Get the free FINANCE - BILLS

Get, Create, Make and Sign finance - bills

Editing finance - bills online

Uncompromising security for your PDF editing and eSignature needs

How to fill out finance - bills

How to fill out finance - bills

Who needs finance - bills?

Understanding the Finance - Bills Form: A Comprehensive Guide

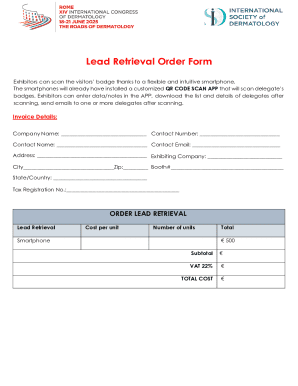

Understanding the finance - bills form

The finance - bills form is a critical document used by individuals and businesses to manage their utility payments and other financial obligations. Its primary purpose is to serve as a formal request for payment, detailing the services rendered and the amount owed. This form encapsulates essential information that aids both payee and payer in tracking expenses and ensuring timely bill payments. The importance of accurate bill management cannot be overstated, as it helps prevent late fees, service interruptions, and promotes better budgeting practices.

Accurate management of these forms plays a pivotal role in maintaining financial health, both at a personal and organizational level. When bills are organized and tracked properly, individuals and teams can make informed decisions regarding their expenditure, set priorities for payment, and implement debt solutions if necessary. By using finance - bills forms effectively, users can gain insight into their financial statements and improve their overall fiscal responsibility.

Key components of the finance - bills form

The finance - bills form consists of several key components that must be filled out accurately to ensure proper processing and payment. Each section plays a significant role in communicating the necessary information to the payee, as well as keeping a detailed record for the payer. Understanding these components is critical for both personal and business finance.

Moreover, familiarizing oneself with common terminology used within the finance - bills form is essential. Terms like 'expenditure', 'amount overdue', and 'billing cycle' ensure clear communication between the payer and the payee. The variations in bills forms across different utilities further highlight their adaptability to specific requirements, but the core components remain consistent for effective management.

Pros and cons of using a finance - bills form

Utilizing a finance - bills form brings several advantages. One significant benefit is improved tracking of expenses. By documenting every bill, users can easily assess their current financial obligations and adjust their budgets accordingly. Enhanced financial record keeping also ensures that any discrepancies between billed amounts and services rendered can be addressed promptly, avoiding larger issues down the line.

Conversely, there are potential drawbacks that users must consider. For instance, filling out multi-item bills can become complex, making it easy to overlook essential details. Meeting deadlines is crucial, as potential late fees can accumulate quickly, putting additional strain on finances. This duality means that users must weigh both sides when deciding how best to handle their bills management through the finance - bills form.

Step-by-step guide to completing the finance - bills form

Completing a finance - bills form requires preparation and attention to detail. Start by gathering necessary documentation such as previous bills and payment records, which will provide context and help maintain accuracy.

Common mistakes that users should avoid include incorrect payee names, which can result in payment misallocation, and overlooking due dates, a mistake that can incur penalties. By following these guidelines, individuals can manage their financial commitments effectively.

Editing and customizing your finance - bills form

Customizable bills forms are beneficial as they allow users to tailor documents to fit the specific needs of different vendors. Financial situations vary, and flexibility in form design can lead to improved management of recurring bills and varied billing periods.

Using pdfFiller's editing tools makes this process seamless. Users can upload existing forms, modify them easily, and even add personal notes or annotations. Instructional tools engage users to ensure all necessary changes are made efficiently, streamlining the billing process and enhancing overall organization.

Electronic signing and collaboration on the bills form

The significance of electronic signing in bill management cannot be overstated. It allows users to authenticate transactions digitally without the hassle of printing or mailing documents. This saves time and adds an additional layer of security.

pdfFiller simplifies the eSigning process. Users can easily navigate through the process with step-by-step instructions available on the platform. Additionally, it enables collaboration with team members on shared bills, making it easy to track contributions and responsibilities, thereby fostering financial accountability.

Managing your finance - bills form online

Leveraging cloud-based document management with pdfFiller allows users to access their finance - bills forms from anywhere, at any time. This flexibility is crucial in today’s fast-paced environment where on-the-go financial management is necessary.

Users can organize completed bills forms for future reference, making it easy to track payment histories. With pdfFiller, users can also set reminders for upcoming due dates, ensuring that bills are paid promptly and effectively minimizing the risk of incurring late fees.

Interactive tools for finance - bills management

pdfFiller offers a variety of interactive tools to assist with effective bill management. Tools like bill calculators and budgeting resources are invaluable for individuals and teams looking to streamline their finances. Integrating bills with financial software can also enhance expense tracking and reporting capabilities.

Case studies have shown that users who effectively leverage these interactive tools typically enjoy enhanced control over their finances. They can make more informed decisions regarding expenditures and prioritize their debts according to their unique financial situations.

Best practices for bill management

Establishing a routine for bill review and payment can significantly improve financial management. Allocate a set time each week or month to review all bills due and upcoming payments. By doing so, users can plan expenditures more effectively and ensure they are adhering to the commitments outlined in their finance - bills forms.

By proactively managing bills, individuals can avert potential penalties and improve their budgeting strategies, paving the way for better financial health in both personal and business spheres.

Frequently asked questions about the finance - bills form

Common queries often arise regarding the completion and submission of finance - bills forms. Questions may include how to address potential issues with online forms or what steps to take if a payment fails to process correctly.

Having a clear understanding of these common issues can alleviate stress during the billing process and encourage a smoother transaction experience.

Navigating financial statements and bills form interconnections

Understanding how finance - bills forms relate to broader financial reporting is crucial. These forms help create a comprehensive view of financial obligations, serving as a microcosm of your overall financial health. Analyzing bills logs helps identify spending patterns, especially regarding priority debts that need immediate attention.

Breaking down expenses documented in finance - bills forms provides valuable insights for managing surplus or deficits. It allows individuals and businesses to strategize effectively and make informed decisions for future expenditures and debt management.

Next steps after completing your finance - bills form

Once the finance - bills form has been completed and submitted, users should consider proper disposal or archiving of old bill forms. Digitally archiving documents not only saves space but secures a reference for future use.

Furthermore, planning for future expenses and budgeting based on historical data from past bills can assist in setting realistic financial goals. Adapting strategies from previous experiences helps enhance future financial management efficiencies, ultimately leading to more informed actions and refined expenditure practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit finance - bills on an iOS device?

How can I fill out finance - bills on an iOS device?

How do I edit finance - bills on an Android device?

What is finance - bills?

Who is required to file finance - bills?

How to fill out finance - bills?

What is the purpose of finance - bills?

What information must be reported on finance - bills?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.