Get the free Reformatted- security deposit partially withheld sample demand - 10-17-2023

Get, Create, Make and Sign reformatted- security deposit partially

Editing reformatted- security deposit partially online

Uncompromising security for your PDF editing and eSignature needs

How to fill out reformatted- security deposit partially

How to fill out reformatted- security deposit partially

Who needs reformatted- security deposit partially?

Reformatted security deposit partially form: A Comprehensive Guide

Understanding security deposits

A security deposit acts as a protection measure for landlords against potential damages or unpaid rent following a tenant's departure. Generally, security deposits are collected at the start of a lease and can be used to cover issues that arise in the unit during the tenancy.

The purpose of a security deposit is two-fold: to ensure the landlord is secured against financial loss due to tenant-induced damages and to encourage tenants to maintain the property in good condition. Understanding how and when a partial refund is appropriate is crucial for both landlords and tenants.

Landlords must understand their legal obligations regarding security deposits, which often vary by state legislation. A failure to comply can lead to disputes and financial penalties.

When is a partial refund appropriate?

A partial refund may be appropriate in several circumstances. Generally, a landlord has the right to deduct amounts from the security deposit when there's proven damage beyond normal wear and tear or if unpaid rent exists.

Identifying conditions for a partial refund requires careful consideration of the damage incurred as well as any valid claims against the tenant's actions or lease obligations.

It's essential that both landlords and tenants assess damage accurately, defining clear responsibilities to avoid disputes down the line.

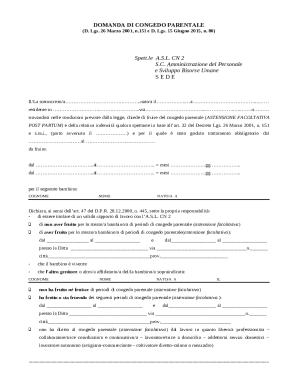

Preparing to refund/not refund a security deposit

Before processing a partial refund of a security deposit, landlords need to gather required information and documentation to justify any deductions. An itemized list of damages and receipts for repairs and cleaning should be compiled to maintain transparency.

Each state has its own legislation regarding security deposits, including timelines for returning deposits to tenants. For instance, in California, landlords must return the security deposit within 21 days. Familiarity with these regulations helps landlords avoid legal pitfalls.

Maintaining detailed records contributes to a smoother process when it comes to issuing refunds, as it can clear misunderstandings between landlords and tenants.

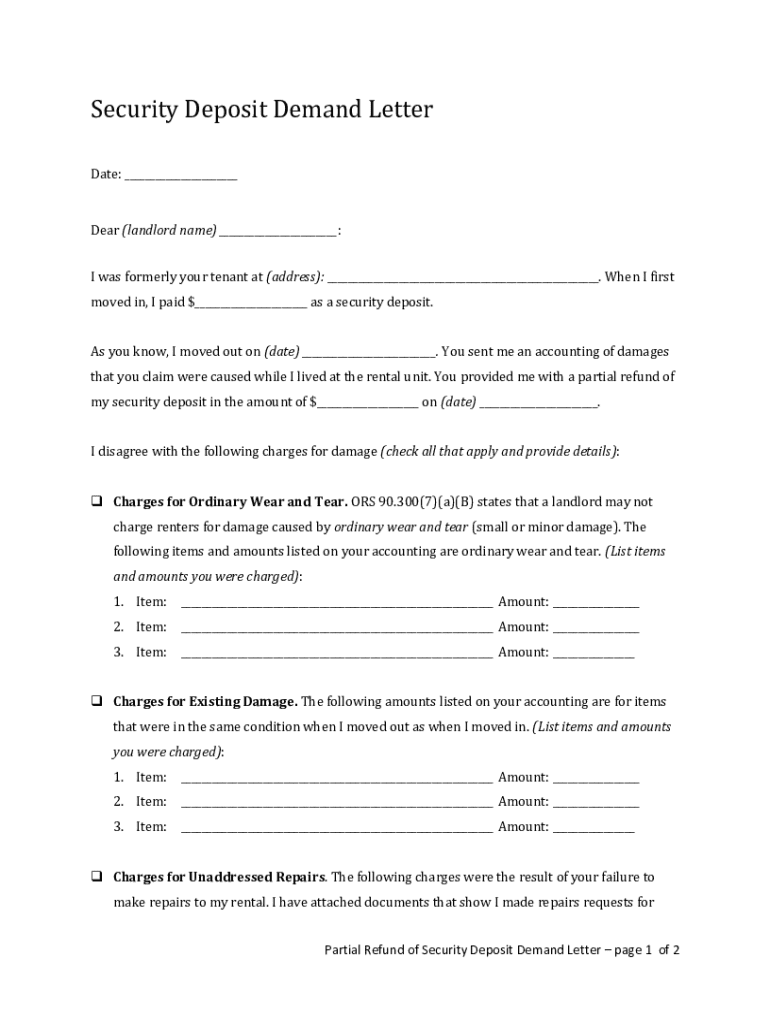

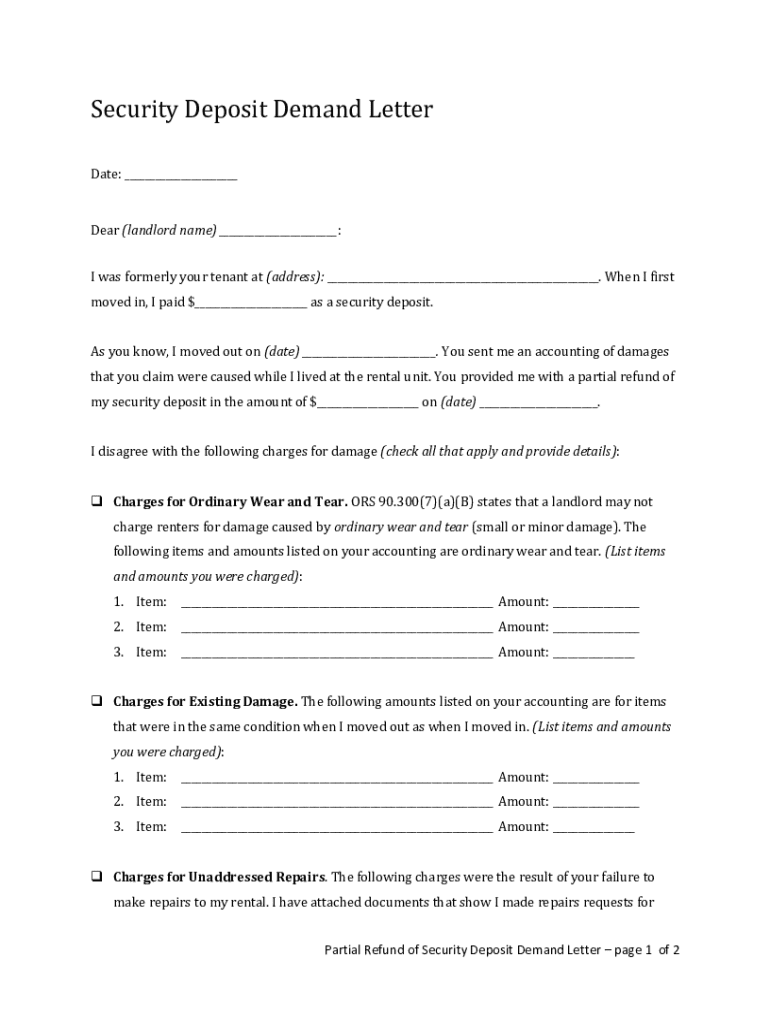

Creating the security deposit refund statement

Drafting a partial refund letter is a critical step in communicating the particulars of the refund process to tenants. The letter should include essential components such as the amount of refund, reasons for deductions, and any attached documentation.

The tone of the letter should remain professional yet clear and friendly. Aim to clearly state the status of the security deposit while justifying deductions based on the lease agreement and the state of the unit.

Providing a structured template for the refund statement helps streamline the process for landlords and builds trust with tenants.

Security deposit refund letter templates

Using templates can simplify the process of issuing a partial refund. Here are examples of letters to assist landlords.

Every letter should be tailored to the scenario while ensuring legal sufficiency and respect for tenant rights.

Timeline for issuing the security deposit refund

Understanding the legal timeline for issuing a security deposit refund is crucial. Many states have specific deadlines that landlords must adhere to, typically between 14 to 30 days.

Best practices suggest that landlords communicate with tenants promptly after vacating, providing adequate detail about any deductions to avoid disputes. The clearer the communication, the smoother the transition for both parties.

Setting clear deadlines for processing refunds can prevent conflicts and promote smoother relations with tenants.

Disputing partial refund decisions

Disputes over partial refunds are not uncommon. Tenants may question deductions or the rationale provided by landlords, which can lead to tension. Common reasons for disputes often stem from unclear communication or exceptionally high repair costs.

For tenants who wish to dispute a partial refund, it is vital to document their case meticulously. This may include gathering photographs of the unit, references from witness statements, and any communication records regarding the condition of the property.

By following the appropriate channels for dispute resolution, tenants can work towards a favorable outcome.

Using pdfFiller for security deposit management

Managing security deposits effectively can be made simpler with a robust document solution like pdfFiller. This cloud-based platform allows users to seamlessly edit PDFs, eSign important documents, and collaborate efficiently.

With pdfFiller, users can easily create, fill out, and manage security deposit forms electronically from anywhere, ensuring that essential documents are accessible on any device.

Investing in pdfFiller for managing security deposits streamlines the entire refund process, making it transparent and efficient.

Managing tenant expectations

Setting clear expectations among tenants regarding security deposit refunds is key to a harmonious landlord-tenant relationship. From the onset, landlords should communicate the conditions that could lead to deductions and how the refund process works.

Communicating effectively with tenants involves proactive engagement, ensuring they are informed about the status of their deposit throughout their tenancy.

By sharing information transparently, landlords can help mitigate disputes related to security deposits, fostering trust and understanding.

Legal considerations for landlords and tenants

Both landlords and tenants should familiarize themselves with the legal landscape governing security deposits. Key laws often dictate the maximum amounts for security deposits, timelines for refunds, and the required documentation for any deductions made.

Tenants have rights regarding their deposits, including the right to challenge inappropriate deductions. It's crucial for landlords to understand the potential penalties for non-compliance with state legislation, as failure to return deposits within the stipulated time frame can result in loss of the entire amount of the deposit.

Grasping these legal aspects is vital in ensuring that both parties understand their rights and obligations, thus minimizing legal conflicts.

Conclusion and next steps

Navigating the complexities of security deposits, especially when dealing with partial refunds, involves understanding a myriad of factors, including legal obligations and tenant rights. By utilizing a structured approach and reliable document management system like pdfFiller, landlords can streamline this process.

Being proactive in managing security deposits not only reduces potential disputes but also fosters positive relationships with tenants. Equip yourself with the right tools, templates, and knowledge to effectively handle the reformatted security deposit partially form and ensure a smoother transition at the end of every lease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send reformatted- security deposit partially for eSignature?

How do I complete reformatted- security deposit partially online?

How do I edit reformatted- security deposit partially online?

What is reformatted- security deposit partially?

Who is required to file reformatted- security deposit partially?

How to fill out reformatted- security deposit partially?

What is the purpose of reformatted- security deposit partially?

What information must be reported on reformatted- security deposit partially?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.