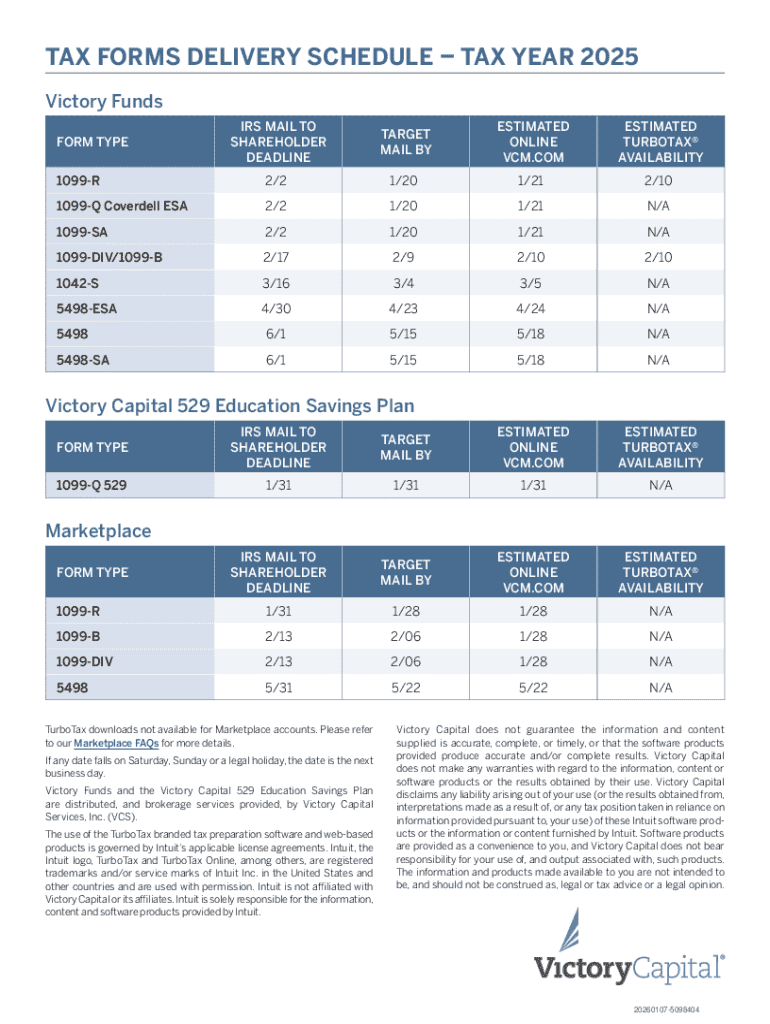

Get the free TAX FORMS DELIVERY SCHEDULE TAX YEAR 2025

Get, Create, Make and Sign tax forms delivery schedule

How to edit tax forms delivery schedule online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax forms delivery schedule

How to fill out tax forms delivery schedule

Who needs tax forms delivery schedule?

Tax Forms Delivery Schedule Form: Your Comprehensive Guide

Overview of tax forms delivery schedule

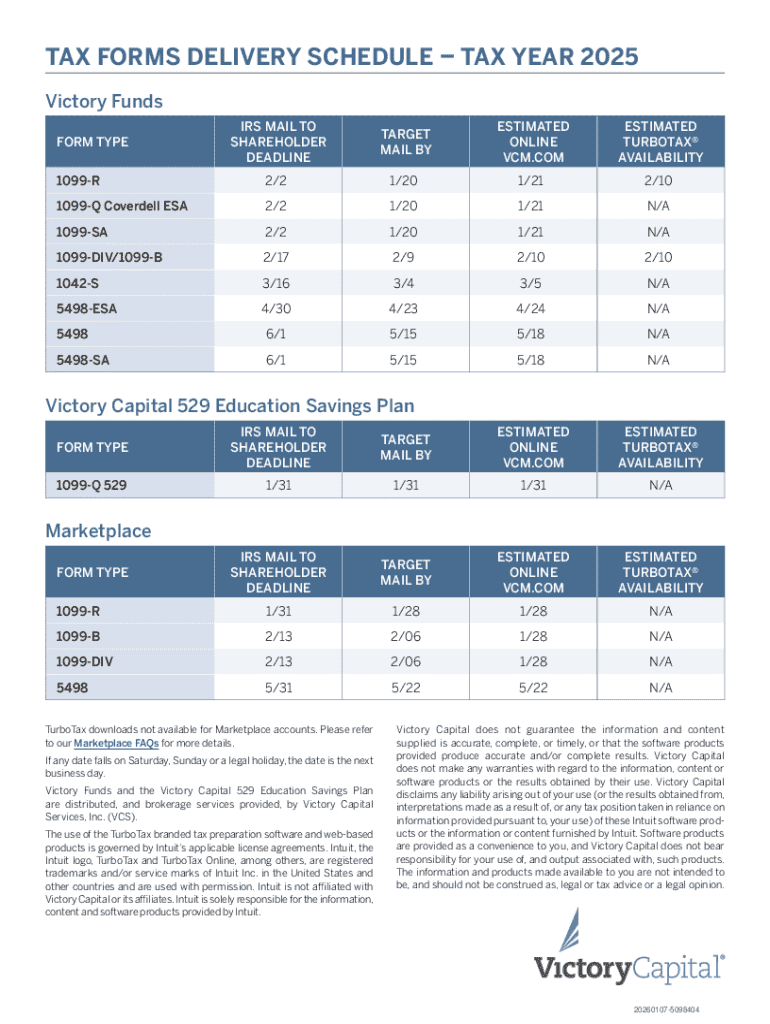

A tax forms delivery schedule is essentially a timeline that outlines when various tax-related forms are expected to be delivered to taxpayers and employers. It plays a critical role in the tax preparation process, helping individuals and businesses plan their filings accurately and on time. Keeping up with these dates is crucial for avoiding late penalties and ensuring compliance with tax regulations.

A well-defined delivery schedule not only aids in timely filing but also allows taxpayers to organize their documents efficiently. This proactive approach is imperative for effectively managing financial records and ensures a smoother tax season.

Key tax forms and their delivery dates

Some of the most common tax forms you’ll encounter include the W-2, 1099, and 1040 forms. Each of these serves its own purpose and has specific delivery dates that taxpayers must keep in mind.

Importance of keeping track of delivery dates

Keeping track of tax forms delivery dates is vital to avoid penalties for late filing. The IRS imposes fines for late submissions, which could add up quickly, impacting an individual's financial standing.

Moreover, knowing delivery dates allows for better financial planning. Employees who receive their W-2 forms on time can file their taxes as soon as possible, potentially leading to earlier refunds. For employers, timely distribution of documents fosters good employee relations and ensures regulatory compliance.

How to access your tax forms

Accessing your tax forms may be straightforward if you know where to look. Here’s a step-by-step guide to help you find the forms you need quickly.

Tools and resources for monitoring delivery dates

Monitoring delivery dates can be made easier using various digital tools. Setting up reminders on your digital calendars helps you receive timely notifications well ahead of key tax deadlines.

Best practices for managing your tax documents

Organizing your tax documents can make a significant difference during tax season. A well-maintained system can minimize stress and streamline the filing process.

Collaborating on tax forms as a team

For businesses with multiple employees, collaboration is essential when handling tax forms. Streamlining the management of these forms can lead to improved efficiency and accuracy in submissions.

Frequently asked questions about tax forms delivery

Tax forms can sometimes lead to confusion or concern, especially regarding discrepancies or non-delivery. Here are some common issues and how to address them.

Staying updated on tax form changes

Changes to tax forms can occur annually, affecting how you file and what information you need to provide. Being aware of these changes can significantly impact your tax strategy.

Utilizing pdfFiller to navigate tax form processes

pdfFiller is an invaluable tool for managing tax forms, aiding users in various ways to smoothly handle their documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit tax forms delivery schedule on an iOS device?

How do I complete tax forms delivery schedule on an iOS device?

How do I fill out tax forms delivery schedule on an Android device?

What is tax forms delivery schedule?

Who is required to file tax forms delivery schedule?

How to fill out tax forms delivery schedule?

What is the purpose of tax forms delivery schedule?

What information must be reported on tax forms delivery schedule?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.