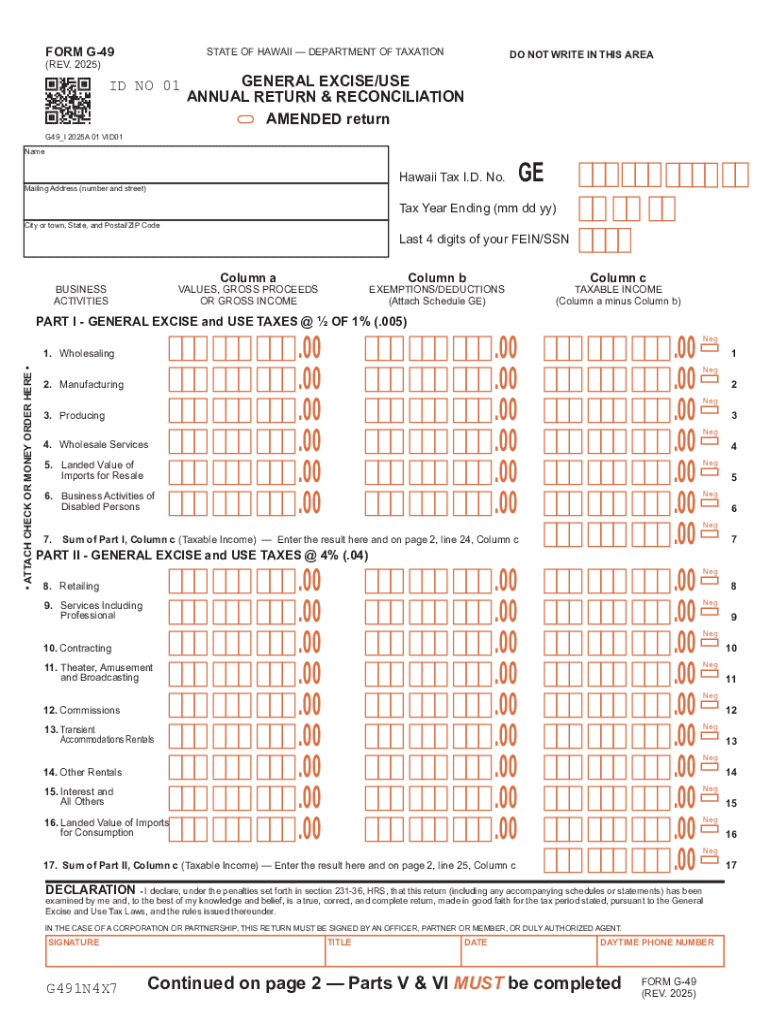

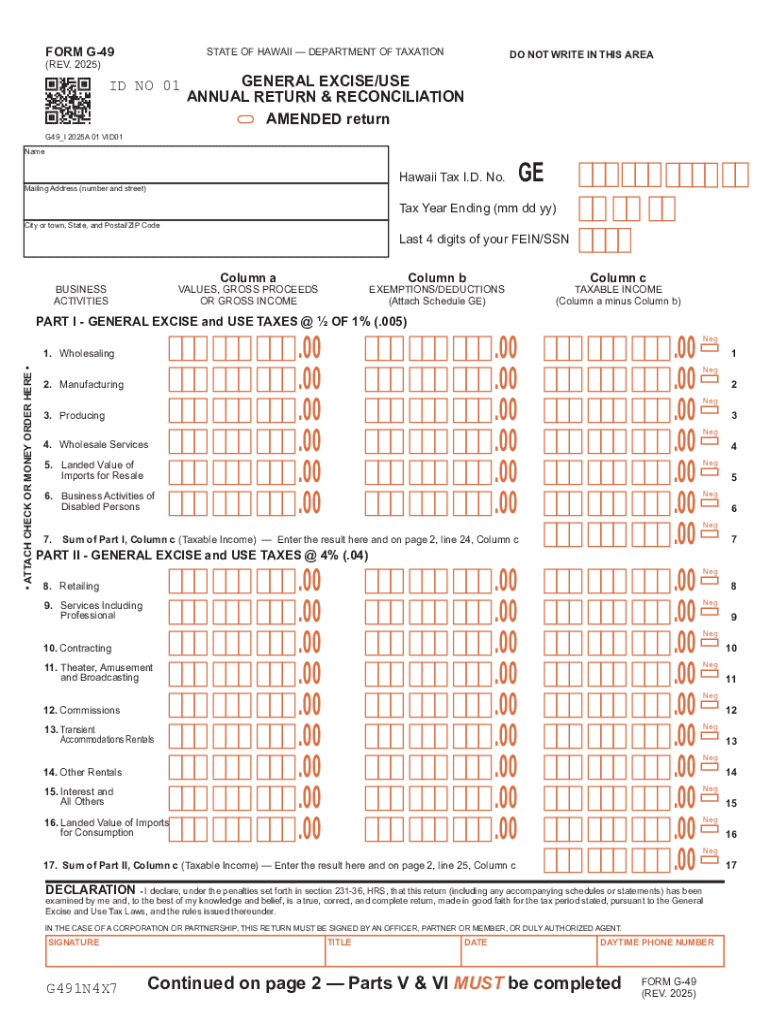

Get the free Form G-49, Annual General Excise/Use Tax Return & Reconciliation, Rev. 2025. For...

Get, Create, Make and Sign form g-49 annual general

How to edit form g-49 annual general online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form g-49 annual general

How to fill out form g-49 annual general

Who needs form g-49 annual general?

How-to Guide Long-Read: Form G-49 Annual General Form

Understanding the Form G-49

Form G-49 is a crucial annual submission required by various organizations to report essential data concerning their financial and operational status. This form not only gathers vital information but also ensures organizations maintain compliance with regulatory requirements.

The purpose of Form G-49 is multifaceted. Primarily, it serves as an accountability mechanism for entities, compelling them to disclose pertinent data regarding their finances, operations, and compliance standings, all of which can be scrutinized by regulatory bodies.

Organizations that meet specific criteria, such as size, revenue, or sector, are typically mandated to file Form G-49. Understanding whether your organization falls under these regulations is critical, as filing this form can impact your operational status and regulatory compliance.

Key components of Form G-49

Form G-49 consists of several key sections that are designed to collate comprehensive data regarding an entity. Each section caters to a distinct category of information, ensuring clarity and ease of analysis for regulatory auditors.

The sections are broadly categorized into: 1. Basic Information: Includes essential details about the filing organization. 2. Financial Data: Captures in-depth financial metrics, including income, expenses, and net profit. 3. Compliance Information: Provides insights into the organization's adherence to regulations and policies.

Familiarity with the terminology and definitions within these sections can facilitate a smoother filing process, enabling filers to provide accurate and concise information.

Step-by-step instructions to fill out Form G-49

Filing Form G-49 requires careful preparation and attention to detail. Begin by gathering the necessary information and documentation. This includes financial records, identification numbers, and other pertinent data that reflect the organization’s operational status.

When completing the form, it's crucial to ensure all data entered is accurate. Double-check figures and verify the correctness of entries. Avoid common mistakes such as incorrect figures, incomplete sections, or mislabeling information, as these errors can lead to penalties or submission rejections.

Editing and modifying your Form G-49

After filling out Form G-49, reviewing and editing the document is imperative. Utilizing tools available on pdfFiller can drastically simplify this process. The platform offers robust editing features that allow you to revise the information easily.

With pdfFiller, you can edit text, add or remove sections, and ensure the document adheres to compliance standards. Ensuring accuracy at this stage can prevent unnecessary complications during submission.

Collaboration tools for team filing

For organizations filing the Form G-49 collaboratively, utilizing team tools can streamline communication and enhance efficiency. pdfFiller provides features that enable sharing the form with multiple team members, allowing for real-time input and feedback.

The platform supports real-time collaboration, allowing team members to make changes simultaneously while leaving comments for review. This can significantly minimize errors and ensure a thorough review process.

Signing your Form G-49

Once the Form G-49 is completed, it requires an official signature to validate the submission. Understanding the signature requirements is crucial, as regulatory bodies require proper authentication to recognize the submission legally.

pdfFiller facilitates this process by enabling users to apply electronic signatures directly within the platform. This not only saves time but also ensures that documents can be signed securely and efficiently.

Submitting Form G-49

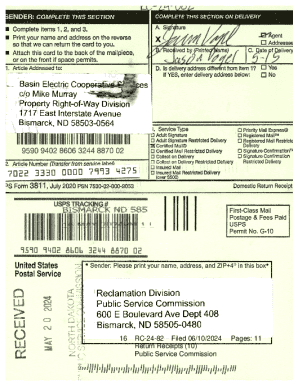

With your Form G-49 signed and ready, the next step is submission. Understanding the various submission methods is essential for filing compliance. You have options to submit online, via mail, or in person.

Online submission is often the fastest and most efficient method, allowing for immediate processing and acknowledgment. For mail or in-person submissions, remember to track your documents to confirm receipt by the necessary regulatory bodies.

Managing your filed Form G-49

Post-filing, managing your Form G-49 is just as important as completing it accurately. pdfFiller allows you to access your filed documents anytime and anywhere, ensuring ease of reference.

Organizing your documents within the platform facilitates quick access and retrieval, whether for audits, amendments, or general use. Furthermore, should you require amendments or resubmissions, pdfFiller simplifies these processes, allowing you to streamline your document flow.

Frequently asked questions about Form G-49

Many individuals and organizations have questions surrounding Form G-49. Common inquiries often focus on filing deadlines, correction procedures, and the consequences of late submissions. Understanding these elements is crucial for compliant filing.

Additionally, troubleshooting issues with electronic submission can be daunting. pdfFiller's support resources are readily available to assist with these concerns, ensuring users can find answers quickly.

Final thoughts on Form G-49

The importance of submitting an accurate Form G-49 cannot be overstated. Beyond compliance, this form serves as a reflection of an organization's operational health and accountability. By utilizing pdfFiller, users can benefit from seamless editing, eSigning, and collaborative features.

Encouraging organizations to leverage cloud technology like pdfFiller can enhance their document management processes significantly, allowing for efficiency and accuracy in fulfilling regulatory obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form g-49 annual general without leaving Google Drive?

How can I send form g-49 annual general for eSignature?

How do I complete form g-49 annual general on an Android device?

What is form g-49 annual general?

Who is required to file form g-49 annual general?

How to fill out form g-49 annual general?

What is the purpose of form g-49 annual general?

What information must be reported on form g-49 annual general?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.