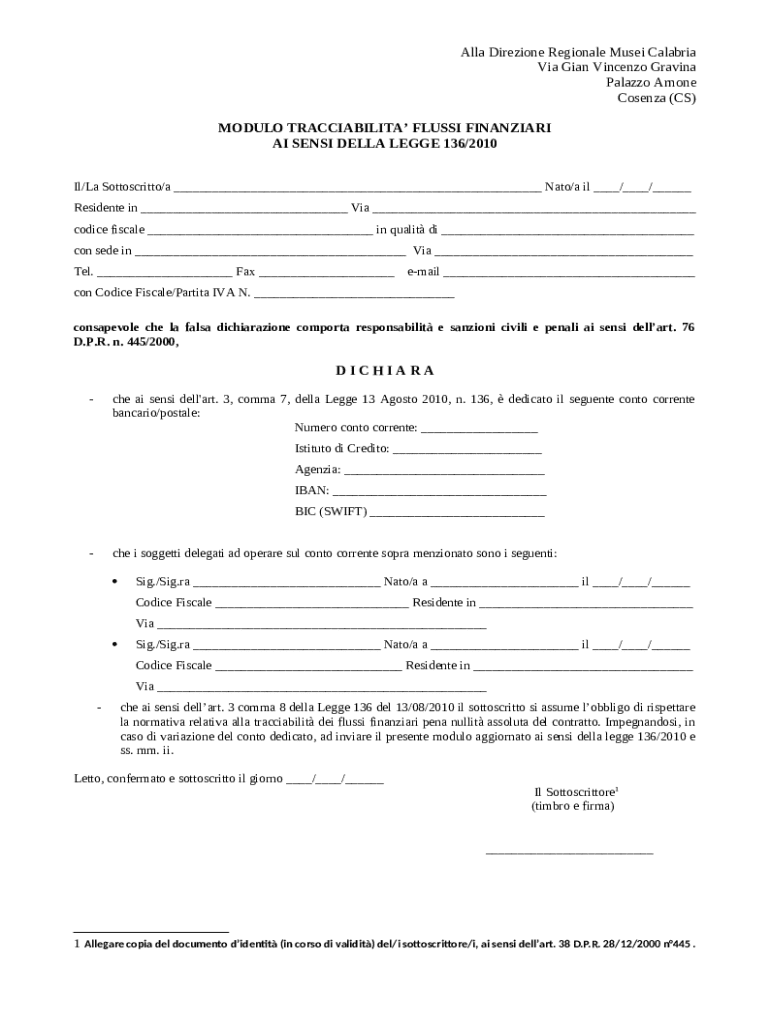

Modulo Tracciabilità Flussi Finanziari Form: A Comprehensive Guide

Overview of Modulo Tracciabilità Flussi Finanziari

The Modulo Tracciabilità Flussi Finanziari is a crucial tool designed for tracking financial flows within organizations. This form is instrumental in ensuring that every financial transaction is documented transparently and clearly, which is essential for compliance with national financial regulations. It plays a vital role in enabling organizations to maintain accurate records, thereby supporting accountability and financial integrity.

The importance of this form cannot be overstated. With the increasing emphasis on financial accountability, companies must harness the Modulo Tracciabilità Flussi Finanziari not just for internal record-keeping but also to comply with legal obligations. By clarifying the flow of money, businesses can preemptively address any potential issues that may arise from improper record-keeping.

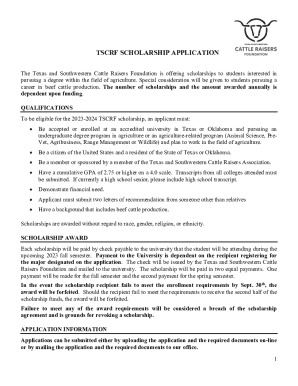

Legal implications

Various laws and regulations mandate the use of this form, primarily to uphold financial transparency and prevent fraudulent activities. For instance, Italian law requires precise documentation of financial transactions to combat issues related to money laundering. Non-compliance with these regulations can result in hefty fines and legal complications, making adherence to the guidelines outlined in the Modulo Tracciabilità Flussi Finanziari essential.

Organizations must stay informed about these legal frameworks and ensure that they comprehensively understand their implications. The consequences of failing to comply with the necessary financial documentation can range from financial penalties to loss of reputation, making the effective use of the Modulo Tracciabilità Flussi Finanziari not just advisable but imperative.

Key features of the Modulo Tracciabilità Flussi Finanziari

The Modulo Tracciabilità Flussi Finanziari stands out with its array of essential components tailored to facilitate the tracking of financial transactions efficiently. Each section of the form is designed with a specific purpose, ensuring that all necessary information is gathered systematically. Users will encounter sections dedicated to identifying information, transaction details, and even a final review checklist to enhance accuracy.

Additionally, modern tools are available through platforms like pdfFiller, which enhance the functionality of the Modulo Tracciabilità Flussi Finanziari. By utilizing digital formats, users have access to interactive tools that allow for easier form management, such as cloud-based editing and real-time collaboration features. This transition to digital also allows for easier access and storage of financial documentation, making life simpler for teams managing multiple forms.

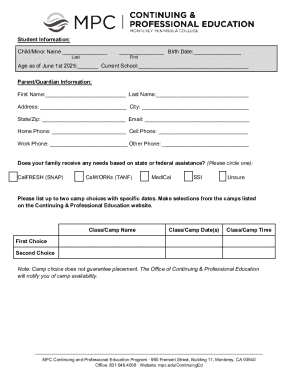

Step-by-step guide to filling out the Modulo Tracciabilità Flussi Finanziari

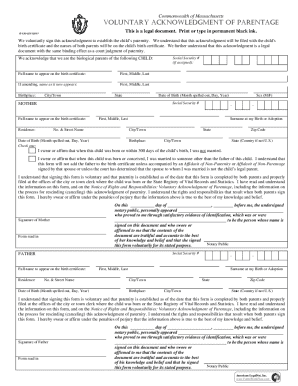

Filling out the Modulo Tracciabilità Flussi Finanziari requires careful preparation and precision. Before starting, gather all relevant documents and information which typically includes financial statements, invoices, and organizational identification such as the codice fiscale. Ensuring you have this information readily available streamlines the process and helps in accurately completing each section of the form.

Follow these detailed instructions for each section of the form:

Identifying Information: Input your personal and organizational data, including the codice fiscale, ensuring that all information is correct to avoid discrepancies.

Transaction Details: Report financial transactions in clear terms, including amounts, dates, and involved parties, which is essential for complete and accurate records.

Final Review and Submission Process: Double-check all entries for accuracy before submitting the form to prevent errors that could lead to compliance issues.

Editing and customizing the Modulo Tracciabilità Flussi Finanziari with pdfFiller

The power of pdfFiller extends beyond simple filling; it offers a robust suite of editing tools tailored for the Modulo Tracciabilità Flussi Finanziari. Users can conveniently edit their forms with features like text addition, reformatting, and even document conversion. To use these tools effectively, simply upload your document to the platform and follow the intuitive prompts to modify sections of the form as required.

Moreover, pdfFiller allows for adding comments and annotations to facilitate team collaborations. Team members can review and suggest changes directly on the document, making communication fluid and efficient and ensuring that all users are aligned on the final details before submission.

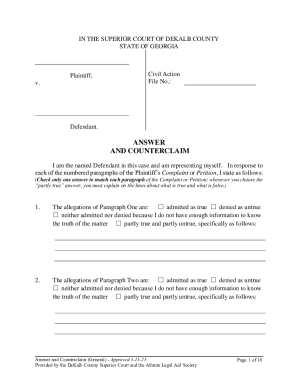

eSigning the Modulo Tracciabilità Flussi Finanziari

eSigning is a crucial aspect of modern financial documentation, including the Modulo Tracciabilità Flussi Finanziari. Electronic signatures hold legal validity just like traditional handwritten signatures, streamlining the process of document approval. This functionality not only enhances efficiency but also enhances security and documentation integrity.

To add an eSignature using pdfFiller, follow these simple steps: upload the completed form, select the eSign option, and either create a new signature or use a previously saved one. Furthermore, ensure that you comply with legal requirements by consistently presenting your signature alongside any necessary identifiers, such as your codice fiscale, to confirm your identity and authorization.

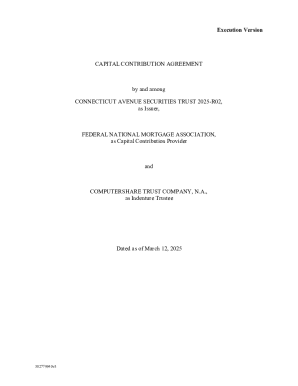

Managing and storing your form with pdfFiller

pdfFiller’s cloud-based features revolutionize the way you manage your financial forms, offering secure access to your documents from anywhere. Once you have completed and saved your Modulo Tracciabilità Flussi Finanziari, it is easily retrievable with a few clicks. The organized interface allows users to search documents by keywords or specific tags, enhancing efficiency in document management.

Additionally, security is a paramount concern for financial documentation, and pdfFiller addresses this with robust encryption protocols and strict access controls. Users can rest assured that their sensitive data remains protected while utilizing the platform for editing, signing, and storing financial forms.

Troubleshooting common issues

As with any formal document submission process, errors can occur while completing the Modulo Tracciabilità Flussi Finanziari. Common pitfalls include incorrect data entry, forgetting significant transaction details, or even failing to sign and submit on time. To avoid these errors, it is advisable to create a checklist of essential elements that need to be included in the form, which can serve as a guide during the preparation process.

Additionally, if you encounter problems while using pdfFiller, refer to the FAQs section available on the platform for immediate assistance. Many common queries regarding the Modulo Tracciabilità Flussi Finanziari and pdfFiller's functionality are addressed, providing users with a valuable resource for troubleshooting.

Benefits of using pdfFiller for financial forms

The benefits of utilizing pdfFiller extend far beyond simple form completion. The cloud-based nature of the platform allows users to access their documents from any device with internet connectivity, enabling seamless management of financial forms such as the Modulo Tracciabilità Flussi Finanziari. This accessibility ensures that users can work on documentation anytime, anywhere, a significant advantage for team members who may be working remotely.

Furthermore, collaborative features foster teamwork by permitting multiple users to edit and contribute to documents concurrently. This level of collaboration can significantly reduce the time spent preparing essential documents, ensuring that all team members have the latest updates while working together.

Real-world applications and case studies

Many organizations have successfully adopted the Modulo Tracciabilità Flussi Finanziari to streamline their financial operations. For example, a mid-sized manufacturing firm in Italy utilized this form to trace their financial flows more accurately, which led to enhanced compliance with local regulations and improved transparency in their business practices.

User testimonials highlight how pdfFiller facilitated a smoother documentation process, improving collaboration among finance teams. Users have praised the platform for its user-friendly interface, which has simplified complex tasks associated with financial documentation, ultimately resulting in time savings and a reduction in errors.

Best practices for using the Modulo Tracciabilità Flussi Finanziari

To maintain accuracy and compliance when utilizing the Modulo Tracciabilità Flussi Finanziari, implement the following best practices:

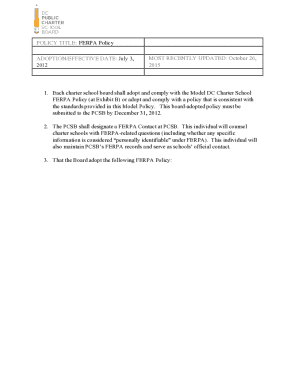

Regularly review and update your financial documentation practices to align with any changes in laws or regulations.

Establish a timeline for submission and review of forms, ensuring they are submitted promptly to meet all regulatory deadlines.

Encourage collaboration within your team by using platforms like pdfFiller to review documents collectively and suggest real-time edits.