Get the free Enhanced HSA Disclosure of Fees, Terms and Conditions

Get, Create, Make and Sign enhanced hsa disclosure of

How to edit enhanced hsa disclosure of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out enhanced hsa disclosure of

How to fill out enhanced hsa disclosure of

Who needs enhanced hsa disclosure of?

Enhanced HSA Disclosure of Form: Your Comprehensive Guide

Understanding the Enhanced HSA Disclosure Form

Health Savings Accounts (HSAs) are specialized accounts that provide a tax-advantaged way for individuals to save for medical expenses. They are often paired with high-deductible health plans, allowing users to contribute pre-tax dollars that can grow tax-free and be withdrawn tax-free for qualified medical expenses. HSAs offer a variety of benefits, including lower taxable income, making them a robust option for healthcare savings.

The Enhanced HSA Disclosure Form details essential information regarding your HSA, including your rights, responsibilities, and key account details. The accuracy of this form is critical because it ensures compliance with Internal Revenue Service regulations and protects your rights as a consumer.

When filling out the Enhanced HSA Disclosure Form, understanding the legal and regulatory context is vital. Compliance with IRS rules not only guarantees appropriate management of funds but also enhances your investment practices and ensures smooth retirement planning.

Key components of the Enhanced HSA Disclosure Form

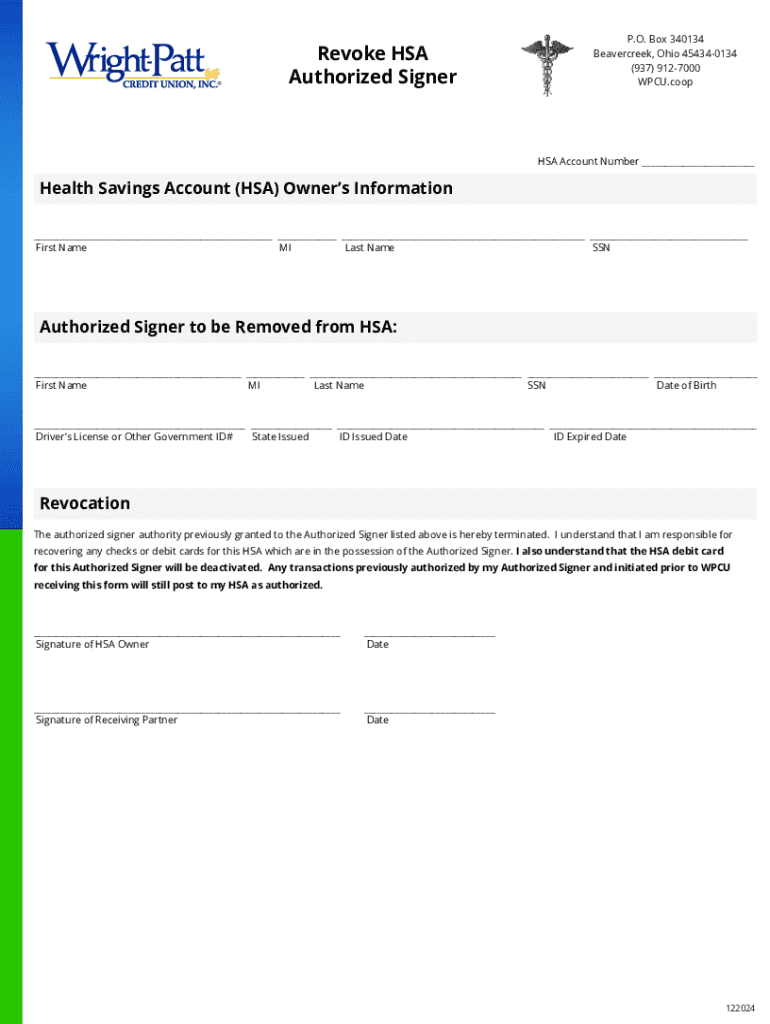

The Enhanced HSA Disclosure Form consists of several critical components. The 'Personal Information Section' requires details such as your name, address, and Social Security number, ensuring that your account is correctly attributed to you. This information is crucial for both identity verification and ensuring compliance with HSA regulations.

Next, the form discloses account balance details, highlighting the amount currently available in your HSA. Furthermore, it includes information on various investment options and their performance, enabling you to make informed decisions about how to grow your savings. Awareness of these components helps users better manage their healthcare finances.

Step-by-step guide to completing the Enhanced HSA Disclosure Form

Before filling out the Enhanced HSA Disclosure Form, gather all necessary documentation, including your employee benefits information and any previous account statements. Accessing the form is made easy through pdfFiller, which offers a straightforward way to edit PDF documents. Be sure to have your personal and financial data at hand to streamline the completion process.

When it comes to filling out the form, accuracy is critical. Start with the Personal Information section, ensuring that each entry matches your official documentation. Next, present your financial data concisely, ensuring no discrepancies in account balances or contributions. Don’t forget to address additional disclosures, such as any beneficiary designations or investment strategies you've chosen.

After filling out your form, it's important to review it thoroughly. Common mistakes include typographical errors and omission of critical information. Utilizing pdfFiller's editing tools will allow for easy revision, ensuring your disclosure is accurate and compliant.

Interactive tools to enhance your filing experience

pdfFiller offers a variety of document editing features that can significantly enhance your filing experience. You can highlight important sections of your Enhanced HSA Disclosure Form, allowing for better visual reference during reviews. Additionally, the platform enables you to insert necessary information quickly, making the completion process efficient.

Electronic signing has become a staple in the digital age. With pdfFiller, you can eSign your Enhanced HSA Disclosure Form with just a few clicks. The legal considerations surrounding eSignatures are well addressed on the platform, ensuring your signed document holds the same weight as a traditional signature.

Managing your Enhanced HSA Disclosure Form

Once you’ve completed and signed your Enhanced HSA Disclosure Form, the next step is managing it effectively. Keeping track of updates related to HSAs is essential to ensure you're aware of any regulatory changes or adjustments in policy that may impact your account. pdfFiller can be your ally in this area through its document version control features.

Storing your document securely is equally important. Leveraging cloud storage through pdfFiller allows for access from anywhere, ensuring you have your enhanced disclosures on hand when needed. Organizing your HSA documents within the platform ensures a streamlined process when you need to retrieve information, maintain compliance, or review your account history.

Real-world applications of the Enhanced HSA Disclosure Form

Employers play a crucial role in the facilitation of HSAs. They often utilize Enhanced HSA Disclosure Forms to provide their employees with essential information about employer-sponsored HSA programs. This practice not only enhances communication but also ensures compliance with relevant regulations, allowing for smoother administration of employee benefits.

Individual case studies reveal that those who effectively utilize Enhanced HSA Disclosure Forms often enjoy better management of their healthcare finances. For instance, by understanding investment options clearly outlined in their disclosures, users can make informed choices that support their overall savings and retirement goals.

Frequently asked questions (FAQs)

Common queries surrounding the Enhanced HSA Disclosure Form often focus on timelines, deadlines, and submission processes. Users frequently ask how soon they should submit the form after completing it, as well as what to do if they receive a notice of incorrect information. Maintaining awareness of the submission schedule ensures you're compliant and your benefits remain uninterrupted.

Additionally, troubleshooting issues can arise when filling out or submitting the form. Many encounter problems such as inability to upload documents or technological glitches. Solutions like contacting pdfFiller’s support team can provide quick resolutions to ensure a hassle-free experience.

Continued education and resources

Staying updated on HSA regulations is crucial for anyone managing these accounts. Regularly reviewing resources from the Internal Revenue Service and subscribing to industry newsletters can help you stay informed about any changes affecting HSAs. Being proactive ensures you remain compliant and make the best decisions for your savings.

Moreover, pdfFiller offers webinars and workshops designed to educate users on document management and compliance. These scheduled learning opportunities provide valuable insights and tools, enabling individuals and teams to maximize their HSA potential and improve their document handling strategies.

We're here to help

pdfFiller is committed to offering exceptional customer support. Users can easily reach out through various channels, including live chat, email, and phone support. This flexibility ensures that any inquiries regarding the Enhanced HSA Disclosure Form can be promptly addressed.

Engaging with the pdfFiller community offers users an additional resource for problem-solving and advice. Forums allow users to share experiences, tips, and challenges they’ve encountered with HSA forms and other document management needs.

Contact Information

For further assistance, connect with our support team available Monday to Friday during business hours. Stay in touch through our social media channels for continued updates on product features and best practices for using pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the enhanced hsa disclosure of in Chrome?

Can I edit enhanced hsa disclosure of on an Android device?

How do I fill out enhanced hsa disclosure of on an Android device?

What is enhanced hsa disclosure of?

Who is required to file enhanced hsa disclosure of?

How to fill out enhanced hsa disclosure of?

What is the purpose of enhanced hsa disclosure of?

What information must be reported on enhanced hsa disclosure of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.