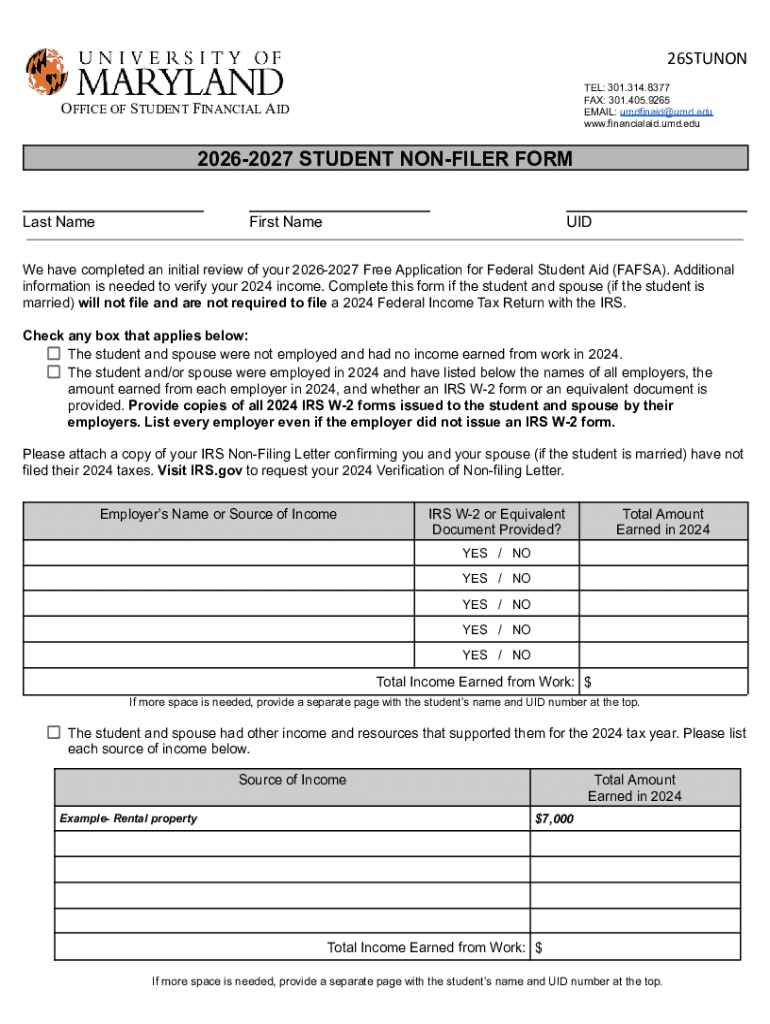

Get the free 2026-2027 Student Non-Filer Form - financialaid umd

Get, Create, Make and Sign 2026-2027 student non-filer form

How to edit 2026-2027 student non-filer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026-2027 student non-filer form

How to fill out 2026-2027 student non-filer form

Who needs 2026-2027 student non-filer form?

Navigating the 2 Student Non-Filer Form

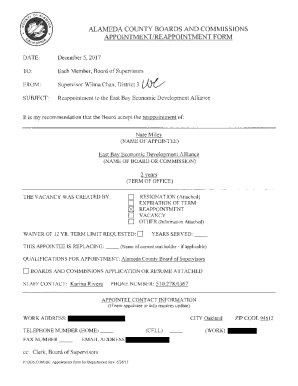

Overview of the Student Non-Filer Form

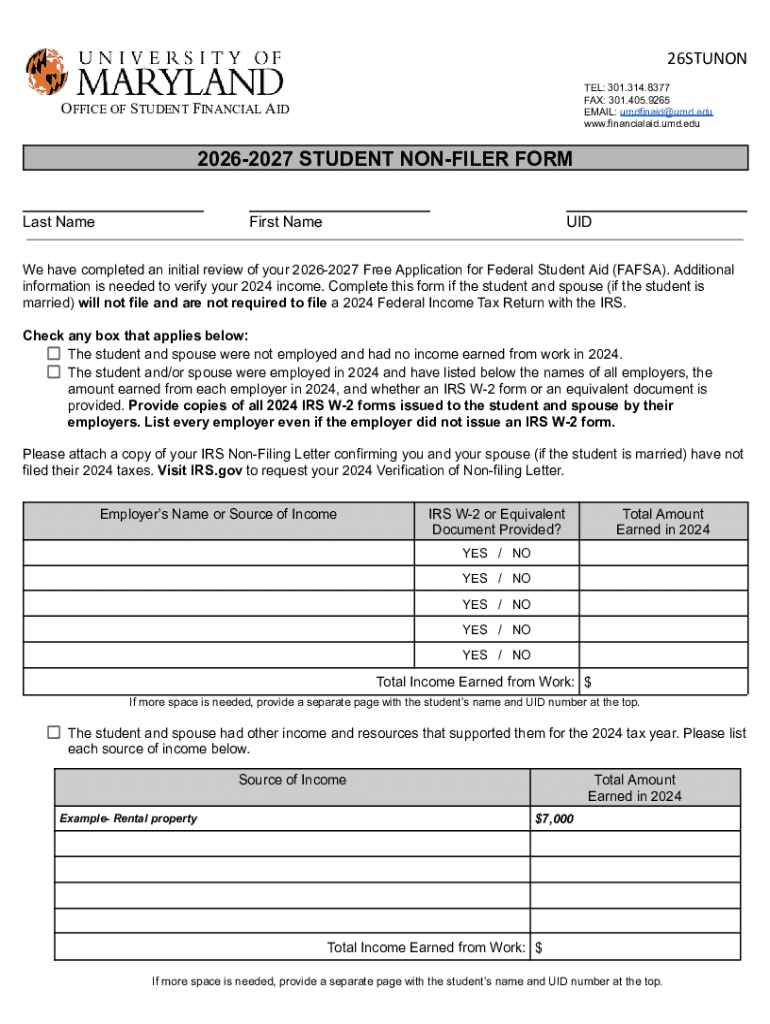

The 2 Student Non-Filer Form is a crucial document for students who do not meet income thresholds requiring tax filing. Essentially, this form signifies that a student is not compelled to file a federal tax return for the applicable year due to low or non-existent income. Its primary purpose revolves around establishing eligibility for financial aid, particularly through the Free Application for Federal Student Aid (FAFSA), ensuring students can still access vital resources for their education.

This form plays a significant role in providing proof of income status and helps students maintain their eligibility for various types of financial aid, grants, and loans. Failing to submit the non-filer form might hinder a student's chances of receiving assistance, impacting their ability to afford education costs. Understanding its importance extends not just to securing financial support but also clarifying tax implications that may arise during the academic year.

Who needs to fill out the non-filer form?

Both undergraduate and graduate students can find themselves in a position where they need to fill out the 2 Student Non-Filer Form. Students who have not earned sufficient income to necessitate filing a tax return fall into this category. Typically, those earning below the minimum income threshold established by the IRS are considered non-filers and should proactively complete this form.

For students relying on financial aid, completing the form is essential. Without proof of their non-filing status, they may encounter significant barriers when applying for grants or loans. The implications extend beyond personal finance, affecting overall enrollment and academic performance if students cannot secure the necessary funds to support their education.

Key sections of the 2 non-filer form

The 2 Student Non-Filer Form is structured to gather essential personal, financial, and family information. This information primarily serves to assess your financial standing and how it relates to your eligibility for aid.

The key sections of this form include:

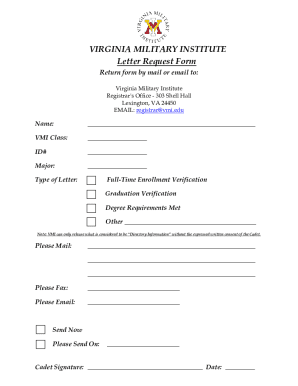

Detailed instructions for completing the non-filer form

Filling out the 2 Student Non-Filer Form accurately requires careful preparation. Here’s a step-by-step guide to ensure your submission goes smoothly.

Ensuring that you double-check all information before submission can prevent delays in your financial aid process. Mistakes can lead to requests for additional information or, worse, denial of aid.

Editing and managing the non-filer form with pdfFiller

Using pdfFiller can streamline your document management process for the 2 non-filer form. This platform allows users to easily upload and edit PDF forms, ensuring your document is polished and professional before submission.

The platform's features empower users with eSigning capabilities, enabling quick turnaround times for necessary approval steps. Collaboration tools allow students to work with financial aid offices and others involved in the submission process. Additionally, pdfFiller provides cloud storage, allowing for secure document management.

Filing and submission process

Once you have completed the 2 Student Non-Filer Form, the next step is submitting it to the appropriate financial aid office. Each institution may have different submission processes, so check with your school’s policies carefully.

It’s vital to be aware of crucial deadlines to ensure your financial aid application is processed on time. Failing to submit the non-filer form within these timelines can jeopardize your aid eligibility for the entire academic year.

FAQs about the 2 student non-filer form

Understanding the intricacies of the 2 Student Non-Filer Form often raises numerous questions among students. Here are some frequently asked queries that can help clarify common concerns.

Enhancements offered by pdfFiller

Using pdfFiller provides students with significant advantages. With accessibility from any device, you can edit, eSign, and submit your documents anywhere, making it an invaluable tool for busy students juggling classes and commitments.

This platform simplifies the financial aid process, from document management to inter-institutional collaboration. By ensuring that your applications are completed, signed, and submitted efficiently, pdfFiller allows you to focus on what truly matters – your education.

Additional support for students

Students often require diverse resources to navigate the complexities of financial aid. Numerous national and local resources can assist in answering questions about the 2 Student Non-Filer Form and related financial aid processes.

Contact information for financial aid offices can usually be found on your school's official website, providing avenues for direct support. Additionally, online forums and communities exist where students can share experiences, tips, and advice regarding their financial aid journeys.

Future updates and considerations

As regulations and requirements for financial aid evolve, it's essential for students to stay informed about potential changes that may arise for future academic years. Understanding these developments is crucial for maintaining eligibility for financial assistance.

By proactively seeking updates and utilizing tools like pdfFiller for ongoing document management, students can navigate the financial aid landscape with greater confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2026-2027 student non-filer form?

How do I execute 2026-2027 student non-filer form online?

How can I edit 2026-2027 student non-filer form on a smartphone?

What is 2026-2027 student non-filer form?

Who is required to file 2026-2027 student non-filer form?

How to fill out 2026-2027 student non-filer form?

What is the purpose of 2026-2027 student non-filer form?

What information must be reported on 2026-2027 student non-filer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.