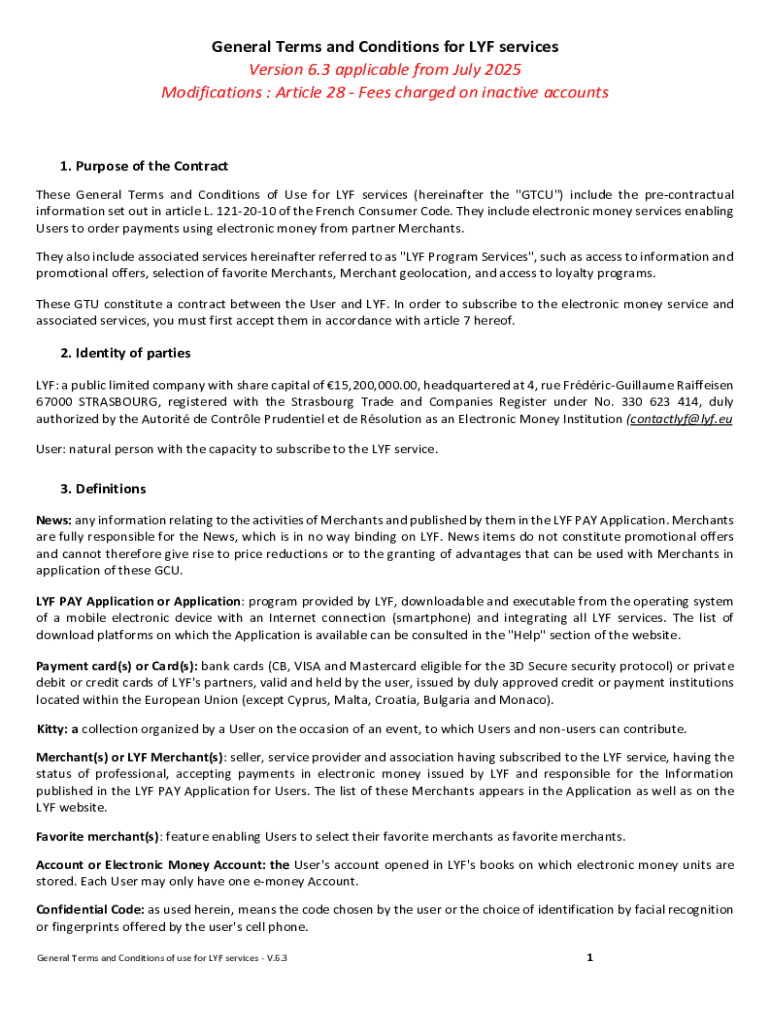

Get the free Fees charged on inactive accounts - Lyf Pay

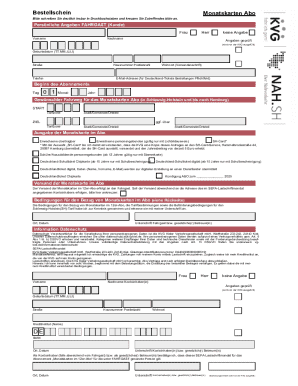

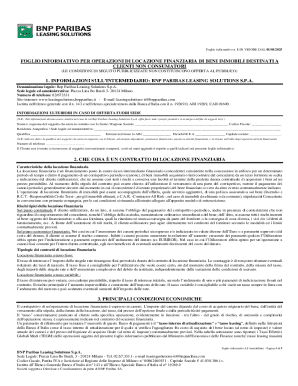

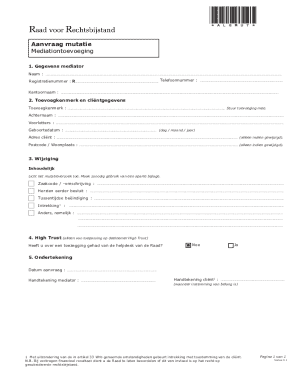

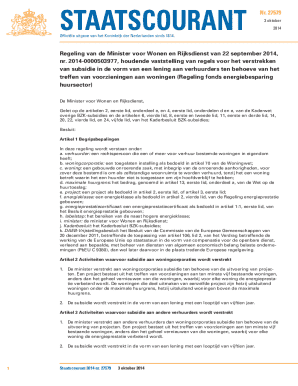

Get, Create, Make and Sign fees charged on inactive

Editing fees charged on inactive online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fees charged on inactive

How to fill out fees charged on inactive

Who needs fees charged on inactive?

Fees charged on inactive form: Understanding and Managing Costs

Understanding inactive form fees

Inactive form fees refer to charges imposed by institutions, businesses, or online platforms on accounts or documents that have not been utilized for a specific period. They are a financial penalty meant to encourage active usage and to cover the administrative costs associated with maintaining inactive records. Users should be aware of this fee structure to avoid unexpected charges, especially when managing financial documents like loans, banking forms, or insurance claims.

Being aware of inactive form fees is crucial for both individuals and teams who rely on timely access to essential documents. These fees can accumulate, potentially leading to significant costs that disrupt finances and diminish document accessibility. By actively managing forms, users can save money and maintain organized documentation, which is particularly relevant for financial accounts and service agreements.

How inactive form fees function

Inactive form fees are assessed based on specific criteria established by the institution or platform managing the forms. Typically, inactivity is determined by a lack of engagement with the form or document for a specified duration, often ranging from six months to a year. Institutions might consider factors such as the last update date, sign-in frequency, and lack of submissions to gauge if a form is active or inactive.

The timeline for fee application usually triggers once a form has been deemed inactive for the specified period. As a result, users should be vigilant about updating their forms regularly to avoid these fees. Common scenarios leading to inactive form fees include lack of usage or failure to update essential information, which can inadvertently classify a necessary document as inactive.

Cost of inactive form fees

Typical charges associated with inactive form fees can greatly vary across institutions. For instance, banks may charge a monthly fee for unused accounts, while loan services might levy charges for loan agreements that see no updates over extended periods. In general, these fees can range from $5 to $25 a month, depending on the institution's policy and the type of account or document being managed.

To illustrate, many banks enforce inactivity fees after six to twelve months of no transactions. Conversely, insurance companies may charge fees for policy documents that haven’t been reviewed or updated in over a year. Conducting a cost-benefit analysis of keeping forms active is advisable; often, maintaining active status can prevent these cumulative fees, thus saving users money in the long run.

Reasons for fees on inactive forms

Understanding the rationale behind inactive form fees is essential for effective management. Institutions incur administrative costs when maintaining records, which can escalate if accounts are not actively utilized. These fees essentially serve as an incentive for users to engage regularly with their documents, ensuring that platforms can efficiently manage resources while providing better services for active users.

Moreover, potential financial implications for users cannot be overlooked. In some cases, individuals might find themselves charged multiple fees across various inactive documents or accounts without realizing it, resulting in a significant financial burden. Staying informed can help users avoid unnecessary expenses while maintaining essential forms.

Managing your forms to avoid inactivity fees

To prevent inactive form fees, proactive steps are essential. Regularly updating document status is crucial. Users should routinely check in on forms, updating any relevant information or confirming that the form remains relevant and necessary. This practice not only helps in avoiding fees but also keeps documents organized, reducing clutter in financial management.

Setting reminders for form management can significantly improve accountability. Users can utilize tools like pdfFiller, which offers features to maintain document activity. With pdfFiller, users can easily edit and manage their forms from anywhere, ensuring that all documents remain current and active. For example, users can set automated reminders right within the platform to revise forms periodically, thus avoiding unnecessary charges.

Can inactive form fees be reversed?

In some cases, inactive form fees may be reversed under specific conditions. Providers often consider special circumstances, such as technical errors or misunderstandings regarding document status, when deciding whether to waive these fees. Users who believe they have been charged unfairly should reach out to the institution promptly to discuss the situation.

To request a fee reversal using pdfFiller, individuals should gather the necessary documentation that supports their claim. Providers may require proof of form usage or previous communications demonstrating intent to keep documents active. Sample communication templates available through pdfFiller can further assist users in crafting effective requests, thereby increasing the likelihood of a successful outcome.

Tips for preventing inactive form fees

Creating a routine for periodic form check-ins can significantly decrease the likelihood of incurring inactive form fees. Users can develop a monthly or quarterly schedule to review their active documents and confirm that all essential information is current. This practice not only prevents fees but also promotes better management of one’s financial documents.

Leveraging pdfFiller’s collaborative tools can further empower users to manage forms effectively. By enabling team members to contribute to document updates and management, accountability is increased, reducing the risk of forms becoming inactive. Additionally, utilizing alerts and notifications within pdfFiller helps users stay informed about important updates or pending tasks, ensuring that forms remain active and accessible.

The value of active form management

Maintaining active forms offers long-term benefits that go beyond simply avoiding fees. Enhanced document accessibility ensures that users can retrieve necessary paperwork when needed, especially in financial matters such as loans and banking. Moreover, preventing inactivity fees can result in significant cost savings over time, with some users managing to save hundreds annually by staying active with their documents.

pdfFiller plays a pivotal role in streamlining document lifecycle management by providing features that facilitate form activity. From editing to convenient eSigning capabilities, pdfFiller allows users to manage documents effectively in a cloud-based environment. Success stories from users demonstrate how proactive management through this platform can lead to improved organization, reduced costs, and overall better financial health.

Frequently asked questions (FAQ) about inactive form fees

What happens to my data if I don’t use my form? Generally, data remains intact for a specific time frame but may become inaccessible as fees accumulate or if the form is eventually archived by the institution. Regular engagement ensures that your data is preserved.

Are inactivity fees common across all document platforms? While many institutions impose such fees, policies can vary significantly between different types of services, such as banking or insurance. Understanding the specific terms of each platform is vital.

Can I turn off inactivity fees? Most institutions do not offer an option to disable these fees, as they are integral to their operational policies. Instead, focusing on active management strategies is essential.

What should I do if I see a charge for an inactive form? Reach out immediately to the provider to inquire about the charge's details and discuss the possibility of reversal if you believe it was incorrectly applied.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fees charged on inactive directly from Gmail?

How can I get fees charged on inactive?

How can I fill out fees charged on inactive on an iOS device?

What is fees charged on inactive?

Who is required to file fees charged on inactive?

How to fill out fees charged on inactive?

What is the purpose of fees charged on inactive?

What information must be reported on fees charged on inactive?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.