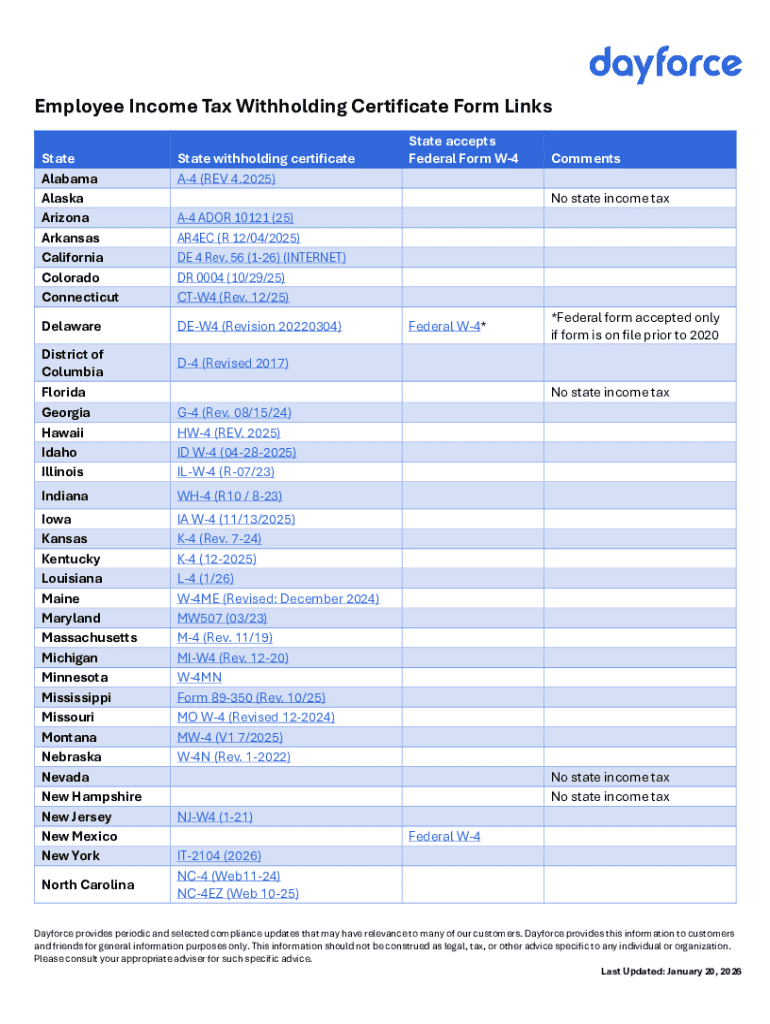

Get the free Employee Income Tax Withholding Certificate Form Links

Get, Create, Make and Sign employee income tax withholding

How to edit employee income tax withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee income tax withholding

How to fill out employee income tax withholding

Who needs employee income tax withholding?

Understanding the Employee Income Tax Withholding Form: A Comprehensive Guide

Understanding employee income tax withholding

Employee income tax withholding is the process by which employers deduct a portion of an employee's earnings for federal, state, and sometimes local income taxes. By doing this before employees receive their paychecks, the tax burden is distributed throughout the year, preventing large tax bills during tax season. This system is crucial for employees, ensuring they do not face penalties for underpayment and simplifying their tax filing process.

For employers, accurate withholding is equally essential. It reduces the risk of financial penalties imposed by tax authorities for failing to withhold the correct amounts and fosters a positive workforce culture. Understanding this process lies at the heart of effective personal finance and corporate compliance.

Overview of the employee income tax withholding form

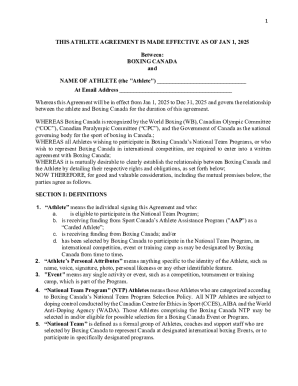

The employee income tax withholding form, often referred to as Form W-4, is a critical document that employees complete to determine the amount of federal income tax their employer should withhold from their paychecks. The form serves multiple key purposes, from allowing employees to specify their tax filing status to declaring any additional income not subject to withholding.

All employees in the United States must complete this form when they start a new job or experience life changes, such as marriage or having a child. Without this form properly filled out, employers may default to withholding at the highest rate, leading to employees potentially underestimating their financial needs throughout the year.

Step-by-step guide to completing the employee income tax withholding form

Completing the employee income tax withholding form accurately is vital for ensuring proper tax deductions. Here is a step-by-step breakdown:

Interactive tools for employees

Leveraging technology enhances the form completion experience. pdfFiller provides various tools that streamline the entire process: editing features allow you to input necessary information directly, while marking tools simplify identifying changes or areas needing attention. Collaboration features enable you to work with teammates or tax consultants efficiently, ensuring all details are accurate before submission.

Using eSignature on pdfFiller further simplifies the process. After filling out the employee income tax withholding form, you can electronically sign the document, which is not only faster than printing and signing but also environmentally friendly. This step helps you submit the form immediately to your employer, facilitating timely tax withholding.

Managing your withholding: Best practices

Accurate tax withholding is crucial for financial health. To estimate your withholding accurately, consider using the IRS's withholding calculator available online. This tool guides you through the tax implications of your income, tax credits, and deductions, ensuring you do not withhold too much or too little.

Adjusting your withholding throughout the year can be necessary after major life changes such as marriage, having a child, or changing jobs. If your situation changes, revisit the employee income tax withholding form promptly and communicate updates to your employer.

Regularly reviewing your withholding is vital, especially if you feel your tax situation has shifted. Performing this evaluation annually or after any significant financial change ensures you remain compliant and financially secure.

Frequently asked questions about employee income tax withholding

Many employees have questions about the employee income tax withholding form and its implications. Here are some common queries:

Tax filing and payment options

With the technological advancements, there are now simpler online filing options available for tax returns. Utilizing platforms like pdfFiller allows for seamless electronic filing of your taxes. This method is not only convenient but also provides immediate confirmation of submission, minimizing errors often associated with manual filing.

Electronic filing speeds up the refund process and allows you to maintain a digital record of your filing history. Key deadlines and important dates should also be kept in mind, such as the standard tax submission deadline, often April 15th annually, to avoid penalties.

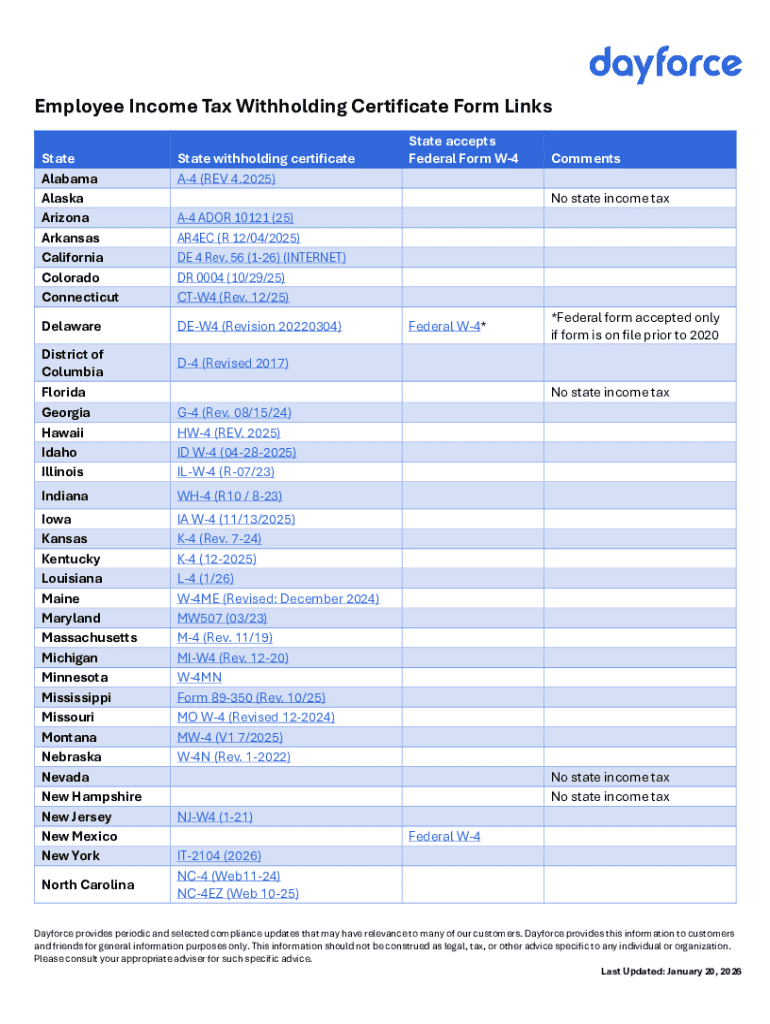

State-specific considerations

It's essential to recognize that the employee income tax withholding form can vary by state. For example, states like Missouri have specific forms (MO W-4) that cater to state income tax withholding. Therefore, it's crucial to understand the state-specific requirements, as failing to do so can lead to incorrect tax withholding and potential penalties.

Additionally, residents in states with no income tax should be aware that they may still need to fill out certain documentation for compliance, though the withholding requirements might be less stringent.

Conclusion of responsibilities

The responsibilities surrounding the employee income tax withholding form rest equally between employees and employers. Precise management of this form not only ensures compliance with tax laws but also ensures that employees maintain financial health throughout the year.

Proper tax withholding provides financial benefits, such as avoiding underpayment penalties and managing cash flow effectively, contributing to a more secure financial future. Thus, staying informed and proactive about requirements in this area is vital for personal fiscal responsibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employee income tax withholding to be eSigned by others?

Can I create an electronic signature for the employee income tax withholding in Chrome?

How do I fill out employee income tax withholding on an Android device?

What is employee income tax withholding?

Who is required to file employee income tax withholding?

How to fill out employee income tax withholding?

What is the purpose of employee income tax withholding?

What information must be reported on employee income tax withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.