Get the free Early Release of Superannuation Benefit on Terminal Illness ...

Get, Create, Make and Sign early release of superannuation

How to edit early release of superannuation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out early release of superannuation

How to fill out early release of superannuation

Who needs early release of superannuation?

Early Release of Superannuation Form: A Comprehensive Guide

Understanding early release of superannuation

Superannuation is a long-term savings and investment plan designed to help Australians fund their retirement. Typically, individuals cannot access their superannuation funds until they reach the preservation age, which varies depending on their birth year. However, circumstances such as severe financial hardship or compassionate grounds enable individuals to apply for early release of superannuation. Understanding these options is crucial as it allows you to better navigate through tough situations while also being acutely aware of eligibility criteria to ensure a smooth process.

Early release can be a valuable lifeline for those struggling financially. However, not everyone is eligible, making it important to understand the specific requirements and documentation needed before submitting your early release of superannuation form. This knowledge can not only save time but also prevent unnecessary stress during times of need.

Eligibility criteria for early release

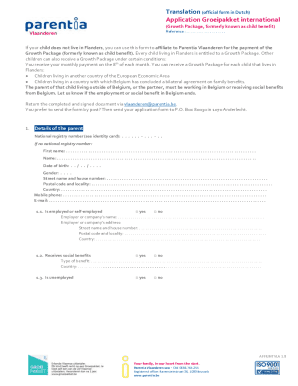

To access your superannuation early, you must meet certain eligibility criteria. These can broadly be categorized into three groups: severe financial hardship, compassionate grounds, and other specific circumstances.

Severe financial hardship

Severe financial hardship refers to situations where an individual cannot meet their basic living expenses. This may include loss of income, mounting debts, or other financial pressures. Examples of severe financial hardship include being unable to pay for food, housing, or medical expenses.

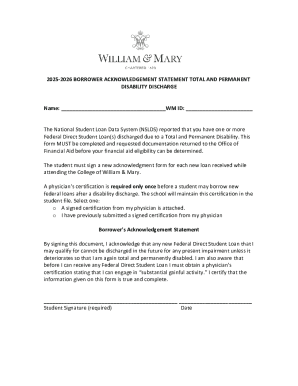

Compassionate grounds

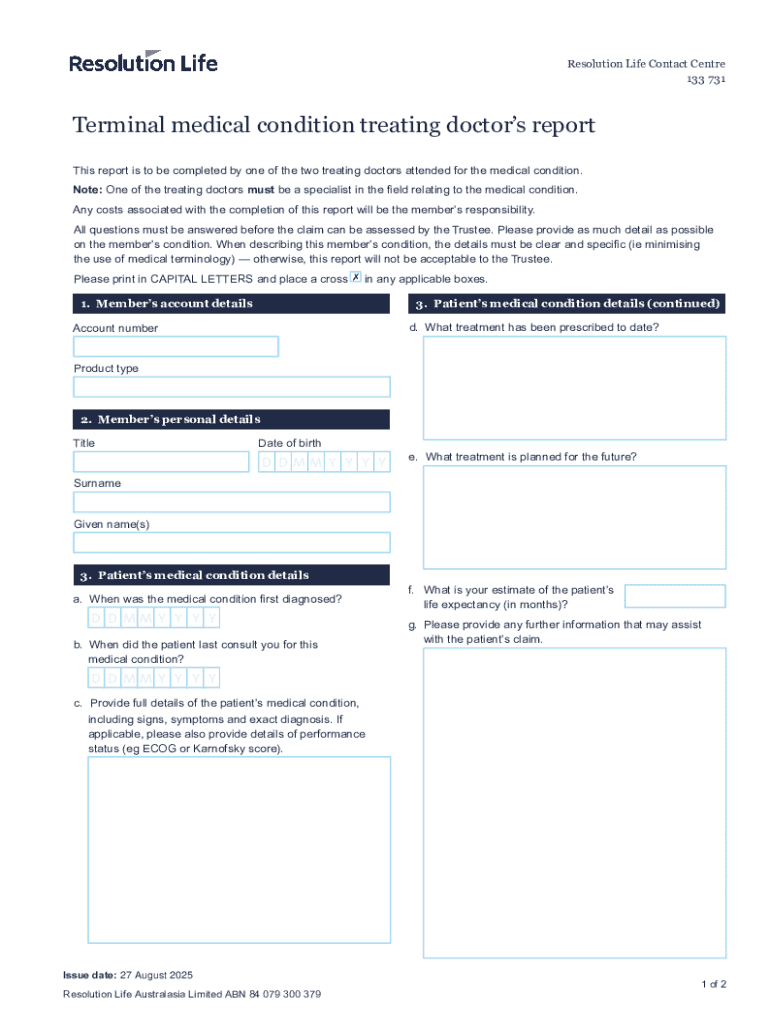

Compassionate grounds allow individuals to access their superannuation early for specific reasons. Situations that qualify include medical treatment or transport for life-threatening conditions, preventing mortgage foreclosure, or other immediate and essential expenses.

Other circumstances

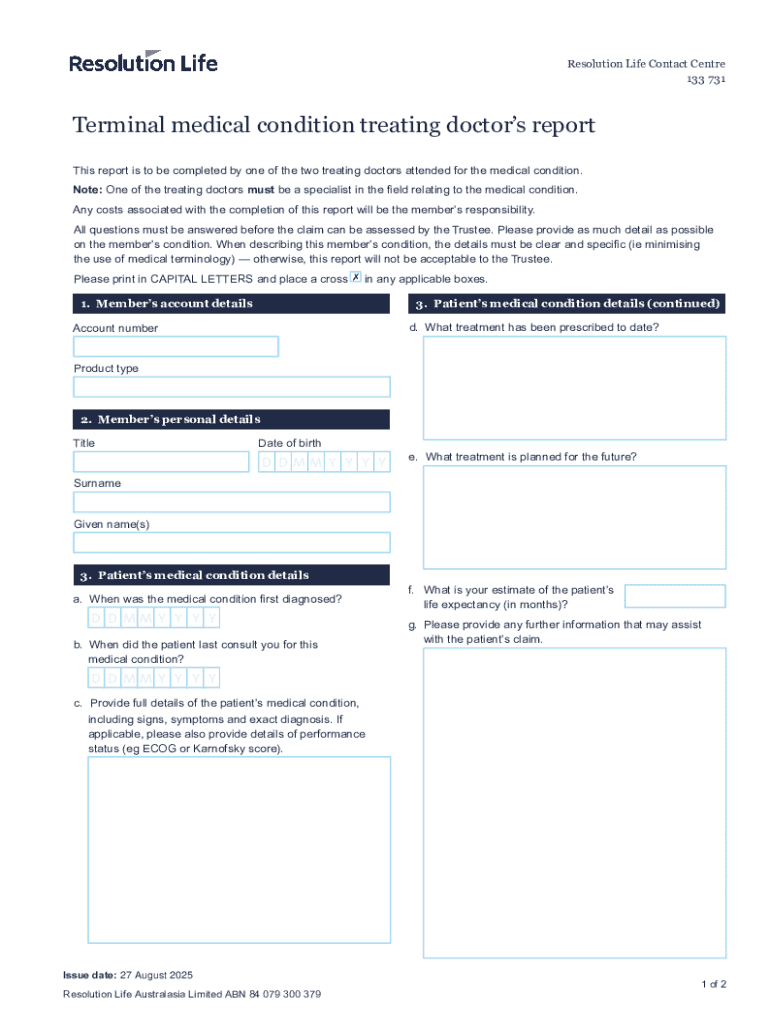

Additional scenarios permitting early release include severe disability or terminal illness. Each of these may have unique conditions and supporting documents, such as medical reports or disability certificates. Understanding these requirements can help you prepare your application effectively.

How to apply for early release of superannuation

The application process for the early release of superannuation can seem daunting, but breaking it down into manageable steps will ease the situation significantly. Here’s a step-by-step guide to help you navigate the process.

When filling out the form, ensure all information is legible and accurate. Providing incomplete or errant information can delay processing. Consider seeking assistance if you're uncertain about any section of the form.

Success in this application relies on your thorough preparation and attention to detail. Avoiding common pitfalls, such as missing documentation or incorrect information, can streamline the review process and result in quicker outcomes.

Alternative solutions for financial assistance

If you find that accessing your superannuation early is not feasible or if it's not the best option for your financial situation, alternative solutions are available. Local governments and community services offer various support programs aimed at helping individuals facing financial difficulties.

Considering these options may not only provide immediate relief but also assist in long-term financial stability.

The role of pdfFiller in managing superannuation forms

pdfFiller’s cloud-based platform provides an invaluable resource for individuals filling out the early release of superannuation form. This tool simplifies the often complex process of document management, allowing users to edit, eSign, and collaborate on important filings.

With features that let you save drafts, track changes, and securely share documents, pdfFiller empowers users to transition from traditional forms to a seamless online experience. This is particularly beneficial when submitting time-sensitive requests like early release applications.

Utilizing pdfFiller not only streamlines the filling process but also provides peace of mind knowing your documents are handled within a secure environment. The convenience of accessing your superannuation forms on the go cannot be overstated, making it easier to focus on what matters most: your financial well-being.

Frequently asked questions (FAQs)

Potential applicants often have numerous questions regarding the early release of superannuation. Clarifying these queries is important to foster understanding and minimize anxieties about the process.

Understanding the answers to these questions is crucial for managing your expectations and planning accordingly.

Real stories: individuals’ experiences with early release

Real-life experiences provide valuable insights into the processes individuals have navigated when applying for the early release of superannuation. Many have faced various challenges, whether it be gathering necessary documentation or dealing with the emotional weight of financial insecurity.

For instance, a single mother may have accessed her super due to unexpected job loss, ultimately providing a crucial safety net during her transition. Through her experiences, she discovered the importance of thoroughly preparing application documents, which significantly reduced the frustration of a lengthy approval process.

Such stories underscore the relevance of being informed and well-prepared. Those looking to take similar steps should learn from these narratives for better outcomes.

Future implications and important considerations

Accessing your superannuation early can have significant implications for your retirement savings. Understandably, reducing your super balance now could impact your financial health later; hence thoughtful consideration is paramount.

While meeting immediate financial needs is crucial, it’s essential to assess how early access will affect your long-term financial goals. Consulting with a financial adviser can provide insights tailored to your circumstances, equipping you with the knowledge to make informed decisions.

Interactive tools and resources on pdfFiller

pdfFiller offers a suite of interactive tools that streamline the form-filling process. Users can easily save, share, and track their superannuation application, significantly enhancing the experience.

Engagement with community forums allows users to connect with others facing similar challenges. These resources provide additional support and share practical advice, making the complex process of early release more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit early release of superannuation from Google Drive?

How do I edit early release of superannuation on an Android device?

How do I fill out early release of superannuation on an Android device?

What is early release of superannuation?

Who is required to file early release of superannuation?

How to fill out early release of superannuation?

What is the purpose of early release of superannuation?

What information must be reported on early release of superannuation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.