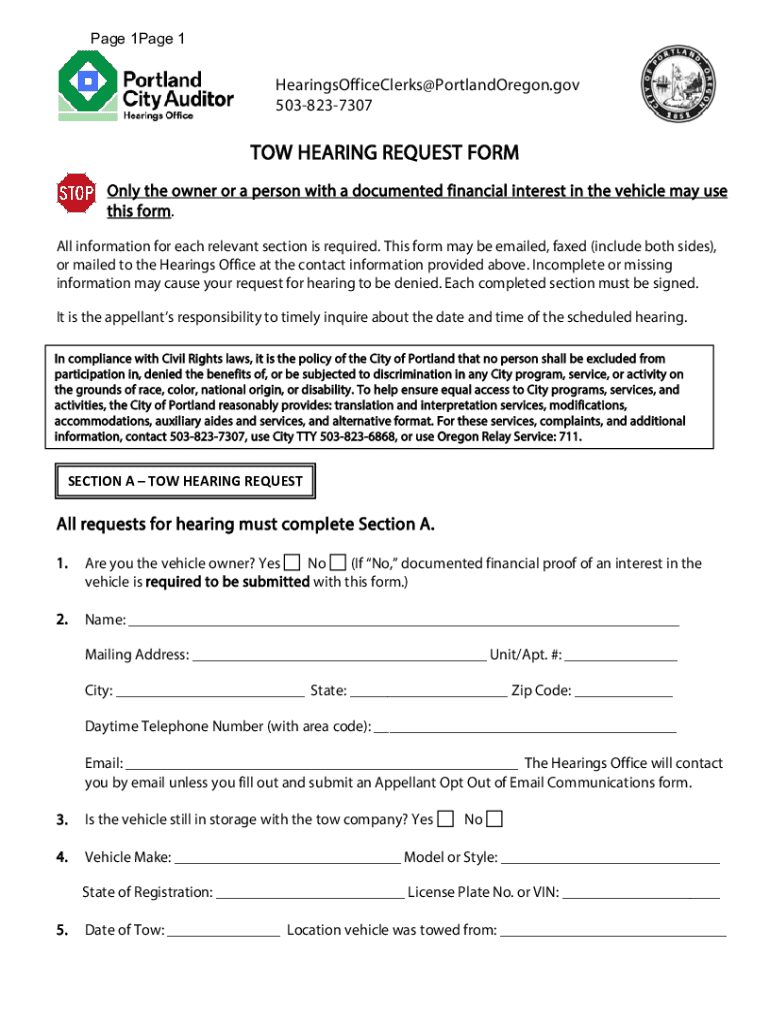

Get the free AFFIDAVIT TO ESTABLISH FINANCIAL INTEREST IN A ...

Get, Create, Make and Sign affidavit to establish financial

How to edit affidavit to establish financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out affidavit to establish financial

How to fill out affidavit to establish financial

Who needs affidavit to establish financial?

Affidavit to Establish Financial Form: A Comprehensive Guide

Overview of the financial affidavit

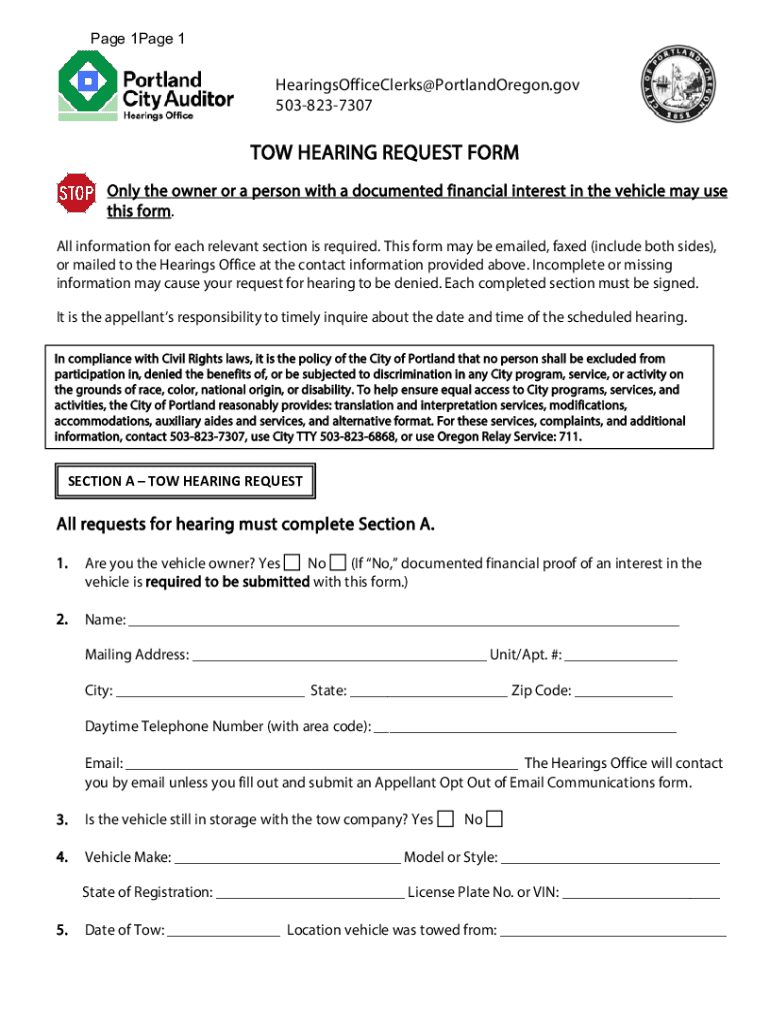

A financial affidavit is a legal document used to disclose an individual's or entity's financial circumstances. Its significance spans various personal and legal contexts, acting as a vital tool in matters such as divorce, loan applications, and government assistance.

Understanding your financial position in a factual manner becomes increasingly crucial during legal proceedings, especially where money management is concerned. Financial affidavits pave the way for transparency, helping courts and other parties make informed decisions.

What is a financial affidavit?

A financial affidavit is a sworn statement that provides an in-depth look into an individual’s financial situation, typically including their income, expenses, assets, and liabilities. It may be required in different scenarios such as divorce or when applying for financial support. This document is not just a formality; it carries legal weight, demanding accuracy and honesty from the affiant.

Common uses of financial affidavits

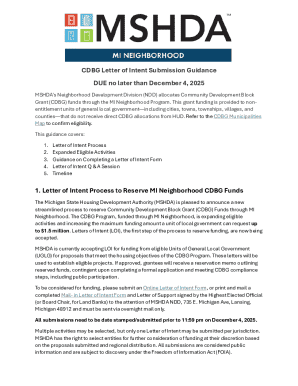

Financial affidavits serve multiple purposes across various situations. Primarily, they are critical in uncontested divorce proceedings, allowing for equitable distribution of marital assets and determining support obligations. In child support and custody cases, these affidavits help establish a parent’s financial responsibilities, thereby ensuring the best interests of the child are met.

Additionally, financial institutions often require an affidavit to validate a borrower’s financial status during loan applications. It plays a pivotal role in bankruptcy cases, allowing a clear picture of debts and assets, while government assistance programs utilize these affidavits to determine eligibility for benefits. Thus, understanding how to draft one properly is essential.

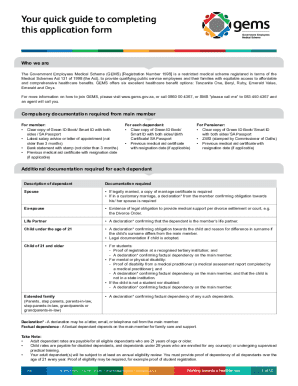

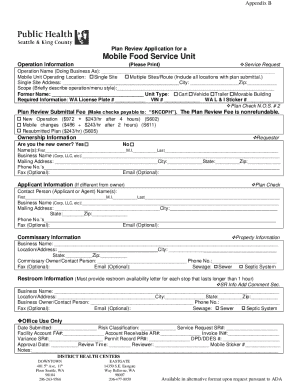

How to fill out a financial affidavit

Properly filling out a financial affidavit requires attention to detail and the following steps should be followed carefully:

Financial affidavit sample

Examining a sample financial affidavit can clarify expectations and provide a practical reference. A completed financial affidavit typically outlines an individual's income, expenses, and assets, demonstrating their financial status comprehensively.

Each section is defined; for example, any income sources will detail gross income and deductions, while Section for liabilities will list credit card debts and obligations. For convenience, users can download a functional template from pdfFiller to facilitate the creation of their own affidavits.

What happens after filling out your financial affidavit?

Once your financial affidavit is completed, it's essential to understand the next steps. In divorce or child support arrangements, you typically submit the affidavit to the court or the involved parties, possibly during mediation or hearings. For loan applications, the signed form is sent directly to your financial institution for their review.

Following submission, it's crucial to keep copies of your affidavit for personal records. This documentation may be referenced later, or required during future legal or financial discussions.

Tips for simplifying financial disclosure

Organizing your finances for a financial affidavit can seem overwhelming. However, employing practical strategies can simplify this process considerably:

Frequently asked questions about financial affidavits

Understanding the intricacies of financial affidavits often leads to several common inquiries. For instance, individuals frequently question whether they are required to disclose all assets and income sources. The answer is yes, full disclosure is crucial to ensure validity, as any omissions could lead to legal complications.

Legal considerations and best practices

Legal obligations tied to financial affidavits cannot be overstated. Accurately representing your financial situation is not just a best practice but a legal necessity. This sworn document holds weight in court, meaning any misrepresentation can lead to serious legal penalties. Therefore, it’s imperative to ensure every detail reflects truthfully your financial status.

To protect yourself legally, maintain comprehensive records supporting your claims. Utilize accounting or bookkeeping tools for precision, and make a habit of updating your affidavit regularly in accordance with changes in circumstances.

Maximizing efficiency with pdfFiller

pdfFiller excels as a cloud-based platform designed for seamless document editing, e-signing, and management. With features tailored to filling out a financial affidavit, users can leverage interactive tools that facilitate the input of necessary data into the affidavit with ease.

Collaborative functions allow multiple parties to view and verify financial disclosures, ensuring that everyone involved has access to the most current version of the affidavit. Furthermore, pdfFiller's cloud storage makes it easy to access files from anywhere, boosting productivity and organizing efforts effectively.

Conclusion

Navigating the complexities of a financial affidavit can feel daunting. However, the importance of accurate financial disclosure cannot be understated. By using efficient management solutions like pdfFiller, individuals can streamline their documentation processes, ensuring they present a truthful representation of their financial situation.

Whether for legal proceedings or financial applications, being well-prepared with a thorough financial affidavit reflects integrity and responsibility, ultimately safeguarding your interests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send affidavit to establish financial for eSignature?

How do I execute affidavit to establish financial online?

Can I edit affidavit to establish financial on an iOS device?

What is affidavit to establish financial?

Who is required to file affidavit to establish financial?

How to fill out affidavit to establish financial?

What is the purpose of affidavit to establish financial?

What information must be reported on affidavit to establish financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.