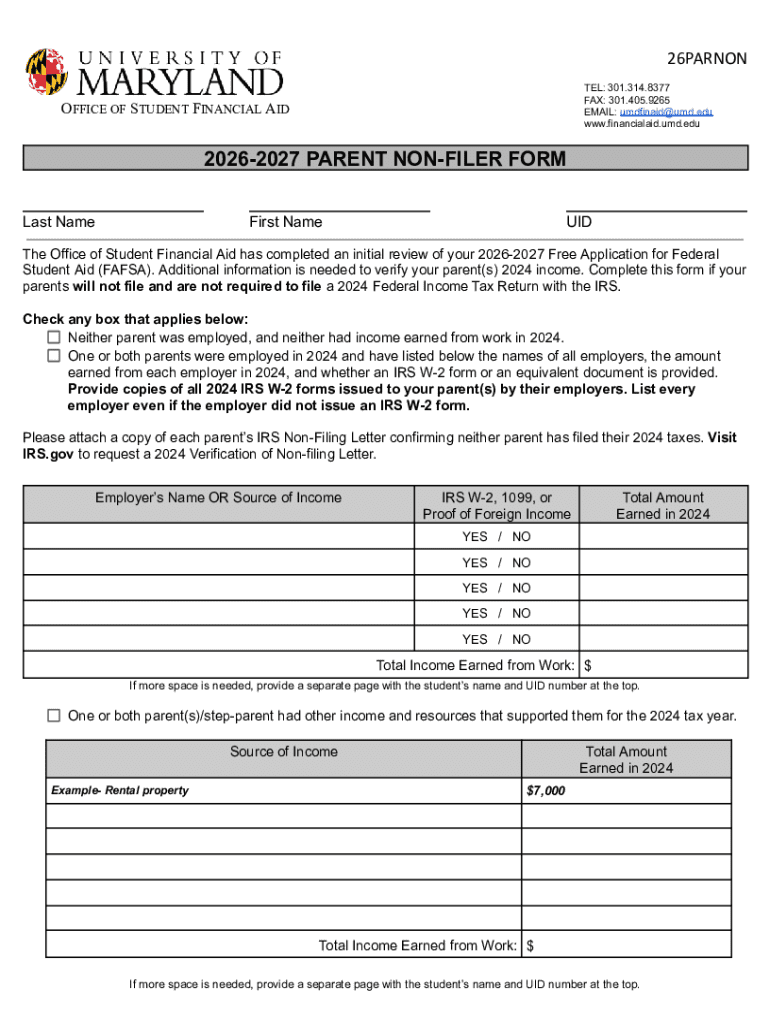

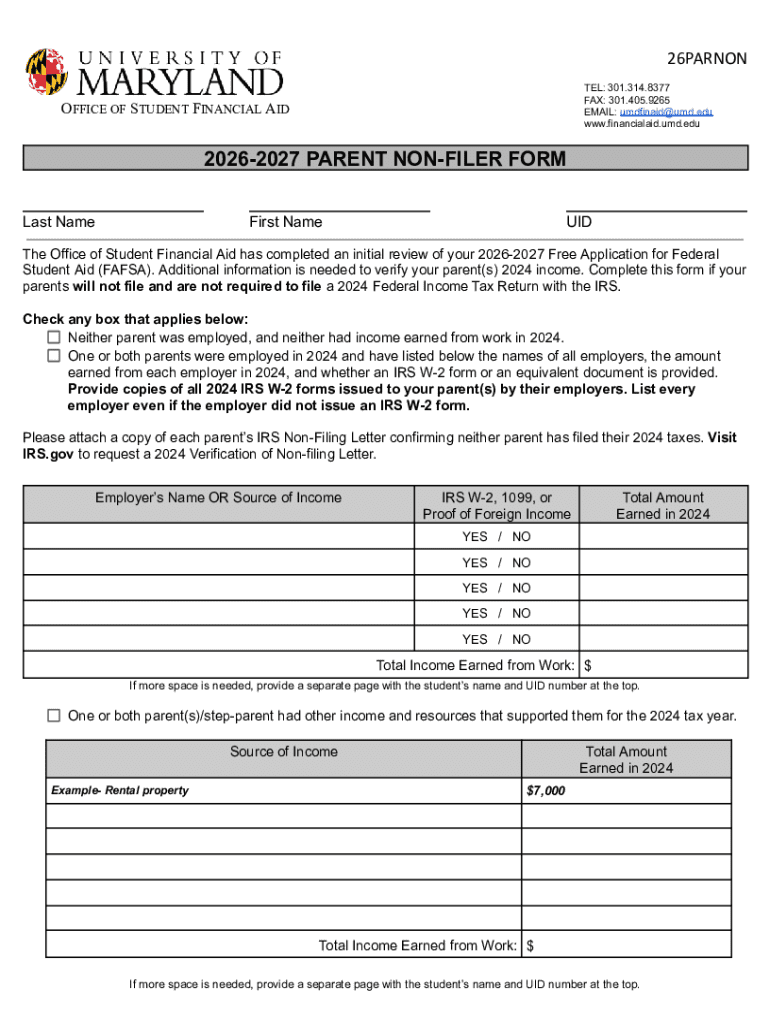

Get the free 2026-2027 Parent Non-Filer Form - financialaid umd

Get, Create, Make and Sign 2026-2027 parent non-filer form

Editing 2026-2027 parent non-filer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026-2027 parent non-filer form

How to fill out 2026-2027 parent non-filer form

Who needs 2026-2027 parent non-filer form?

Navigating the 2 Parent Non-Filer Form: A Comprehensive Guide

Understanding the Parent Non-Filer Form

The 2 Parent Non-Filer Form is a crucial document designed for families who do not submit a tax return due to their income being below the threshold set by the IRS. Its primary purpose is to provide necessary financial information to educational institutions during the financial aid application process. This form plays a vital role in ensuring that students receive the appropriate aid, as it helps verify the financial situation of non-filing parents.

Understanding the importance of this form cannot be overstated. Institutions like colleges and universities often require detailed financial data for aid packages, and the Parent Non-Filer Form ensures that families who do not file taxes can still access vital financial support.

Who needs to use the Parent Non-Filer Form?

The Parent Non-Filer Form is typically necessary for families who earn less than the filing threshold but still wish to apply for financial aid. This includes families where one or both parents have little or no income, are unemployed, or are primarily living on government assistance programs. By filling out this form, these families can affirm their income status without needing to complete a full tax return.

Common scenarios where the Parent Non-Filer Form is applicable include single-parent households, situations where parent income is below the threshold, or families with students who have not yet graduated high school but are applying for college financial aid.

Overview of the financial aid process

The 2 financial aid process includes several key updates compared to previous years. For instance, there are adjustments in the income thresholds and the overall application requirements for federal financial aid. These changes aim to streamline the process and make it accessible for families who may not be aware of their eligibility for aid.

The Parent Non-Filer Form plays an integral role in this updated financial aid landscape. By providing accurate non-filing information, parents can ensure that their students receive a fair evaluation when it comes to aid packages, scholarships, and grants.

Preparing to fill out the Parent Non-Filer Form

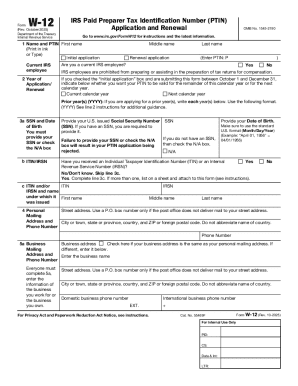

Before you start filling out the 2 Parent Non-Filer Form, it's important to gather necessary documents and information. This includes identification documents such as Social Security numbers or driver's licenses for both parents and any legal guardians involved. Additionally, you’ll need to provide information about the household’s financial situation, including income sources, bank statements, and documentation of any government assistance received.

Many misconceptions exist about what qualifies as income. Some believe they need to report all income sources, regardless of amounts. However, the form specifically caters to families with realized income below the filing threshold that do not warrant a full tax return. Knowing these nuances can simplify the process significantly.

Step-by-step guide to completing the Parent Non-Filer Form

Accessing the 2 Parent Non-Filer Form is straightforward. Parents can obtain the form from the official financial aid websites such as FAFSA or directly through pdfFiller's extensive document library. pdfFiller allows users to access, edit, and manage forms conveniently from any internet-enabled device.

Once you have the form, it’s time to fill it out. Here’s a breakdown of each section:

After completing each section, take the time to review and finalize the form. Using pdfFiller's editing tools can help ensure that all information is accurate and up to date. Mistakes can lead to delays in financial aid processing.

Submitting the Parent Non-Filer Form

Submission of the Parent Non-Filer Form can be done through various methods. Many families opt for online submission via platforms like the FAFSA site due to its speed and efficiency. Alternatively, parents may choose to mail in the form or submit it in person at their chosen financial aid institution.

After submitting, tracking the status of your application is crucial. Many financial aid offices provide confirmation emails or online tracking systems to help you verify receipt of your form. If an issue arises, such as delayed processing, it’s advisable to reach out to the institution directly for clarification.

Common challenges and solutions

Navigating the Parent Non-Filer Form can be challenging. Common issues include submitting an incomplete form or misinterpreting the filing guidelines. These problems can delay financial aid processing, which might impact students' educational plans.

To address these challenges, parents should utilize resources available through pdfFiller. Additionally, reaching out to financial aid counselors can provide essential guidance and clarification of the non-filer regulations.

Additional tips for financial aid success

Understanding your financial aid award is essential after submitting your Parent Non-Filer Form. It's crucial to know what to expect in terms of financial aid offers, including grants, scholarships, and loans. In some instances, you may need to appeal if the aid package does not meet your financial needs.

Moreover, maximizing your eligibility requires maintaining accurate records and filing other forms, such as the FAFSA or state-specific aid applications. Keeping a thorough documentation trail allows families to clearly demonstrate their financial circumstances when applying for aid.

Interactive tools and resources on pdfFiller

pdfFiller offers a variety of document management features that simplify the completion and submission of the 2 Parent Non-Filer Form. Users can create, edit, and manage important documents seamlessly from any device. This cloud-based solution empowers families to stay organized and focused on their financial aid applications.

In addition, pdfFiller's eSignature and collaboration tools make it easy for families to gather necessary signatures, ensuring that all documents are completed accurately and submitted on time. This interactive approach fosters better communication among family members and financial aid advisers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2026-2027 parent non-filer form from Google Drive?

How can I send 2026-2027 parent non-filer form for eSignature?

How do I edit 2026-2027 parent non-filer form on an Android device?

What is 2026-2027 parent non-filer form?

Who is required to file 2026-2027 parent non-filer form?

How to fill out 2026-2027 parent non-filer form?

What is the purpose of 2026-2027 parent non-filer form?

What information must be reported on 2026-2027 parent non-filer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.