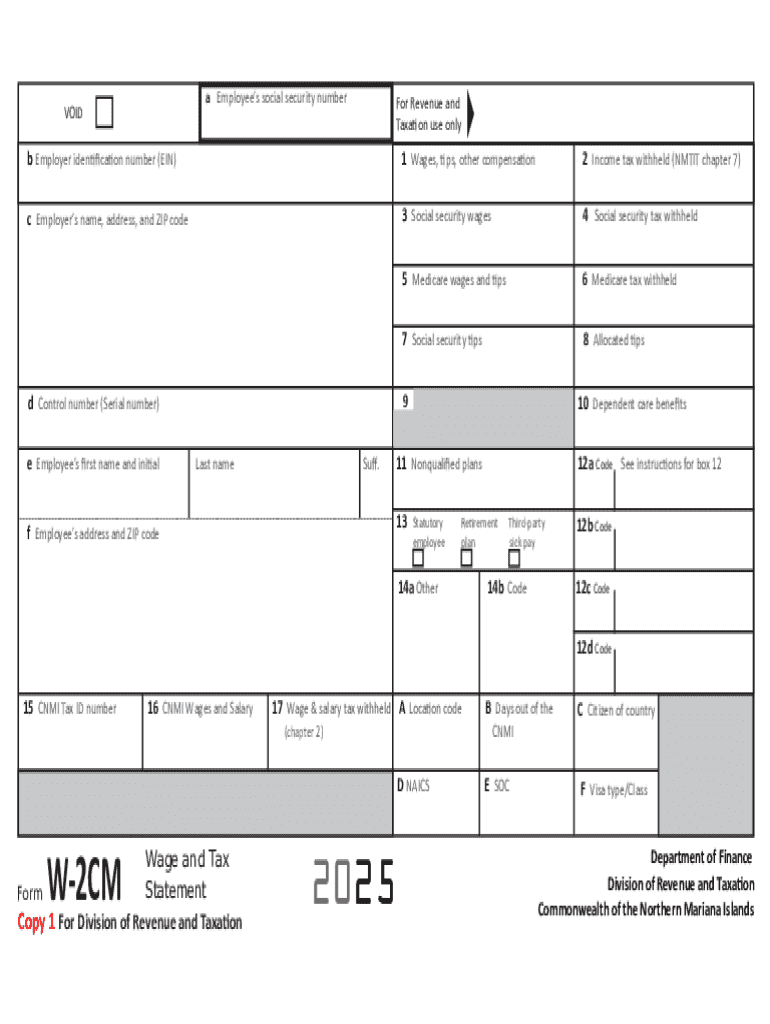

Get the free Form W-2CM Wage and Tax Statement (2025). Form W-2CM Wage and Tax Statement (2025)

Get, Create, Make and Sign form w-2cm wage and

Editing form w-2cm wage and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form w-2cm wage and

How to fill out form w-2cm wage and

Who needs form w-2cm wage and?

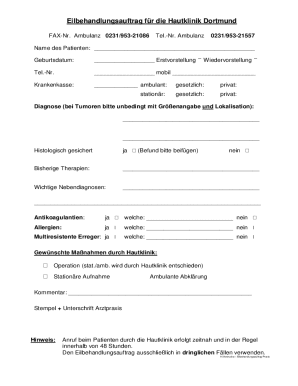

Form W-2CM Wage and Tax Statement

Overview of Form W-2CM Wage and Tax Statement

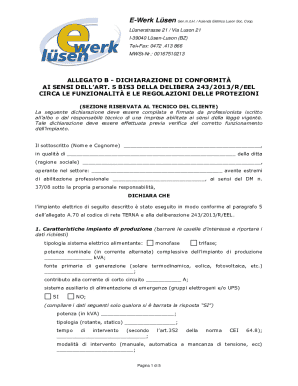

Form W-2CM is a crucial document for businesses operating in the Commonwealth of the Northern Mariana Islands (CNMI). Designed to report wages and tax information, it serves both employers and employees, ensuring compliance with federal tax obligations while also facilitating accurate income reporting. The importance of the W-2CM cannot be overstated, as it affects not just tax liabilities but also eligibility for various social benefits. This form helps maintain transparency and ensures that both parties understand the tax withholdings throughout the year.

The W-2CM features a straightforward layout that summarizes key financial information. It includes specific sections detailing wages earned, taxes withheld, and other critical data. Employers fill out W-2CM forms by employing precise formatting, which is vital for consistent reporting. Each section has designated fields for employee details, employer identification, and detailed breakdowns of taxable income, ensuring clarity and accuracy.

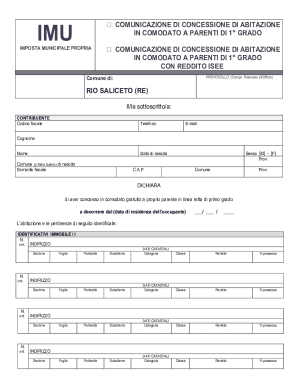

Who should use Form W-2CM?

The primary users of Form W-2CM are employers operating within the CNMI. These businesses must accurately report wages and taxes for every employee to remain compliant with federal laws. In addition, employees who receive wages from these businesses are direct beneficiaries, as this form serves as their official tax document. It's essential for employees to retain their W-2CM, as they will need it when filing their annual tax returns.

Moreover, there are specific scenarios outside of traditional employment that also require the W-2CM. Independent contractors or self-employed individuals engaged in work within the CNMI must also utilize this form to report their earnings. This highlights the versatility and importance of the W-2CM across various employment landscapes in the region.

Step-by-step guide to completing Form W-2CM

Completing Form W-2CM requires attention to detail. The first step is gathering all necessary information. This includes personal details of the employee, such as their name, address, and Social Security number. Employers must also collect their identification details, including the Employer Identification Number (EIN) for accurate submissions.

Once the information is assembled, the next step involves filling out the wage details. Employers must report total earnings, including salary, wages, and any additional compensations. It's crucial to accurately record tax withholdings, ensuring that both federal income tax and any applicable local taxes are noted.

Next, report any other income types. This might include tips, bonuses, or non-wage payments. Properly categorizing these payments helps ensure comprehensive reporting. Compliance with state-specific nuances is also significant, as certain jurisdictions have unique requirements that must be adhered to. Finally, review the form to ensure completeness before submission.

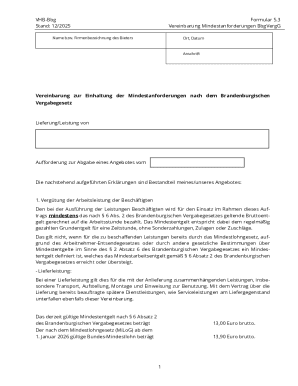

Important deadlines and submission guidelines

Timeliness is critical when dealing with Form W-2CM. Employers are required to issue the W-2CM to employees by January 31st each year, allowing employees sufficient time to prepare for tax filing. Additionally, employers must submit their W-2CM forms to the IRS by the end of February if filing by paper, or by the end of March if filing electronically.

Distribution methods for employees can vary. While users have the option of delivering W-2CM forms electronically or in paper format, it is fundamental to obtain consent if choosing electronic delivery. Recordkeeping is indispensable as employers must retain copies of submitted forms for at least four years, guaranteeing they can address any future inquiries or discrepancies.

Common mistakes to avoid when filling out W-2CM

Filling out the W-2CM can be straightforward but mistakes often occur. One common error is inaccuracies in employee identification. Providing incorrect names or Social Security numbers can lead to complications during tax filings. Additionally, employers should watch for miscalculations in wages and taxes withheld, which could result in substantial penalties.

Furthermore, omissions of required information frequently occur. Employers must ensure all sections of the form are fully completed. Missing data can trigger queries from the IRS or tax authorities and complicate the filing process. Comprehensive review and accuracy checks before submission can prevent these common pitfalls.

Frequently asked questions (FAQs) about Form W-2CM

One prevalent question is what to do if an error is found on a W-2CM. In such cases, the employer must issue a corrected W-2CM and inform the employee of the changes. Amendments ensure both parties have accurate information for tax reporting and filing purposes.

Another frequent inquiry involves consequences for late submissions. Late filings can lead to penalties, which may escalate the longer the submission is delayed. Consequently, ensuring adherence to deadlines is crucial to avoid financial repercussions.

Additionally, employees often wonder about accessing their W-2CM online. Many companies provide digital access via secure portals, allowing users to retrieve their W-2CM forms easily when tax season arrives.

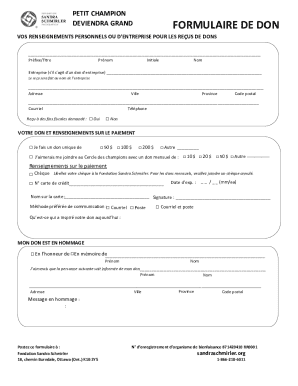

Tools and resources for efficient document management

Leveraging online solutions can streamline the process of filling out Form W-2CM. Tools like pdfFiller offer interactive filling options, making it easy to input necessary data accurately. Features such as eSigning and collaboration allow employers and employees to work together seamlessly, enhancing the document management experience.

For security, storing and managing tax documents should adhere to best practices. These include using encrypted storage solutions and providing role-based access to sensitive information. This not only secures critical documents but also allows for easy retrieval and management when needed.

Conclusion: The benefits of using pdfFiller for your W-2CM needs

Utilizing pdfFiller for Form W-2CM management offers numerous advantages. The platform's extensive features enhance the document-filling experience, enabling users to edit PDFs effortlessly and maintain a well-organized document system. The convenience of managing such tax documents from a cloud-based platform empowers users, ensuring they can access and modify their forms from anywhere.

Ultimately, pdfFiller promotes seamless compliance and organization for businesses and individuals alike. With its user-friendly interface, it alleviates the challenges of tax documentation management, allowing users to focus on their core operations without unnecessary stress or worry.

User testimonials and case studies

Real-life examples showcase the efficiency of pdfFiller in document creation. Customers have reported significant time savings and reduced errors when creating W-2CM forms through pdfFiller's intuitive interface. For teams managing multiple documents, the platform's collaboration features have allowed for streamlined communication and fewer misunderstandings.

Success stories reveal how businesses in the CNMI have utilized the platform to enhance their tax documentation processes. With the ease of access and security that pdfFiller provides, users feel empowered to manage their W-2CM needs effectively while ensuring compliance with local regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form w-2cm wage and for eSignature?

Can I create an electronic signature for signing my form w-2cm wage and in Gmail?

How do I fill out form w-2cm wage and using my mobile device?

What is form w-2cm wage and?

Who is required to file form w-2cm wage and?

How to fill out form w-2cm wage and?

What is the purpose of form w-2cm wage and?

What information must be reported on form w-2cm wage and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.