Get the free :INLAND 11: - Fmk I NORGE 17: - Nkr (inkl moms)

Get, Create, Make and Sign inland 11 - fmk

Editing inland 11 - fmk online

Uncompromising security for your PDF editing and eSignature needs

How to fill out inland 11 - fmk

How to fill out inland 11 - fmk

Who needs inland 11 - fmk?

Inland 11 - FMK Form: A Comprehensive How-to Guide

Understanding the Inland 11 - FMK form

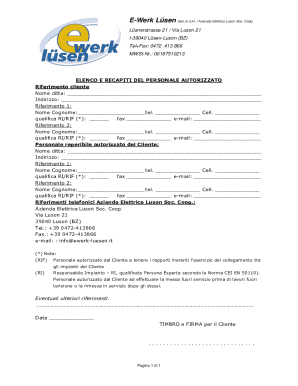

The Inland 11 - FMK form is a specialized document crucial for GST compliance in various jurisdictions. Primarily used in tax submissions and accounting practices, it allows individuals and companies to claim input taxes effectively, ensuring adherence to legislation. Understanding this form is essential for efficient financial management and to maximize potential tax refunds.

The purpose of the Inland 11 - FMK form is twofold: it provides a structured manner for GST claims and facilitates the tracking of financial transactions involving GST. By having a standardized format, both users and tax authorities can streamline processes, minimize errors, and enhance clarity in communications regarding tax affairs.

Who needs the Inland 11 - FMK form?

The Inland 11 - FMK form is targeted towards a variety of stakeholders, including businesses, independent contractors, and financial teams who need to submit tax information and claims regularly. Individuals engaging in self-assessment for taxes also find this form indispensable, particularly in instances involving substantial financial transactions.

Common use cases include businesses seeking to claim input tax credits against their GST payable, accountants preparing tax submissions during the accounting period, and companies ensuring that their historical records concerning pastopen submissions comply with current tax standards. Moreover, it serves as a template for managing payvouchers related to tax refunds.

Step-by-step guide to filling out the Inland 11 - FMK form

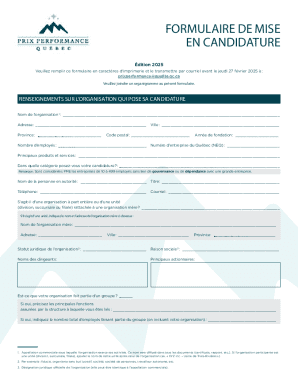

Before diving into filling out the Inland 11 - FMK form, ensure you gather all necessary information such as your company’s GST number, financial records, and transaction receipts. Having everything handy will help you avoid confusion and errors during the completion process.

Pre-filling considerations

Start by creating a checklist of documents required for accurate filling. This includes financial records, invoices, proof of sales, and details concerning your GST registration. Keep in mind the exact accounting period for which you are filing, as this will affect the information presented on the form.

Section-by-section breakdown

The Inland 11 - FMK form is organized into several sections. Let’s break down each part for better understanding:

After filling, make sure to conduct a final review. Check for accuracy, ensure all required fields are completed, and verify your figures before submission. Overlooking even a small detail can lead to significant delays or complications in processing your GST claims.

Editing the Inland 11 - FMK form

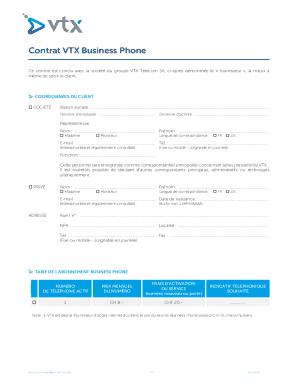

Accessing editing tools for the Inland 11 - FMK form is simple with pdfFiller. This platform provides users with the flexibility to make necessary changes directly on the PDF. First, upload your completed form to pdfFiller, and you can begin the editing process with user-friendly features designed to help even non-tech-savvy individuals.

To make changes, you can click on text fields to amend information, add new images or annotations, and adjust any misrepresented figures or details accordingly. This dynamic editing capability ensures that your form remains accurate and compliant.

Save vs. export options

One compelling feature of pdfFiller is the ability to save different versions of your Inland 11 - FMK form. Keeping multiple iterations allows you to track changes over time. Exporting options enable you to save the document in various formats such as PDF or Word, making it easier for sharing with other stakeholders or departments that may need to review or process the information.

Signing the Inland 11 - FMK form

Implementing e-signatures through pdfFiller significantly enhances the efficiency of completing the Inland 11 - FMK form. E-signatures are not only more convenient, but they also provide a layer of security that traditional handwritten signatures do not. They streamline the signing process, allowing users to sign documents from anywhere at any time.

To eSign the Inland 11 - FMK form, simply navigate to the signing section of the pdfFiller platform. You can draw, type, or upload your signature directly onto the document. Remember to verify that the signature meets any legal standards necessary for your jurisdiction to ensure compliance.

Understanding the legal implications of e-signatures is also crucial. In various contexts, e-signatures are treated equivalently to handwritten signatures, but it’s essential to be aware of specific legislation that supports their use in your region.

Managing and storing the Inland 11 - FMK form

Organizing your documents effectively ensures that accessing the Inland 11 - FMK form and related documentation is straightforward. Consider categorizing files by clients, financial years, or specific tax periods. This categorization method facilitates quicker retrieval during audits or reviews.

Utilizing cloud storage solutions, such as the one offered by pdfFiller, can be highly beneficial. This approach grants instant access to your forms from any device, promoting collaboration among team members without the hassle of physical document sharing.

Sharing the Inland 11 - FMK form with teams is easily manageable through pdfFiller's collaborative features. You can grant access to relevant personnel, allowing for seamless teamwork while maintaining version control and clear communication regarding any necessary revisions.

Troubleshooting common issues

Despite its straightforward nature, users often encounter challenges when filling out the Inland 11 - FMK form. Common issues include missing information, incorrect financial data, and discrepancies with GST calculations. Fortunately, many of these problems can be avoided with careful preparation and an understanding of the form’s requirements.

Here are solutions for some typical challenges:

Addressing frequently asked questions about the Inland 11 - FMK form can alleviate concerns. Many users seek clarity on submission deadlines, the importance of accurate financial reporting, and how to rectify errors after filing. Understanding these areas can enhance your overall experience with the documentation process.

Enhancing document efficiency with pdfFiller

Integrating pdfFiller with other tools like accounting software can drastically improve productivity when managing the Inland 11 - FMK form. This integration reduces the time spent on transferring data manually, allowing users to focus on more strategic tasks rather than administrative ones.

User testimonials reveal the transformative power of pdfFiller. Clients have reported that utilizing the platform has streamlined their document management processes significantly. Whether through rapid form filling, precise editing capabilities, or simplified e-signatures, users experience a notable reduction in administration time.

Latest updates and changes to the Inland 11 - FMK form

Staying updated on amendments to the Inland 11 - FMK form is vital for compliance. Recent legislative adjustments have introduced clarifications regarding GST claims, impacting how users should complete the form going forward. As these changes are often region-specific, it's essential to review local guidance and legislative updates.

These changes can affect submission guidelines and might introduce new fields or modify existing requirements. Regularly checking for updates helps users avoid mistakes that could lead to complications with their GST submissions or inaccuracies that could result in penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify inland 11 - fmk without leaving Google Drive?

Where do I find inland 11 - fmk?

How do I fill out the inland 11 - fmk form on my smartphone?

What is inland 11 - fmk?

Who is required to file inland 11 - fmk?

How to fill out inland 11 - fmk?

What is the purpose of inland 11 - fmk?

What information must be reported on inland 11 - fmk?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.