Get the free Online pstrust Form 990 Return of Organization ...

Get, Create, Make and Sign online pstrust form 990

How to edit online pstrust form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online pstrust form 990

How to fill out online pstrust form 990

Who needs online pstrust form 990?

Online PSTRUST Form 990 Form: A Complete Guide

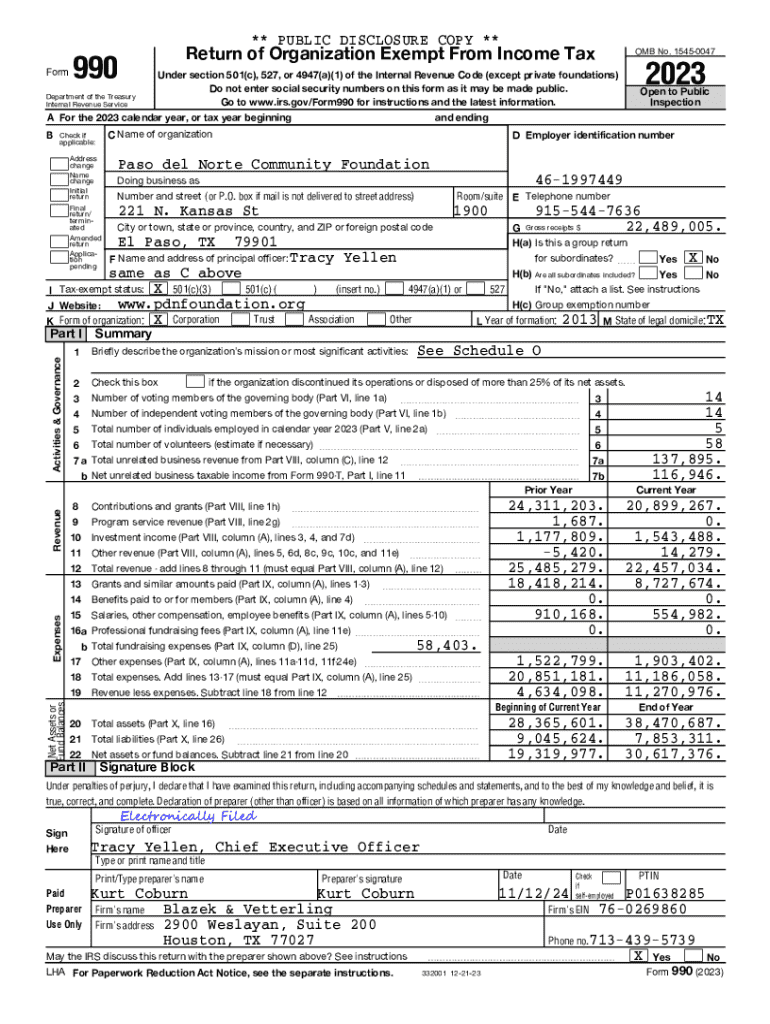

Understanding the PSTRUST Form 990

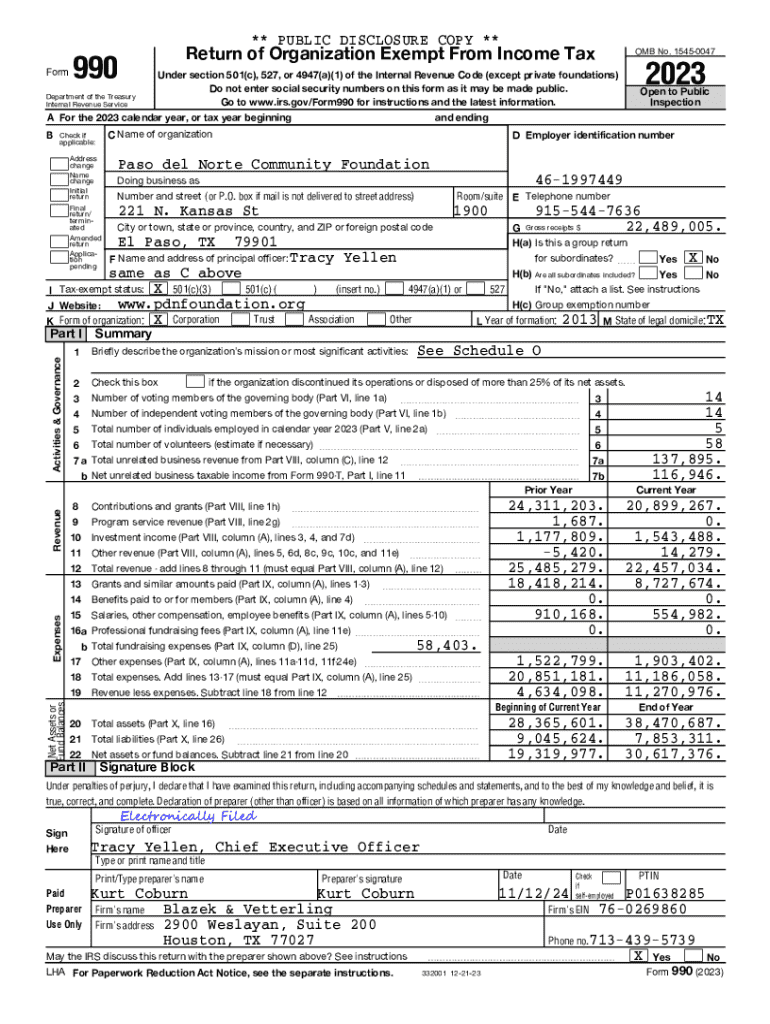

The PSTRUST Form 990 is a crucial document for organizations seeking to maintain their tax-exempt status with the IRS. This form provides the IRS with essential financial information about a tax-exempt organization, including its revenue, expenses, and overall financial health. The primary purpose of the Form 990 is to promote transparency and ensure that nonprofits are using their resources effectively for their stated missions.

Organizations that must file include those that are tax-exempt under Internal Revenue Code Section 501(c)(3) and others classified under various 501(c) categories. The requirement to file the Form 990 applies to non-profits with gross receipts over $200,000 or total assets exceeding $500,000. However, smaller organizations may qualify to file a simpler version, the Form 990-N (e-Postcard).

Importance of compliance

Timely filings of the PSTRUST Form 990 are not merely procedural; they fulfill legal obligations essential for maintaining tax-exempt status. Failure to file can trigger penalties from the IRS, including fines or potentially losing tax-exempt status altogether. Compliance is critical, as it reflects an organization’s commitment to transparency and accountability, fostering trust among donors and stakeholders.

The consequences of non-compliance can extend beyond financial repercussions. Organizations may experience reputational damage, decreasing trust within the community and jeopardizing future funding opportunities and partnerships. Hence, staying abreast of filing requirements is an essential duty for all nonprofit organizations.

The structure of the PSTRUST Form 990

The PSTRUST Form 990 is structured into various sections that gather comprehensive information about the organization's operations. Each section serves a distinct purpose, providing insights into different aspects of the organization. An overview of these key sections includes vital elements such as revenue sources, operational expenses, and governance practices. Familiarizing yourself with the structure of the Form 990 is essential for smooth completion.

Some important terms included in the form are ‘program services’, which refers to the actual activities that fulfill the organization’s stated mission, and ‘functional expenses’, which categorize expenses based on their relation to program services, management, and fundraising. Understanding these terms helps in reporting and analyzing the financial data accurately.

Common attachments required

When submitting the PSTRUST Form 990, several attachments are commonly required to provide a thorough picture of the organization’s financial status. These include financial statements such as the balance sheet and income statement, which are required to offer insight into the organization’s fiscal health. Additionally, the governance documents, like bylaws and policies, may be required to demonstrate compliance with legal and ethical standards.

Ensure that you gather these necessary documents well in advance of your filing deadline. This will allow ample time to review and curate the most relevant information, ultimately enhancing your submission's accuracy and completeness.

Step-by-step guide to completing the Form 990

Completing the PSTRUST Form 990 can seem daunting, but with a structured approach, it becomes manageable. Start with preparation by gathering all necessary information and documents. This phase is crucial as it significantly impacts the ease of filling out the form. Required documents include financial statements, records of contributions, and a list of board members.

Filling out the Form entails a section-by-section approach to ensure all areas are accurately reported. Here’s a closer look at the critical sections:

The final step involves a thorough review and validation of your entries on the Form 990. Using a checklist can help ensure that all necessary areas are appropriately covered and that all figures align with supporting documentation.

Editing and signing the PSTRUST Form 990

Digital tools such as PDFfiller make editing the PSTRUST Form 990 not only easier but also more efficient. PDFfiller allows users to modify, annotate, and finalize documents seamlessly without the hassle of printing and scanning. Features like drag-and-drop functionality and ready-made templates can save significant time while ensuring accuracy.

To maximize efficiency, take advantage of PDFfiller's collaboration features, which enable teams to work concurrently on the form. This streamlines the process of gathering input from different stakeholders before finalizing the document.

Once the form has been edited, you’ll need to sign it. eSigning the Form 990 through PDFfiller brings several benefits including enhanced security, quicker processing times, and elimination of the need for physical paper. The process is user-friendly: Simply click the eSign feature, follow the prompts, and your signature is affixed.

Submitting the Form 990

When it comes to submitting the PSTRUST Form 990, organizations have several options. e-Filing is generally the recommended approach, as it allows for quick processing and instant confirmation of receipt. The IRS website provides a user-friendly platform for electronic submissions, ensuring that your form is filed timely and without delays.

Alternatively, paper filing is available but involves longer processing times and can run the risk of lost mail. Ensure that you keep copies of all submitted documents, regardless of your chosen submission method.

Key deadlines for filing the Form 990 must be observed, typically within five months after fiscal year-end. Organizations can request extensions, but this is crucial to communicate with the IRS and maintain compliance.

Managing your PSTRUST Form 990 after filing

After submitting the PSTRUST Form 990, maintaining thorough records is imperative. Keep copies of the submitted documents, including all confirmations if e-filed, as this helps track compliance and is beneficial for any future audits. Organizations should also actively monitor the status of their submission via the IRS website, ensuring timely follow-ups if needed.

If changes become necessary after filing, understanding the process to handle revisions and amendments is critical. Organizations can amend their Form 990 if errors are detected, ensuring that all information is accurate and up to date. It’s essential to know the implications of these amendments, as they may further impact compliance and organizational reputation.

Frequently asked questions about the PSTRUST Form 990

Filers of the Form 990 often encounter common issues that can lead to stress if not addressed properly. Frequently asked questions include inquiries about the importance of compliance deadlines, how to categorize expenses correctly, and the documentation required for board governance. Understanding these concerns is essential for avoiding pitfalls in the filing process.

It's also beneficial to have troubleshooting tips readily available. For example, if issues arise during e-filing, resources are typically provided on the IRS website. Additionally, maintaining contact with support teams at platforms like PDFfiller can help resolve issues swiftly, ensuring a seamless filing experience.

Interactive tools and resources

PDFfiller excels in providing interactive tools designed to enhance productivity when working on the PSTRUST Form 990. These tools cater to the unique requirements for filling out, editing, and submitting the form efficiently. Users can access templates specifically crafted for Form 990, streamlining the completion process.

In addition to PDFfiller’s suite of resources, organizations should explore additional online resources, including links to official IRS guidance to help clarify filing requirements. Engaging with recommended websites can further enhance understanding of nonprofit operational standards, governance, and compliance best practices.

The role of PDFfiller in simplifying Form 990 processing

Choosing PDFfiller to assist in the PSTRUST Form 990 process offers unique advantages that can streamline the entire filing experience. The platform enables users to edit PDFs, collaborate with teams, and eSign documents efficiently from anywhere with an internet connection. Its user-friendly design and reliable features make it a preferred choice for organizations.

User testimonials highlight the ease of use and time-saving aspects of PDFfiller. Many organizations have discovered that leveraging PDFfiller not only reduces the stress associated with completing the Form 990 but also increases accuracy and compliance, ensuring a smooth filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my online pstrust form 990 directly from Gmail?

How do I execute online pstrust form 990 online?

How do I complete online pstrust form 990 on an Android device?

What is online pstrust form 990?

Who is required to file online pstrust form 990?

How to fill out online pstrust form 990?

What is the purpose of online pstrust form 990?

What information must be reported on online pstrust form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.