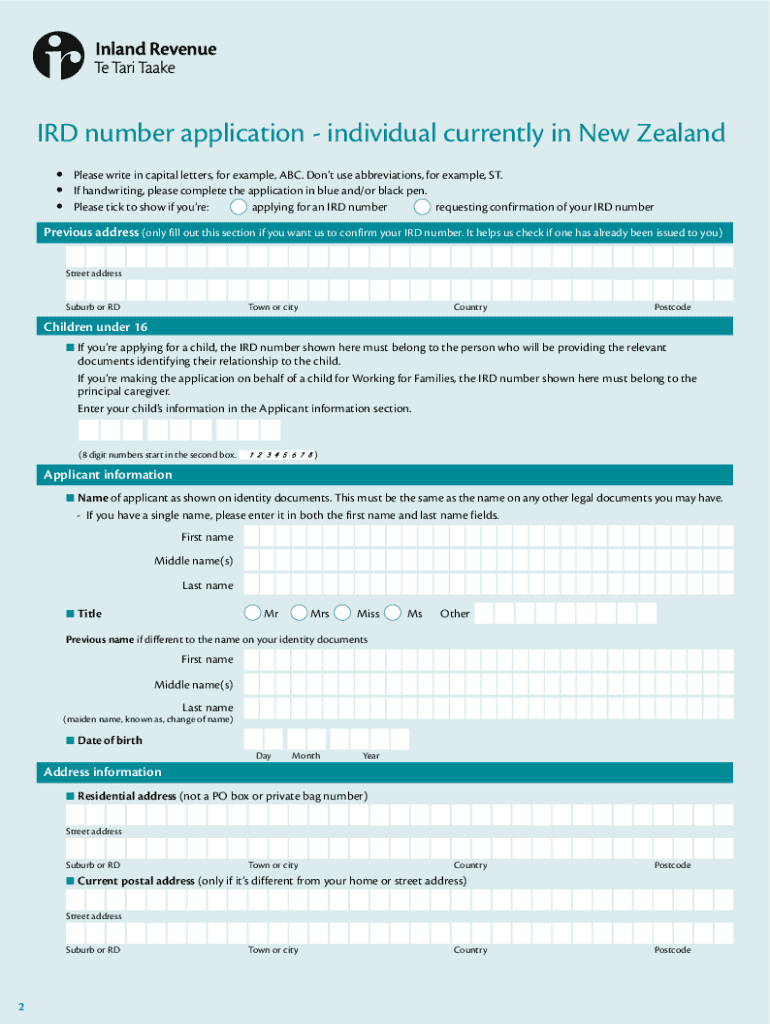

Get the free IR595 IRD number application individual currently in New Zealand

Get, Create, Make and Sign ir595 ird number application

How to edit ir595 ird number application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ir595 ird number application

How to fill out ir595 ird number application

Who needs ir595 ird number application?

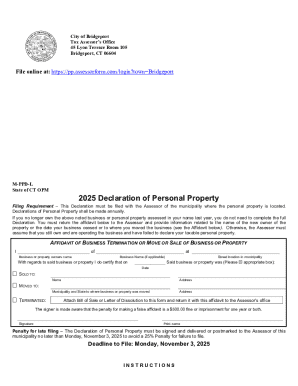

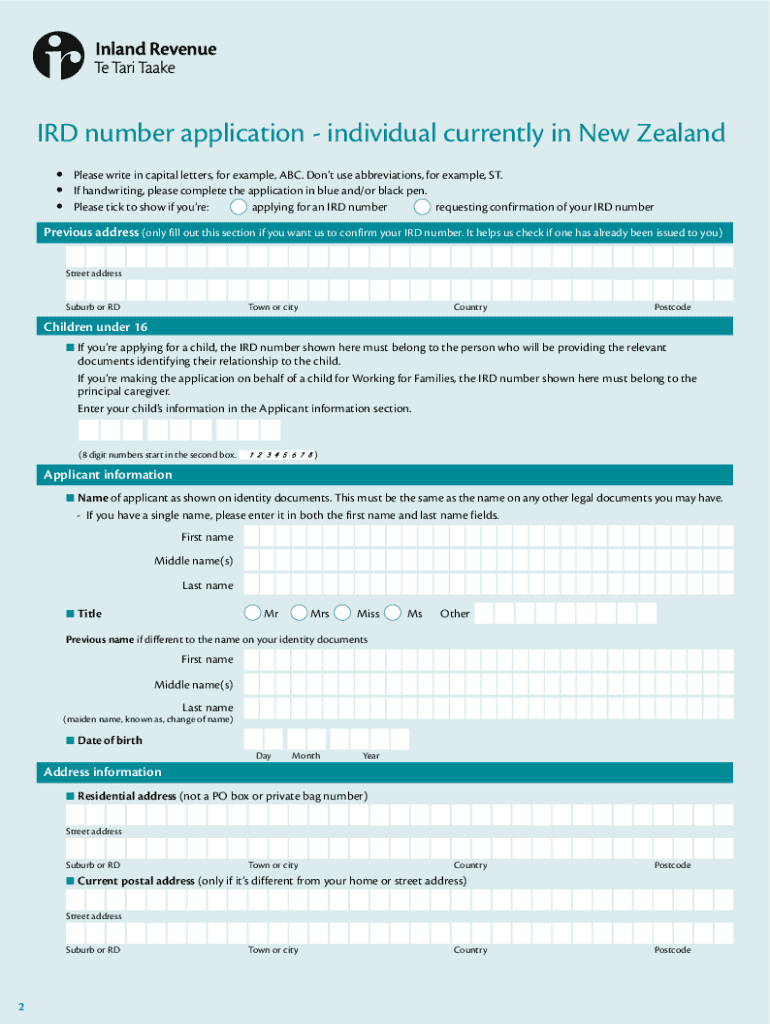

Comprehensive Guide to the IR595 IRD Number Application Form

Overview of the IR595 IRD number application process

The IR595 form is the official document used in New Zealand for individuals and businesses applying for an IRD (Inland Revenue Department) number, which is essential for tax purposes. An IRD number serves as a unique identifier for taxpayers, enabling the Inland Revenue to track income and collect taxes efficiently. Obtaining an IRD number is crucial for anyone earning income in New Zealand, as it ensures compliance with tax regulations.

The application process with the IR595 form is straightforward, designed to streamline the collection of necessary information. Applicants can access the form both online and in print, allowing for flexibility depending on personal preferences and situations.

Understanding the IRD number

An IRD number is a unique identifier assigned by the New Zealand government to individuals and entities for income and tax identification purposes. It is necessary for anyone who earns income in New Zealand to ensure they meet their tax obligations. This number helps streamline tax collection and contributes to the broader economic infrastructure of the country.

People and businesses needing an IRD number include employees, students, contractors, and self-employed individuals. The benefits of having an IRD number include the ability to file tax returns, access essential social services, and engage in business transactions legally. Additionally, it ensures individuals are taxed appropriately based on their income.

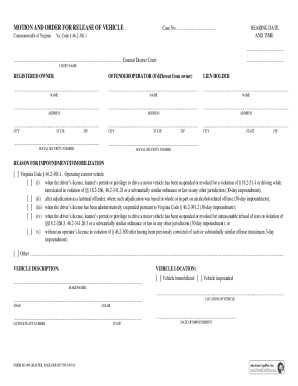

Preparing to complete the IR595 form

Before tackling the IR595 form, it’s crucial to gather all required identification documents. This preparation phase significantly enhances the likelihood of a smooth application process. Accepted identification documents include a valid New Zealand passport, a birth certificate, or a residence permit for non-residents.

Ensuring that the documents are current and valid is imperative. Additionally, understanding your eligibility -- whether you're an individual, a child, or a business -- is vital. Residents typically process their applications differently than non-residents, thus applicants should ensure they meet the necessary criteria for their specific situation.

Step-by-step guide to filling out the IR595 application form

Accessing the IR595 form can be done easily online through the official Inland Revenue website or directly via pdfFiller, a platform that allows for comprehensive document management. Once you find the form, proceed to fill it out carefully.

Step 1: Accessing the IR595 form

The IR595 form is conveniently available online, making it easy to download, print, or fill out digitally via pdfFiller. This allows for easy access from any device, streamlining the whole process.

Step 2: Completing personal information section

When filling in personal details on the IR595 form, ensure you enter accurate information such as your name, address, and date of birth. Each field must be completed with great care, as even minor errors can delay your application. Be attentive to include all relevant details consistently.

Step 3: Providing identification details

It's important to input the details of your identification documents accurately. Incorrect information can lead to significant delays in processing your application. Double-check all entries before moving on to the next section.

Step 4: Additional information requirements

Along with personal details, the form requires information regarding your tax residency and sources of income. Be clear when answering whether you have been assigned a previous IRD number. Proper answers will facilitate the processing of your application smoothly.

Step 5: Reviewing your application

Once your form is filled, a thorough review is essential. Check for any errors or missing information. pdfFiller’s editing tools can assist you in making necessary adjustments, ensuring your application is flawless before submitting.

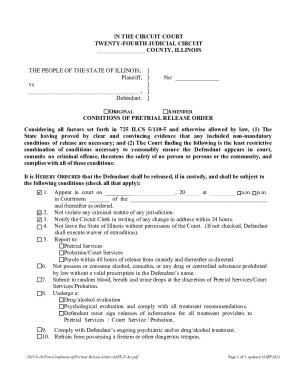

Submitting the IR595 form

You can submit the IR595 form through two primary methods: online submission or mail-in application. Each method has its specific procedures. For most applicants, online submission via pdfFiller is recommended for its efficiency.

Methods of submission

Submitting online is straightforward. After completing the application on pdfFiller, simply follow the prompts for electronic submission. Alternatively, for those who prefer mailing, ensure to print, sign, and send the completed form to the appropriate postal address for the Inland Revenue.

What to expect after submission

Once your application is submitted, expect a processing timeline of usually between 8-10 working days, though this can vary. You’ll receive notification from the Inland Revenue once your IRD number has been issued. Tracking your application's progress is possible by contacting their service center or accessing your account online.

Managing your IRD number once issued

Upon receiving your IRD number, you’ll find it documented within your correspondence from the Inland Revenue. It's important to keep this number secure and private, treating it like sensitive information.

Updating your information

Should you need to update any personal details linked to your IRD number, this can typically be done online through the Inland Revenue website. Keeping your information accurate is critical to ensure compliance and avoid any potential issues with tax reporting or social benefits.

Troubleshooting common issues

Despite careful preparation, issues may arise during the application process. If your application is rejected, understanding the common reasons—such as incorrect forms or documentation—will help you address them effectively.

What to do if your application is rejected

If you receive a rejection, review the feedback provided and rectify any issues before reapplying. Common fixes include resubmitting with corrected information or updated identification documents. Moreover, gathering additional supporting documentation might strengthen any subsequent submissions.

How to handle lost or forgotten IRD numbers

If you forget your IRD number, you can retrieve it by accessing your account online or requesting it from the Inland Revenue service center. For lost numbers, the same steps apply; ensure you keep this information readily available to prevent future complications.

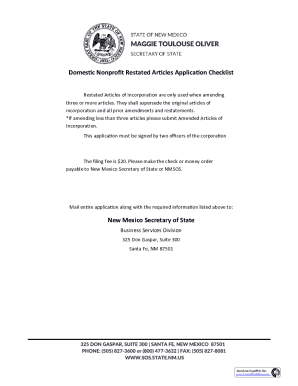

Leveraging pdfFiller tools for efficient document management

pdfFiller simplifies the process of filling and submitting forms like the IR595. With its user-friendly interface, you can effortlessly edit documents, eSign them, and collaborate with others if needed. By utilizing pdfFiller, users can manage their document requirements efficiently from any location.

Many users have shared experiences of successfully navigating the IR595 application process using pdfFiller, citing features such as real-time saving, document sharing abilities, and smooth eSigning as key benefits.

Interactive tools for a better application experience

pdfFiller comes equipped with interactive features that enhance your form-filling experience. For instance, users can utilize templates specifically crafted for related forms, facilitating a smoother transition between different document tasks. Such tools empower users to work more efficiently on their tax-related documents.

Frequently asked questions (FAQs)

Inquiries about the IR595 form and the IRD number application process commonly include questions about eligibility, processing times, and submission methods. Being informed about these aspects can greatly ease the application experience for all individuals and businesses.

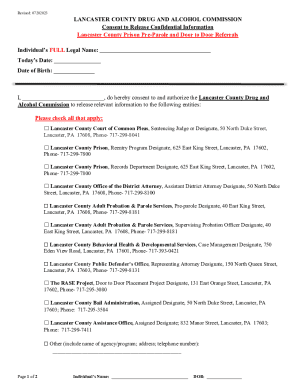

Additional notes on privacy and security

Securing personal information during the application process is paramount, especially when handling sensitive data like your IRD number. pdfFiller adheres to strict privacy regulations, ensuring that user data is protected throughout the document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ir595 ird number application in Chrome?

How can I edit ir595 ird number application on a smartphone?

How do I complete ir595 ird number application on an iOS device?

What is ir595 ird number application?

Who is required to file ir595 ird number application?

How to fill out ir595 ird number application?

What is the purpose of ir595 ird number application?

What information must be reported on ir595 ird number application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.