Get the free By the Numbers: A Breakdown of Results From Sotheby's ...

Get, Create, Make and Sign by form numbers a

Editing by form numbers a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out by form numbers a

How to fill out by form numbers a

Who needs by form numbers a?

By form numbers a form: A comprehensive guide

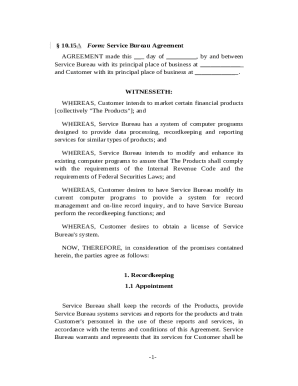

Overview of form numbers

Form numbers are essential identifiers assigned to specific documents across various sectors, including government, finance, and healthcare. These numbers serve a crucial purpose in streamlining processes, ensuring that submissions are organized and that individuals they pertain to can identify them with precision. For example, in the realm of taxation, the W-2 form number helps individuals report their annual earnings to the IRS, enhancing clarity and accountability.

The significance of accurate form numbers cannot be overstated. They play a key role in ensuring that submissions are processed correctly and timely. Misplaced or incorrect form numbers can lead to delays, rejections, or the submission of inappropriate forms, causing frustration for users. Understanding form numbers allows individuals and organizations to select the right documents for their specific needs, thereby facilitating smoother interactions with various systems.

How to identify form numbers

Identifying the correct form number is the first step in ensuring accurate completion and submission. One effective way to find form numbers online is by utilizing search engines with specific queries, including the name of the form and the jurisdiction it pertains to. For instance, searching for 'IRS W-2 form number' will yield relevant results directly linked to the official IRS website.

In addition, it’s useful to consult standard databases and governmental websites, such as the IRS website or the Healthcare.gov site. These platforms usually have comprehensive sections dedicated to forms, where users can find links to the exact form numbers they need.

A comprehensive guide to specific forms by number

Familiarity with commonly used forms and their respective numbers can greatly expedite various processes. For instance, the W-2 form, a critical document for wage reporting, is recognized by its unique number, making it essential for both employees and employers alike. The 1099 form is another key document used mainly for reporting income from non-employment sources, ensuring that taxpayers accurately report their financial situations to the authorities.

Understanding how form numbers are structured is also beneficial. Reading a form number involves recognizing its components. For instance, the W-2 form includes indicators for the type of document and specifics related to tax years, allowing individuals to quickly identify which version they need to use.

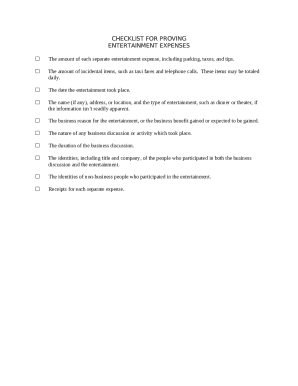

Steps to fill out forms by number

Before filling out any form, it is crucial to prepare adequately. This involves gathering all relevant documents and information that may be needed for completion. For example, if completing a W-2 form, you'll need details about your earnings, tax withholdings from your pay stubs, and personal identification and address information. Thoroughly understanding the requirements for each specific form assists in ensuring nothing is overlooked.

Once you have everything in place, follow a streamlined process to fill out the forms accurately. Here’s a detailed step-by-step guide for filling out the W-2 form: 1. Begin with your employer’s information, including name and address. 2. Next, enter your personal details, such as your name, Social Security number, and address. 3. Fill in the appropriate boxes regarding your earnings and tax withholdings. 4. Verify each section thoroughly before moving onto the next, as any errors could result in complications.

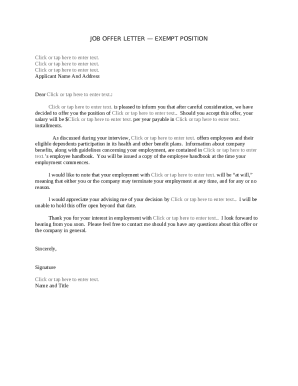

Editing and signing forms

Once the forms are completed, you may need to edit and adjustments for clarity or accuracy. Utilizing tools like pdfFiller can significantly enhance your ability to modify existing PDFs effortlessly. With features for annotation, highlighting, and inserting text boxes, editing forms becomes a straightforward task even for those who may not be tech-savvy.

Incorporating electronic signatures into your documents allows for quicker processing and eliminates the need to print or physically mail forms. To eSign your forms using pdfFiller, simply follow these steps: 1. Open your form in pdfFiller. 2. Click on the ‘eSign’ button and select 'Add Signature.' 3. Choose to either draw your signature, upload an image, or type your name for auto-generating a signature.

Collaborating and sharing completed forms

Sharing completed forms for review or collaboration with teams and clients can make workflows smoother and more organized. Best practices for sharing documents must be adhered to, ensuring that security and proper permissions are in place. Password protection and access restrictions can keep sensitive information safe while allowing others to review or sign documents.

To facilitate collaboration using pdfFiller, utilize features such as shared links for easy access. You can also gather feedback directly on the platform, using comments and suggestions to facilitate discussions. This helps streamline the process of obtaining approvals while keeping records of changes made throughout.

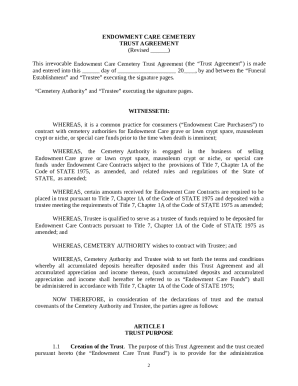

Managing your forms and documents

Efficient document management is critical for maintaining an organized filing system. Utilizing pdfFiller allows users to store and categorize forms systematically, leveraging folders and tags for streamlined retrieval. This greatly reduces the time spent searching for specific documents, thereby enhancing productivity.

Additionally, tracking the status of submitted forms becomes easier with online tools. pdfFiller offers features for monitoring submissions and keeping tabs on any changes made, ensuring that users have access to both the latest and previous versions of their documents. This capability is particularly useful in environments where multiple versions of documents may exist.

Troubleshooting common issues with form numbers

Despite thorough preparation, users often encounter challenges with form numbers. Common issues include misfiled forms featuring incorrect numbers, which can lead to late or denied submissions. Such hurdles can be frustrating and time-consuming, but they can be resolved with the right approach.

If a form is rejected due to an incorrect number, the first step to take is to carefully review the feedback provided. Many organizations will specify the error, allowing you to correct it promptly. Additionally, reaching out to customer support or utilizing resources available on the institution's website can provide guidance for smooth resubmission.

Real-world examples of form usage

To grasp the importance of effective form management, consider the following real-world case studies. A local nonprofit organization successfully navigated grant applications by adhering to the proper utilization of form numbers, resulting in timely funding. They made use of pdfFiller to collaborate seamlessly with multiple stakeholders, ensuring that all forms were readily available and errors were markedly reduced.

Conversely, an individual experienced delays in their tax return processing due to submitting an incorrect form number on their income tax return. This highlighted the importance of accuracy in form identification, pushing the individual to implement changes in their document management approach, emphasizing the need to utilize reliable platforms like pdfFiller for ensuring optimal completion and submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit by form numbers a from Google Drive?

How can I send by form numbers a for eSignature?

Can I edit by form numbers a on an Android device?

What is by form numbers a?

Who is required to file by form numbers a?

How to fill out by form numbers a?

What is the purpose of by form numbers a?

What information must be reported on by form numbers a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.