Comprehensive Guide to the Fac-Simile Dichiarazione Assoggettamento Form

Understanding the fac-simile dichiarazione assoggettamento

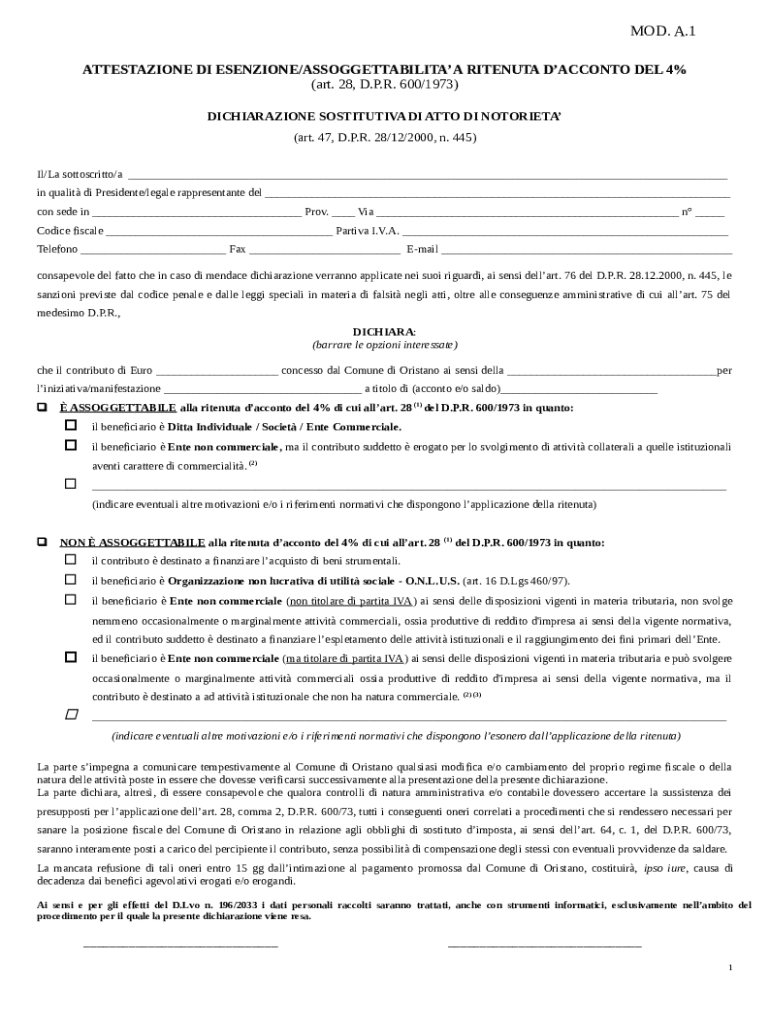

The fac-simile di dichiarazione assoggettamento form is an essential document used primarily in Italy for individuals and businesses to declare their financial status and tax obligations. This form serves multiple purposes in the realm of finance and administration, helping ensure accurate reporting to tax authorities. It's crucial to understand that the form plays a vital role in compliance, as inaccuracies can lead to significant penalties or delays in processing.

Accurate completion of the fac-simile di dichiarazione assoggettamento form is not just a matter of convenience; it carries legal implications. For businesses, this form can be instrumental in auditing processes and assessing tax liabilities. Individuals often use it for personal tax returns or to declare changes in financial circumstances, like income or residency status. The form's effective use can streamline correspondence with the Amministrazione Cantonale, making it a cornerstone in Swiss administrative interactions.

Individuals: Use the form to report personal income, ensuring compliance with local tax laws.

Businesses: Required for tax reporting and financial transparency; essential for audits.

Legal Requirements: Following prescribed formats is necessary to avoid penalties and ensure valid submissions.

Key components of the fac-simile dichiarazione assoggettamento

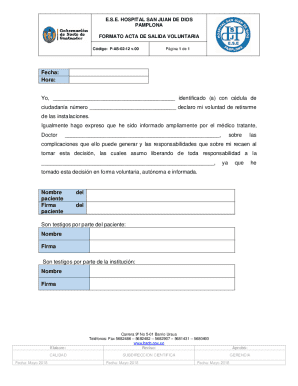

Understanding the structure of the fac-simile di dichiarazione assoggettamento form is paramount for its proper use. The layout typically includes several distinct sections, each with its own specific function. Chunking the form into manageable parts helps ensure that the user can provide all necessary information without feeling overwhelmed. Each section has a clear purpose, guiding users through the necessary fields and data required for completion.

The personal information fields often include essential identifiers such as name, address, and tax identification numbers. In the financial data sections, individuals and businesses need to provide income details, bank information, and any relevant deductions or credits. Finally, the form typically requires a date and signature, affirming that the information reported is accurate and reflective of the individual or entity’s tax standing.

Sections and Their Functions: The form is divided into identifiable sections detailing personal data, financial status, and signature verification.

Required Information: Users must fill in personal information accurately, including identity and financial credentials.

Signature Requirements: Completing the form is concluded with user validation through a signature, which confirms the authenticity of the submission.

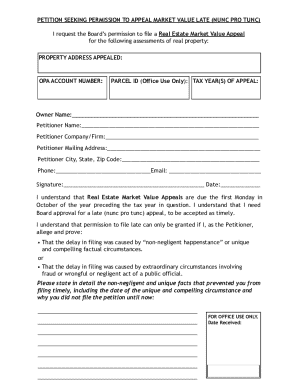

Step-by-step instructions for filling out the form

Before diving into filling out the fac-simile di dichiarazione assoggettamento form, gather all necessary documents to facilitate a smooth process. Essential documents may include previous tax returns, financial statements, and identity verification documents. Having these on hand reduces errors and omissions, making it easier to complete the form accurately.

The process of completing the form can be broken down into three key sections. First, personal information needs to be input accurately; for individuals, this includes details like full name and contact information. Second, when inputting financial details, ensure all income sources are declared with the corresponding amounts to maintain transparency. Finally, it’s crucial to fill in the date and provide a signature, confirming all information presented is accurate to the best of your knowledge.

Personal Information: Input details such as your full name, address, and tax identification number.

Financial Details: Declare all relevant income and applicable deductions or credits to ensure accuracy.

Date and Signature: Review all entered information before signing and dating the form to validate it.

Avoid common mistakes such as miscalculating income totals, overlooking required signatures, or entering incorrect identification numbers, as these errors can lead to complications or delays in processing.

Editing and customizing the form via pdfFiller

Using pdfFiller to edit and customize your fac-simile di dichiarazione assoggettamento form offers a streamlined experience. Users can quickly access the editor via the pdfFiller platform, allowing for easy alterations and enhancements to the document. The ease of use is one of the primary features that distinguishes pdfFiller from traditional forms.

Once you have accessed the editor, you can add or remove fields as necessary, ensuring that your form is tailored to your specific requirements. Utilizing templates from the pdfFiller library can also enhance efficiency, giving users a pre-formatted document that requires only the addition of personalized details.

Accessing the Editor: Log into pdfFiller and navigate to the appropriate section where your form resides.

Adding/Removing Fields: Use the intuitive interface to customize forms, aligning them with your needs.

Utilizing Templates: Take advantage of pre-designed templates that can save time during editing.

Collaborating on the form

Collaboration becomes integral, especially when multiple stakeholders must review or input information into the fac-simile di dichiarazione assoggettamento form. pdfFiller facilitates a multi-user collaboration feature that allows individuals or teams to work together seamlessly. Shared access to the form enables prompt feedback and quicker adjustments.

Additionally, the commenting tools available within pdfFiller enhance the overall collaborative experience. Users can leave constructive feedback, ask questions, or propose changes directly on the document. This direct interaction significantly boosts productivity and ensures clarity in communication among users.

Multi-User Collaboration Features: Enable multiple users to work on the same document in real-time.

Sharing the Form for Feedback: Easily share drafts with colleagues for input before finalizing.

Commenting Tools: Use in-app comments for suggestions or questions to streamline the revision process.

Signing the fac-simile dichiarazione assoggettamento

A noteworthy feature of pdfFiller is its ability to facilitate eSignatures, making the process of finalizing the fac-simile di dichiarazione assoggettamento form efficient and legally valid. Digital signatures are becoming increasingly important in the realm of document management, as they ensure authenticity and security.

To eSign your completed form with pdfFiller, follow a straightforward guide: after filling out your form, navigate to the eSignature option, specify your signature preferences, and finalize the signing process. This method not only saves time but also ensures the security of your document without the need for printouts.

Importance of Digital Signatures: They enhance security and reduce the risk of forgery.

Step-by-Step Guide to eSigning: Choose and apply your signature using the tools provided in pdfFiller.

Legal Validity of eSignatures: Understand that eSignatures are recognized by law, ensuring your submissions are legitimate.

Managing your documents

After finishing your fac-simile di dichiarazione assoggettamento form, effective document management becomes essential. pdfFiller offers various organizational tools to keep your completed forms sorted and accessible. Whether for individual users or teams, managing documents can streamline processes and allow for easier tracking of essential paperwork.

Secure storage options are also available within pdfFiller, providing peace of mind when it comes to sensitive information. Users can retrieve and share completed forms conveniently via the platform, enhancing accessibility and teamwork, regardless of physical location.

Organizing Your Completed Forms: Use folders and tagging systems for easy retrieval.

Secure Storage Options: Benefit from encrypted storage for safeguarding sensitive documents.

Retrieving and Sharing Completed Forms: Easily access and distribute forms to relevant parties.

Troubleshooting common issues

Even with user-friendly tools like pdfFiller, issues can arise when filling out the fac-simile di dichiarazione assoggettamento form. Common errors include data entry mistakes, which can lead to incorrect submissions. Identifying these errors early on can prevent potential penalties or processing delays.

Additionally, technical issues with pdfFiller could hinder the editing or eSigning processes. It's advisable to be prepared and know who to contact for support when needed. pdfFiller ensures users have access to dedicated support resources, helping to resolve technical glitches swiftly.

Common Errors When Using the Form: Review the most frequent mistakes to watch for while filling the form.

Technical Issues with pdfFiller: Understand and troubleshoot common technical problems users face.

Support Options Available: Access the support channels provided by pdfFiller to resolve issues quickly.

Additional features of pdfFiller

Beyond mere form filling, pdfFiller provides additional features that enhance user experience and document management capabilities. Integration with other tools can streamline workflows, ensuring that documents flow smoothly within the user’s ecosystem. This is particularly beneficial for teams working on various projects that require collaboration across different applications.

Mobile accessibility ensures that users can manage their documents from anywhere, accommodating a mobile workforce. As a cloud-based solution, pdfFiller stands out for its ability to provide services that are not only effective but also adaptive to various environments and use cases.

Integration with Other Tools: Connect with applications like Google Drive and Dropbox for comprehensive document management.

Mobile Accessibility: Use pdfFiller on-the-go via mobile devices for convenience.

Benefits of a Cloud-Based Solution: Access your forms and documents from any device with internet connectivity.

Real-world applications and testimonials

The fac-simile di dichiarazione assoggettamento form has been instrumental for various users in real-world applications, showcasing its value across different sectors. Testimonials from individuals and businesses highlight how the accurate, efficient use of this form has improved compliance and operational workflows. From personal finance management to business audits, the impact of effectively managing this form is clear.

For example, companies in the Repubblica and Cantone Ticino region utilize the fac-simile for successful interactions with the Amministrazione Cantonale, leading to enhanced credibility and transparency. Effectiveness in handling this form often correlates with improved financial outcomes, punctuality in tax reporting, and overall satisfaction among stakeholders involved.

User Success Stories: Readers can find relatable experiences that demonstrate effective form management.

Case Studies of Businesses Using the Fac-Simile: Understand how companies have benefitted from its effective use.

Impact on Efficiency and Compliance: Evidence shows that proper management leads to significant improvements.