Get the free Disability Homestead Property Tax Exemption

Get, Create, Make and Sign disability homestead property tax

Editing disability homestead property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disability homestead property tax

How to fill out disability homestead property tax

Who needs disability homestead property tax?

Disability Homestead Property Tax Form: Your Comprehensive Guide

Understanding disability homestead property tax benefits

Disability homestead property tax benefits provide crucial financial relief for those living with disabilities. These exemptions are designed to alleviate some of the financial pressure on disabled homeowners, allowing them to retain their homes without the burden of excessive property taxes. Understanding how these exemptions work can lead to significant savings, enhancing the quality of life for those in need.

Homestead exemptions for disabled individuals vary by state, but they generally reduce the taxable value of a property, making it more affordable. This advantage is particularly important as it can help disabled individuals maintain independence and stability in their housing situation.

Who qualifies for disability homestead exemptions?

To qualify for disability homestead property tax exemptions, a person must be considered disabled under the law. Definitions of disability can vary, but typically, they include individuals with physical or mental impairments that substantially limit major life activities. Each state may have specific criteria regarding severity and type of disability, which can affect eligibility.

In addition to the disability definition, there are often residency requirements that applicants must meet. This means the individual must be a permanent resident of the home for which they are applying for the exemption. It's essential to review these criteria carefully to ensure you meet all necessary qualifications.

Key benefits of disability homestead exemptions

One of the primary benefits of disability homestead exemptions is the reduced property tax burden. Depending on the state, eligible homeowners can receive significant reductions in their assessed property value, which translates to lower annual property taxes.

These exemptions can lead to annual savings that might range from a few hundred dollars to several thousand, depending on the property's value and local tax rates. For many disabled homeowners, this assistance makes a substantial difference in their budgets.

Do you need to be receiving disability benefits?

It's a common misconception that only those receiving disability benefits can qualify for homestead exemptions. This is not necessarily true. Many states allow for exemptions based merely on the presence of a documented disability, regardless of whether the individual is receiving formal benefits.

For example, a veteran with a service-related disability might not be receiving Social Security disability benefits but still qualifies for a homestead exemption based on their veteran status and disability documentation.

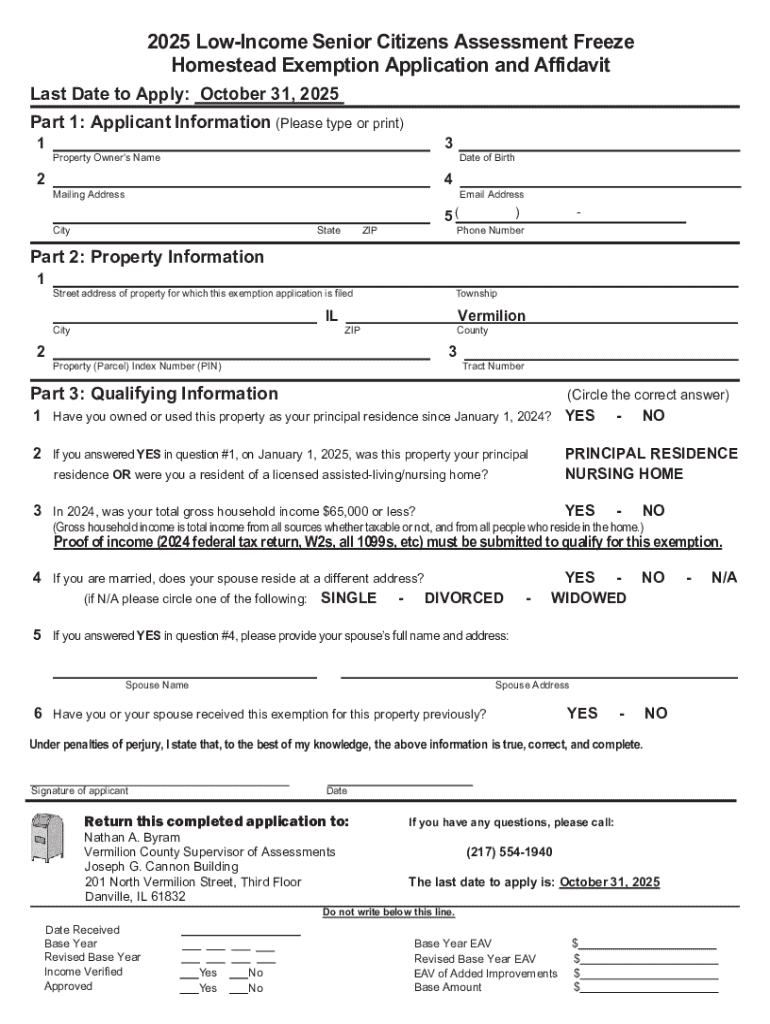

Essential documents for claiming the exemption

When applying for a disability homestead property tax exemption, specific documentation is required to substantiate your claim. Gathering these documents early can streamline the application process and increase your chances of approval.

Commonly required documentation includes proof of disability, such as medical records or benefit letters, income verification documents, and evidence of property ownership. Be sure to check your state’s requirements, as they can differ significantly.

Step-by-step guide to completing the disability homestead property tax form

Filling out the Disability Homestead Property Tax Form can be simplified by following a step-by-step approach. Start by accessing the form directly from pdfFiller, which offers an easy-to-navigate online platform.

Here are the essential steps:

After filling out the form, reviewing your submission for accuracy and completeness is crucial. Common mistakes include missing signatures or incorrect information, which can lead to delays or denials of your application.

Submitting the disability homestead property tax form

Once your form is completed, you’ll need to submit it. Submission processes may include online submission through your state’s tax authority or mailing the completed form to the appropriate local office. Understanding the submission process is vital for ensuring your application is processed in a timely manner.

Additionally, be mindful of important deadlines. Many states require applications to be submitted by a certain date, often March 1st, for the tax year. Missing the deadline can mean waiting another year to reap the benefits of the exemption.

Maximizing your benefits: are you leaving money on the table?

In addition to the disability homestead exemption, other tax credits and exemptions might be available to you as a disabled homeowner. This could include additional deductions for medical expenses or low-income housing assistance. It's wise to review your overall tax situation each year to ensure you're not missing out on valuable benefits.

Exploring all your options can lead to greater savings on your overall property tax bill, enhancing your financial situation. Don't hesitate to seek assistance from local tax advocates or during tax season for personalized guidance.

Understanding property tax exemptions beyond disability

It’s essential to be aware that several property tax exemptions are available aside from the disability homestead exemption. Many states offer exemptions for veterans, seniors, and low-income individuals. Understanding these different types of exemptions can help you effectively strategize for maximum savings.

In some cases, multiple exemptions can be stacked or combined. For instance, a disabled veteran might qualify for both a disability exemption and a veteran's exemption, which can offer greater tax savings.

Tips for managing your property tax affairs with pdfFiller

Using pdfFiller provides an intuitive experience for managing all your property-related documents. The platform allows users to collaborate efficiently with family members or caretakers on documentation, ensuring everyone's input is considered.

Key features include secure cloud storage for tax documents, making it easier for you to access important files whenever needed. Additionally, pdfFiller supports eSigning functionalities, speeding up the approval process, which can be especially useful when deadlines loom.

State-by-state variations in disability homestead exemptions

Disability homestead exemptions are not uniform across the United States; they vary significantly by state. Some states offer broader benefits, while others may require more stringent documentation. This disparity underscores the importance of understanding your local regulations to optimize your application.

To find personalized assistance, utilize state-specific resources and contacts available through your state's tax authority website. Engaging with local professionals can provide you with tailored guidance.

Frequently asked questions (FAQs) about disability homestead exemptions

As you navigate the process of securing a disability homestead exemption, you may have several questions. Common inquiries revolve around eligibility criteria, what happens if your disability status changes, and renewal processes for the exemption.

For example, individuals often wonder if they need to reapply every year. In some states, once granted, disabilities are recognized continuously unless otherwise stated, while others may require periodic review.

Conclusion of the guide

Securing a disability homestead property tax exemption is a vital step in easing financial burdens for disabled homeowners. By understanding the application process, the necessary documentation, and the benefits available, you can take proactive measures to lessen your property tax responsibilities.

Don't overlook the importance of timely filings and keeping your documents organized. With platforms like pdfFiller at your disposal, managing your property tax affairs can become a streamlined, efficient task. Embrace the opportunity to maximize your benefits and ensure your home remains a place of comfort and security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute disability homestead property tax online?

How do I complete disability homestead property tax on an iOS device?

How do I complete disability homestead property tax on an Android device?

What is disability homestead property tax?

Who is required to file disability homestead property tax?

How to fill out disability homestead property tax?

What is the purpose of disability homestead property tax?

What information must be reported on disability homestead property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.