Get the free Thailand Employee and Contractor Data Protection Notice

Get, Create, Make and Sign thailand employee and contractor

Editing thailand employee and contractor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out thailand employee and contractor

How to fill out thailand employee and contractor

Who needs thailand employee and contractor?

Understanding the Thailand Employee and Contractor Form

Overview of employment regulations in Thailand

Thailand boasts a comprehensive legal framework governing employment, which includes labor laws that protect both employers and employees. Workers' rights and obligations are articulated through various statutes, providing guidance on issues like minimum wage, working hours, and benefits. For businesses, adhering to these regulations is crucial, as failure to comply can result in significant penalties. Equally important is the documentation involved in the hiring process; accurate and complete forms can safeguard your business and ensure you meet legal requirements.

Employers must recognize the importance of proper documentation when hiring employees or contractors. Accurate forms not only help in establishing a clear employment relationship but also play a vital role in protecting the rights of all parties involved. Moreover, maintaining thorough records can aid in meeting compliance standards and facilitate smooth operational processes.

Employee vs. contractor: Key differences

In Thailand, understanding the distinction between employees and contractors is essential. Employees are typically engaged through employment contracts, which outline specific duties, benefits, and obligations governed by labor laws. Being classified as an employee means access to protection under the labor regulations, including rights to paid leave, health insurance, and severance pay, making it imperative for employers to understand their responsibilities.

Conversely, contractors, often hired for specific tasks or projects, operate under a different legal framework. They are not entitled to the same benefits as employees and generally have more flexibility in their work arrangements. However, they are responsible for their own taxes and insurances, which shifts certain liabilities to them. Understanding these differences is crucial for businesses to ensure proper classification and the associated legal implications.

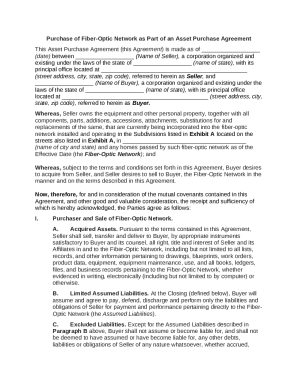

Essential components of the Thailand employee form

A well-structured Thailand employee form comprises several essential components that capture critical personal and work details. At the outset, personal information requirements include full name, address, and contact details. This foundational data allows companies to maintain accurate records.

In addition to personal information, the form must detail work specifics such as job title, start date, and department. This captures the employee's role within the organization. Compensation information, including salary, bonuses, and other benefits, must also be outlined to ensure transparency and compliance with labor laws. Furthermore, documenting the agreement duration and working hours is essential to adhere to local regulations and ensure a mutual understanding between the employer and employee.

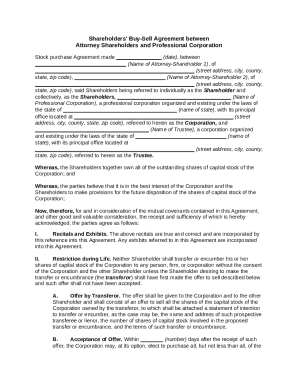

Comprehensive breakdown of the contractor form

Similar to the employee form, the contractor form requires specific identification details to ensure clarity and accountability. Key elements include the contractor's name, business registration details, and contact information. This is vital for contractual agreements and any potential disputes.

Additionally, outlining the scope of work is crucial, which should encompass a clear project description along with the timeline for completion. This not only sets expectations but also facilitates better project management. The payment structure must be detailed, including the rates, invoicing procedures, and taxes applicable. Lastly, including termination clauses clarifies conditions under which either party can dissolve the agreement, providing security for both individuals and organizations.

How to fill out employee and contractor forms correctly

Filling out forms correctly is essential to avoid legal complications. For employees, the first step is to gather necessary information, including identification and personal details. Once that is ready, ensure accuracy by filling out forms with complete and precise data. It’s also paramount to review the completed form to ensure compliance with local laws and internal policies.

For contractors, the process involves customizing the contractor form to fit the specific project needs. Clearly defining terms of engagement helps in preventing misunderstandings. Make sure to include the scope of work accurately and outline all financial terms to ensure clarity and prevent any discrepancies down the line.

Common mistakes to avoid in employment and contractor forms

Avoiding common mistakes in employment and contractor forms is critical for both compliance and operational efficiency. Common errors include incomplete information, which can lead to processing delays or legal issues. Furthermore, misunderstanding employment classification can result in unforeseen liabilities, impacting payroll and benefits. Employers should ensure they classify workers accurately to avert legal complications that could arise from misclassification.

In addition, failing to comply with Thailand’s labor regulations can lead to serious consequences. Conducting regular reviews of employee and contractor forms helps safeguard against errors and ensures adherence to evolving laws and provisions, thus promoting a compliant and responsible workplace.

Managing changes and updates in employment and contractor forms

Keeping employment and contractor forms up-to-date is vital for maintaining compliance and organizational efficiency. Regular changes might be necessary due to shifts in regulations, employee status, or project parameters. It is essential to know when and how to update these forms to reflect the current working conditions accurately.

Moreover, establishing a strong record-keeping system streamlines the process of managing updates. Utilizing digital tools, such as those offered by pdfFiller, simplifies document management, allowing users to store, edit, and approve forms efficiently while ensuring compliance with legal requirements.

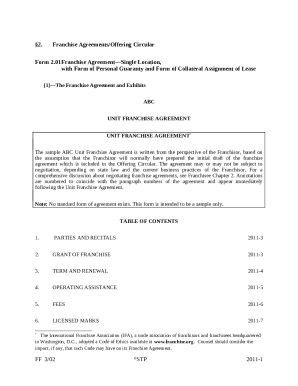

Utilizing digital tools for form management

Implementing cloud-based platforms for document creation offers numerous advantages, especially in today’s fast-paced work environment. These solutions enhance collaboration among teams, enabling staff to access documents from anywhere, streamlining the overall workflow. This capability improves communication and ensures that all parties can stay informed about key documents.

pdfFiller, in particular, offers interactive features that allow for seamless editing and signing of documents. The availability of eSigning capabilities enhances the speed and convenience of securing critical agreements, while real-time editing options promote accuracy and collaboration, ultimately contributing to a more agile and responsive business environment.

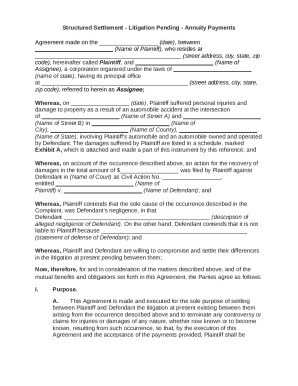

Real-world scenarios: Examples of effective form usage

Examining real-world scenarios sheds light on the effective usage of employee and contractor forms. For instance, a technology startup in Bangkok utilized comprehensive contractor forms to engage freelance software developers. This not only clarified the project scope but also included specific payment terms, resulting in successful project completion and mutual satisfaction.

Moreover, teams using pdfFiller reported enhanced efficiency when managing their documentation process. By streamlining form management, companies reduced administrative burdens, allowing them to focus more on core business activities, while still ensuring compliance with employment and contractor regulations.

Security and compliance considerations

Security and compliance must never be an afterthought when handling employee and contractor information. Protecting data privacy is paramount, particularly given Thailand’s data protection regulations. Businesses must implement stringent security measures to ensure sensitive information remains confidential and is only accessible to authorized personnel.

Incorporating compliance checks within the document management process helps mitigate risks associated with data handling. Platforms like pdfFiller provide enhanced security features, ensuring user data is stored securely while also facilitating compliance with local regulations, thus fostering trust with employees and contractors alike.

Frequently asked questions (FAQs)

1. What documents do I need to hire an employee or contractor in Thailand? To hire, you typically need a signed employee or contractor form, along with identification documents, tax information, and perhaps work permits for foreign workers.

2. How do employment laws affect the terms in these forms? Employment laws dictate the minimum requirements for employee benefits, wages, and working conditions, influencing how terms are structured in these forms.

3. Can I use a single form for both employees and contractors? While similarities exist, it’s advisable to maintain separate forms as they cater to different legal requirements and obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute thailand employee and contractor online?

Can I create an eSignature for the thailand employee and contractor in Gmail?

How do I edit thailand employee and contractor on an iOS device?

What is Thailand employee and contractor?

Who is required to file Thailand employee and contractor?

How to fill out Thailand employee and contractor?

What is the purpose of Thailand employee and contractor?

What information must be reported on Thailand employee and contractor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.