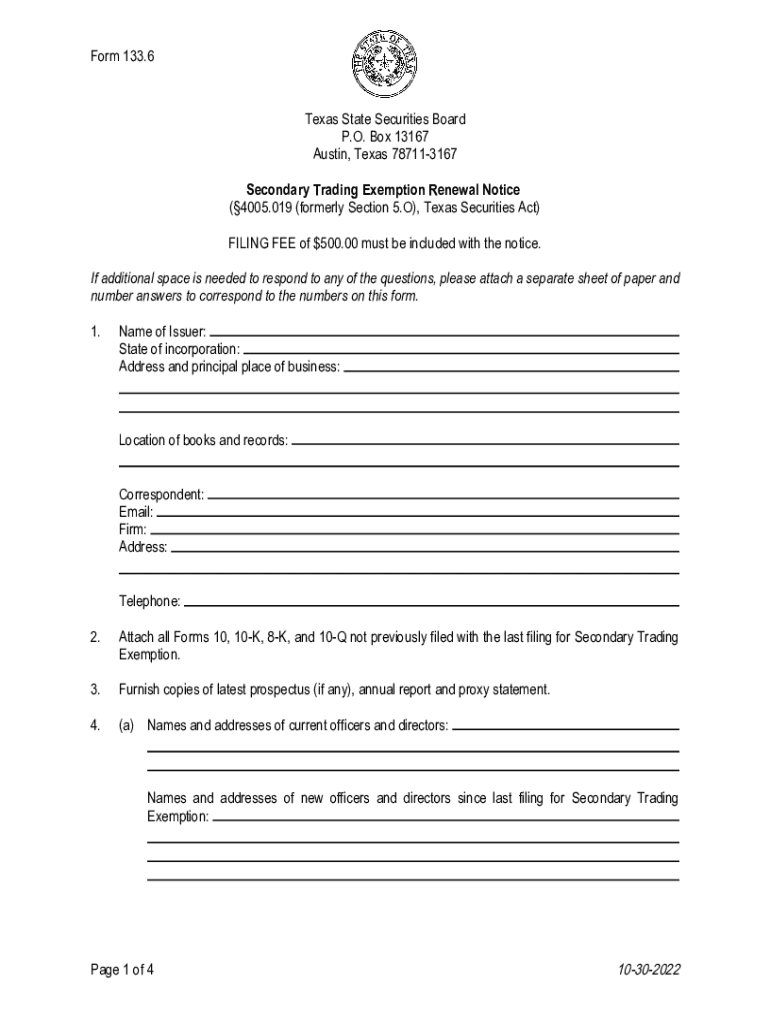

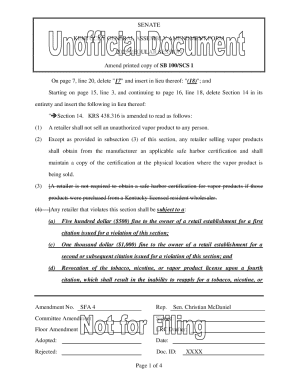

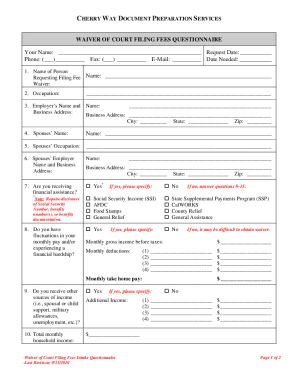

Get the free Form 133.6

Get, Create, Make and Sign form 1336

How to edit form 1336 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1336

How to fill out form 1336

Who needs form 1336?

How to Complete Form 1336

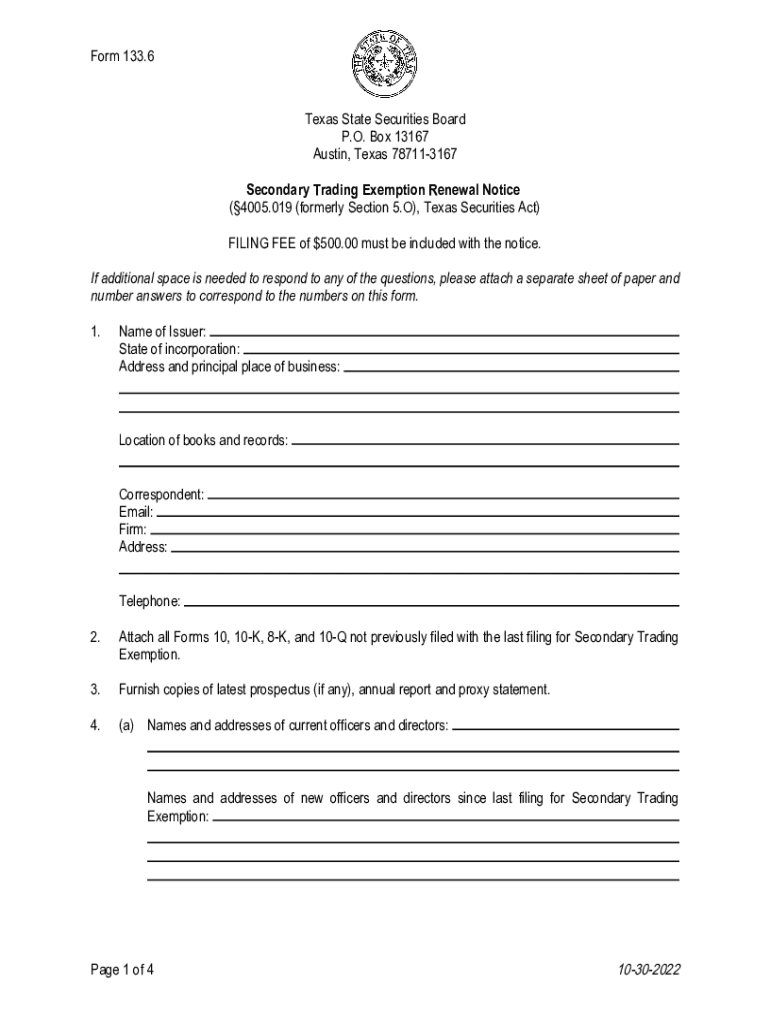

Overview of Form 1336

Form 1336 serves a pivotal role in various financial and regulatory processes. It primarily addresses reporting requirements and acts as a formal declaration for specific entities. Understanding its importance cannot be overstated, as improper handling or filing can lead to compliance issues. The form is commonly utilized by businesses, freelancers, and even individuals who need to report specific financial conditions or transactions.

Common use cases for Form 1336 include tax reporting, financial statements preparation, and audit trails for companies. It holds significance during audits and financial reviews, providing essential data that impacts financial integrity. Various professionals, such as accountants, tax preparers, and business owners, should familiarize themselves with this form to ensure compliance with applicable laws.

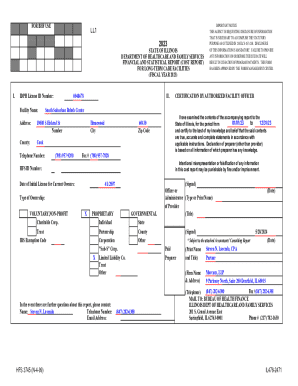

Understanding the structure of Form 1336

The structure of Form 1336 is specifically designed to facilitate accurate reporting. It consists of several key sections that gather essential data. The primary areas include personal information, financial details, and relevant dates, each integral to presenting a clear and comprehensive report.

Understanding specific terms and fields on the form is crucial. Required inputs include essential identification numbers and financial figures, while optional inputs can enhance the clarity of your filing, allowing for additional context or explanations as necessary.

Step-by-step guide to completing Form 1336

Completing Form 1336 might seem daunting, but breaking it down into manageable steps can simplify the process. Start by gathering all necessary documents that will provide the information required on the form. This may include previous tax documents, financial statements, and records of any relevant transactions.

Following preparation, proceed to fill out the form. Pay close attention to details, starting with personal information. Ensure accuracy since discrepancies can delay processing. When reporting income and expenses, be thorough in recognizing all sources of income and categorizing expenses correctly. For dates, meticulously record submission deadlines to avoid any late fees.

After completing the form, set aside time to review what you have entered. Create a checklist to ensure all sections are filled out accurately. Common errors often include miscalculations in financial entries or omitted signatures, so maintain diligence during this review stage.

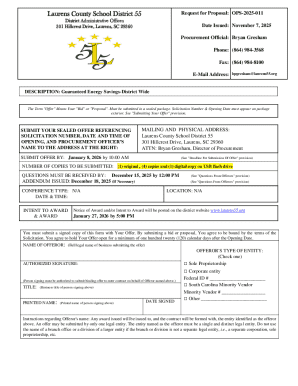

Tools for editing and managing Form 1336

Navigating Form 1336 can be made easier with tools designed for editing and managing documents. pdfFiller offers an excellent platform for seamless form completion. Its interactive features enable users to edit documents effortlessly, ensuring all fields are appropriately filled before submission.

The integration of eSignature capabilities further simplifies the process, allowing you to sign documents digitally without the need for printing or scanning. Collaborating with team members becomes straightforward with pdfFiller's sharing options. You can manage permissions effectively, giving team members access to review and edit the form as needed.

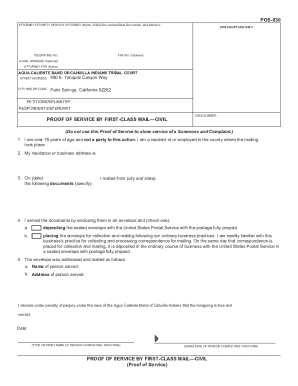

Submitting Form 1336

Once Form 1336 is completed, submitting it correctly is the next crucial step. Submission methods vary, with options for online submission that may be quicker or traditional mailing for those who prefer hard copies. For online submissions, ensure you follow the platform’s guidelines carefully to prevent rejection.

Deadlines are paramount when submitting Form 1336. Mark important dates on your calendar, as missing them can lead to penalties. Additionally, familiarize yourself with any associated fees that may arise from late or incorrect submissions so you can avoid unnecessary costs.

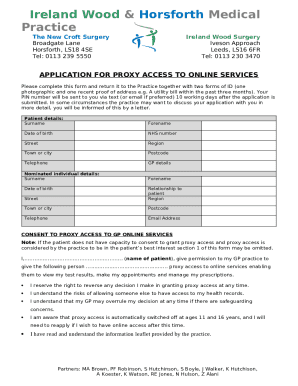

Frequently asked questions about Form 1336

As with any regulatory form, questions often arise regarding the particulars of Form 1336. Common queries include how to handle missing information or what to do if a mistake is made on the form. Responding proactively to these issues is essential.

For further assistance, don’t hesitate to reach out to the appropriate authorities. Contact information is usually provided on the document or relevant websites, allowing you to clarify your concerns directly with the source.

Troubleshooting Form 1336 issues

Experiencing issues with Form 1336 is not uncommon. Common reasons for form rejection include incomplete fields or discrepancies in reported data. To mitigate these issues, review the completed form thoroughly before submission.

Should you need to make amendments, familiarizing yourself with the follow-up process is critical. Understanding how to document changes can save time and ensure compliance. Be wary of frequently overlooked problems, such as incorrect signatures or mismatched dates, to ensure your filing goes smoothly.

Best practices for Form 1336 management

Managing Form 1336 effectively can streamline your financial processes. Keeping secure digital copies is paramount; this can safeguard against loss and facilitate easy access when required. Regularly updating form information ensures that the data remains current, reducing the chances of future complications.

Utilizing tools like pdfFiller enhances long-term management, allowing you to edit templates and create customized forms as needed. The cloud-based platform ensures that you can access your documents from anywhere, which is invaluable for teams requiring collaboration.

Additional information on Form 1336

Staying informed about updates and changes to Form 1336 is vital. Regulatory bodies often revise forms to adapt to new legislation or reporting standards. It is also beneficial to understand associated forms that might relate to Form 1336, such as tax returns or other financial declarations.

Legal considerations for filing include understanding statutes of limitations and compliance requirements. Being proactive in seeking information can help navigate any potential legal issues that arise.

Leveraging pdfFiller for optimal document management

pdfFiller stands out as a powerful tool for managing Form 1336 and similar documents effectively. Its comprehensive features include robust cloud storage solutions that keep your documents secure and readily available. Additionally, customizable templates for various forms streamline your workflow, making document handling less burdensome.

By incorporating pdfFiller into your document management processes, you can experience a significant enhancement in efficiency and organization, ultimately simplifying your compliance tasks while ensuring accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 1336 online?

How do I fill out form 1336 using my mobile device?

How do I fill out form 1336 on an Android device?

What is form 1336?

Who is required to file form 1336?

How to fill out form 1336?

What is the purpose of form 1336?

What information must be reported on form 1336?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.