Get the free NOTICE OF NO REVENUE IMPACT

Get, Create, Make and Sign notice of no revenue

How to edit notice of no revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of no revenue

How to fill out notice of no revenue

Who needs notice of no revenue?

Notice of No Revenue Form - How-to Guide

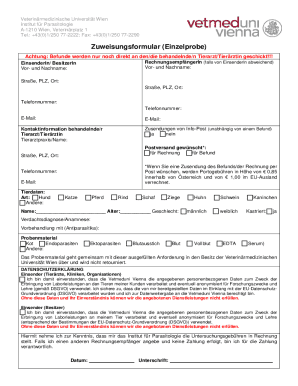

Understanding the Notice of No Revenue Form

The Notice of No Revenue Form is a crucial document for businesses that have experienced a fiscal year with no revenue. This form serves as a formal notification to the tax authorities, ensuring that they are aware of your business's financial status. By filing this form, you can avoid unnecessary penalties for failing to report income that does not exist. The importance of this form cannot be overstated, especially when a business aims to maintain its compliance with tax regulations.

Businesses of various types—from small startups to established corporations—may find themselves needing to file the Notice of No Revenue Form. This is especially true for companies facing economic downturns, transitioning phases, or seasonal fluctuations in earnings. It's vital for all business owners to recognize when to utilize this form as part of their overall tax strategy.

Prerequisites for filing the form

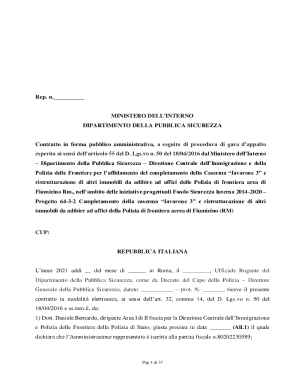

Before you can file the Notice of No Revenue Form, having specific documentation and information ready is imperative. You will need your business identification details, such as your Employer Identification Number (EIN) or Social Security Number (SSN), depending on your entity type. Moreover, while you're reporting no revenue, it's essential to have records that showcase your financial activity (or the lack thereof) during the reporting period.

Preparing your business for filing involves a comprehensive review of your previous filings and compliance history. Ensuring that all past returns are complete and accurate can significantly simplify the process. Businesses should also keep track of any changes in their operational status that might affect their tax reporting requirements.

Step-by-step instructions for completing the form

Step 1: Accessing the form

You can find the Notice of No Revenue Form through various government websites or by using services offered on pdfFiller. Simply navigate to the Forms section and search for 'Notice of No Revenue.' If you prefer a physical copy, you can request one from your local tax office.

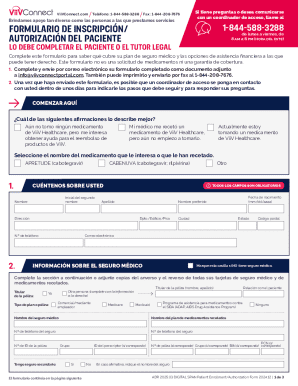

Step 2: Filling out the form

When filling out the form, begin by entering your complete business information—including your name, address, and identification number. Next, the revenue reporting section is critical; you will clearly state that your reported revenue for the designated period is zero. Make sure to read through any certification and signature requirements. A common pitfall is neglecting to sign the form, which can lead to delays in processing.

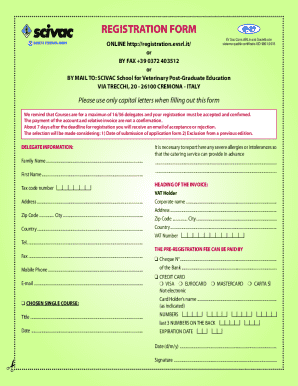

Filing options and submission process

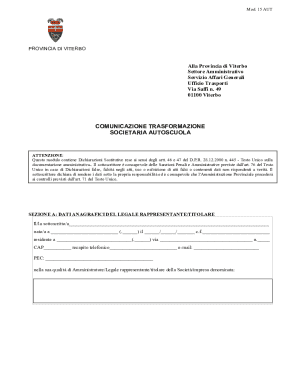

Electronic submission

For those who prefer a convenient approach, electronic submission via pdfFiller is an excellent option. With a user-friendly interface that allows for seamless electronic filing, the benefits include instant confirmation of submission and less paperwork. To file electronically, simply upload your completed form to pdfFiller, finalize any required edits, and submit it directly to the appropriate agency.

Physical submission

If you choose to submit the Notice of No Revenue Form physically, make sure you mail it to the correct address provided on the form. It's prudent to send your form via a trackable mail service to ensure it reaches the agency. This allows you to verify submission status without stress.

What happens after submission?

After you submit the Notice of No Revenue Form, it typically undergoes a processing period that can vary based on the agency's workload. Generally, expect to wait between 4 to 8 weeks for your submission to be processed. During this time, you can check the status of your filing by contacting the agency directly or checking any online portals they may provide.

Common issues and troubleshooting

While filing, you may encounter various issues, such as missing fields or incorrect information. Always double-check your entries before submission. If you find yourself in a situation where your submission has been rejected, reach out to the agency's support team for guidance. They can assist in identifying the issues preventing successful processing.

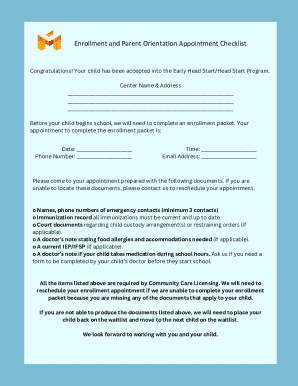

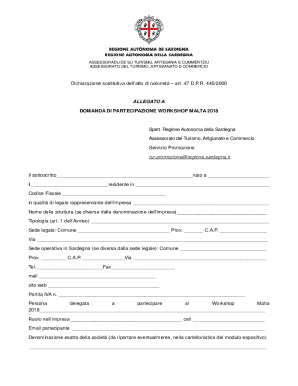

Related forms and documentation

It's essential to recognize that the Notice of No Revenue Form is often part of a broader set of documentation needed when managing business revenues. For example, depending on your situation, you may also find forms related to tourist development tax rates, property tax, or utility services necessary for additional reporting requirements. Understanding when to file these related forms can help maintain compliance and avoid complications.

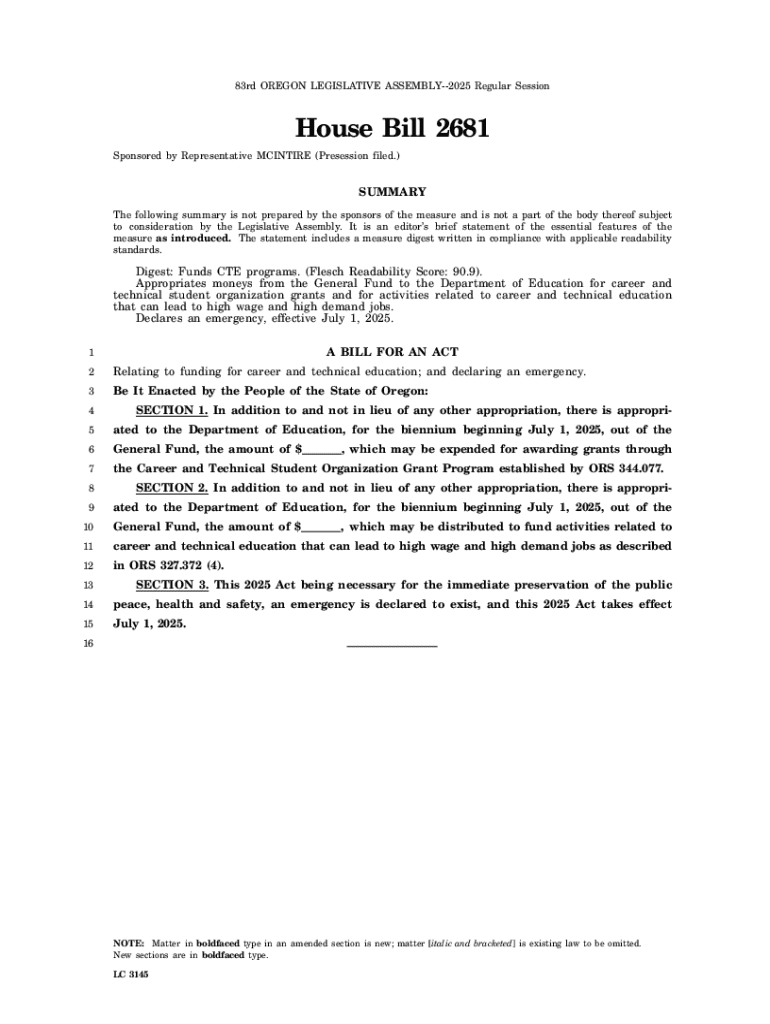

Best practices for business compliance

Maintaining regulatory compliance goes beyond filing the Notice of No Revenue Form. It's vital to keep accurate records of all transactions and business activities, even if they are minimal. Using tools like pdfFiller for comprehensive document management can streamline this process. Keeping everything organized can save you time and stress in future filings.

Real-life examples and case studies

Consider the case of a local Florida startup that faced an unexpected economic downturn. They filed their Notice of No Revenue Form accurately and in a timely manner, which safeguarded them from potential fines. They utilized pdfFiller to manage their documents seamlessly, which proved invaluable when it came time to submit other forms later in the year. Key lessons from this scenario include the importance of timely filing and using the right tools to manage documentation effectively.

Conclusion

Navigating the complexities of the Notice of No Revenue Form is essential for any business that experiences a fiscal year without revenue. This guide has highlighted critical steps and best practices to ensure compliance and avoid unnecessary penalties. Leveraging services like pdfFiller enhances document management, streamlining the completion, editing, and submission processes. Equip your business to respond effectively to its financial landscape while remaining on the radar of regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my notice of no revenue directly from Gmail?

How can I send notice of no revenue for eSignature?

Can I sign the notice of no revenue electronically in Chrome?

What is notice of no revenue?

Who is required to file notice of no revenue?

How to fill out notice of no revenue?

What is the purpose of notice of no revenue?

What information must be reported on notice of no revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.