Get the free PTAX-340 2025 Low-Income Senior Citizens Assessment Freeze

Get, Create, Make and Sign ptax-340 2025 low-income senior

Editing ptax-340 2025 low-income senior online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-340 2025 low-income senior

How to fill out ptax-340 2025 low-income senior

Who needs ptax-340 2025 low-income senior?

Comprehensive Guide to the PTAX Low-Income Senior Form

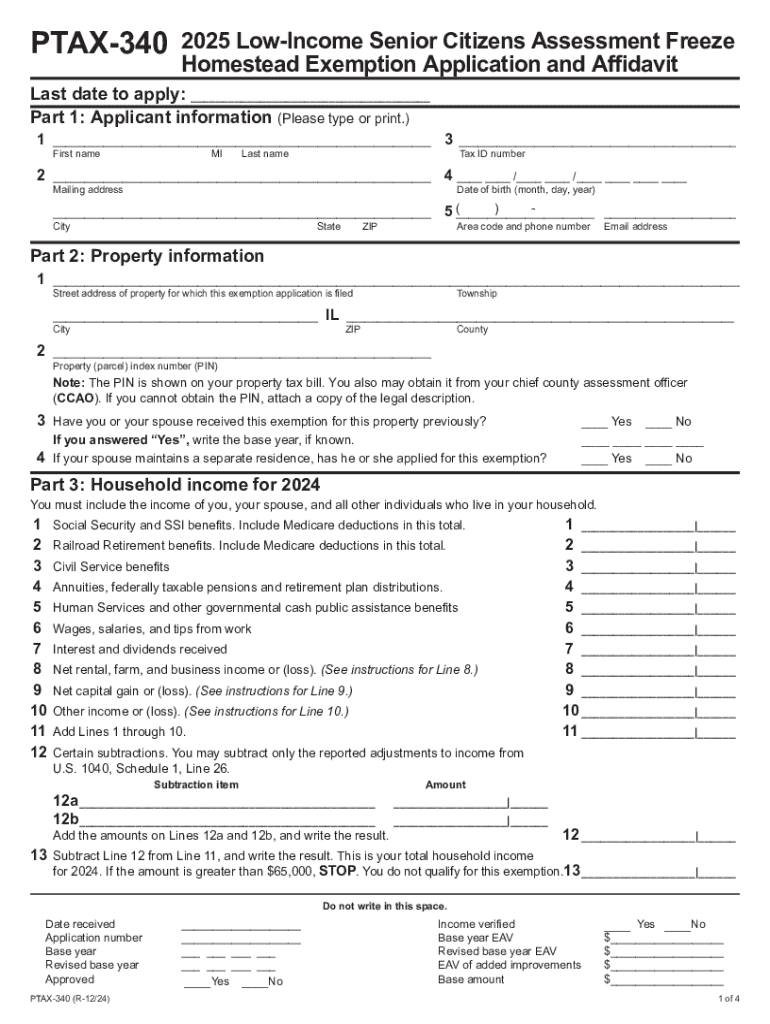

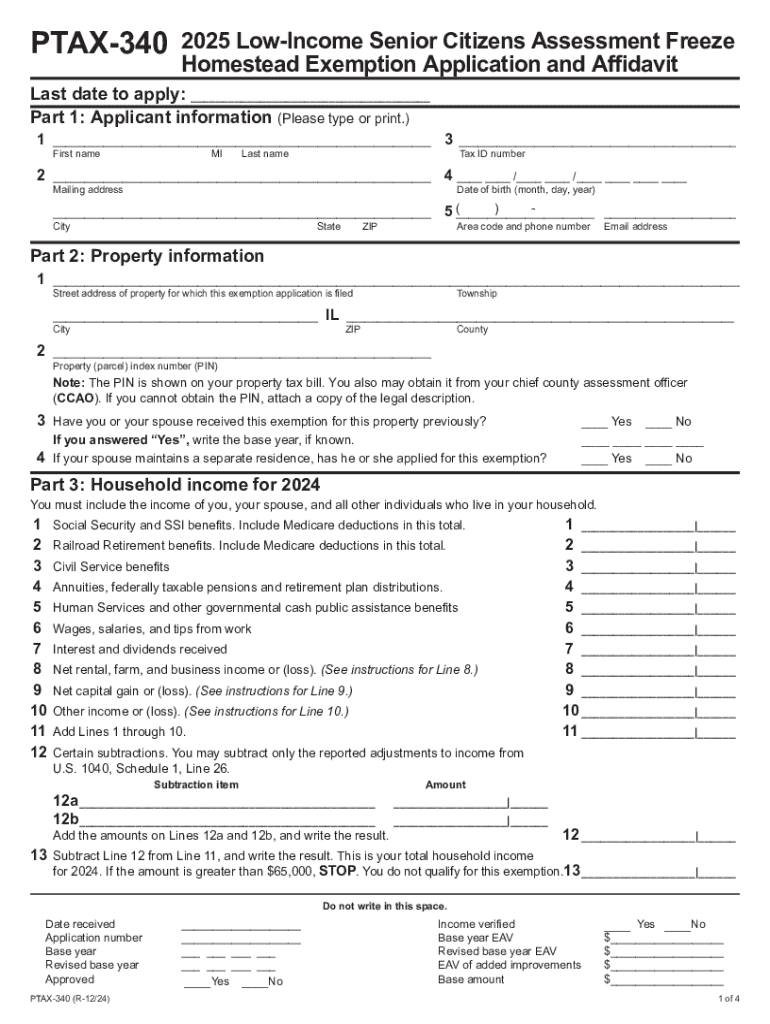

Overview of the PTAX-340 form

The PTAX-340 form serves as a crucial tool for low-income seniors seeking financial relief from property taxes. Designed specifically for older adults, it provides exemptions that can significantly ease the tax burden individuals face during retirement.

Understanding the PTAX-340 form is essential because it directly addresses the challenges many seniors encounter when managing limited fixed incomes. Each year, tax assessments can lead to financial strain, making this exemption vital for those who meet the criteria.

Eligibility criteria for low-income seniors

To qualify for the PTAX-340 exemption, applicants must meet specific eligibility criteria, which includes age requirements, income limits, and residency considerations. Typically, applicants must be at least 65 years old by the end of the tax year to be eligible.

Regarding income limits, the definition of low-income is often tied to a maximum threshold set by state regulations. Applicants will need to provide documentation proving their income, including tax returns and Social Security statements. Additionally, proof of residency is required to ensure that the property being claimed is their primary residence.

How to access the PTAX-340 form

Accessing the PTAX-340 form is a straightforward process when using platforms like pdfFiller. Simply navigate to the website and use the search function to locate the form quickly.

Users can download the PTAX-340 form as a PDF for easy printing or filling out online. For printing, simply select the print option after downloading the document to your device.

Step-by-step instructions for completing the PTAX-340 form

Filling out personal information section

The personal information section requires accurate details that must match official documents. Key fields include the senior's full name, date of birth, and address. It’s advisable to have identification documents ready, such as a driver’s license or state ID, to verify this information.

Declaring income sources

When declaring income, be thorough in reporting all applicable sources. Income could include wages from employment, monthly Social Security payments, and pension or retirement benefits. Ensure to outline these in the designated sections clearly.

Certain types of income should be excluded from the calculations, such as gifts or inheritances. Understanding what counts as income versus what does not is crucial for accurate reporting.

Providing financial documentation

Along with the form, seniors must submit various documents for verification purposes. These typically include recent tax returns, pay stubs, and bank statements. Being organized will ease the application process; consider keeping all documentation in a dedicated folder.

Certifying the application

The final step in completing the PTAX-340 is signing and dating the application. Understanding the certification statement is crucial, as it usually includes affirmations about the accuracy of the supplied information and acknowledgment of the application process.

Editing and signing the PTAX-340 form on pdfFiller

Once the PTAX-340 form is filled out, pdfFiller’s suite of editing tools can help finalize the document. Users can enhance readability by utilizing features such as text highlighting and adjustable font sizes to ensure clarity.

To electronically sign the PTAX-340 form, pdfFiller allows users to add a digital signature. This method is legally valid, making it especially convenient for those who prefer online submissions.

Submitting the PTAX-340 form

When it comes to submitting your completed PTAX-340 form, it's essential to follow the guidelines provided by your local tax authority. Usually, individuals can choose to either mail the form or submit it in person at designated offices.

To track the status of your application after submission, maintain a copy of your documents, and inquire directly with the tax office to ensure they have received your application. If any issues arise, follow up promptly to resolve them.

Frequently asked questions (FAQs)

Many seniors have questions about the PTAX-340 form. Some common queries include what to do if your income exceeds the limits outlined for the exemption, and how to appeal if your application is rejected. It's crucial to stay informed on such matters as they can significantly impact financial planning.

Understanding the processing time for applications is also essential. Generally, confirmation of receipt should be expected within a few weeks, but it may take longer during peak filing seasons. Being aware of these timelines can help you plan effectively.

Financial planning tips for low-income seniors

Effective financial planning is crucial for low-income seniors to maintain their quality of life. Strategies should focus on budgeting, understanding healthcare costs, and exploring additional assistance programs such as SNAP or Medicaid.

Consultative services can also provide valuable insights into managing finances, ensuring that seniors make informed decisions regarding their income and expenses. Utilizing available resources can lead to better financial outcomes.

Updates for 2025 tax year

For the 2025 tax year, it’s expected that some of the eligibility criteria for the PTAX-340 form may change, particularly with potential increases in income limits to accommodate inflation and rising living costs.

Stay updated on these changes through your local tax authority's announcements to ensure eligibility and understanding of any new processing methods or requirements.

Additional tools and features on pdfFiller

pdfFiller not only simplifies the completion of the PTAX-340 form but also offers a range of document management capabilities. Users can store, share, and collaborate on multiple documents directly within the platform, ensuring a seamless experience.

Utilizing collaboration tools available on pdfFiller allows for easy handling of documents, making it a perfect solution for teams or family members assisting seniors with their applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ptax-340 2025 low-income senior?

Can I create an eSignature for the ptax-340 2025 low-income senior in Gmail?

How do I complete ptax-340 2025 low-income senior on an Android device?

What is ptax-340 2025 low-income senior?

Who is required to file ptax-340 2025 low-income senior?

How to fill out ptax-340 2025 low-income senior?

What is the purpose of ptax-340 2025 low-income senior?

What information must be reported on ptax-340 2025 low-income senior?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.