Get the free Form 8867: What This Tax Preparer Form Means for Expats

Get, Create, Make and Sign form 8867 what this

How to edit form 8867 what this online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8867 what this

How to fill out form 8867 what this

Who needs form 8867 what this?

Form 8867: What This Form Entails

Understanding Form 8867

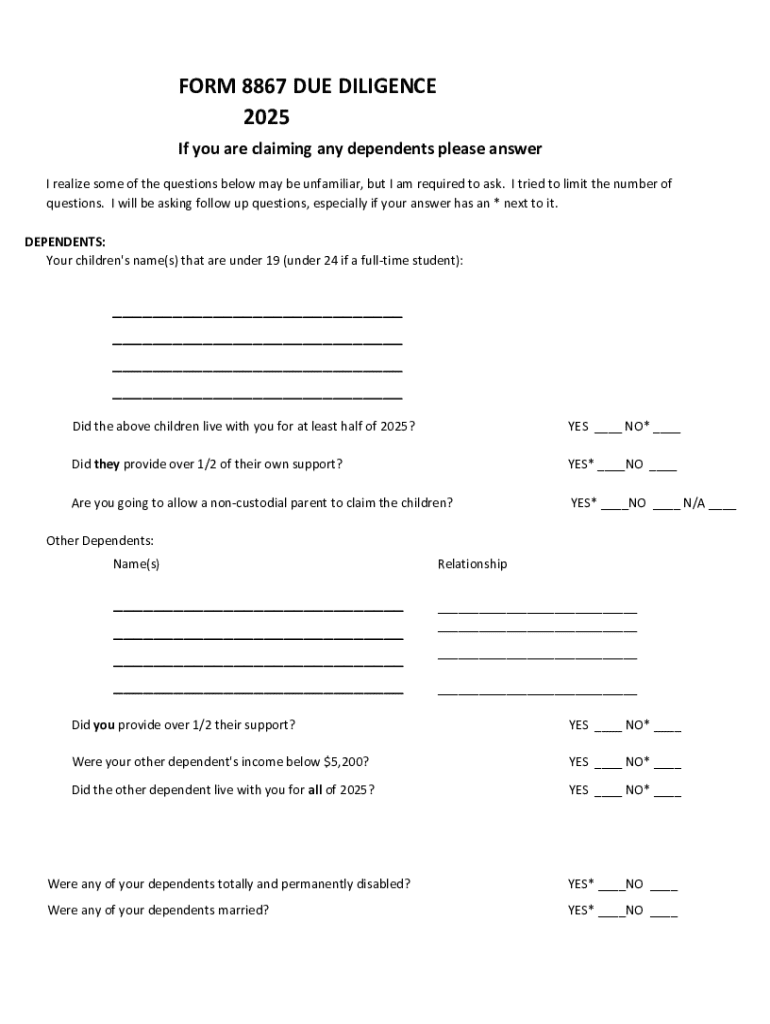

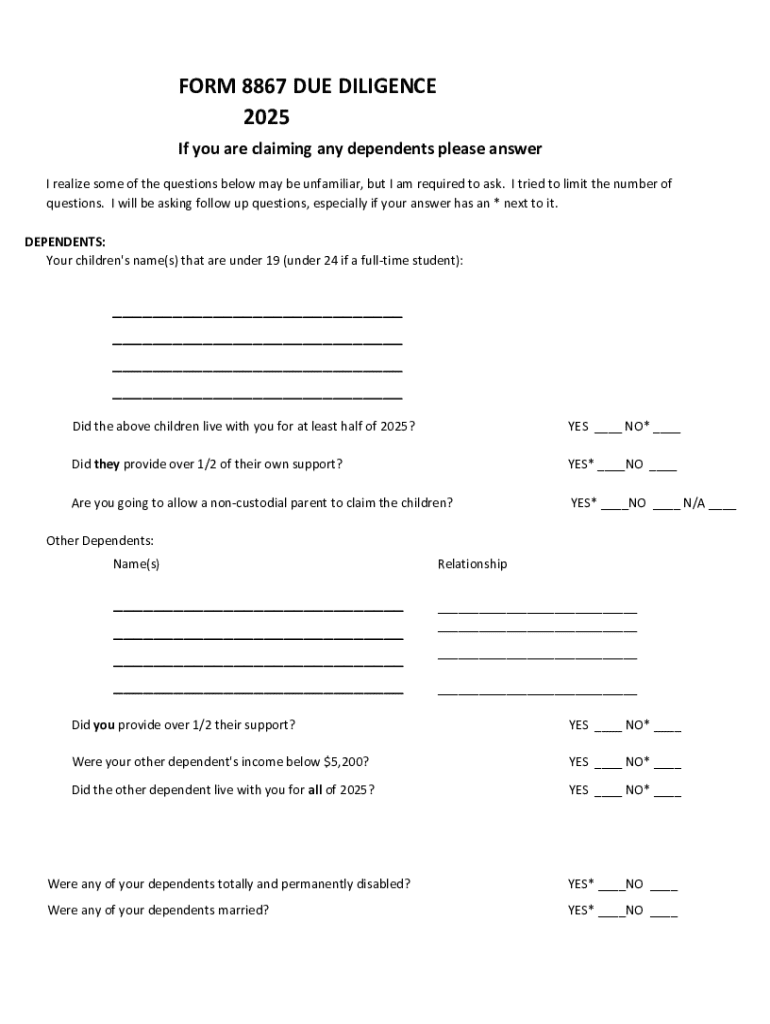

Form 8867, also known as the ‘Paid Preparer's Due Diligence Checklist’, is a vital document used in the context of the Earned Income Tax Credit (EITC). Its primary purpose is to ensure that tax preparers meet the necessary due diligence requirements while preparing tax returns that claim certain tax credits such as the EITC or the Child Tax Credit. By completing Form 8867, tax professionals present a structured approach to validate the eligibility of clients for these credits. This form is not just an administrative requirement; it plays a crucial role in verifying that claims made on tax returns are compliant with IRS regulations.

The EITC offers significant financial benefits to low-to-moderate-income workers, but to receive these benefits, applicants must meet specific criteria. Form 8867 serves as a safeguard that helps maintain the integrity of this tax credit process. For tax preparers, understanding the nuances of this form is essential to providing accurate service and avoiding potential penalties.

Importance of Form 8867 in tax preparation

Form 8867 is instrumental in ensuring compliance and accuracy in tax returns. Tax preparers are required to adhere to due diligence standards when preparing returns claiming the EITC or related credits. If a preparer fails to file this form or fills it out incorrectly, the consequences can be significant. They risk facing penalties, which can detract from the profitability of their tax preparation services and undermine their reputation as reliable professionals.

Inaccuracies in EITC claims can lead not only to financial penalties but can also subject tax preparers to audits, increasing their workload and potentially damaging client relationships. Form 8867 acts as a protective measure, reinforcing the importance of thorough checks and balance in claiming tax credits, thereby safeguarding both taxpayers and tax preparers.

When is Form 8867 needed?

Tax preparers must file Form 8867 when a client claims the EITC, the Child Tax Credit, or other related credits. The IRS specifies that the form is necessary if the preparer expects to receive a fee for preparing a return that includes any of these tax benefits. Situations that necessitate the filing of Form 8867 include claims made for clients with qualifying children or those whose income levels fluctuate significantly from year to year.

It is crucial for tax professionals to determine if their clients meet the specific qualifications for EITC claims linked to the completed form. They should review factors such as filing status, income thresholds, and the number of dependents claimed. By assessing these requirements closely, preparers can ensure they are compliant, thereby protecting both their practices and their clients' interests.

Does Form 8867 protect me?

Completing Form 8867 provides a layer of protection for tax preparers, known as due diligence protection. This protection helps preparers defend against penalties associated with the preparation of tax returns claiming the EITC. When the form is filled out correctly and all necessary documentation is kept, the preparer can argue that they made significant efforts to comply with IRS due diligence requirements.

However, it’s important to note that due diligence protection has its limitations. For instance, if a tax preparer neglects to verify the information provided by their client or if obvious discrepancies exist, the protection may not hold. Therefore, it is imperative for preparers to maintain meticulous records and openly communicate with clients to mitigate risks.

Obligations of tax preparers

Tax preparers are required to use Form 8867 whenever handling returns claiming the EITC or similar credits. The IRS mandates that preparers complete Form 8867 if they expect compensation for their services. This means tax professionals must ensure they ask thorough questions to gather relevant client information, including proof of income, residencies, and the number of dependents. Failing to meet these obligations can lead to penalties and loss of credibility.

Moreover, tax preparers should keep updated with changes in tax law that may affect EITC eligibility, as these changes can occur annually. Consistently reviewing IRS guidelines ensures that clients receive proper guidance and tax preparation services, ultimately leading to better outcomes in tax submissions.

How often should tax preparers submit Form 8867?

The submission of Form 8867 is contingent upon the client cases handled by tax preparers. Each time a return is prepared that claims the EITC or another related credit, the form must accompany that return. Tax preparers should also consider the specific situations of their clients and adjust submissions accordingly to reflect ongoing eligibility for tax credits. This means that if there are multiple clients claiming EITC in a single tax season, multiple submissions of Form 8867 may be needed.

Best practices suggest that tax preparers establish a routine to review the common elements across client filings. Having a prepared checklist that illustrates which clients warrant the use of Form 8867 streamlines the process of maintaining compliance with IRS regulations.

Documenting due diligence

A competent tax preparer knows that documenting due diligence is critical for maintaining compliance. Essential records that must be kept alongside Form 8867 include evidence of eligibility for the credits, documentation of income, and residential addresses. Tax preparers should encourage their clients to provide accurate and timely information, which might include prior tax returns and any IRS notifications.

In addition to gathering documentation, tax preparers should employ a checklist that outlines the types of questions to ask clients. This could include queries about marriage status, number of dependents, and work statuses to ensure all angles are covered to support EITC claims effectively. Taking structured notes during client meetings also enhances the ability to revisit essential info and ensures that tax returns are fully supported.

How to document and support EITC claims effectively?

Effective documentation and support for EITC claims require a systematic approach to information collection. Tax preparers should maintain a checklist of required documents, which might include Form W-2s, IRS notices, and any relevant proof of child residency. By utilizing tools such as pdfFiller, preparers can manage documentation digitally, allowing easy access to files and prompts for ongoing client collaboration.

A structured approach minimizes risks associated with incomplete filings or misunderstandings. Interactive tools available on pdfFiller can assist tax professionals in managing these documents efficiently, allowing them to focus on providing value-added services while securing their due diligence processes.

Filing and submission options for Form 8867

Tax preparers today have convenient filing options for Form 8867, including e-filing. E-filing simplifies the submission process, allowing preparers to integrate Form 8867 seamlessly into their electronic tax returns. By choosing e-filing, tax preparers can receive instant confirmations from the IRS, enhancing efficiency and reducing the likelihood of errors.

Platforms like pdfFiller facilitate the e-filing process through cloud capabilities. Users can fill, edit, and submit Form 8867 all within the same interface. This integration helps eliminate the need for paper forms and traditional mailing processes, streamlining workflows for tax professionals. Engaging with these digital solutions not only improves accuracy but also enhances legal compliance.

Step-by-step instructions for e-filing Form 8867

E-filing Form 8867 can be accomplished with a few straightforward steps. The first step involves logging into pdfFiller. Next, tax preparers should locate Form 8867 in the template directory. Users can either fill the form out directly or upload a completed version. After ensuring all necessary details are accurate, the preparer can proceed to e-file the form alongside the client's tax return.

As part of the e-filing process, users receive step-by-step prompts that guide them through each section of the form. This process helps to guarantee that information is filled correctly and thoroughly. Additionally, many platforms offer interactive features such as previewing completed forms to ensure clients' claims are substantiated before submission.

Exceptions to Form 8867 requirements

While Form 8867 is essential for most clients claiming the EITC, there are certain exceptions to the requirement. Notably, if a tax preparer is not charging a fee for the service or if the claim is being filed by the taxpayer themselves, the form may not be mandatory. Understanding these circumstances can reduce unnecessary paperwork for both tax preparers and clients.

Guidelines for identifying exceptions are crucial for tax professionals. For instance, if a client has previously established eligibility for the EITC and is filing a return without new circumstances altering their eligibility, the form might not be needed. However, tax preparers must exercise caution when categorizing these cases to ensure compliance with IRS regulations.

Special cases and considerations

When dealing with special cases regarding Form 8867, preparation becomes critical. For example, clients who have recently moved or have had changes in dependents may require additional documentation to support their claims. Real-life scenarios illustrate the importance of adjustment; for instance, a client who changes jobs or experiences a fluctuation in income must reassess their eligibility for the EITC.

Tax preparers should ensure they gather any additional documentation that showcases these changes, such as pay stubs or school records for dependents. Being comprehensive in these situations can prevent issues and ensure that all credits claimed are valid and well-supported.

Leveraging pdfFiller for efficient tax management

Using tools like pdfFiller can significantly enhance the efficiency of the tax preparation process. Its unique features—such as collaborative options, cloud-based access, and interactive fields—can streamline client interactions. By integrating these tools, tax preparers can quickly share forms, receive digital signatures, and manage comprehensive documentation all in one place.

Furthermore, pdfFiller allows tax professionals to maintain proper organization and accessibility of their documents, which is crucial during high-volume seasons. Clients can benefit from real-time updates and transparency throughout the filing process, fostering better communication and a smoother user experience.

Best practices for working with Form 8867

To ensure optimal use of Form 8867, tax preparers should adopt several best practices. Regular training on the latest tax regulations and Form 8867 instructions can be beneficial for maintaining compliance. An organized filing system is also essential for keeping track of important documents.

By adopting these strategies, tax professionals can minimize errors and foster reliable communication with clients, ultimately leading to successful claim submissions.

Common queries regarding Form 8867

Tax preparers often have questions regarding Form 8867 and its implications. Addressing common queries can provide clarity and ensure proper usage of the form.

For more in-depth answers to specific situations, tax professionals are encouraged to refer to relevant sections for additional insights into their queries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8867 what this for eSignature?

How do I fill out the form 8867 what this form on my smartphone?

Can I edit form 8867 what this on an Android device?

What is form 8867?

Who is required to file form 8867?

How to fill out form 8867?

What is the purpose of form 8867?

What information must be reported on form 8867?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.