Get the free 20262027 Federal Verification Worksheet Dependent ...

Get, Create, Make and Sign 20262027 federal verification worksheet

Editing 20262027 federal verification worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 20262027 federal verification worksheet

How to fill out 20262027 federal verification worksheet

Who needs 20262027 federal verification worksheet?

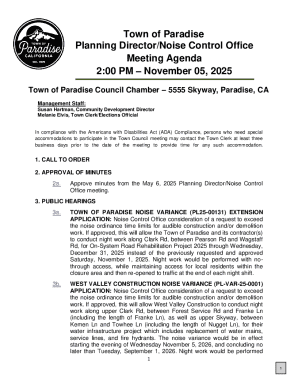

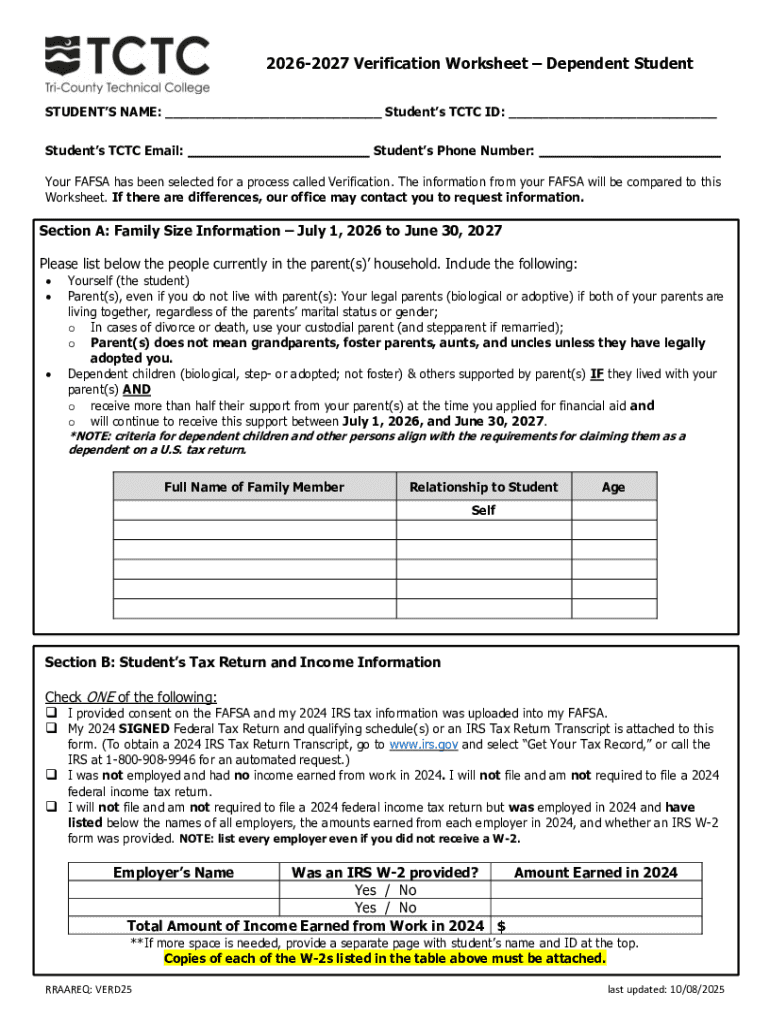

Comprehensive Guide to the 20262027 Federal Verification Worksheet Form

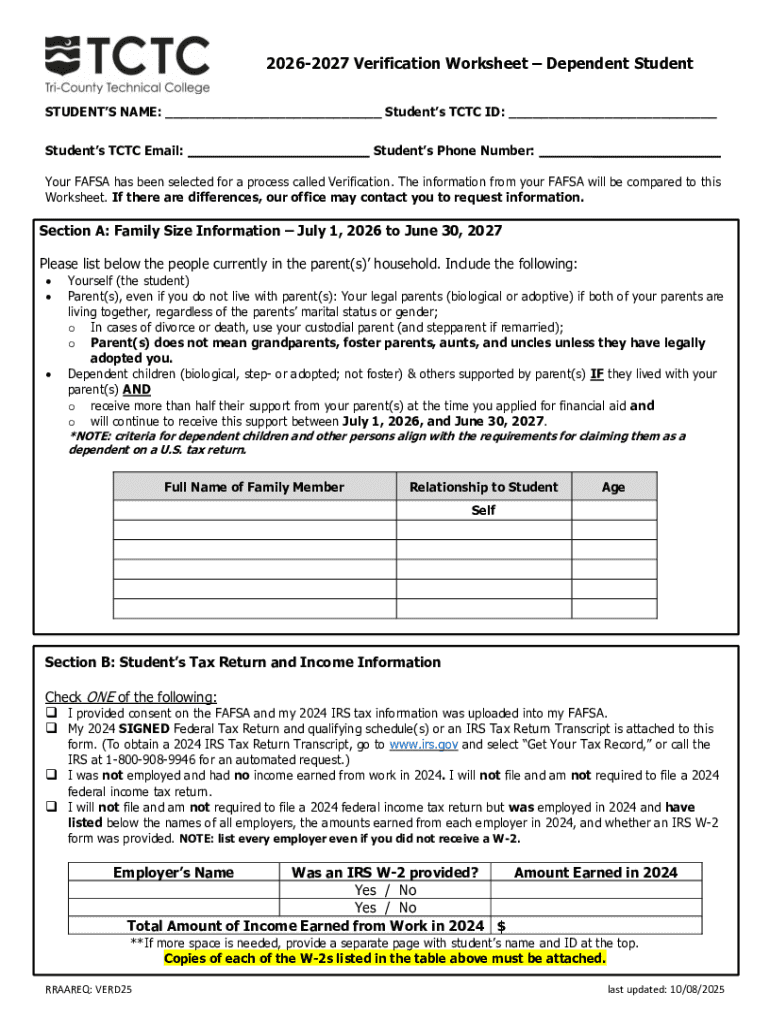

Overview of the 20262027 federal verification worksheet form

The 20262027 federal verification worksheet form is a critical document in the financial aid process, designed to verify the information submitted on the Free Application for Federal Student Aid (FAFSA). This process is essential for ensuring that students receive the correct amount of financial aid, which can greatly impact their ability to attend college without incurring unnecessary debt.

Completing this verification worksheet is crucial for students receiving federal student aid and other forms of financial assistance. The verification process increases the integrity of financial information, thus helping the Office of Financial Aid ensure that participants are eligible for federal aid.

Typically, students selected for verification will be notified through their Student Aid Report (SAR), and accordingly, it’s important to understand who needs to complete this form. This generally includes dependent students, whose parents' financial data is a key factor in determining aid eligibility.

Key features of the 20262027 federal verification worksheet

The 20262027 federal verification worksheet form boasts several user-friendly features designed to simplify the verification process. One of the most notable aspects is its accessibility on the pdfFiller platform, which enables individuals to fill out the form online, seamlessly edit necessary information, and manage their documents effectively.

Aside from the ease of use, pdfFiller offers interactive tools that guide users through completing the worksheet. With cloud-based access, users can retrieve their documents from any device, ensuring they can work on their verification even when they’re not at home or on a specific computer.

Detailed components of the form

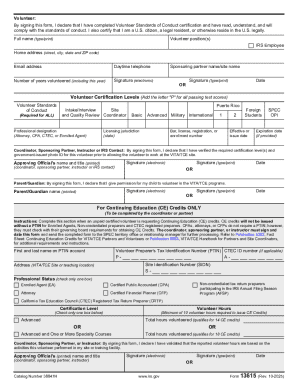

A. Parent's information

In this section, users are required to provide personal details about their parents. This includes names, Social Security numbers, and general demographic information. It's crucial to ensure that this information is accurate, as any discrepancies could lead to delays in the verification process.

Specific instructions for filling out this section emphasize the need for complete and legible information, as well as clarifications regarding how to report parents’ marital status, which might affect financial aid amounts.

B. Parent's income and benefits information

This part of the worksheet requires a detailed breakdown of the parent’s income and benefits. It’s essential to verify different income sources such as wages, salaries, and unemployment benefits. Users should be prepared to include copies of acceptables documents, including W-2 forms, 1099 statements, or tax returns, as these are commonly requested items to substantiate reported income.

It's important to pay attention to specific line items when filling this section out — for example, indicating if parents received benefits such as Supplemental Nutrition Assistance Program (SNAP) or Temporary Assistance for Needy Families (TANF), which can influence expected family contribution calculations.

Step-by-step guide to filling out the 20262027 federal verification worksheet

1. Gathering necessary documents

Before attempting to fill out the 20262027 federal verification worksheet, gather all necessary documents to ensure accuracy and completeness. The required documents often include:

It is advisable to keep these documents organized for easy reference, which will help prevent inadvertent errors during form completion.

2. Completing the form

When starting to complete the 20262027 federal verification worksheet, it's beneficial to go section by section. Begin with the parent’s personal information, ensuring all names are spelled correctly and Social Security numbers are valid. Pay close attention to details in each section as mistakes can lead to prolonged reviews or even rejections.

Common mistakes include omitting required information, such as not declaring all income sources, or misreporting tax filing status. An accurate and thorough approach will lead to a smoother submission process.

3. Reviewing and editing your submission

After filling out the form, take advantage of pdfFiller's editing tools to review all the information. Ensure data accuracy by double-checking figures, confirming that all necessary fields are filled appropriately, and verifying the submission for completeness.

This stage is crucial in preventing future complications; being diligent now reduces the chances of having to resubmit due to discrepancies later on.

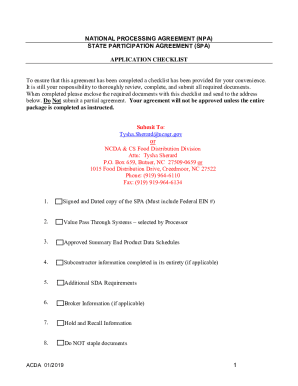

Submitting your form

A. Electronic submission process

Once the 20262027 federal verification worksheet is completed, the next step is submitting the form. The electronic submission process via pdfFiller is designed to be straightforward. Simply navigate to the submission section within the platform, follow the prompts to upload your completed document, and electronically sign it using the e-signature tool.

Using pdfFiller for e-signing not only expedites the process but also provides a digital trail, giving you peace of mind that your submission was processed efficiently.

B. Other submission options

For those who may prefer traditional methods, there are alternatives available. Submissions can be mailed directly to the financial aid office, but it’s important to ensure you send the documents via certified mail to have proof of delivery.

In-person submissions are also an option; however, keep in mind the additional considerations regarding office hours and document handling protocols that may differ from institution to institution.

What happens after submission?

Understanding the verification process that follows your submission is crucial. Once the financial aid office receives your completed 20262027 federal verification worksheet, they will initiate a review period, which typically lasts several weeks.

During this time, the aid office may reach out for further clarification or additional documents if there are any inconsistencies or missing needed information. Tracking the status of your verification can often be done via your school's financial aid portal, allowing you to stay informed throughout the process.

Troubleshooting common issues

When navigating the submission process for the 20262027 federal verification worksheet, it’s not uncommon to encounter a few hurdles. Common issues may include not receiving confirmation of submission or experiencing an error in file uploads.

If you face problems, first consult the help section of pdfFiller for troubleshooting assistance. Additionally, reaching out to your institution's Office of Financial Aid can provide clarity and resolve specific questions or issues that arise during verification.

Communicating with peers through community forums can also yield practical solutions from others who have faced similar situations. These resources can be incredibly valuable when tackling concerns related to completing or submitting the worksheet.

Tips for managing your verification documents

Effective document management plays a key role in the financial aid process. pdfFiller provides excellent document organization tools that can help users keep track of their 20262027 federal verification worksheet and all supporting documentation in one place. This eliminates the chaos that often accompanies multiple submissions and necessary forms.

For future document management, it’s essential to establish a routine for organizing financial documents, which may include setting reminders for important deadlines or using tags to categorize forms by type or status. Security practices, such as saving documents in encrypted formats and regularly backing them up, are also pivotal to maintaining personal information safety.

Understanding the consequences of inaccurate information

Filling out the 20262027 federal verification worksheet accurately can have significant repercussions on your financial aid eligibility. Inaccurate or incomplete information can lead to a reduction or elimination of federal aid awards, putting students' educational goals at risk.

Timely submissions are essential; failing to meet deadlines can cause delays in receiving financial aid payments, which may impact tuition payment schedules and the ability to register for classes.

Additional considerations for specific situations

A. Special circumstances

If you have experienced a change in your financial situation since the last tax return submission — such as loss of income, medical expenses, or other factors affecting your finances — it is vital to communicate this during the verification process. Schools can consider these circumstances and may be able to adjust your aid eligibility accordingly.

Non-traditional family structures, including blended families or independent students, also warrant a careful approach in filling out the worksheet. Understanding specific guidelines for reporting income and household size can lead to more accurate aid calculations.

B. Resources for undocumented students

Undocumented students may face unique challenges during the financial aid process. It's crucial to identify applicable resources and advocacy groups that can provide tailored guidance on completing verification requirements without jeopardizing their legal standings.

Documentation strategies for these students may include utilizing alternative income verification tools, which can help navigate the complexities of their circumstances and maintain compliance with federal aid requirements.

Enhancing your experience with pdfFiller

Beyond the features offered for filling out the 20262027 federal verification worksheet, pdfFiller includes a variety of tools designed to enhance overall document management experiences. From templates for other educational forms to collaborative features that allow sharing documents with others for input, the platform empowers users to streamline their workflow.

Looking ahead, users can prepare for future document needs by exploring document storage options, which provide secure access to past submissions and the ability to use this information for future financial aid applications, fulfilling requirements quickly and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 20262027 federal verification worksheet online?

How do I edit 20262027 federal verification worksheet on an iOS device?

How do I edit 20262027 federal verification worksheet on an Android device?

What is 20262027 federal verification worksheet?

Who is required to file 20262027 federal verification worksheet?

How to fill out 20262027 federal verification worksheet?

What is the purpose of 20262027 federal verification worksheet?

What information must be reported on 20262027 federal verification worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.