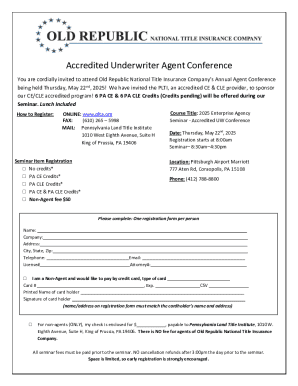

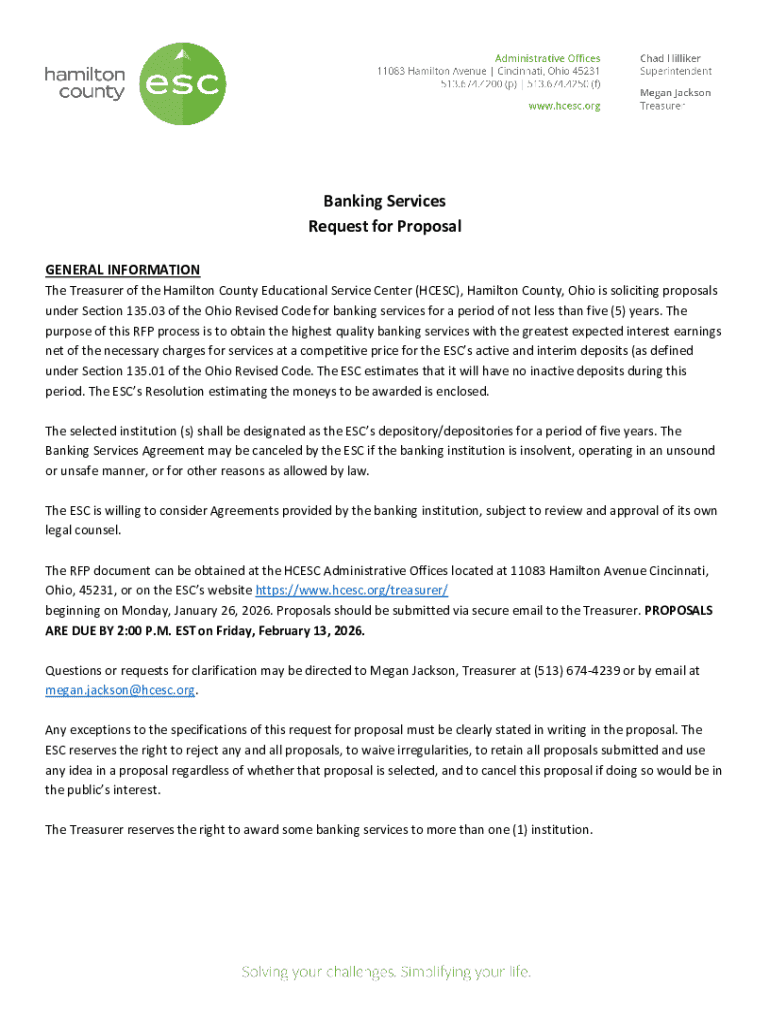

Get the free Banking Services Request for Proposal - Hamilton County ESC

Get, Create, Make and Sign banking services request for

Editing banking services request for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out banking services request for

How to fill out banking services request for

Who needs banking services request for?

Banking Services Request for Form - How-to Guide Long-Read

Understanding banking services requests

Banking services requests refer to formal requests made by individuals or businesses to banks for various services such as opening accounts, applying for loans, or accessing credit lines. These requests, when communicated effectively through structured forms, allow banks to gather essential information to process services efficiently.

These request forms play a significant role in banking operations, ensuring that customer requests are categorized, recorded, and addressed without unnecessary delays. They serve as a standardized method for collecting personal and financial information needed to evaluate and fulfill requests.

Typically, banking services requested can be classified into two main categories: personal banking services, which may include checking accounts, savings accounts, and home loan applications; and business banking services, that encompass business checking accounts, loans for business expansion, and lines of credit.

Overview of banking services request forms

A banking services request form must contain key components to facilitate the processing of any request. The personal information section usually requires the applicant's full name, address, contact details, and Social Security Number or Tax Identification Number, ensuring the bank can identify the individual or business.

The service-specific requests section is critical as it details the exact banking service being requested. This may include specifying whether one is requesting a new account, a loan, or information about a financial product. Additionally, consent and acknowledgment clauses often inform the applicant about data privacy and the bank's policies, ensuring regulatory compliance.

Common mistakes that applicants should avoid when filling out these forms include overlooking mandatory fields, providing incorrect information, or failing to read the consent clauses thoroughly. Such errors can lead to processing delays or outright rejection of the requests.

Accessing the banking services request form

To access a banking services request form, start by navigating your bank's official website. Most banks have a dedicated section for forms or service requests. Look for drop-down menus or distinct tabs titled ‘Customer Service’ or ‘Forms’ that can guide you to the required template.

For convenience, many banks also provide direct links to common forms in their FAQs or Help sections. Look for links labeled ‘Banking Services Request Form’ or similar phrases. Additionally, these forms can generally be downloaded in PDF format, making it easy to fill out or print for submission.

Step-by-step instructions for completing your request form

Completing your banking services request form accurately is crucial. Start with the personal information section, which is typically the first section. Here, fill in all required fields such as your name, address, phone number, and email address. Ensure all data is accurate to avoid delays in your application process.

Next, in the section for specifying your banking service request, provide detailed information about what you need. For example, if applying for a loan, specify the amount, purpose, and type of loan desired. Be clear and succinct as this helps the bank team to understand your needs without ambiguity.

Incorporate supporting documents as necessary; these may include identification, proof of income, or business licenses, depending on your request type. Understand the submission guidelines, whether you upload these documents online or mail them alongside your completed form.

Finally, take time to review your form before submission. Check for any missing information and ensure clarity in the services you've requested. Common pitfalls include overlooked signatures or incorrect administrative details that can delay processing.

Utilizing pdfFiller for your banking services request form

pdfFiller provides a seamless platform for managing your banking services request form. Creating an account on pdfFiller allows easy access to a plethora of document management tools. Start by visiting the pdfFiller website, where you can create an account by providing basic information like your email address.

Once logged in, you can upload your banking services request form. The platform's editing tools allow you to fill out the form accurately, insert text, and make necessary adjustments efficiently. Adding digital signatures is an integral feature and can be done through simple clicks, ensuring your form is ready for submission.

Moreover, pdfFiller enables collaboration by allowing team members to review the document. This can streamline the process, as multiple eyes can catch errors before the document is finalized. Benefits of using pdfFiller include secure document storage, excellent organization features, and the ability to access your forms from anywhere with internet connectivity.

Common issues and troubleshooting

Many applicants encounter issues when submitting banking services requests. Missing information is the most common problem, leading to delays or outright rejection of a request. Thoroughly filling out every mandatory field helps minimize this risk.

Additionally, delayed responses can frustrate applicants. Understanding your bank's typical response times is vital, and follow-up procedures should be communicated clearly. Have the important contact numbers or emails ready to reach out if needed; many banks offer chat options for real-time assistance.

Ensuring successful processing of your request

Once you submit your banking services request form, several steps typically follow. The bank will begin a review process, where they assess the submitted information against their requirements. Communication from the bank can range from immediate acknowledgment receipts to more detailed follow-up inquiries regarding additional information needed.

Understanding the bank's policies regarding service requests helps set realistic expectations. Familiarize yourself with approval criteria which may differ from one service to another. In cases of denied requests, knowing the appeal processes provided by the bank can provide pathways to overturn decisions if applicable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send banking services request for to be eSigned by others?

How do I make changes in banking services request for?

Can I create an eSignature for the banking services request for in Gmail?

What is banking services request for?

Who is required to file banking services request for?

How to fill out banking services request for?

What is the purpose of banking services request for?

What information must be reported on banking services request for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.