Get the free 20 2 3 R U R A L E C O N O MIC OU TLO O K C O N F E R E N C E

Get, Create, Make and Sign 20 2 3 r

How to edit 20 2 3 r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 20 2 3 r

How to fill out 20 2 3 r

Who needs 20 2 3 r?

A Comprehensive Guide to the 20 2 3 R Form

Understanding the 20 2 3 R form

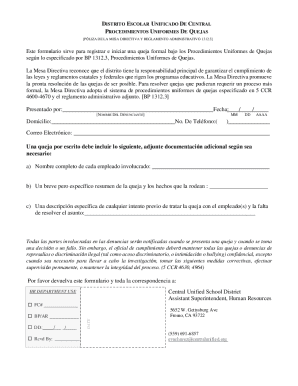

The 20 2 3 R form serves a vital role in documenting and validating essential information, particularly in situations relating to government policies and compliance requirements. It is primarily designed for use by organizations needing to report financial statuses, ensuring accuracy and transparency in their dealings with governmental entities. This form is not just bureaucratic; it aligns with executive orders and policies set forth by various government organizations to streamline data collection.

Utilizing the 20 2 3 R form is crucial in scenarios where proper documentation is necessary for stakeholder assessments, funding approvals, or regulatory compliance. Its applications vary widely—covering areas from grant applications to project funding requests—ultimately helping teams and individuals maintain organized records while adhering to compliance protocols.

Essential components of the 20 2 3 R form

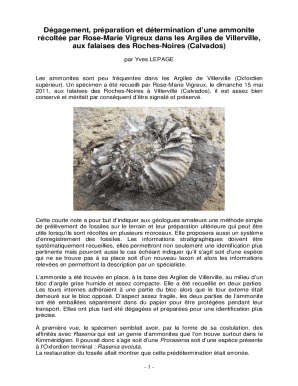

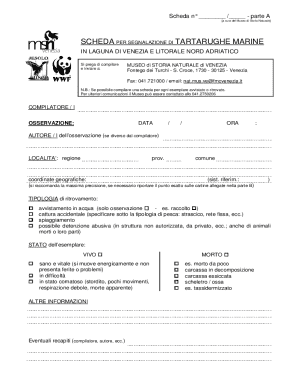

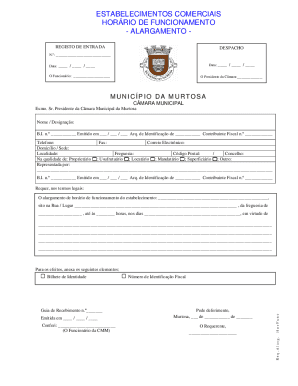

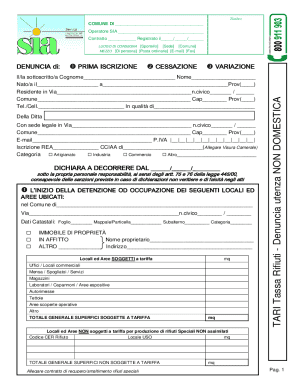

The 20 2 3 R form consists of several key components designed for collecting critical information efficiently. Part A of the form focuses on information gathering, where applicants are required to provide essential details such as organizational structure, contact information, and nature of business activities. This fundamental data is crucial as it helps governmental offices understand the context of the proposal and the credibility of the applicant.

Part B shifts focus to financial details, a section where accurate numerical data is key for determining eligibility and assessing funding potential. This includes projected budgets, past financial records, and other monetary details that impact the decision-making process. Lastly, Part C encompasses certifications and signatures, ensuring that all information presented is verified, establishing accountability in the provided financial claims.

Step-by-step instructions for filling out the 20 2 3 R form

Filling out the 20 2 3 R form doesn't have to be a daunting task, especially with a structured approach. Start by gathering all necessary documentation, including past financial records, legal information, and any additional data required that may support your application. This preliminary step sets a solid foundation for filling out the form accurately.

Proceed to Part A, where you'll input organizational details. Ensure that all information is entered clearly and is up-to-date, as this represents your organization to government bodies. In Part B, accurately fill in financial details, making sure to double-check numbers to avoid errors. After completing these sections, review the entire form for comprehensiveness and accuracy before signing in Part C. Finally, utilize the e-sign feature provided by pdfFiller to submit your form electronically.

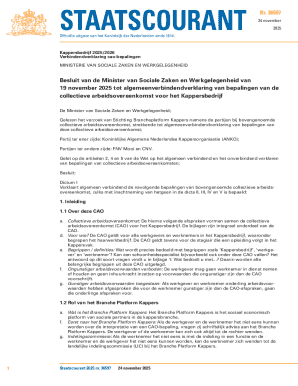

Interactive tools for creating and managing the 20 2 3 R form

pdfFiller offers a range of innovative tools that simplify the creation and management of the 20 2 3 R form. Their user-friendly drag-and-drop form builder enables users to customize documents to meet specific needs creatively. This feature is particularly beneficial for organizations looking to tailor the form more closely to their operational requirements or compliance checks.

The auto-fill capabilities further enhance usability, allowing individuals and teams to pre-populate fields using previously entered data. This expedites the form-filling process and minimizes errors. Additionally, pdfFiller's real-time collaboration tools empower multiple team members to work on a form simultaneously, maintaining productivity and efficiency throughout the documentation review process.

Common mistakes to avoid when filling out the 20 2 3 R form

Even minor errors on the 20 2 3 R form can lead to significant delays in processing applications. One of the most common mistakes is incorrect data entry, where numbers and information are mistyped, leading to discrepancies in financial reporting. It is essential to cross-check all entries to ensure they match the supporting documents provided.

Another frequent oversight involves missing fields and documentation; applicants often fail to fill out all required sections or neglect to include supporting documents, which can halt processing indefinitely. Lastly, adhering to submission guidelines is critical; failure to comply with the outlined procedures may result in the rejection of your application, reiterating the importance of understanding the submission protocols defined by the relevant government organization.

Best practices for managing the 20 2 3 R form in pdfFiller

Managing the 20 2 3 R form efficiently using pdfFiller can streamline your overall documentation process. First, organize your documents systematically within the platform, labeling files accurately and maintaining a version control system to prevent errors that arise from using outdated forms. This strategy ensures that every team member is on the same page regarding the latest information and reduces confusion.

Additionally, utilize the sharing and access management features to control who can view or edit the form. This level of control is particularly important in collaborative environments where multiple stakeholders are involved, as it helps maintain confidentiality and data integrity throughout the document lifecycle.

Advanced features for enhanced form management

To optimize the form management experience, pdfFiller offers advanced features that enhance functionality and ensure quicker approvals. One significant offering is the integration of e-signatures, allowing users to complete the document approval process swiftly without the need for physical signatures. This can significantly reduce processing time and improve overall efficiency.

Another remarkable feature is the availability of templates for future use. Users can save completed forms as templates, enabling them to efficiently address future applications with similar requirements. Furthermore, pdfFiller provides analytics and reporting tools that allow teams to track form usage and submission trends, enhancing decision-making and resource allocation processes.

Case studies: successful implementation of the 20 2 3 R form

Numerous organizations have successfully implemented the 20 2 3 R form, leading to significant efficiency gains in their operational processes. One notable case involved a non-profit organization that utilized the form to secure government grants. By adhering strictly to the form requirements and utilizing pdfFiller's tools, they were able to reduce the time taken for application submissions by over 40%, greatly enhancing their fundraising capabilities.

Another case study highlights a local government department that restructured its financial reporting processes through the 20 2 3 R form. By standardizing submissions and ensuring compliance with guidelines, they improved their reporting accuracy and reduced audit times by 25%. These examples exemplify the form's role in enhancing operational efficiency and fostering better relationships with government agencies.

FAQs about the 20 2 3 R form

Navigating questions related to the 20 2 3 R form is essential for ensuring compliance and accuracy. Frequently asked questions generally revolve around submission procedures, required documentation, and processing timelines. Understanding what constitutes complete information and the verification process can alleviate confusion and enhance the accuracy of submissions.

Many applicants also inquire about troubleshooting common issues, such as missing signatures or incorrectly filled fields. pdfFiller provides comprehensive support and informative resources that guide users through the potential pitfalls of form completion, significantly reducing the likelihood of submission errors and rejections.

Additional tips for maximizing the use of your 20 2 3 R form

To ensure that your 20 2 3 R form remains effective and relevant, keeping it up-to-date is paramount. As government regulations and compliance requirements evolve, so should your documentation practices. Regularly reviewing your forms and adapting them to reflect new policies will not only ensure compliance but also maintain operational efficiency.

Furthermore, consider future-proofing your document management strategy by integrating cloud solutions that facilitate access from any location. With the right tools, your team can collaborate seamlessly, enhancing the experience of managing critical compliance documents like the 20 2 3 R form. Staying proactive in these strategies will position your organization for sustained success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 20 2 3 r online?

How do I edit 20 2 3 r in Chrome?

Can I edit 20 2 3 r on an Android device?

What is 20 2 3 r?

Who is required to file 20 2 3 r?

How to fill out 20 2 3 r?

What is the purpose of 20 2 3 r?

What information must be reported on 20 2 3 r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.