Get the free Understanding Advanced Tax Scenarios: Essential Test ...

Get, Create, Make and Sign understanding advanced tax scenarios

Editing understanding advanced tax scenarios online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding advanced tax scenarios

How to fill out understanding advanced tax scenarios

Who needs understanding advanced tax scenarios?

Understanding Advanced Tax Scenarios Form: A Comprehensive Guide

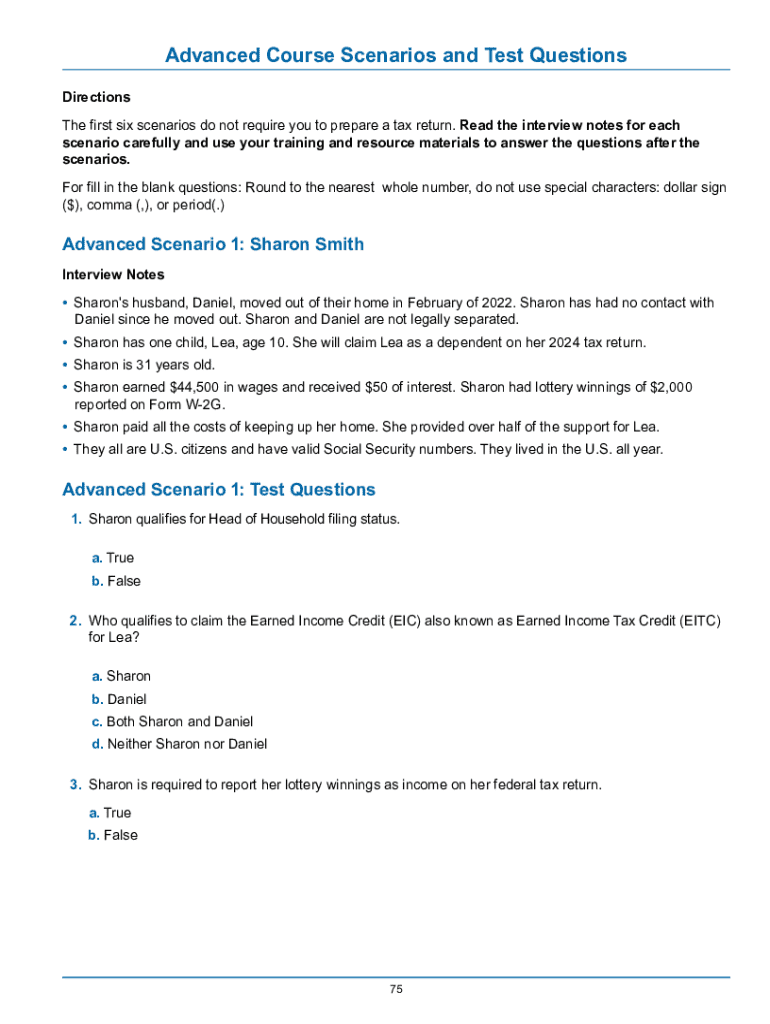

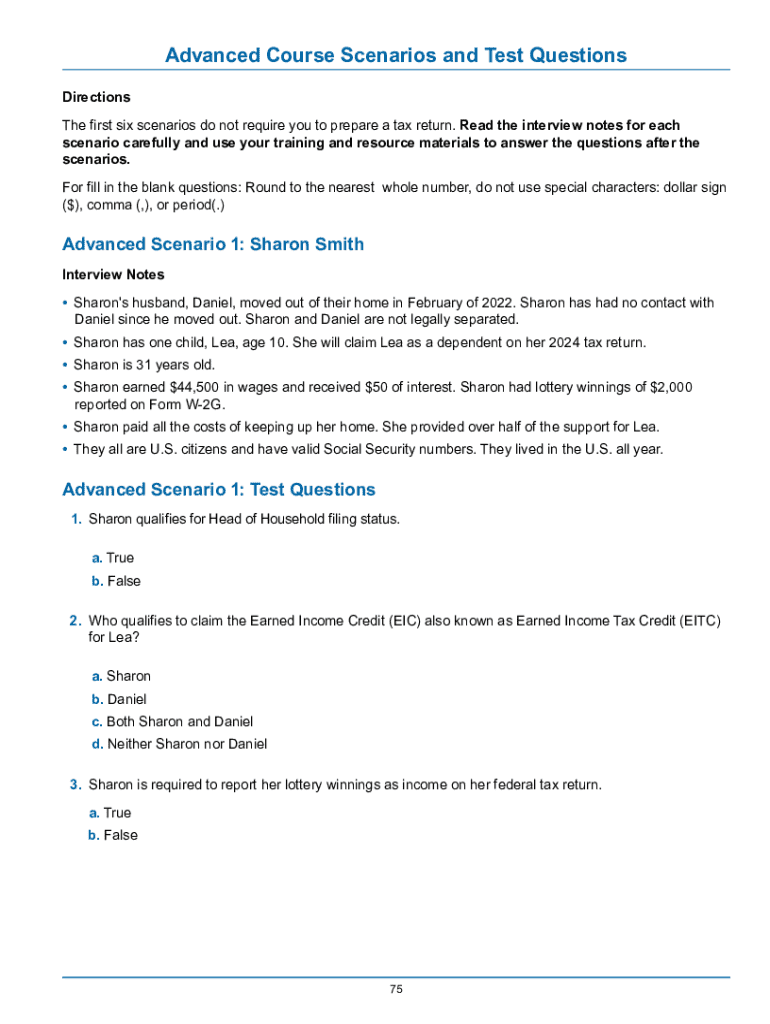

Overview of advanced tax scenarios

Advanced tax scenarios refer to complex tax situations that require a deeper understanding of tax laws and regulations. These situations can arise from various factors including business ownership, investment income, and significant changes in personal circumstances such as marriage or property ownership. The importance of understanding advanced tax scenarios cannot be overstated, as they can significantly influence an individual or business's financial health, potentially leading to substantial tax savings or penalties.

Common situations requiring advanced tax strategies include self-employment income, capital gains, rental property income, and significant deductions. For instance, homeowners can leverage mortgage interest deductions, while self-employed individuals may benefit from various business-related deductions. Understanding these scenarios is crucial for taxpayers who wish to optimize their tax returns and minimize tax liability.

Key forms related to advanced tax scenarios

Several IRS forms are pivotal in navigating advanced tax scenarios. Understanding these forms is essential to accurately report income and deductions, helping to avoid tax issues down the line. Among the most commonly used forms are Form 1040, Form 1099, and Form W-2.

Form 1040 serves as the primary individual income tax return form for individuals. Form 1099 encompasses various types of income that are not part of regular employment, while Form W-2 reports annual wages and tax withholdings for employed individuals. Each form has specific importance depending on one's financial situation, and misfiling any of these forms can lead to unwanted penalties.

Detailed breakdown of selected advanced tax forms

Diving deeper into Form 1040, it is divided into several sections that allow taxpayers to report various income sources, claim deductions, and evaluate taxes owed or refunds due. Understanding each section is imperative for accurately completing the form. Taxpayers can benefit from identifying eligible deductions such as mortgage interest and medical expenses, which can significantly reduce taxable income.

Form 1099 also comes in various variants, including 1099-MISC for miscellaneous income and 1099-INT for interest income. Each type has unique reporting requirements and deadlines. Particularly for those in freelance or contracting roles, these forms are crucial in ensuring that all income is reported accurately to avoid underreporting penalties.

Form W-2 details the wages earned as well as federal, state, and social security taxes withheld throughout the year. It is essential for employees to review this form thoroughly to ensure all reported information aligns with paychecks to avoid discrepancies. Benefits provided by employers can affect reported income, and thus, they need careful attention.

Navigating advanced tax scenarios with pdfFiller

Using pdfFiller simplifies navigating advanced tax scenarios. The platform offers step-by-step guides for each form, allowing users to fill out their tax returns accurately and efficiently. With interactive tools for completing forms, pdfFiller helps ensure that all required fields are filled in correctly, reducing the likelihood of errors during submission.

Editing PDFs is made easy with pdfFiller, as users can easily make adjustments to their forms. Practical tips and tricks provided within the platform enhance accuracy, ensuring that every document submitted to the IRS is error-free. Furthermore, eSigning features enable timely form submissions, while collaboration tools foster teamwork when handling multiple forms.

Unique tax considerations for various situations

Tax considerations vary greatly depending on your personal situation. For self-employed individuals and freelancers, navigating advanced tax scenarios requires knowledge of special deductions such as home office expenses and self-employment tax. Understanding how to file estimated tax payments is crucial, as these can affect cash flow and your overall tax liability at year-end.

Homeowners benefit from numerous tax breaks, including deductions for mortgage interest and property taxes. Documenting these expenses properly is essential, especially when reporting rental or vacation property income. Tax planning for investments also demands careful analysis of capital gains and losses. The correct forms must be selected to report investment income, ensuring compliance with IRS requirements.

Common mistakes to avoid in advanced tax filing

When filing taxes, particularly in advanced scenarios, it is crucial to be aware of common mistakes that can lead to legal issues and financial penalties. Missing filing deadlines can result in penalties and interest, so it's essential to stay organized and aware of key dates. Also, missing documentation can result in your tax return being incomplete, leading to audits or missed deductions.

Underreporting income can have severe consequences, and it's essential for taxpayers to report all sources of income, including freelance work and interest earned. Additionally, making inaccurate submissions can lead to audits and potential fines, so accuracy is paramount. Utilizing tools like pdfFiller can help mitigate these risks by streamlining the filing process.

Leveraging pdfFiller for efficient tax management

pdfFiller provides a robust document workflow that aids in organizing tax documents efficiently. Keeping track of submission deadlines is a crucial component of tax management, and pdfFiller's tools can assist with reminders and alerts, ensuring that taxpayers never miss an important filing date.

The platform's cloud-based solutions also allow for access from anywhere, facilitating collaboration among team members. For those who work offline, pdfFiller includes features that support document management without an internet connection, ensuring that taxpayers can continue working on their forms without interruption.

Engaging with tax professionals

Understanding advanced tax scenarios sometimes requires the expertise of tax professionals. Recognizing signs that you need a tax consultant can save time and potentially money. If you experience significant life changes, run a business, or have complex investment income, consulting the right tax professional becomes paramount to ensure all aspects of your taxes are covered.

Integrating professional insights with tools such as pdfFiller enhances the filing process. Securely sharing forms with tax professionals for review helps ensure all information is accurate and comprehensive, leading to better outcomes during audits and filings.

Frequently asked questions about advanced tax scenarios

Navigating advanced tax scenarios can generate many questions. Taxpayers often wonder about necessary documents for filing, with standard requirements including forms like W-2, 1099, and schedules for deductions. With pdfFiller's tools, the preparation process is simplified, allowing users to easily gather and edit necessary documents.

Penalties for late filing are a significant concern for taxpayers. Understanding deadlines and penalties can help mitigate risks. Additionally, many taxpayers wonder about amending submitted tax returns, which is possible through filing Form 1040-X. Being proactive about keeping records and understanding forms can lead to less frustration during tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my understanding advanced tax scenarios directly from Gmail?

How do I edit understanding advanced tax scenarios on an iOS device?

How do I fill out understanding advanced tax scenarios on an Android device?

What is understanding advanced tax scenarios?

Who is required to file understanding advanced tax scenarios?

How to fill out understanding advanced tax scenarios?

What is the purpose of understanding advanced tax scenarios?

What information must be reported on understanding advanced tax scenarios?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.