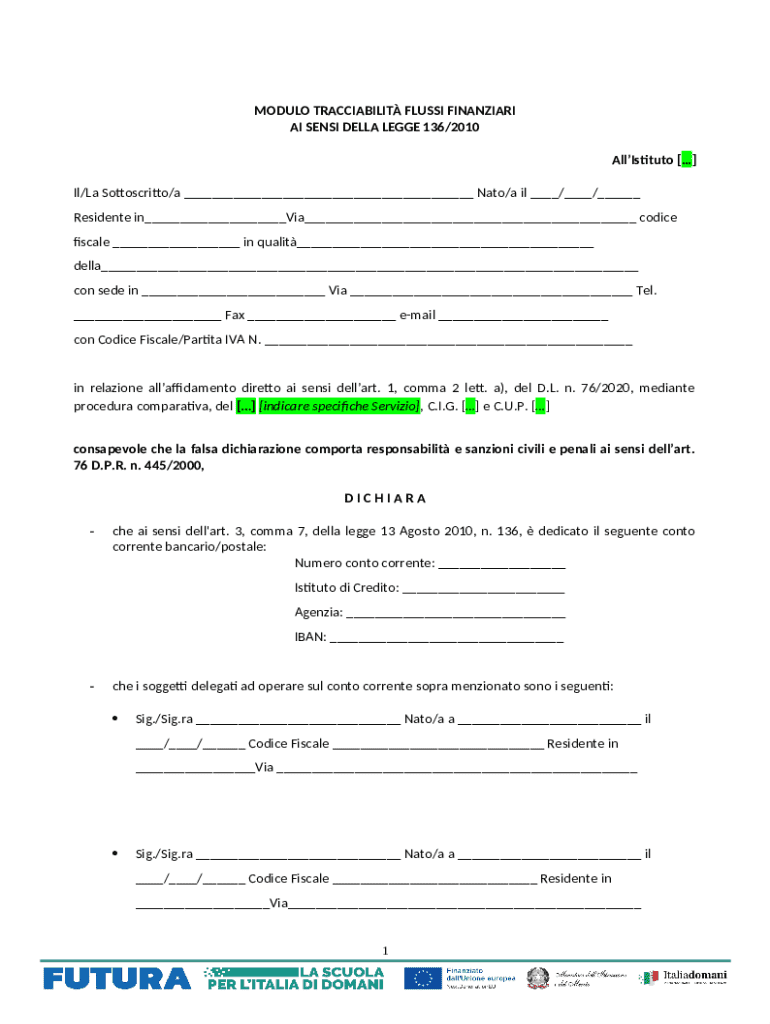

Modulo Tracciabilità Flussi Finanziari Form: A Comprehensive Guide

Overview of Modulo Tracciabilità Flussi Finanziari

The Modulo Tracciabilità Flussi Finanziari is essentially a financial flow tracking form employed primarily in Italy. Its primary purpose is to ensure that all financial transactions are recorded and traceable, complying with regulatory requirements. By documenting each financial flow thoroughly, this form plays a critical role in enhancing transparency and accountability in financial dealings.

Understanding the implications of the Modulo Tracciabilità Flussi Finanziari is paramount for organizations, especially in the context of compliance with laws and regulations centered around financial tracking. Neglecting to complete this form can lead to significant legal repercussions, including fines and other penalties that could jeopardize an organization’s financial integrity.

Definition and clarity on the purpose of the form.

Importance of compliance in financial operations.

Consequences and implications of non-compliance.

Key features of the Modulo Tracciabilità Flussi Finanziari

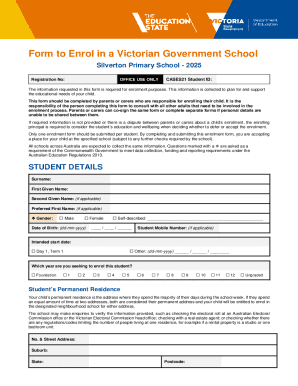

The Modulo Tracciabilità Flussi Finanziari consists of several essential components that facilitate the accurate recording of financial transactions. Each section of the form is designed with specific purposes in mind that contribute to a comprehensive financial tracking system. These components encompass identifying information, transaction specifics, and spaces for necessary approvals or confirmations.

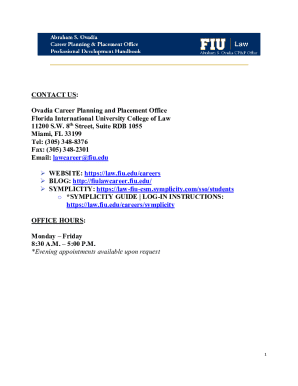

Using digital tools available through platforms like pdfFiller can simplify the process of utilizing the Modulo Tracciabilità Flussi Finanziari. These tools not only allow users to fill out forms efficiently but also provide a cloud-based management system that enhances collaboration and ease of access. Leveraging such technology significantly boosts productivity and ensures that financial documentation remains organized and compliant.

Identifying information section to capture user and organizational details.

Detailed transaction information for accurate financial reporting.

Spaces for approvals, ensuring compliance with internal protocols.

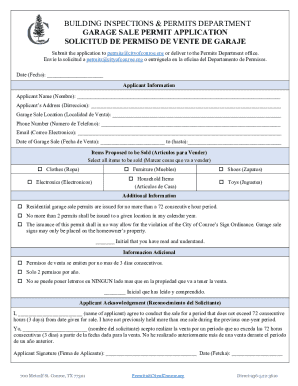

Step-by-step guide to filling out the Modulo Tracciabilità Flussi Finanziari

Before diving into the form, it's crucial to prepare necessary documentation to make the process smoother. Collect relevant financial documents that will support your entries, such as invoices, transaction receipts, and identification details, including your codice fiscale.

Filling out the Modulo Tracciabilità Flussi Finanziari involves several key steps. In the identifying information section, ensure that you accurately input your personal details and the organizational data required, including your codice and contact information. Next, when reporting transaction details, document each financial flow meticulously, specifying the nature of the transaction and its corresponding amount, ensuring transparency.

Gather all necessary information and documents prior to filling the form.

Complete the identifying information section with accurate personal and organizational details.

Meticulously record transaction details for each financial interaction.

Review the completed form thoroughly before submission to ensure all data is accurate.

Editing and customizing the Modulo Tracciabilità Flussi Finanziari with pdfFiller

pdfFiller offers an array of editing tools that allow users to modify the Modulo Tracciabilità Flussi Finanziari efficiently. Users can easily add, remove, or change text, making it simple to adapt the form to specific needs. The platform's friendly interface ensures that every user can navigate the editing process with ease, whether they are familiar with digital forms or not.

Additionally, collaborative features enable team members to add comments and annotations, streamlining communication about changes in documentation. This proves particularly useful in situations requiring multiple stakeholders' inputs, ensuring everyone is on the same page while working on their financial documents.

Utilize pdfFiller's tools to edit the form with ease.

Add comments or annotations for collaborative input.

Ensure effective communication with team members during the editing process.

eSigning the Modulo Tracciabilità Flussi Finanziari

In today's digital age, the significance of eSigning documents, especially financial ones, cannot be overstated. The legal validity of electronic signatures is well-established, ensuring that signed documents hold up in courts and compliance evaluations. This makes eSigning an essential process when handling the Modulo Tracciabilità Flussi Finanziari.

Using pdfFiller, adding an eSignature is a straightforward process. Users simply select their signature style, place it on the document, and complete the signing process. To ensure signature compliance, it’s crucial to follow specific guidelines, such as verifying the identity of signers and being aware of any state-specific legislation surrounding eSigning.

Recognize the legal validity of electronic signatures.

Follow a simple process to add your eSignature using pdfFiller.

Ensure compliance with regulations specific to your location concerning eSigning.

Managing and storing your form with pdfFiller

One of the major advantages of using pdfFiller is its cloud-based features that enable effective document management. Users can not only store their filled-out Modulo Tracciabilità Flussi Finanziari securely but can also organize forms based on different categories and labels for easy retrieval. This is particularly beneficial for financial audits or compliance checks, where quick access to records is essential.

Alongside organizational benefits, pdfFiller prioritizes security, providing users with assurances that their sensitive data and personal information are protected. By employing encryption protocols and secure storage solutions, pdfFiller mitigates risks associated with document handling, which is crucial in maintaining trust and integrity in financial transactions.

Utilize cloud-based features for efficient document management.

Organize forms for easy retrieval during audits.

Benefit from robust security measures that protect sensitive data.

Troubleshooting common issues

When filling out the Modulo Tracciabilità Flussi Finanziari, users may encounter common errors that could potentially lead to non-compliance. Recognizing these pitfalls in advance can save time and prevent complications during submission. Common mistakes include incomplete information, inaccuracies in transaction reporting, and failing to provide necessary supporting documents.

Furthermore, having a frequently asked questions (FAQs) section can help clarify concerns regarding the Modulo Tracciabilità Flussi Finanziari. Understanding common inquiries can help users navigate the complexities of the form, thereby streamlining the completion process and maintaining compliance with relevant regulations.

Identify common errors such as incomplete forms.

Utilize FAQs to address concerns regularly mentioned by users.

Stay updated with common troubleshooting solutions.

Benefits of using pdfFiller for financial forms

One of the most significant advantages of using pdfFiller is the flexibility it offers for accessing forms from anywhere at any time, providing users with the freedom to manage their documentation on-the-go. Particularly for individuals and teams operating in dynamic environments, having access to important forms like the Modulo Tracciabilità Flussi Finanziari can greatly enhance workflow efficiency.

Moreover, pdfFiller's collaborative features boost teamwork, allowing multiple users to work on the same document simultaneously, offering feedback, and making changes in real-time. This level of collaboration fosters increased productivity and ensures that all financial documentation is completed accurately and on time.

Access your forms anytime and anywhere for unparalleled flexibility.

Leverage collaborative features for effective teamwork.

Increase overall productivity in managing financial documentation.

Real-world applications and case studies

Many organizations have successfully integrated the Modulo Tracciabilità Flussi Finanziari into their operational protocols, streamlining their financial tracking and compliance processes. Real-world cases highlight how adherence to this form can lead not only to compliance but also improved operational efficiency in financial reporting.

Feedback from users who have utilized pdfFiller’s services in conjunction with the Modulo Tracciabilità Flussi Finanziari is overwhelmingly positive. Testimonials often emphasize the user-friendly interface and time-saving capabilities that pdfFiller brings to the table, further validating its role as an indispensable tool for individuals and teams alike.

Case studies illustrating successful Modulo Tracciabilità Flussi Finanziari integration.

User testimonials highlighting positive experiences with pdfFiller.

Examples of operational efficiency achieved through better financial tracking.

Best practices for using the Modulo Tracciabilità Flussi Finanziari

Practicing diligence and accuracy when utilizing the Modulo Tracciabilità Flussi Finanziari will aid in maintaining compliance and bolstering overall financial integrity. Regular updates to the form, reflection on submission timelines, and thorough reviews of entered data can significantly reduce the risks of errors.

Moreover, incorporating a routine of double-checking completed forms and collecting feedback from your team can foster a culture of accountability. By following recommended timelines for submission, ensuring proper documentation is attached, and staying informed regarding any changes in regulations, users can uphold their responsibility towards maintaining compliance.

Practice accuracy in form filling to maintain compliance.

Implement regular reviews of submitted forms to minimize errors.

Stay informed about regulatory updates relating to financial documentation.