Get the free Commissioner of Revenue Tax Relief & Exemption Forms

Get, Create, Make and Sign commissioner of revenue tax

How to edit commissioner of revenue tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commissioner of revenue tax

How to fill out commissioner of revenue tax

Who needs commissioner of revenue tax?

A Complete Guide to the Commissioner of Revenue Tax Form

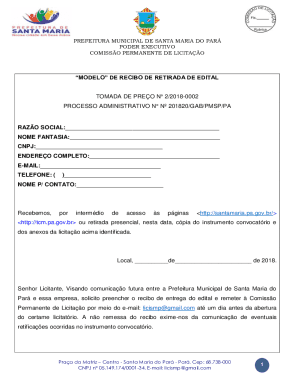

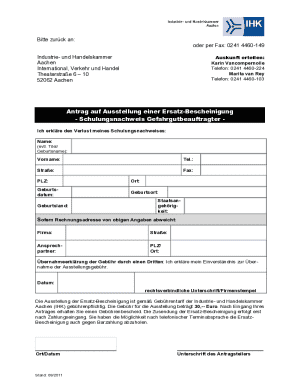

Understanding the commissioner of revenue tax form

The commissioner of revenue tax form serves a pivotal role in tax collection and revenue generation at both local and state levels. Designed to capture critical information about an individual's or a business's financial activities within a specific tax year, this form is the backbone of compliance with tax regulations. Accurate filing is essential, as it ensures that individuals and businesses fulfill their tax obligations while also avoiding penalties.

Completing this form not only contributes to public funding and services but also safeguards your rights as a taxpayer. Failure to file accurately can lead to audits or penalties; thus, understanding every aspect of the commissioner of revenue tax form is crucial.

Key features of the commissioner of revenue tax form

The commissioner of revenue tax form is structured to facilitate accurate reporting of financial information. Key features include sections dedicated to income reporting, deductions, credits, and payment information. Each section plays a critical role in ensuring that the form accounts for various sources of income and compliant tax credits, which ultimately impact your total tax liability.

Typically, the form is laid out in a user-friendly manner, with clear headings and spaces for required information. Regions or states may vary in their specific forms, which may reflect their unique taxation laws, so it’s important to use the version applicable to your locality.

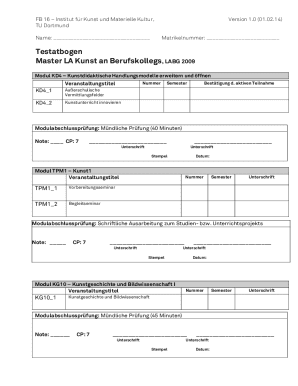

Step-by-step instructions for completing the form

Before filling out the commissioner of revenue tax form, gather the necessary documents, including W-2s, 1099s, and any relevant receipts. Familiarizing yourself with the terminology used on the form is also beneficial—this ensures you understand what is expected in each section.

The following is a breakdown of how to fill the form out effectively:

Common mistakes occur in overlooked fields or miscalculated deductions. Review your completed form or use an editing tool to ensure precision, especially concerning numbers.

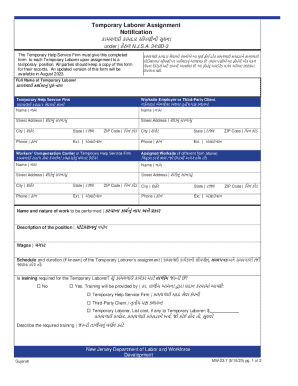

Editing and managing your commissioner of revenue tax form

Once you’ve filled out the commissioner of revenue tax form, it’s advisable to consider using tools such as pdfFiller for any needed edits. Uploading your form to pdfFiller allows you not only to access the document but also to collaborate with others who may need to review it.

Using tools available on pdfFiller, you can annotate the form, making notes or adjustments as necessary. Saving your form in the cloud means that you can access it from any device, ensuring that your documents are secure and easily shareable with colleagues or tax professionals.

Signing the commissioner of revenue tax form

When it comes to signing the commissioner of revenue tax form, utilizing the eSign features within pdfFiller simplifies the process. Electronic signatures are both legally valid and widely accepted, making it easier to finalize your submission electronically.

Ensuring the security of your document is vital as sensitive information is involved. pdfFiller provides features that allow you to secure your files, ensuring that personal details are protected during and after the submission process.

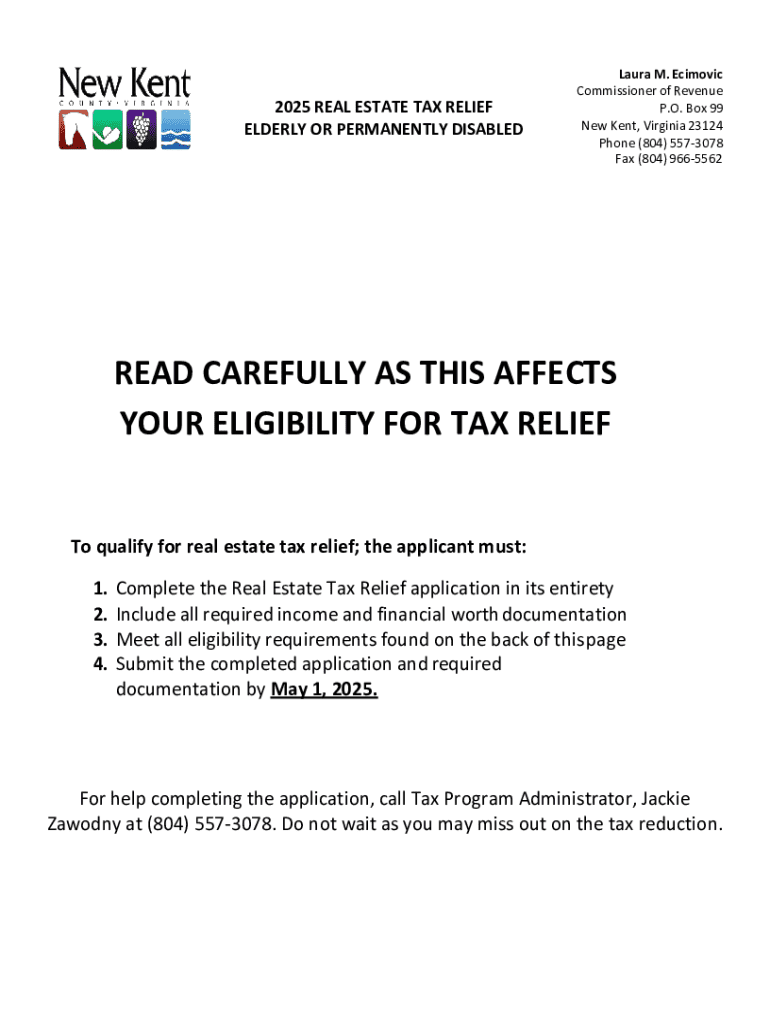

Submitting your commissioner of revenue tax form

When it's time to submit the completed commissioner of revenue tax form, you have multiple options. Many local and state revenue departments now offer an online submission option, which is both convenient and efficient. Ensure that you follow the specific online processes set forth by your revenue department.

If you choose to mail in your form, comply with the provided instructions for mail-in submissions, including the necessary envelope and postage. After submitting, it's crucial to confirm receipt of your form to ensure it was processed correctly. This can often be done through the revenue department's online portal.

Troubleshooting common issues

Even with the utmost care, issues can arise post-submission. If you've made a mistake after filing, it’s important to know how to rectify the situation. Typically, you can submit an amended form to correct any errors noted by the commissioner of revenue.

Tax inquiries or audits can be daunting. Staying informed about your rights and responsibilities is advisable. Should you receive a notice, respond promptly, and reach out to customer services at the revenue department for clarification or guidance. Resources like pdfFiller also provide support in managing your documents throughout this process.

Additional resources for tax filers

For comprehensive assistance, tax filers can refer to a variety of online resources. Official state or local revenue department websites often provide downloadable forms and guides to assist you further. These sites also post updates about changes in tax laws, which can be crucial for compliance.

Engaging with the tax community can also be beneficial. Look for forums, webinars, or local workshops that can connect you with professionals. Networking with tax experts can provide insights into best practices and keep you informed about the latest tax news and updates.

Find additional forms and templates related to revenue tax

If you are looking for other tax-related forms, pdfFiller offers an easy navigation experience to locate them. Simply access the forms library and search for forms relevant to your needs, whether for state, local, or federal tax obligations.

Each form is available for download, ensuring you have the necessary copies for supplementary tax requirements. This seamless access to multiple forms simplifies tax preparation and allows for maintaining thorough records.

Sign up for email updates related to tax filing

Staying informed about tax laws and relevant updates can ease the filing process. By signing up for email notifications through pdfFiller, you can receive timely tax filing reminders and important information about tax-related events.

This proactive approach allows you to manage your tax responsibilities efficiently, ensuring that you're aware of changes that could affect your filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my commissioner of revenue tax directly from Gmail?

Can I create an electronic signature for the commissioner of revenue tax in Chrome?

How do I edit commissioner of revenue tax on an Android device?

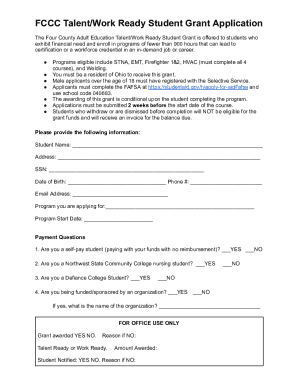

What is commissioner of revenue tax?

Who is required to file commissioner of revenue tax?

How to fill out commissioner of revenue tax?

What is the purpose of commissioner of revenue tax?

What information must be reported on commissioner of revenue tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.