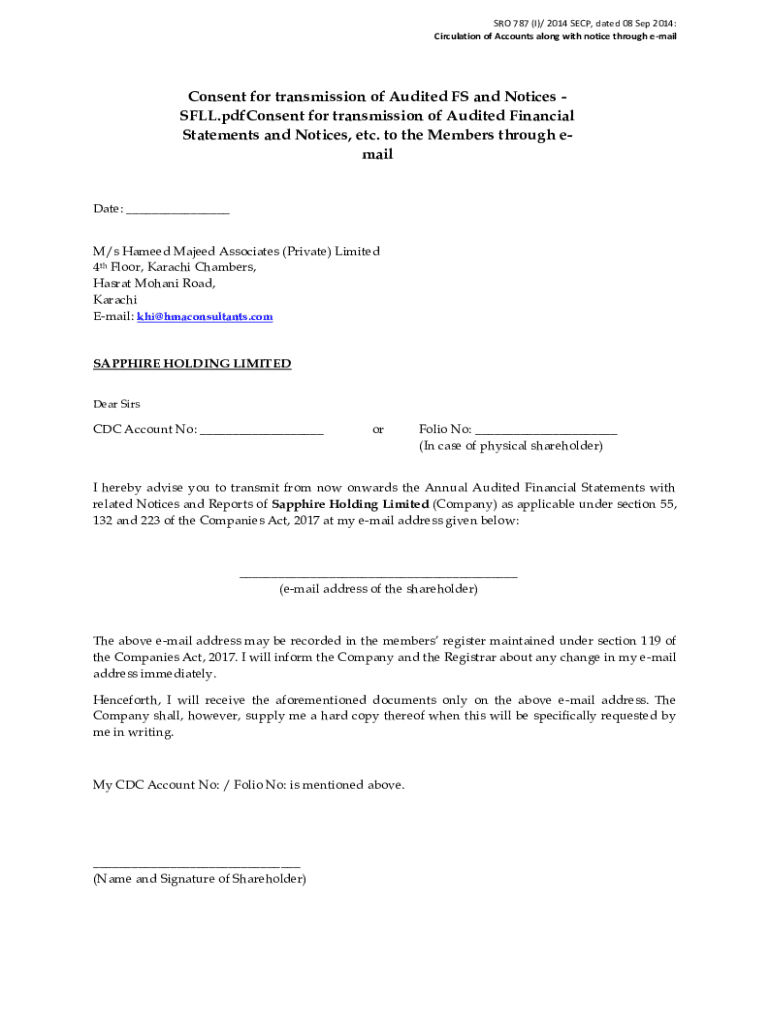

Get the free Form-for-Transmission-of-Audited-Financial-Statements- ...

Get, Create, Make and Sign form-for-transmission-of-audited-financial-statements

Editing form-for-transmission-of-audited-financial-statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form-for-transmission-of-audited-financial-statements

How to fill out form-for-transmission-of-audited-financial-statements

Who needs form-for-transmission-of-audited-financial-statements?

Form for Transmission of Audited Financial Statements: A Comprehensive Guide

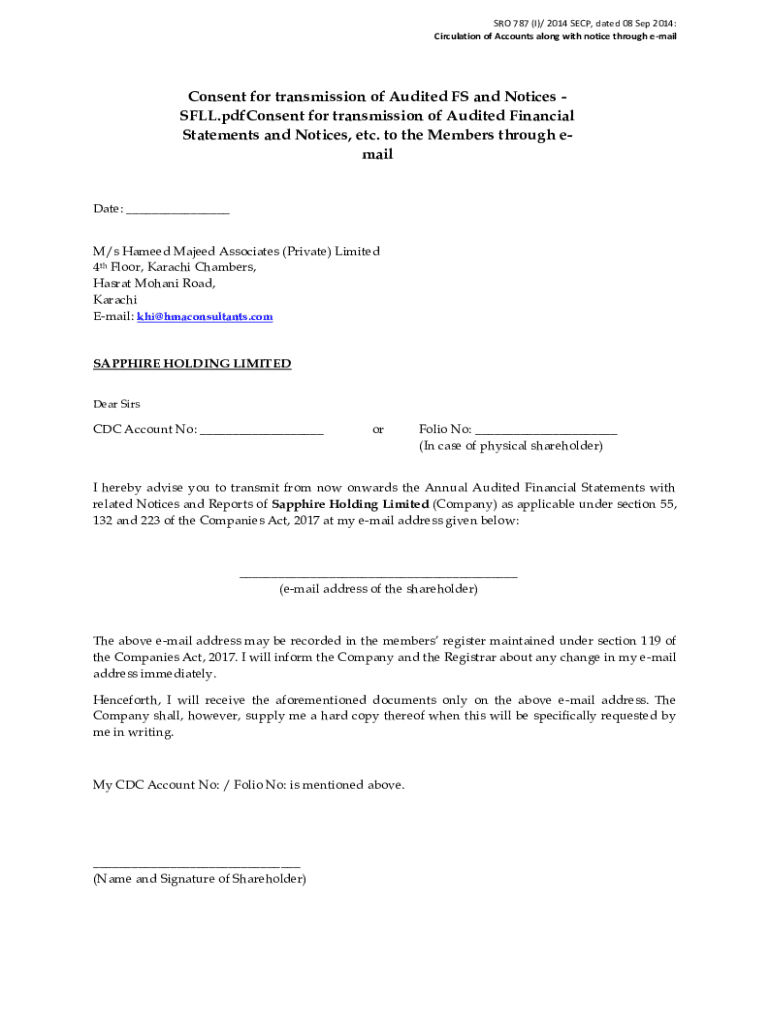

Overview of the form for transmission of audited financial statements

The form for transmission of audited financial statements is a crucial component in the field of financial reporting. This form enables organizations to formally submit their audited financial documents to stakeholders—including regulatory bodies, investors, and financial institutions—ensuring transparency and accountability in financial practices.

Its importance extends beyond mere compliance; the form serves as a declaration of the integrity and accuracy of the financial statements presented within. Failing to complete this form correctly can lead to legal ramifications and damage the credibility of an organization.

Key definitions

To understand the implications of the form for transmission of audited financial statements, it’s essential to grasp a few key definitions. Audited financial statements are a formal set of financial records that have been reviewed and verified by an independent auditor. These documents typically include the balance sheet, income statement, cash flow statement, and statement of changes in equity.

Transmission refers to the act of formally sending these financial statements to relevant parties. This process ensures that stakeholders receive accurate and validated financial information necessary for decision-making. Understanding these terms is foundational, as they guide the expectations and requirements surrounding the form.

Who needs this form?

The form for transmission of audited financial statements is targeted toward a variety of users. Primarily, it is used by individuals such as accountants and business owners whose organizations must comply with financial reporting standards. Audit committees and finance departments are also key users, responsible for ensuring that the organization’s financial data aligns with both internal governance and external regulations.

This form is applicable in several situations, including annual reporting, where companies must submit their yearly financial information, as well as during business mergers and acquisitions, where clarity and accuracy in financial transactions are critical. Organizations often need this form to fulfill compliance requirements imposed by regulatory bodies, ensuring they meet industry standards and legal obligations.

Preparing to complete the form

Completing the form requires thorough preparation. The essential documentation needed includes the last year’s audited financial statements, the auditor’s report, and any supporting financial documents that provide context or clarification. Having these materials on hand streamlines the process and ensures all necessary information is included.

In addition to gathering documents, understanding the regulatory requirements is crucial. Users must familiarize themselves with applicable laws and standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Familiarity with these guidelines helps in accurately presenting information and avoiding potential compliance pitfalls.

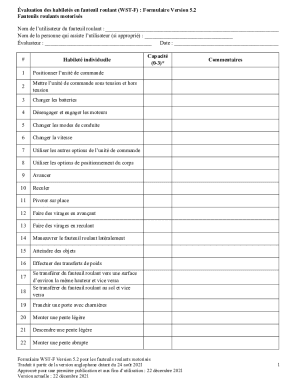

Step-by-step guide to filling out the form

Filling out the form for transmission of audited financial statements involves several key steps:

Editing and customizing the form

One of the outstanding features of pdfFiller is its ability to edit PDFs flexibly. Users can modify the form by adding comments, notes, or additional information to enhance clarity. These customizations ensure that the document meets all necessary guidelines while also addressing the specific requirements of the entity submitting it.

Moreover, collaboration is made seamless with pdfFiller's sharing options. Users can easily share the form with team members for joint reviews, ensuring that all stakeholders are on the same page before submission. This collaborative feature adds significant value, particularly in larger organizations where multiple approvals might be required.

Submitting the form

Once the form is complete, it’s essential to know how to properly submit it. Users should consult the submission guidelines provided by their regulatory bodies to ensure compliance. Typically, submissions can be sent digitally through designated online portals or by email, depending on the entity’s requirements.

To ensure the form was received, tracking submission status is advisable. Users can follow up through appropriate channels, which helps in confirming acceptance of the submitted documents. Confirming the submission not only protects the entity but also provides peace of mind, knowing that their financial statements are now officially on record.

Managing submitted forms

Managing submitted forms effectively is just as critical as completing and sending them. Users can utilize tools within pdfFiller to track their submission status and monitor any responses or requirements for additional information from regulatory authorities.

For long-term efficiency, storing and archiving documents should be prioritized. Implementing best practices for document management—such as organizing files by date and type—can enhance retrievals when revisiting past submissions. PdfFiller offers a robust cloud-based system to keep these essential documents safe and accessible from anywhere.

Common mistakes to avoid

While filling out the form is relatively straightforward, several common mistakes can compromise its effectiveness. Users often leave fields incomplete, which can delay processing. Ensuring every section is filled out accurately is paramount.

Moreover, providing incorrect financial data is another frequent error that can lead to compliance issues. Therefore, it's vital to double-check figures and reports before finalizing the submission. Adhering to the outlined regulatory requirements is also non-negotiable; overlooking this aspect can result in severe repercussions.

Frequently asked questions (FAQs)

Users often have pressing questions regarding the form for transmission of audited financial statements. For instance, if a submission needs to be amended, understanding the procedure is crucial. Generally, users must follow the regulatory authority’s guidelines on amendments to ensure compliance.

Another common concern involves handling issues with the auditor. Open communication with the auditor is essential in resolving discrepancies or receiving clarifications about the audited financial statements. Establishing a clear line of communication prevents misunderstandings and aids in achieving accurate submissions.

Additional tools and resources

PdfFiller continues to enhance the user experience by offering interactive tools. Users have access to a variety of templates for financial statements, reducing the time spent on document preparation. Additionally, the platform provides access to legal advice and resources on financial reporting, empowering users with the knowledge needed to navigate complex regulations.

For further learning, users can explore curated articles and guides available within pdfFiller, contributing to a well-rounded understanding of compliance, reporting standards, and best practices in financial documentation.

Testimonials and user experiences

Real-life case studies provide compelling evidence of the effectiveness of utilizing the form for transmission of audited financial statements. Users across various industries have reported significant improvements in their submission processes, emphasizing efficiency and compliance.

User feedback often highlights how pdfFiller has streamlined their document management, confirming that the platform not only simplifies form completion but also enhances collaboration and tracking of submissions, showcasing its invaluable role in the financial reporting landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form-for-transmission-of-audited-financial-statements online?

How do I make edits in form-for-transmission-of-audited-financial-statements without leaving Chrome?

How can I edit form-for-transmission-of-audited-financial-statements on a smartphone?

What is form-for-transmission-of-audited-financial-statements?

Who is required to file form-for-transmission-of-audited-financial-statements?

How to fill out form-for-transmission-of-audited-financial-statements?

What is the purpose of form-for-transmission-of-audited-financial-statements?

What information must be reported on form-for-transmission-of-audited-financial-statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.