Get the free MLO v

Get, Create, Make and Sign mlo v

Editing mlo v online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mlo v

How to fill out mlo v

Who needs mlo v?

MLO Form: A Comprehensive Guide to Document Management

Understanding MLO Form

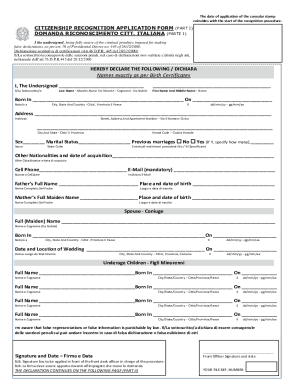

The MLO Form, or Mortgage Loan Originator Form, serves as a crucial document in the field of mortgage processing. Its primary purpose is to gather essential details about the mortgage loan originators who play a significant role in facilitating mortgage transactions. Ensuring that these professionals are licensed, competent, and certified is vital for protecting consumers and maintaining industry standards.

The importance of the MLO form in mortgage processes cannot be overstated. It not only verifies the qualifications of licensees but also helps in tracking and managing the performance of these individuals. By doing so, it contributes to building consumer confidence in the mortgage system.

Key differences between MLO and other forms

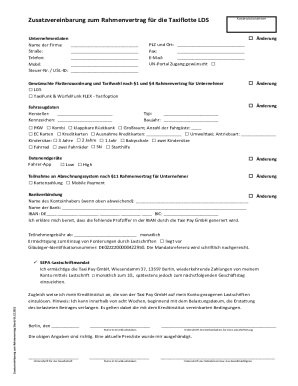

Unlike many other mortgage-related documents, the MLO form has unique fields that specifically cater to the licensing and qualification information of mortgage loan originators. These fields typically include sections for applicant details, license numbers, and jurisdiction information. This specificity sets the MLO form apart, as it emphasizes the regulatory aspects of mortgage lending, ensuring compliance with various state and federal laws.

Overview of pdfFiller's features for completing MLO forms

pdfFiller streamlines the process of completing MLO forms through its robust set of features designed for efficiency and user-friendliness. One of the standout capabilities is its seamless PDF editing, which allows users to edit and customize the MLO form easily. By simply uploading the document into pdfFiller’s cloud-based platform, users can fill in fields, tweak layouts, and adjust designs without hassle.

To make the most of pdfFiller, users should consider customizing existing templates to fit their specific needs. This can include changing branding elements or adjusting the wording to align with individual jurisdictional requirements. Such flexibility allows for a more accurate and personalized documentation approach.

eSigning capabilities

Another remarkable feature of pdfFiller is its eSigning capabilities, which streamline the signing process for MLO forms. To electronically sign, users can simply navigate to the signature field within the document and follow a few easy steps to designate their signature. In contrast to traditional ink-on-paper methods, eSigning is faster, reduces errors, and enhances security.

Electronic signatures not only speed up the approval process but also mechanize tracking for users and applicants. When both parties sign the document electronically, they receive an immediate confirmation that facilitates record-keeping and further enhances collaboration.

Document collaboration

Collaborating on MLO forms becomes incredibly easy with pdfFiller's real-time document collaboration features. Teams can share documents instantaneously, allowing multiple users to work on an MLO form simultaneously. This is particularly beneficial for organizations where multiple stakeholders need to review and approve licensing applications.

Users can utilize various sharing options available through pdfFiller to distribute the MLO form via email or shared links. This ensures effective and timely communication and keeps all parties updated on changes or comments made during the collaborative process.

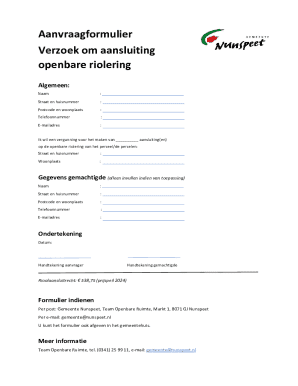

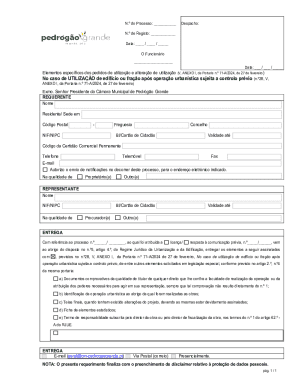

Step-by-step guide to filling out the MLO form

Preparing to fill the MLO form requires attention to detail and certain prerequisites. Key documents such as individual identification, proof of licensing, and other relevant materials should be assembled beforehand. Not only does this streamline the filling-out process, but it also significantly reduces the likelihood of common mistakes.

An essential checklist could include items like: - Current License Number: Double-check your license number's accuracy. - Personal Identification: Ensure that your identification matches the name on the application. - Required Consents: Various disclaimers and consent forms might need to be completed as well.

Filling out the MLO form fields

While filling out the MLO form, each area has specific requirements that need to be addressed thoroughly. The applicant's information must be accurate to prevent any delays in processing. For example, details like your full name, address, and contact information should be clearly stated.

Further, interactive tools available within pdfFiller guide users on completing each section, addressing common misconceptions or frequent errors along the way. The specifics of filling out the consent fields and legal disclaimers are often misunderstood, so utilizing built-in FAQ sections can help clarify these common pitfalls.

Reviewing and editing your completed MLO form

Before submitting the MLO form, conducting a thorough review is paramount. Best practices involve checking for any typos or inaccuracies and ensuring all required fields are correctly filled. Utilizing pdfFiller's tools provides a double layer of assurance, enabling users to edit and update information even after initial completion.

Make it a habit to verify licensing details and personal identifiers against official documents. Such attention to detail not only enhances credibility but ensures compliance with applicable regulations.

Managing MLO forms beyond submission

Once the MLO form has been submitted, managing ongoing documentation remains crucial. Storing and organizing MLO forms in an efficient manner greatly impacts access and record-keeping. pdfFiller’s cloud storage feature allows users to securely save their completed forms, ensuring easy retrieval when necessary.

Taking advantage of access management features is equally important. Individuals can set permissions to authorize who can view or edit documents, providing an extra layer of security. This is particularly useful for organizations managing multiple applicants’ forms at once.

Tracking application status

Monitoring the status of submitted MLO forms can alleviate anxiety during the waiting period. Users can track application statuses directly through their respective lending institutions or regulators. It involves staying proactive in following up and inquiring about the progress of applications.

Keeping a checklist of contact persons within the organizations can aid in facilitating communication. When following up, prepare specific questions regarding timelines or any outstanding requirements; such preparation demonstrates professionalism and diligence.

Troubleshooting common issues with MLO forms

Users often encounter common errors while completing MLO forms that can delay processing. Misunderstanding field requirements is prevalent; for instance, applicants might overlook essential consent fields, leading to incomplete forms. To avoid these issues, referring to a list of common errors can help.

Solutions for rectifying these errors usually involve returning to the form and cross-referencing with the official guidelines or FAQs. Legal compliance considerations are another aspect users must navigate. Familiarizing themselves with regulations on disclosures and the ethical guidelines of their respective jurisdictions ensures they remain compliant throughout the process.

Staying proactive about changes in legislation and how they affect the requirements of the MLO form can prevent future complications.

Resources and tools for MLO form management

Utilizing useful templates and examples can significantly aid in the completion of MLO forms. pdfFiller provides downloadable templates that are customizable to suit various jurisdictions and requirements. These templates serve as a helpful roadmap for applicants, making it easier to understand the expectations and data needed.

Users should also explore completed MLO form examples, which can serve as guideposts for accuracy and appropriateness, ensuring clarity in every detail provided.

Additional tools and integrations

pdfFiller offers various integrations that enhance overall document management. By linking with other software tools, users can synchronize their document efforts, increasing efficiency considerably. This is particularly beneficial for those who frequently handle high volumes of MLO forms or need to engage in complex workflows.

Integrating with CRM systems or project management tools further streamlines document handling, making it easier to manage multiple forms and track progress as applications move through the approval process.

Interactive features and how to access them

Navigating pdfFiller’s user interface is essential for leveraging the interactive tools designed for MLO forms. Upon logging into the platform, users will be greeted with an intuitive dashboard. This beginner’s guide aims to familiarize users with accessing these interactive features, ensuring efficient form management.

Every task, from filling out a new form to tracking submitted applications, is easily accessible through clearly labeled menu options. Furthermore, utilizing pdfFiller's support resources, users can find additional assistance should they encounter problems regarding MLO forms. Contacting pdfFiller's dedicated support team provides personalized help tailored to the user's specific challenges, ensuring a more fluid document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete mlo v online?

How do I edit mlo v online?

How do I edit mlo v straight from my smartphone?

What is mlo v?

Who is required to file mlo v?

How to fill out mlo v?

What is the purpose of mlo v?

What information must be reported on mlo v?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.