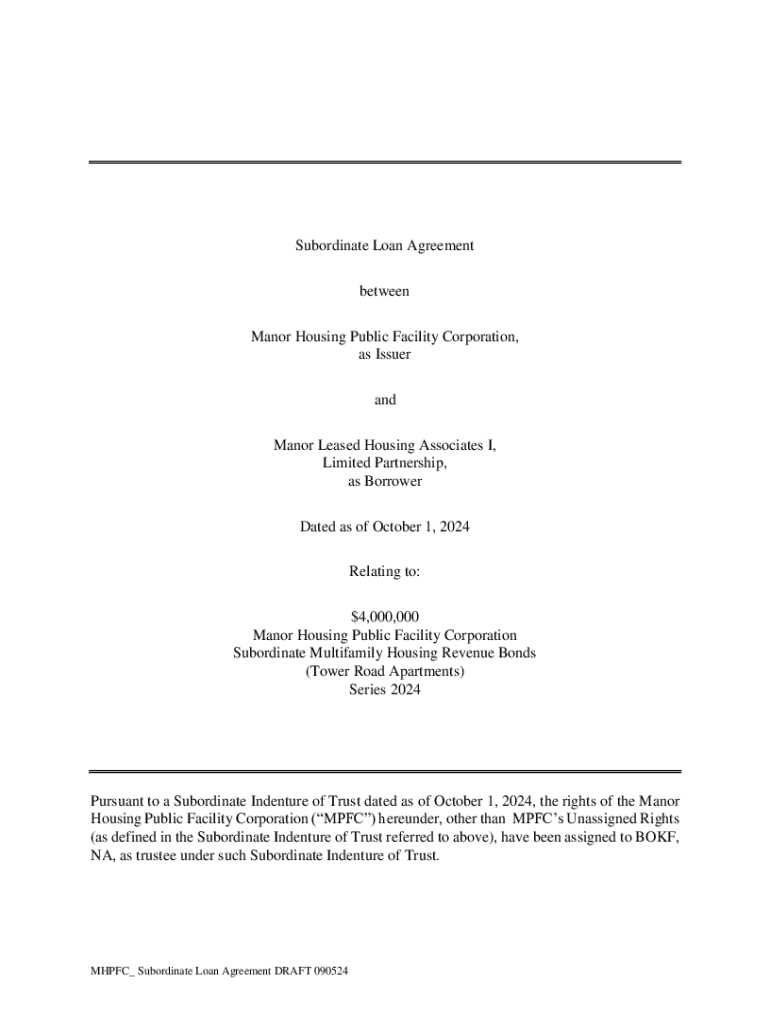

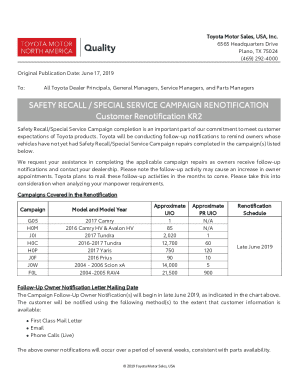

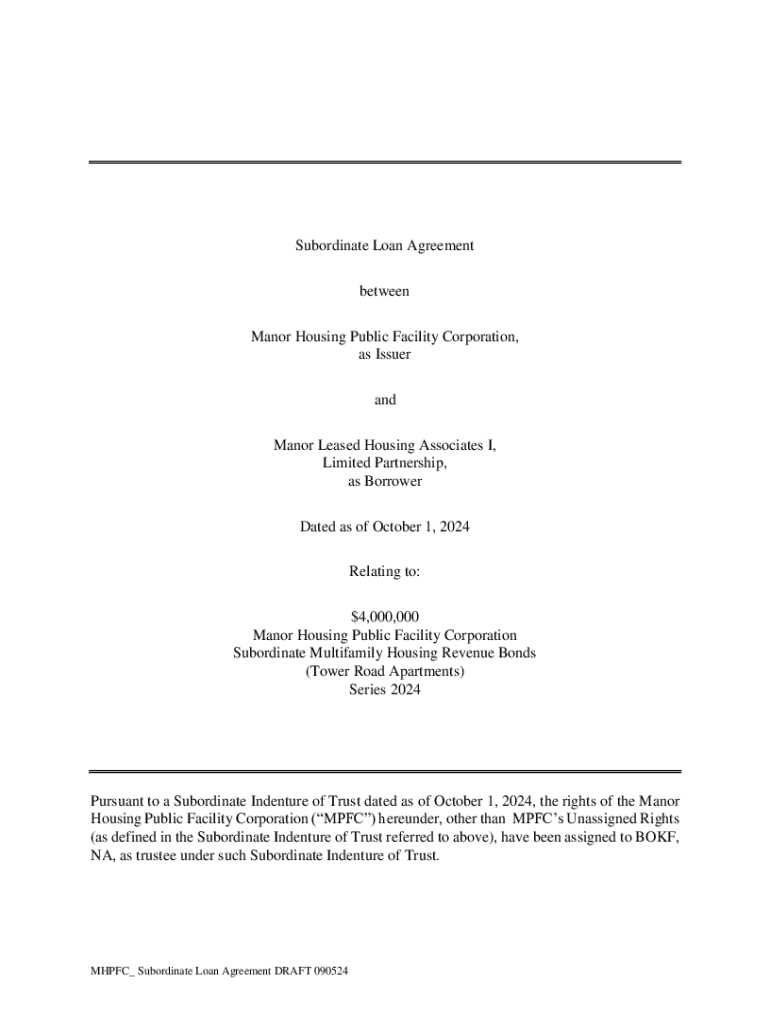

Get the free Subordinate Loan Agreement between Manor Housing Public ...

Get, Create, Make and Sign subordinate loan agreement between

Editing subordinate loan agreement between online

Uncompromising security for your PDF editing and eSignature needs

How to fill out subordinate loan agreement between

How to fill out subordinate loan agreement between

Who needs subordinate loan agreement between?

Understanding Subordinate Loan Agreement Between Forms

Understanding subordinate loan agreements

A subordinate loan agreement is a specific type of financial agreement that outlines the terms and conditions under which subordinate loans are made. Subordinated loans are typically used in various financial transactions, especially in real estate financing, to help borrowers secure necessary fundings when they have exhausted other forms of credit.

The purpose of a subordinate loan is to benefit both borrowers seeking to finance projects with higher levels of debt and lenders looking to diversify their investment portfolios. While these loans may come with higher risks for lenders, they often carry higher potential returns, making them attractive for certain investment strategies.

Key components of a subordinate loan agreement

A well-structured subordinate loan agreement comprises several critical components that clarify the terms for all parties involved. These elements include clearly defined parties, loan amounts, interest rates, repayment schedules, subordination clauses, and conditions for default. Without these details, misunderstandings can easily arise, leading to disputes.

The parties typically involved in a subordinate loan agreement include the borrower, who requires additional capital, and the lender, who is providing the subordinate funds. The loan amount is fundamental, as it dictates how much funding will be provided and influences the repayment terms. Interest rates can vary significantly based on the lender's risk assessment and market conditions.

The subordinate loan agreement template

A subordinate loan agreement template provides a valuable resource for both borrowers and lenders. It offers a standardized format that can be used to create customized agreements efficiently. This template is designed to feature fillable sections where specific information can be entered, making it highly accessible for users unfamiliar with legal jargon.

Interactive features enhance the usability of the template, allowing users to navigate easily through various sections and fill in the required data. Moreover, digital signature options make it effortless to finalize the agreement without the hassle of printing and scanning.

Step-by-step instructions for filling out the subordinate loan agreement

Filling out a subordinate loan agreement requires several essential steps to ensure accuracy and compliance. Start by gathering all necessary information, including the identities of borrowers and lenders and relevant financial data. This foundational knowledge is crucial for completing the subsequent sections accurately.

Once you have all your data, begin with Step 1, completing the parties section by ensuring that both borrower and lender information is correct. In Step 2, define the loan amount and terms, including interest rates and repayment timelines. Step 3 involves specifying all subordination terms clearly to avoid future misunderstandings. Finally, before moving to Step 5, review and finalize the agreement, making sure all details are correctly stated.

Editing and customizing your subordinate loan agreement

With pdfFiller’s user-friendly editing tools, customizing your subordinate loan agreement is both straightforward and efficient. Users can easily modify text, adjust formatting, and add or delete sections as required. This flexibility ensures the agreement remains relevant to the specific transaction at hand.

Collaboration features allow multiple stakeholders to contribute to document edits, ensuring that all perspectives are considered before finalizing the agreement. Additionally, pdfFiller’s version control and document history emphasize accountability, making it easy to track changes over time.

Managing your subordinate loan agreement

Effective management of subordinate loan agreements is crucial for both lenders and borrowers. Utilizing cloud storage solutions allows for secure, easily retrievable agreements anytime and from any location. This access is particularly beneficial in maintaining up-to-date records and ensuring that all parties can reference the agreement when needed.

Additionally, tracking changes and updates helps to keep all parties informed regarding adjustments to the agreement. Sending reminders for payment terms ensures borrowers stay on track with their commitments, fostering a responsible repayment culture.

Frequently asked questions about subordinate loan agreements

Understanding the implications of subordinate loan agreements raises several questions among borrowers and lenders alike. One significant concern is the significance of subordination in lending, which affects the repayment priority of loans during a default scenario. Essentially, subordinated loans are riskier because they stand behind senior loans in the repayment hierarchy.

Another common question is whether a subordinate loan agreement can be modified after both parties have signed. The answer is generally yes; however, modifications must be documented and agreed upon by all parties to maintain legality. Lastly, understanding what happens in case of a loan default is vital, as it often means the lender has limited recourse to recover their investment.

Related templates for financial agreements

In addition to subordinate loan agreements, various related templates can facilitate financial transactions. A promissory note template serves as a formal instrument wherein the borrower promises to pay back the loan in specified terms. The loan agreement template outlines more general terms applicable to most lending situations, while a financial disclosure statement template provides necessary insights into a borrower’s financial health.

Useful resources for understanding loan agreements

Enhancing your grasp of subordinate loan agreements and financial documentation begins with familiarizing yourself with common terminology. A glossary of terms used in loan agreements can clarify complex phrases and enhance understanding. Additionally, linking up with financial institutions that offer subordinate loans can provide insights into how these agreements apply in the real world.

Lastly, it's crucial to adhere to guidelines for legal compliance when drafting any loan agreement. This ensures that your agreement is valid and enforceable. By staying informed and utilizing available resources, borrowers and lenders can navigate subordinate loan agreements successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit subordinate loan agreement between from Google Drive?

Can I create an electronic signature for signing my subordinate loan agreement between in Gmail?

How do I edit subordinate loan agreement between straight from my smartphone?

What is subordinate loan agreement between?

Who is required to file subordinate loan agreement between?

How to fill out subordinate loan agreement between?

What is the purpose of subordinate loan agreement between?

What information must be reported on subordinate loan agreement between?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.