Get the free Receipt of Bank Reconciliation Reports December 2025

Get, Create, Make and Sign receipt of bank reconciliation

Editing receipt of bank reconciliation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out receipt of bank reconciliation

How to fill out receipt of bank reconciliation

Who needs receipt of bank reconciliation?

Understanding the Receipt of Bank Reconciliation Form

Understanding the bank reconciliation process

Bank reconciliation is a critical financial process that involves comparing a company's internal financial records to those of its bank accounts. This thorough examination helps to ensure that the amounts recorded in the company's cash account are aligned with the figures shown on the bank statement. Discrepancies may arise due to outstanding checks, bank fees, or errors, which makes regular reconciliation essential.

Accurate bank reconciliation not only reinforces financial accuracy but also plays a vital role in fraud detection and cash flow management. By methodically reviewing transactions, businesses can identify unauthorized withdrawals and discrepancies in their accounts, thereby safeguarding their financial assets and ensuring liquidity.

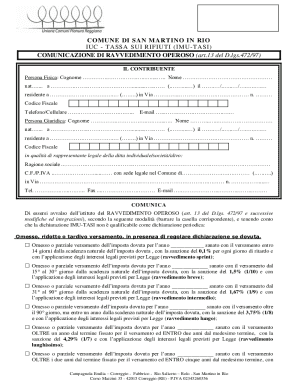

Overview of the receipt of bank reconciliation form

The receipt of bank reconciliation form is an essential document that serves as a record of the reconciliation process. This form consolidates all relevant data in one place, allowing for easy reference and analysis. It typically includes summaries of any discrepancies found during the reconciliation and provides teams with a formal document to support financial audits and reviews.

Key components of the receipt of bank reconciliation form include the date of reconciliation, bank account numbers, related bank statements, and any necessary adjustments or discrepancies identified during the process. By having all this information documented in a standardized format, businesses can facilitate smoother financial operations and improve accountability amongst team members.

Preparing for bank reconciliation

Effective bank reconciliation begins with gathering necessary documentation. Essential documents include recent bank statements, internal cash account records, and any previous reconciliation reports. Having access to these materials is crucial for accurately comparing figures and identifying any discrepancies that may arise.

Organizing data is equally important to streamline the reconciliation process. Properly filed documents allow for thorough checks and cross-verification of transactions. A well-structured approach not only minimizes errors but also promotes productivity within finance teams, as everyone involved can quickly access the relevant information.

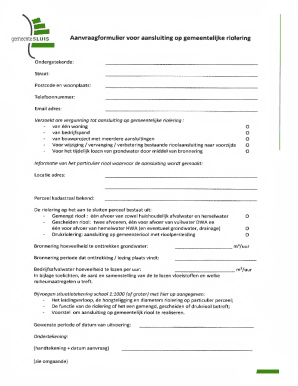

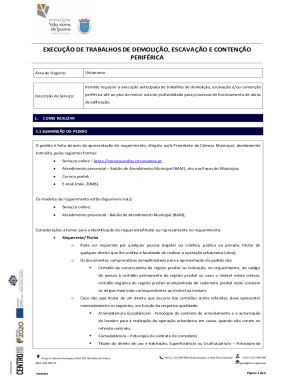

Filling out the receipt of bank reconciliation form

Completing the receipt of bank reconciliation form follows a specific process that ensures all necessary information is captured accurately. The first step involves entering the date of reconciliation, which sets the context for the review undertaken. Next, input the account information, including bank account numbers to clarify which accounts are being reconciled.

After entering the basic details, it is essential to record the bank statement balances reflecting the actual cash balance as per the bank's records. Following this, any discrepancies—such as outstanding checks or deposits—should be meticulously listed, along with required adjustments to reconcile the figures correctly. This step culminates in finalizing the reconciliation details to complete the form.

Common errors in bank reconciliation and how to avoid them

Despite the structured nature of bank reconciliation, common errors can result in inaccurate financial records. Overlooking bank fees or interest accrued, failing to account for outstanding checks or deposits, and misentering figures are frequent issues that can complicate the process. Such mistakes not only affect the immediate reconciliation but can lead to inaccurate financial reporting.

To prevent these errors, regular training and updates for teams working on financial documentation are crucial. Implementing automated solutions or accounting software can also significantly enhance efficiency and accuracy. Utilizing tools that allow for easy tracking of changes and discrepancies can provide teams the support they need for flawless reconciliation practices.

Best practices for managing a receipt of bank reconciliation form

Maintaining a consistent schedule for regular reconciliation can greatly enhance financial tracking and management. Monthly reconciliations are often advisable for most businesses; however, depending on the complexities of operations, some may choose to engage in quarterly reconciliations. Keeping to a regular schedule helps prevent discrepancies from building up over time while also ensuring that financial data remains accurate.

Collaboration among team members is also key to effective bank reconciliation. The use of pdfFiller, a cloud-based document platform, facilitates teamwork by allowing multiple users to access and edit documents concurrently. This approach fosters real-time collaboration while ensuring that the most updated document version is always available. Lastly, secure storage and backup of records is vital to maintaining document integrity, with pdfFiller providing a secure environment to protect sensitive financial data.

Utilizing technology to enhance the reconciliation process

In today’s digital age, adopting technology for bank reconciliation can lead to significant improvements in efficiency. Utilizing electronic forms reduces the dependency on paper, which not only streamlines the workflow but also contributes to sustainable business practices. Software solutions allow for seamless integration of financial data, ensuring better accuracy and saving time during the reconciliation process.

Specific platforms, such as pdfFiller, simplify the bank reconciliation procedure by offering easy editing of PDFs and built-in eSign capabilities for quick approvals. This platform enhances the management of forms and templates, creating an intuitive user experience that promotes accuracy and efficiency in financial documentation.

Case studies: success stories of effective bank reconciliation

Examining successful implementations of the receipt of bank reconciliation form reveals how effective reconciliation can transform business operations. One notable example is a small business that initially faced challenges in tracking cash flows and reconciling accounts. After instituting a structured reconciliation process using the form, they saw enhanced visibility into their finances, which helped them to identify unnecessary expenses and improve cash flow management.

Another compelling case involved a corporate financial team that previously relied on manual tracking methods. Transitioning to pdfFiller tools brought about radical shifts in efficiency, with team members reporting reductions in time spent reconciling accounts. The new automated processes allowed them to focus on strategy rather than routine tasks, demonstrating the tangible benefits of adopting technology for financial management.

FAQs about the receipt of bank reconciliation form

As businesses adopt structured approaches to bank reconciliation, questions frequently arise about best practices and processes. For instance, many wonder what to do if discrepancies are found during reconciliation. The answer lies in thoroughly investigating each difference and adjusting records accordingly. It's also wise to establish a set timeline for regular reconciliations. Most experts recommend monthly, yet certain industries may find quarterly reconciliations adequate.

Clarifications on specific terms used in the form, like 'outstanding checks' or 'bank fees,' can also prove beneficial for users new to the process. Understanding these terms and being proactive in addressing discrepancies can enhance reconciliation accuracy and ultimately strengthen financial management.

Conclusion: the role of effective reconciliation in financial management

Establishing effective reconciliation practices yields long-term benefits for businesses, promoting financial accuracy and reducing risks associated with discrepancies. The structured approach provided by the receipt of bank reconciliation form supports teams in managing their finances competently. By leveraging platforms such as pdfFiller, companies can streamline their financial documentation processes, ensuring secure, efficient, and collaborative efforts in maintaining accurate accounts.

Ultimately, successful reconciliation contributes not only to healthier financial practices but also empowers teams with better insights into cash flow management, enabling informed decision-making for future growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit receipt of bank reconciliation from Google Drive?

Can I create an eSignature for the receipt of bank reconciliation in Gmail?

How do I edit receipt of bank reconciliation straight from my smartphone?

What is receipt of bank reconciliation?

Who is required to file receipt of bank reconciliation?

How to fill out receipt of bank reconciliation?

What is the purpose of receipt of bank reconciliation?

What information must be reported on receipt of bank reconciliation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.