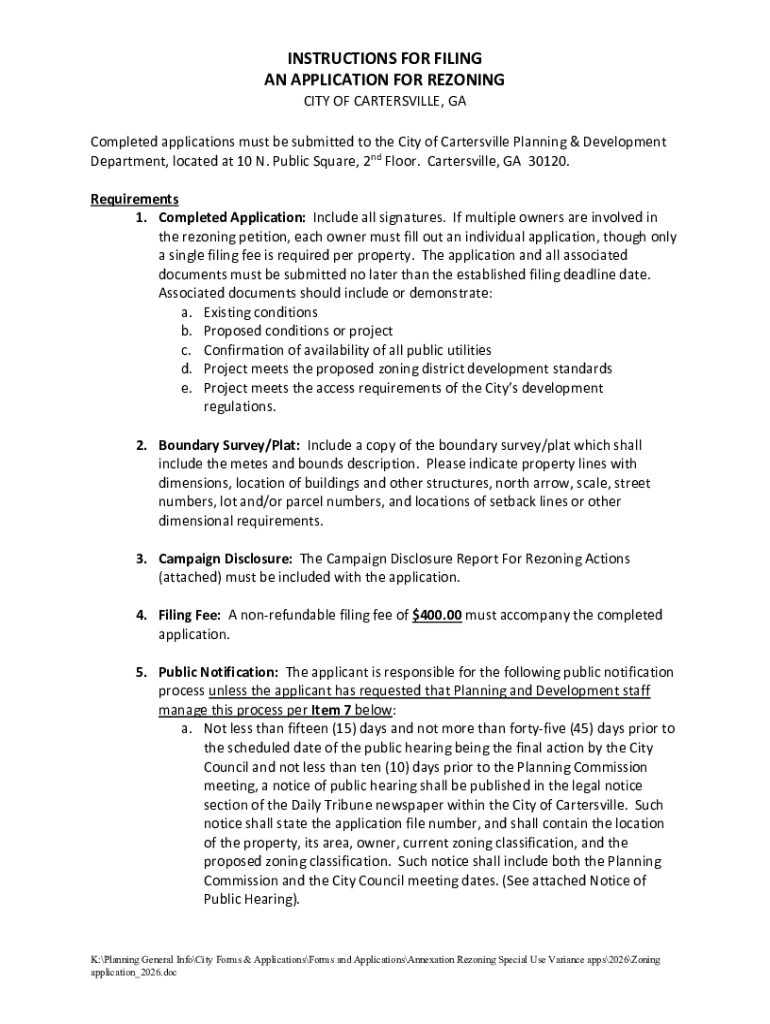

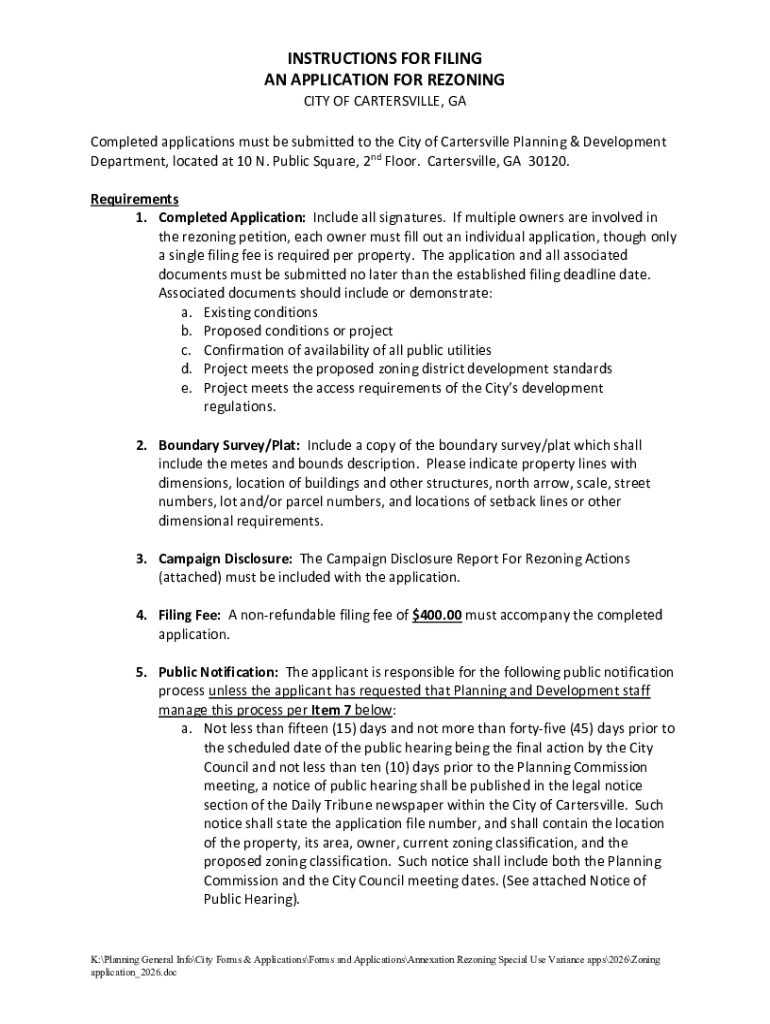

Get the free INSTRUCTIONS FOR FILING AN APPLICATION FOR REZONING

Get, Create, Make and Sign instructions for filing an

Editing instructions for filing an online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for filing an

How to fill out instructions for filing an

Who needs instructions for filing an?

Instructions for filing a form: A comprehensive guide

Understanding the form you need to file

Knowing which form to file is crucial. There are various types of forms, each serving different purposes. Common categories include tax forms, government assistance applications, and medical forms. For instance, tax forms like the 1040 allow individuals to report income for tax purposes, while W-2 forms provide necessary wage information. Medical forms, such as HIPAA authorizations, are essential for maintaining privacy and ensuring compliance within healthcare settings.

Filing forms properly is critical to avoid negative consequences. Incorrect filings, whether it’s providing inaccurate information or missing deadlines, can result in fines, damage to your credit score, or delayed access to benefits. Timely submissions can facilitate smoother processes and ensure compliance, thereby leading to faster resolutions for your requests.

Preparing to file your form

Preparation is the first step in the filing process. Start by collecting all necessary documents related to your form. This typically includes identification, proof of address, and supporting documents such as income statements. Failure to include these can lead to delays or denials in the processing of your form.

Decide on a filing method that fits your needs. You have the option to file online or via traditional paper methods. Online submissions are increasingly preferred due to their convenience and immediate feedback, while paper filing may be necessary for certain forms. Utilizing digital tools enhances efficiency, allowing for functions like PDF editing and eSigning, which simplify the process significantly.

Step-by-step instructions for filling out the form

When you begin filling out the form, it's critical to understand each section. Generally, forms include personal information, financial details, and any additional requirements specific to the document. For example, personal information often consists of your name, address, and date of birth, while financial information can include income sources and tax ID numbers.

During this process, accuracy is paramount. Double-check the details entered to avoid common mistakes, such as incorrect social security numbers or misspellings. Utilize strategies like reviewing your entries after a break to notice errors more easily.

Utilizing interactive tools for form filling

Tools like pdfFiller offer extensive features for document management, allowing users to streamline the filing process effectively. Real-time collaboration tools enable individuals or teams to work together on form completion, reducing errors and enhancing productivity.

Using pdfFiller, you can edit existing documents and add necessary components like signatures or checkmarks. Simply upload your form, and the intuitive editing process allows you to make quick adjustments. This capability ensures that your forms are not only correctly filled out but also professionally presented.

Submitting your form: Key processes

Once you’ve filled out the form, the next step is submission. If opting for online submission, navigate to the appropriate government portal for your specific form type. Be sure to save your file correctly and follow all required steps to finalize submission, which may include confirmation prompts that ensure your form has been received.

If you choose mail-in procedures, it’s essential to understand the size and weight requirements for envelopes. Ensure your document is well-protected during shipping. Additionally, address the envelope with complete and accurate information to avoid any unwanted delays.

Post-submission tips and tracking

After submitting your form, confirming its receipt is crucial. Look out for confirmation emails or letters that verify your submission. If applicable, utilize any tracking numbers provided to monitor the status of your filing, ensuring you stay informed throughout the process.

In case issues arise, such as rejection of the form or requests for additional information, it’s imperative to act swiftly. Identify common errors that might result in complications and be prepared to provide any necessary documentation promptly. This proactive approach can significantly mitigate further delays.

Managing your document efficiently

Once the form is submitted, consider the importance of retaining copies of your submissions. Having both digital and physical versions can be crucial for future reference. Utilizing pdfFiller allows for secure storage of your documents, reducing the risk of loss and ensuring easy access when needed.

If you need to make edits or resubmit a form, pdfFiller simplifies this process significantly. Amendments can be done quickly and efficiently, ensuring that any necessary changes are made without compromising your timeline or compliance.

Best practices for future filings

To streamline future form submissions, creating a filing calendar can help keep track of important deadlines. Each form typically has specific submission dates and timelines, and being organized is key to avoiding late filings and unnecessary penalties.

Continuously educating yourself on changes in form requirements can also prove beneficial. Websites often update their forms and guidelines, and utilizing resources provided by pdfFiller for learning materials ensures you stay informed. This approach helps you remain compliant and efficient in your future filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get instructions for filing an?

How do I edit instructions for filing an online?

How can I edit instructions for filing an on a smartphone?

What is instructions for filing an?

Who is required to file instructions for filing an?

How to fill out instructions for filing an?

What is the purpose of instructions for filing an?

What information must be reported on instructions for filing an?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.