Get the free Form SSA-7162-OCR-SM Report to U.S. SSA

Get, Create, Make and Sign form ssa-7162-ocr-sm report to

Editing form ssa-7162-ocr-sm report to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ssa-7162-ocr-sm report to

How to fill out form ssa-7162-ocr-sm report to

Who needs form ssa-7162-ocr-sm report to?

Form SSA-7162-OCR-SM Report to Form

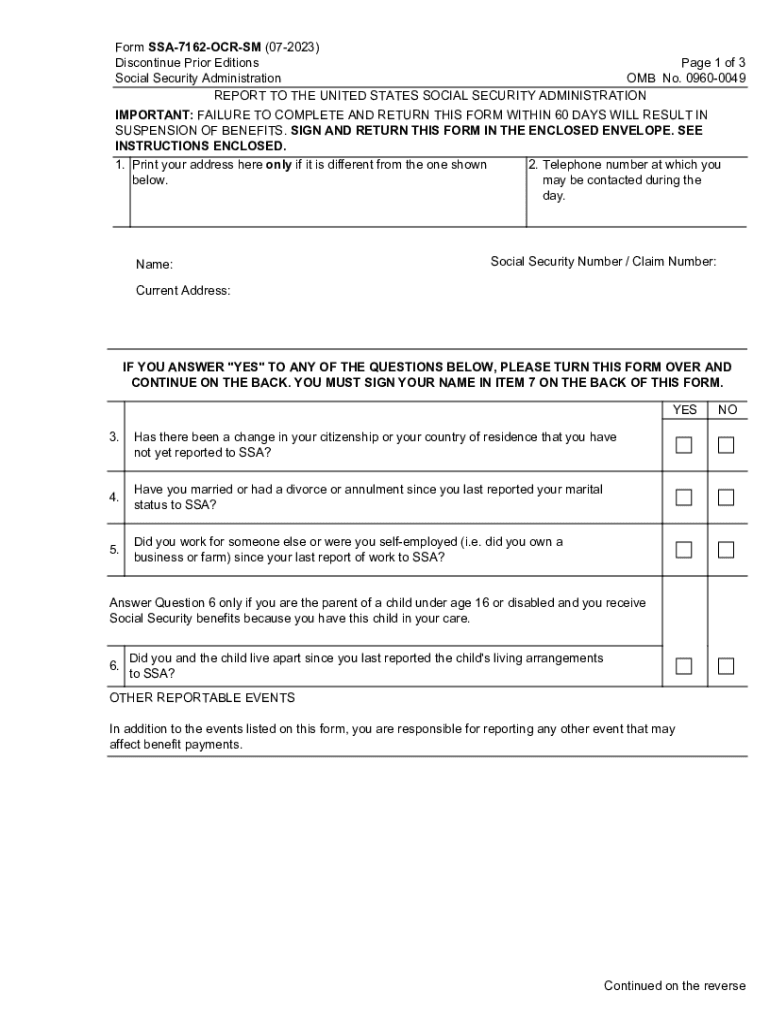

Overview of Form SSA-7162-OCR-SM

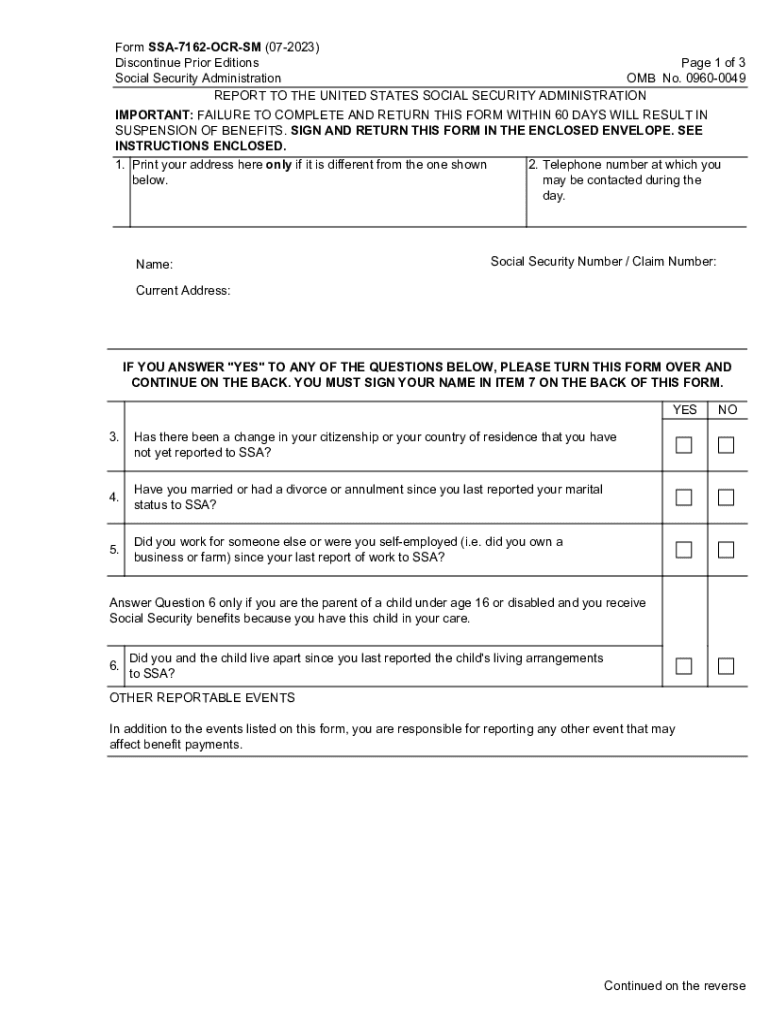

The Form SSA-7162-OCR-SM is a crucial document used by the Social Security Administration (SSA) to collect necessary information from individuals receiving Social Security benefits while living outside the United States. This form serves as an official request for verification of the beneficiary's ongoing eligibility for benefits, ensuring compliance with federal regulations regarding international benefit payments.

The importance of Form SSA-7162-OCR-SM cannot be overstated. For U.S. citizens and certain non-resident aliens receiving Social Security benefits abroad, this form is an essential part of maintaining access to their financial support. Without this verification report, beneficiaries risk interruptions or even termination of their benefits, which can significantly impact their financial stability overseas.

Who needs to complete Form SSA-7162-OCR-SM?

The SSA-7162-OCR-SM is primarily required for U.S. citizens residing outside the country who receive Social Security benefits. This includes individuals who have moved abroad for retirement, employment, or personal reasons. Moreover, certain non-resident aliens may also be required to submit this form if they are entitled to specific Social Security benefits under applicable treaties or regulations.

It's worth noting that there are exceptions to who needs to file this form. For example, individuals whose benefits are not dependent on their residency status, such as those living in a U.S. territory, may not have to complete the SSA-7162-OCR-SM. Additionally, those who receive pension benefits or those not liable for SSA reporting may also be exempt.

Key information required on the form

Filling out the Form SSA-7162-OCR-SM requires specific key information to ensure proper processing by the SSA. First and foremost, the form requires detailed personal information such as your full name, current mailing address, and date of birth. Providing your Social Security number accurately is crucial for the SSA to match your report with your benefits record.

In addition to basic personal information, the SSA may request documentation to support your claims, specifically for verifying your identity and residency abroad. This can include identification documents like a passport or green card and proof of your physical residence in your foreign country, such as utility bills or lease agreements.

Step-by-step instructions for completing Form SSA-7162-OCR-SM

Completing Form SSA-7162-OCR-SM doesn't have to be a daunting task. Here’s a simple step-by-step guide to assist you.

Submission process for Form SSA-7162-OCR-SM

Once you have completed Form SSA-7162-OCR-SM, the next step is submitting it to the SSA. There are two main options for submission: online through the SSA portal or by mailing the completed form to the appropriate SSA office.

For online submissions, you should create an account on the SSA's official website, follow the instructions provided, and upload your completed form and any supporting documentation. If mailing, ensure you send the form to the designated SSA office based on your location and check that all required documents are attached to avoid any delays.

Key timing considerations

Timely submission of Form SSA-7162-OCR-SM is crucial for beneficiaries outside the United States. Generally, this form should be submitted to the SSA promptly after moving abroad, or whenever there is a renewal period for benefits. There are specified deadlines, and missing these could result in delayed payments or even suspension of benefits.

Furthermore, if you fail to submit the form on time, the SSA will review your case, and it's possible to face repercussions including delayed payments, requiring you to re-establish your eligibility, or in extreme cases, losing access to your benefits altogether. Planning ahead when considering an international move can prevent these issues.

Troubleshooting common issues

While filling out the Form SSA-7162-OCR-SM may seem straightforward, many users encounter common mistakes. Errors in personal information like misspelled names or incorrect Social Security numbers are frequent. Missing documentation can also lead to processing delays.

If you experience issues during the submission process, reaching out to SSA support can be beneficial. The SSA offers assistance via a help line for beneficiaries abroad, providing guidance on completing the form and troubleshooting any challenges you face.

The impact of Form SSA-7162-OCR-SM on Social Security benefits

The timely submission of Form SSA-7162-OCR-SM directly affects the continuity of Social Security benefit payments. If an individual fails to submit the form correctly or on time, their benefits may be suspended until the form is completed, causing significant financial strain.

Moreover, consistent filing ensures that the SSA has updated information about your residency status, which can be integral in determining the correct benefit payments. Beneficiaries should be diligent in their submissions to prevent any lapses in their Social Security income.

Insights on managing your document needs with pdfFiller

Navigating the complexities of the SSA-7162-OCR-SM can be made easier using pdfFiller, a cloud-based platform designed to simplify document management. With pdfFiller, users can easily fill out, edit, and manage their SSA forms from anywhere, ensuring that no detail is overlooked.

Additionally, pdfFiller offers features such as e-signatures and collaboration tools, allowing multiple users to work together on the same document, which is ideal for families or teams navigating the process. This seamless access helps ensure that all necessary forms are completed accurately and on time.

Final tips for a smooth process

Before concluding your SSA-7162-OCR-SM form submission process, consider these final tips. Always double-check your entries for accuracy, particularly your name and Social Security number. Utilizing templates and resources available on pdfFiller can streamline the form-filling process significantly.

Furthermore, keep a copy of your submitted form and any supporting documents for your records. If you are submitting by mail, consider using a trackable service to confirm receipt by the SSA. By adhering to these recommendations, you’ll enhance your chances of a smooth and successful application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form ssa-7162-ocr-sm report to online?

Can I sign the form ssa-7162-ocr-sm report to electronically in Chrome?

How can I edit form ssa-7162-ocr-sm report to on a smartphone?

What is form ssa-7162-ocr-sm report to?

Who is required to file form ssa-7162-ocr-sm report to?

How to fill out form ssa-7162-ocr-sm report to?

What is the purpose of form ssa-7162-ocr-sm report to?

What information must be reported on form ssa-7162-ocr-sm report to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.