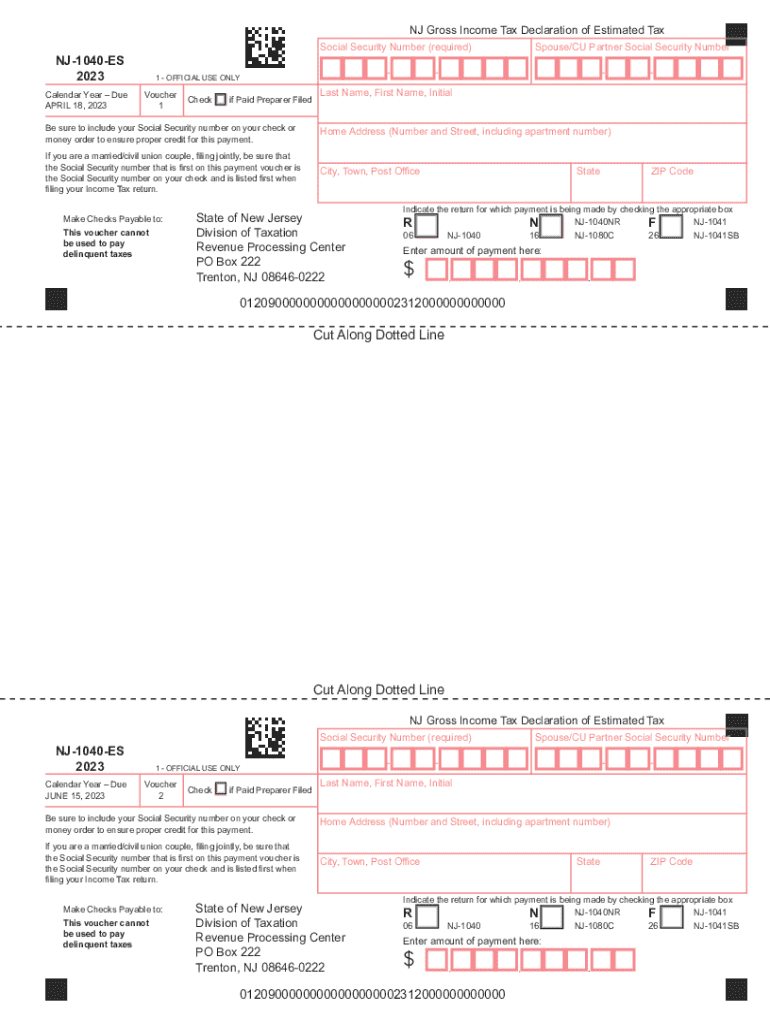

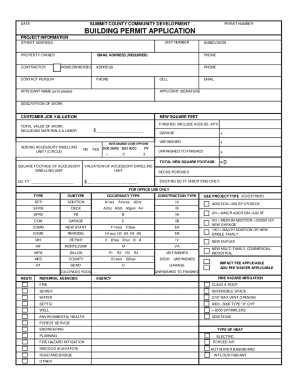

Get the free 2023 NJ Gross Income Tax Declaration of Estimated Tax, form NJ ...

Get, Create, Make and Sign 2023 nj gross income

How to edit 2023 nj gross income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 nj gross income

How to fill out 2023 nj gross income

Who needs 2023 nj gross income?

A Comprehensive Guide to the 2023 NJ Gross Income Form

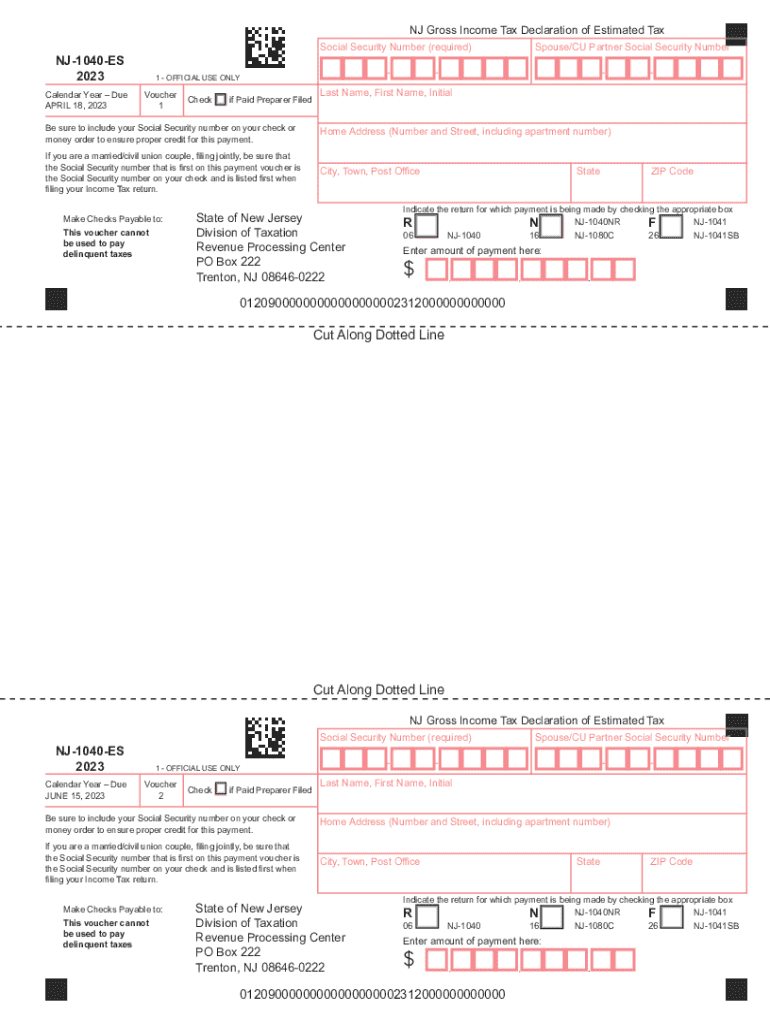

Overview of the 2023 NJ Gross Income Form

The 2023 NJ Gross Income Form is a crucial document for residents and income earners in New Jersey, serving as the primary means for reporting income and calculating taxes owed to the state. Understanding this form is essential for ensuring compliance with state tax laws and maximizing possible deductions or credits.

For the 2023 tax year, several key changes have been introduced that affect how residents file their income taxes. These changes include updated income thresholds and the introduction of new deductions and credits to alleviate the tax burden on individuals and families.

Eligibility criteria for filing

Filing the 2023 NJ Gross Income Form is mandatory for various categories of income earners under specific conditions. Primarily, individuals whose gross income meets or exceeds the state’s minimum income level must file. This requires understanding the income limits set for the filing year, which can vary based on filing status such as single, married, or head of household.

Residency matters significantly. Generally, all residents of New Jersey are obliged to file, while non-residents earning income within the state may also have an obligation to report. Furthermore, dependents with their own income might be required to file if their earnings surpass the prescribed threshold.

Preparing to fill out the 2023 NJ Gross Income Form

Preparation for filling out your 2023 NJ Gross Income Form is essential for accuracy and completeness. Begin by gathering all necessary documentation, including W-2s for wages earned, 1099 forms for other types of income, and any statements relevant to deductions or credits you intend to claim.

It’s vital to familiarize yourself with the definitions of gross income in the context of New Jersey tax code. This encompasses not only your salary or wages but also other income sources such as rental income, pension distributions, and certain social security benefits.

Step-by-step guide to completing the form

Accessing the 2023 NJ Gross Income Form can be done easily through the New Jersey Division of Taxation website or via platforms like pdfFiller. Both digital and paper options are available, with digital forms offering benefits like automated calculations and ease of submission.

Filling out the form involves several key sections. Start with your personal information, followed by reporting various types of income — including wages, investment income, and business earnings. Pay careful attention to the adjustments and deductions section to maximize your tax benefits, then proceed to claim any eligible tax credits.

Common pitfalls and mistakes to avoid

Several common errors recur in submissions of the 2023 NJ Gross Income Form. These include misreporting income amounts, overlooking deductions, and failing to provide required documentation. Such mistakes can delay processing or lead to issues with your tax filings.

To avoid these pitfalls, take the time to double-check your entries for accuracy. Cross-reference your submitted amounts with your W-2s and 1099s, ensuring that everything aligns. If a mistake is discovered after submission, New Jersey offers procedures to amend your returns, though timely action is crucial.

Submitting your 2023 NJ Gross Income Form

Once your 2023 NJ Gross Income Form is complete, you have options for submitting it. E-filing is highly recommended due to its efficiency and immediate confirmation of receipt. pdfFiller provides simplified solutions for e-filing, allowing users to manage and submit their forms within its user-friendly platform.

If you opt to mail your form, ensure it is sent to the correct address and keep records of your filing as a safeguard against potential issues. Adhering to submission timelines is vital to avoid late filing penalties, which can accumulate quickly.

After you file: What to expect

After filing your 2023 NJ Gross Income Form, the state will begin reviewing your submission as part of the income assessment process. Expect to receive any applicable refunds or communication from the state concerning your filings. The timeline for refunds can generally vary, but being proactive in tracking your status can provide peace of mind.

Utilizing New Jersey's online portal will allow you to easily monitor the status of your refund, ensuring you remain informed throughout the process.

Resources for additional help

Filing your 2023 NJ Gross Income Form might lead to questions or uncertainties. Fortunately, several resources are available for assistance. The New Jersey Division of Taxation website provides official guidance, while community forums and tax assistance programs can offer additional support.

pdfFiller also enhances the filing experience with tools for document management, thus enabling users to collaborate effectively with others in their filing efforts.

Interactive tools on pdfFiller for your tax needs

pdfFiller stands out as an essential resource for managing your 2023 NJ Gross Income Form effectively. Utilizing the platform's templates enables hassle-free tax preparation, allowing you to focus on accuracy and compliance. The collaboration features facilitate teamwork when managing collective filings, streamlining the process for groups and families.

Additionally, the platform allows for revisions and digital signing capabilities, making it easier to finalize documents and ensure all signatures are collected in one streamlined process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2023 nj gross income for eSignature?

How do I complete 2023 nj gross income online?

How do I complete 2023 nj gross income on an iOS device?

What is 2023 nj gross income?

Who is required to file 2023 nj gross income?

How to fill out 2023 nj gross income?

What is the purpose of 2023 nj gross income?

What information must be reported on 2023 nj gross income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.