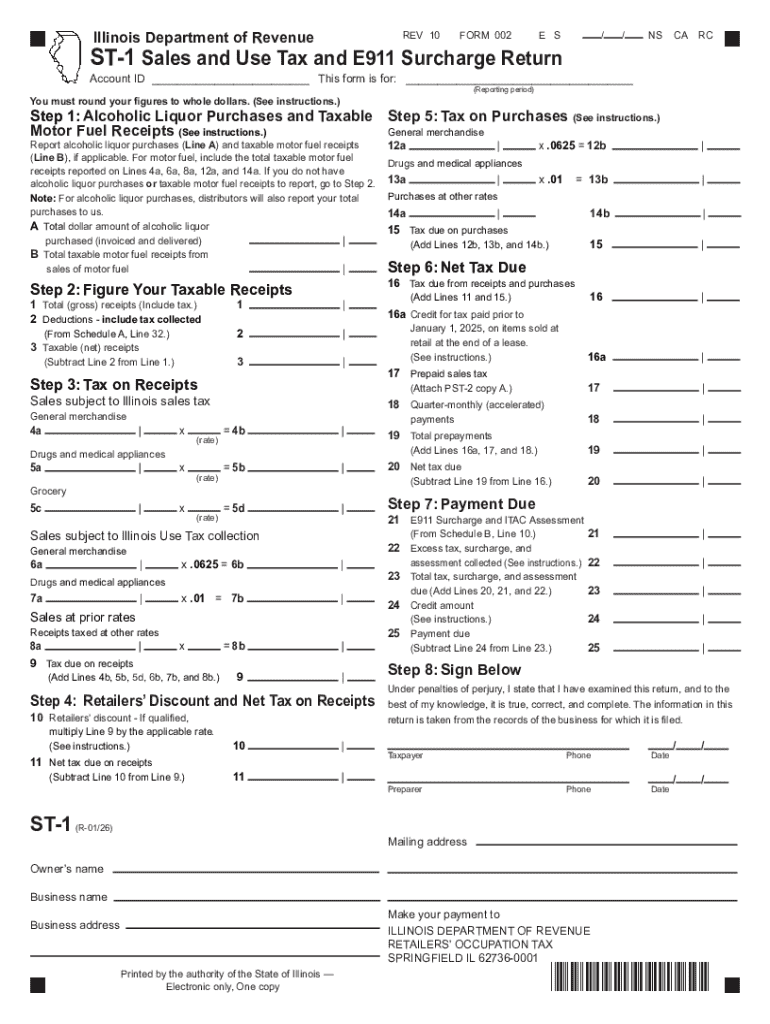

IL ST-1 2026 free printable template

Get, Create, Make and Sign IL ST-1

Editing IL ST-1 online

Uncompromising security for your PDF editing and eSignature needs

IL ST-1 Form Versions

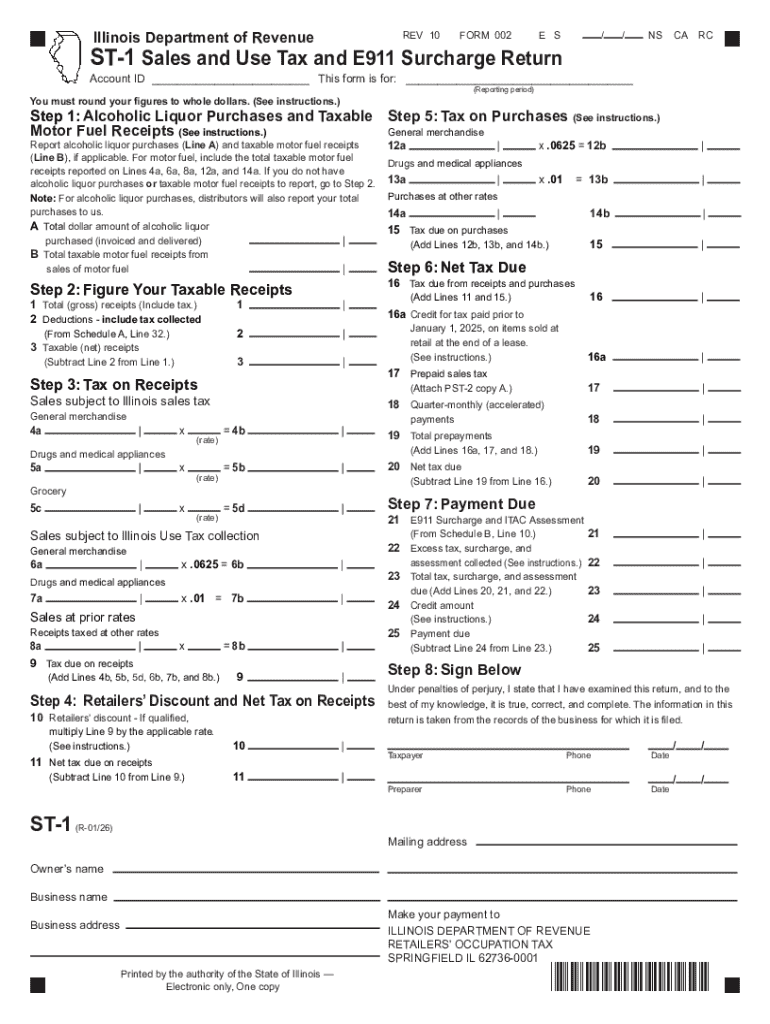

How to fill out IL ST-1

How to fill out st-1 sales and use

Who needs st-1 sales and use?

Your Essential Guide to the ST-1 Sales and Use Form

Understanding the ST-1 sales and use form

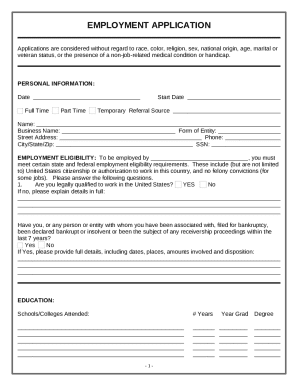

The ST-1 Sales and Use Form is a crucial document for individuals and businesses seeking to declare and manage their sales tax liabilities effectively. This form enables taxpayers to report and remit sales and use tax to their respective state authorities. It is essential for compliance with state tax regulations, ensuring that all applicable taxes are paid on time and correctly.

The importance of the ST-1 form cannot be overstated as it serves as a record of sales tax collected on taxable purchases. Failing to file this form can lead to significant penalties, interest on unpaid taxes, and potential legal action from tax authorities. Knowing who needs to use the ST-1 form is vital; typically, it is required by retailers, wholesalers, and other entities making taxable sales or purchases.

Key components of the ST-1 sales and use form

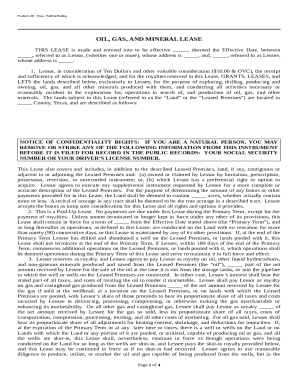

Understanding the structure of the ST-1 form is essential for accurate completion. The form comprises several key sections that gather critical information regarding the taxpayer, the purchases made, and the calculations pertaining to sales tax. Each part of the form plays a unique role in ensuring the accurate reporting of sales tax obligations.

Step-by-step guide to completing the ST-1 form

Completing the ST-1 form can seem daunting, but following a systematic approach will simplify the process. Begin by gathering all necessary documentation, which will ensure you have all the required information at hand.

Interactive tools for managing the ST-1 form

Utilizing modern tools can greatly enhance your experience in completing the ST-1 sales and use form. pdfFiller offers a user-friendly platform that empowers you to edit PDF documents effortlessly, making it easier to fill out the ST-1 form. You can add text, modify existing fields, and even import data from your previous submissions.

Moreover, the eSignature feature provided by pdfFiller allows you to sign the form digitally, providing a seamless submission process. Digital signatures are not only convenient but also legally binding, ensuring compliance with state requirements without the hassle of printing or scanning physical copies.

Common issues and FAQs related to the ST-1 sales and use form

When dealing with the ST-1 form, users often have questions regarding its completion and submission. Understanding these common inquiries can mitigate confusion and help ensure compliance. Here are some of the most frequently asked questions.

Best practices for managing your sales and use tax documents

Effective management of your tax documents can streamline your financial processes and reduce stress during tax season. Utilizing tools such as pdfFiller can help keep you organized. With features designed for document storage and retrieval, keeping track of your ST-1 form and related documents becomes effortless.

Additionally, setting reminders for submission deadlines, utilizing calendar integrations through pdfFiller, will help you stay on top of your filing dates. By establishing a routine to organize your documents, you can save time and avoid the rush often associated with tax submission periods.

Conclusion: mastering sales tax compliance with the ST-1 form

Adhering to sales tax regulations through the careful completion and submission of the ST-1 form lays the groundwork for sound financial practices. Effective management of tax documents not only aids compliance but also bolsters your credibility with taxing authorities. Embracing user-friendly tools like pdfFiller will ensure an efficient experience.

Collaboration, organization, and accurate submissions are integral to success in managing your sales and use tax obligations, and with the right resources, you can navigate the complexities of sales tax compliance confidently.

Need more help with your ST-1 sales and use form?

If you require further assistance with the ST-1 form, consider reaching out to support for personalized help navigating your state's specific requirements. Tax laws can vary widely by jurisdiction, making it vital to have up-to-date information tailored to your location.

Staying informed and connected with resources can make completing the ST-1 sales and use form much more manageable.

Popular searches related to the ST-1 form

Users often seek additional resources when dealing with the ST-1 sales and use form. Understanding related forms and templates, coupled with clarifications on other tax compliance requirements, can be beneficial.

Breadcrumb navigation for easy access

For a smoother experience in navigating tax forms and resources, having a clear breadcrumb navigation will help users access different sections with ease. Whether you are looking for information on related forms, submission deadlines, or specific instructions on the ST-1 form, knowing where to find these details can save you time and keep your applications organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IL ST-1 for eSignature?

How do I make changes in IL ST-1?

Can I sign the IL ST-1 electronically in Chrome?

What is st-1 sales and use?

Who is required to file st-1 sales and use?

How to fill out st-1 sales and use?

What is the purpose of st-1 sales and use?

What information must be reported on st-1 sales and use?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.