents from anywhere.

Key features of pdfFiller include ease in creating and amending documents, collaboration tools for teams, and comprehensive editing capabilities. Furthermore, with interactive tools for form management, users can access templates and fillable forms efficiently, simplifying the amendment process.

Best practices for maintaining accurate policies on Colorado forms

To ensure policies remain accurate on Colorado forms, implementing best practices is crucial. Regularly reviewing existing policies can help identify necessary updates or amendments, especially in response to changes in legal requirements.

Another effective strategy involves keeping a checklist of required updates based on ongoing legal changes. This proactive approach is essential to avoid complications in compliance and reporting.

Encouraging team collaboration also proves beneficial. By working together, teams can ensure precise document handling, enhance the accuracy of information, and minimize errors.

Case studies: Successful amendments and their impact

Analyzing real-life examples of effective amendments to Colorado policies reveals the importance of timely and accurate submissions. For instance, a small business owner amended their entity registration to reflect changes in management, leading to improved credibility and trust among clients and stakeholders.

Such amendments illustrate how a proactive approach results in enhanced operational efficiency. Furthermore, understanding the outcomes of these amendments provides crucial insights into the processes and common pitfalls to avoid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my amending policy on colorado directly from Gmail?

How do I execute amending policy on colorado online?

How do I complete amending policy on colorado on an iOS device?

What is amending policy on Colorado?

Who is required to file amending policy on Colorado?

How to fill out amending policy on Colorado?

What is the purpose of amending policy on Colorado?

What information must be reported on amending policy on Colorado?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.