Get the free Completing Form 8867Internal Revenue Service

Get, Create, Make and Sign completing form 8867internal revenue

How to edit completing form 8867internal revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out completing form 8867internal revenue

How to fill out completing form 8867internal revenue

Who needs completing form 8867internal revenue?

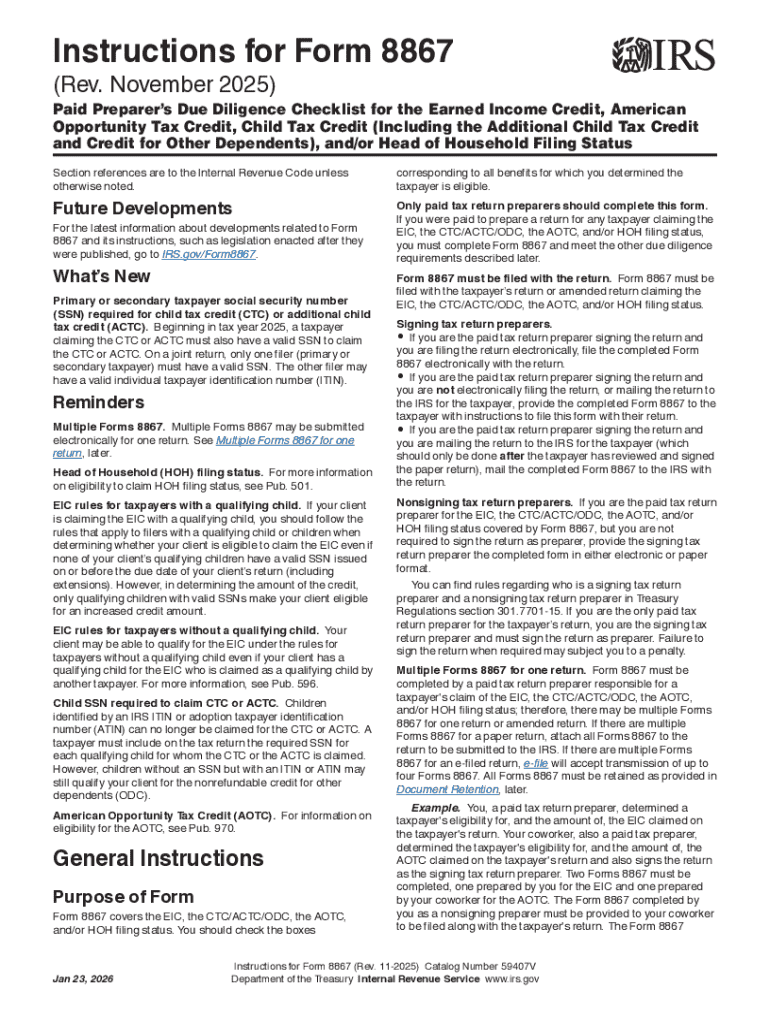

Completing Form 8867: A Comprehensive Guide for Tax Preparers

Understanding Form 8867: A Critical Document for Tax Preparers

Form 8867 is a vital document for tax preparers to ensure compliance with IRS requirements when claiming tax credits such as the Child Tax Credit and the American Opportunity Tax Credit. This form serves as a declaration that due diligence has been exercised in determining and verifying the eligibility of clients for these credits. It aims to prevent inaccurate claims and assists preparers in avoiding penalties during audits.

For tax preparers, understanding Form 8867 is essential not only for compliance but also for maintaining professional integrity. The significance of this form cannot be overstated, as it directly impacts the financial outcomes for clients and the reputation of the preparers themselves.

Who needs to file Form 8867?

Both tax preparers and clients must be familiar with Form 8867. Tax preparers who are filing returns for clients claiming certain credits must complete this form to certify that they have met the due diligence requirements. Specifically, preparers should focus on clients who qualify for tax credits that more rigorously scrutinize eligibility.

Understanding the eligibility criteria for these credits is crucial, as incorrect claims may lead to audits, fines, or even legal repercussions for both the preparer and the client.

Key components of Form 8867

Form 8867 comprises several key sections that preparers must navigate to accurately represent their clients' eligibility. Each section addresses different components of due diligence and eligibility verification.

Accurate completion of each section enhances a preparer's credibility and protects them from potential audits.

Required supporting documentation

Filing Form 8867 requires certain supporting documents to substantiate claims. Tax preparers must gather these documents to back up the information provided in the form, ensuring all claims are legitimate. Common documents include:

Being meticulous about documentation can mitigate common mistakes, ensuring a smoother filing process and compliance with due diligence requirements.

Why Form 8867 matters for tax preparers

Form 8867 acts as a critical safeguard for tax preparers against audits and penalties from the IRS. By thoroughly completing this form, preparers demonstrate their commitment to adherence to tax laws and proper client representation.

Not filing or incorrectly completing Form 8867 can attract significant consequences for tax preparers, including fines, reprimands, or potential loss of licensure. This illustrates the importance of scrupulous attention to detail in every filling process.

Ensuring client eligibility

To ensure that clients are eligible for tax credits, preparers must engage in comprehensive client interviews. Key questions to delve into may include their dependence status, income levels, and even residency questions pertinent to credit eligibility.

These inquiries not only assist in gathering necessary details but also empower preparers to identify signs of potential ineligibility and prevent fraudulent claims from occurring. Crafting an effective dialogue with clients is fundamental to maintaining ethical standards.

Due diligence in preparing Form 8867

Due diligence is a critical requirement for tax preparers when completing Form 8867. This ensures they investigate and substantiate each claim made on their clients' returns. Key questions guide preventers in assessing client situations accurately.

Having a thorough checklist for compliance helps maintain adherence to due diligence. Best practices involve keeping detailed records of all consultations and received documentation, thereby empowering tax preparers both to defend their submissions and address any discrepancies that may arise during audits.

Common scenarios and red flags

Certain scenarios demand enhanced due diligence from tax preparers. For example, clients who have newly claimed dependents or who are switching their filing status may warrant closer scrutiny.

Identifying red flags, such as inconsistent income reporting or possible overstating of credits, is vital. Tax preparers must ethically address these concerns, whether that means questioning clients further or seeking additional documentation.

Benefits of professional assistance with Form 8867

Engaging a qualified tax professional can significantly enhance the completion of Form 8867. Tax professionals possess the expertise to navigate the complexities and ensure all criteria surrounding due diligence are met accurately.

When selecting a tax preparer, evaluating characteristics such as certifications, client reviews, and communication are essential. Proper vetting ensures a reliable partnership that can make the process smoother for clients.

Utilizing pdfFiller for Form 8867 management

pdfFiller provides a seamless platform for preparing Form 8867. The step-by-step guidance within the application simplifies the process of filling out the form and managing documentation.

The cloud-based capabilities of pdfFiller offer convenience and flexibility, allowing tax professionals to access and manage forms from anywhere. This is especially useful given the remote nature of many tax preparation workflows today.

Future considerations for tax preparers with Form 8867

Tax regulations are continuously evolving, and preparers should stay informed about upcoming changes that could impact Form 8867. An awareness of these changes enables tax professionals to proactively adjust their practices and educate clients accordingly.

Embracing technology not only boosts compliance but also improves accuracy in tax preparation processes, positioning preparers favorably in a competitive marketplace.

Conclusion: Mastering Form 8867 for client success

Mastering Form 8867 is essential for tax preparers aiming to deliver the best possible outcomes for their clients. Understanding its intricacies, the required documentation, and maintaining a thorough due diligence process protects both clients and preparers from potential pitfalls.

Fostering continuous education and adherence to best practices will ensure that tax professionals remain competent in their duties, thereby enhancing their expertise and reliability in an ever-changing field.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute completing form 8867internal revenue online?

Can I create an electronic signature for signing my completing form 8867internal revenue in Gmail?

How do I complete completing form 8867internal revenue on an iOS device?

What is completing form 8867 internal revenue?

Who is required to file completing form 8867 internal revenue?

How to fill out completing form 8867 internal revenue?

What is the purpose of completing form 8867 internal revenue?

What information must be reported on completing form 8867 internal revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.