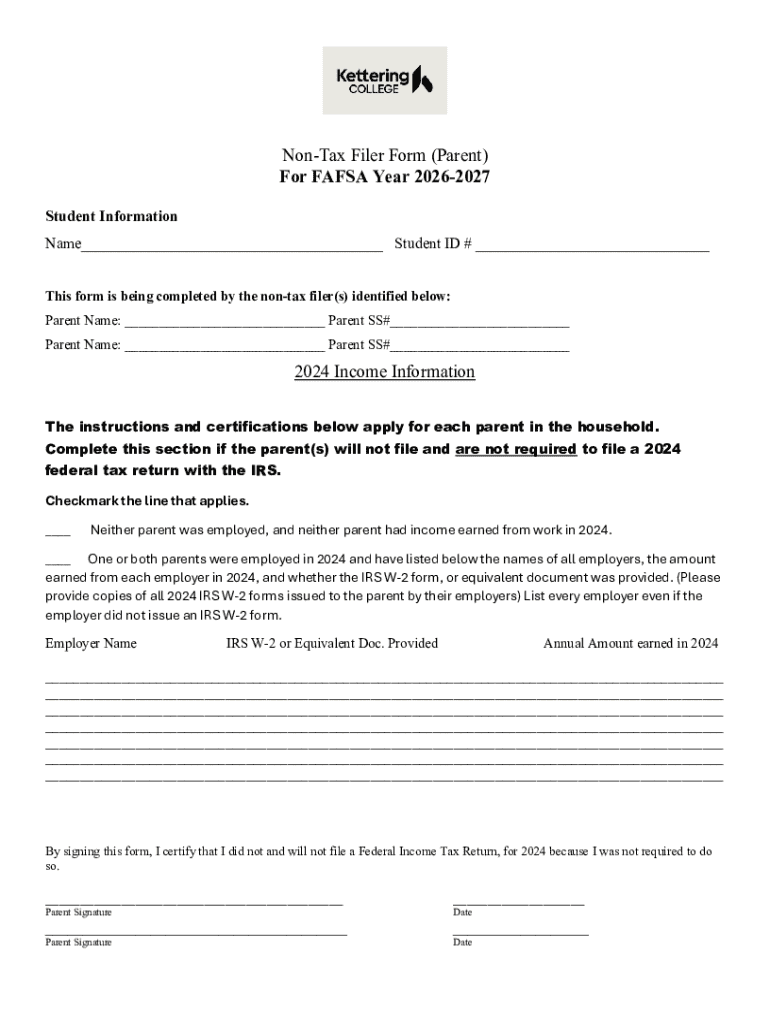

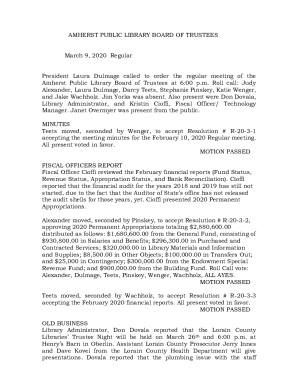

Get the free Non-Tax Filer Form (Parent) For FAFSA Year 2026-2027

Get, Create, Make and Sign non-tax filer form parent

Editing non-tax filer form parent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-tax filer form parent

How to fill out non-tax filer form parent

Who needs non-tax filer form parent?

Understanding the Non-Tax Filer Form Parent Form: A Comprehensive Guide

Understanding the non-tax filer form for parents

The non-tax filer form for parents is an essential document used particularly in the context of financial aid applications. This form serves as a declaration from parents who, for various reasons, do not file federal income taxes. Understanding its purpose and relevance is critical for both parents and students navigating college funding opportunities. Financial institutions and educational bodies often require this documentation to assess the financial status of applicants accurately.

The importance of this form cannot be understated; it plays a pivotal role in ensuring that families can access critical financial aid. For example, many federal and state aid programs, including Pell Grants and work-study opportunities, necessitate proof of income. Without the non-tax filer form, students may miss out on eligible financial assistance simply because their parents did not meet the requirements to file.

Who needs to complete the non-tax filer form?

Not every parent is required to fill out the non-tax filer form; however, certain individuals qualify under specific circumstances. Typically, parents who earn below the threshold to file federal tax returns or those who have irregular income sources might find this form advantageous. The distinction between tax filers and non-tax filers hinges primarily on income levels and tax obligations.

For parents of dependent students, filling out the non-tax filer form becomes vital for the financial aid process. When applying for federal financial aid, such as the Free Application for Federal Student Aid (FAFSA), providing accurate information on the parent's financial situation is paramount. Failure to disclose that they are non-tax filers can complicate the process or result in inadequate financial assistance.

Key requirements for filling out the non-tax filer form

To successfully complete the non-tax filer form, certain requirements must be adhered to. First and foremost, parents need to compile personal identification details, which typically include names, Social Security numbers, and contact information. Additionally, a comprehensive overview of financial information is necessary, including any income and assets that may be relevant.

Moreover, while tax forms might not be applicable to non-tax filers, alternative documentation policies come into play. Acceptable documents could include W-2 forms, end-of-year summaries from employers, or other proving income sources that do not follow traditional tax reports.

Step-by-step guide to filling out the non-tax filer form

Putting together the non-tax filer form can seem daunting, but the process is straightforward if you approach it methodically. Start by gathering all necessary personal and financial data, reviewing what’s required. Make sure to set aside some time to fill out the form in a distraction-free environment to enhance focus and accuracy.

You can access the non-tax filer form conveniently through pdfFiller. Search for the form on the platform and open it. Begin filling it out by following these outlined steps:

Once the form is filled out, take a moment to review all entries carefully. Verify numbers and personal information for accuracy, as mistakes can delay your financial aid application.

Tips for editing and signing your non-tax filer form on pdfFiller

Using pdfFiller offers various interactive tools that streamline the editing process. For those who wish to correct errors or personalize their documents, these tools make the work much more manageable. Leverage features that allow you to highlight, annotate, or add notes directly onto the document, making revisions clearer.

After ensuring that the form is ready for submission, adding a digital signature is the next crucial step. Follow the instructions on pdfFiller to implement your signature seamlessly, verifying that your identity is authenticated.

Submitting your non-tax filer form

Once the non-tax filer form is completed and signed, it's time for submission. Understanding how and where to submit your form can alleviate any confusion. Depending on the institution of requirement, completed forms can typically be sent online via the specific financial aid sites or mailed to designated addresses.

Tracking the submission status is equally vital. Many institutions provide a method for you to confirm if your form has been received and processed, ensuring you stay updated throughout the financial aid application period.

Common mistakes to avoid

When filling out the non-tax filer form, specific errors frequently occur that can have significant ramifications later. Common mistakes include omitting details, such as income or assets, which are necessary for processing the application. Always ensure that every required section is addressed accurately.

Moreover, failing to sign and date the form can lead to unnecessary delays or rejections. Remember, thoroughness in reviewing your entries is essential before submission; double-checking can save time and stress.

Frequently asked questions about non-tax filer form for parents

Parents often have concerns regarding the non-tax filer form, particularly about deadlines and procedures. A common question includes what happens if the submission deadline is missed. It’s essential to understand that late submissions can adversely affect the allocation of financial aid, necessitating prompt actions.

Another frequent inquiry relates to whether forms can be amended post-submission. Indeed, if any mistakes or changes arise after filing, parents should contact the relevant institution immediately to determine next steps and ensure that all information remains accurate. Understanding the follow-up process is crucial for ensuring that your financial aid remains unaffected.

Additional support for non-tax filers

Navigating the financial aid process can be overwhelming, which is why resources and support systems are available. pdfFiller offers customer support for users needing assistance with filling out their non-tax filer forms. Accessing personalized guidance and clarifications can help prevent costly mistakes.

In addition to direct support, utilizing online communities, forums, and social media groups can provide substantial insights. Many parents share their experiences, tips, and resources, creating a wealth of knowledge and assistance that can be invaluable during this process.

Overview of related forms and templates

Parents looking into the non-tax filer form may also need to consider additional forms related to financial aid. Connecting with other necessary documentation, such as the FAFSA and state-specific aid applications, can enhance the overall process of obtaining financial support.

Resource availability through pdfFiller also extends beyond the non-tax filer form. Utilizing various templates and guides ensures that parents have everything they need to facilitate a comprehensive financial aid application package.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify non-tax filer form parent without leaving Google Drive?

How do I edit non-tax filer form parent online?

How do I edit non-tax filer form parent on an Android device?

What is non-tax filer form parent?

Who is required to file non-tax filer form parent?

How to fill out non-tax filer form parent?

What is the purpose of non-tax filer form parent?

What information must be reported on non-tax filer form parent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.