Understanding the Tracciabilit dei Flussi Finanziari Form

Overview of tracciabilit dei flussi finanziari

Tracciabilit dei flussi finanziari refers to the process of tracking and documenting the flow of financial transactions. This practice is crucial for transparency and accountability in financial operations, especially for businesses and individuals managing large sums of money. Maintaining precise records of financial flows helps various stakeholders, including regulatory bodies, to ensure compliance with laws and regulations.

The key reasons for maintaining traceability include preventing money laundering, fraud detection, and ensuring proper tax reporting. By accurately tracking financial transactions, entities can not only comply with regulations but also build trust with clients and partners, thereby enhancing their reputation in the marketplace.

Enhances transparency in financial dealings.

Facilitates compliance with regulatory requirements.

Aids in fraud detection and prevention.

Builds trust among stakeholders.

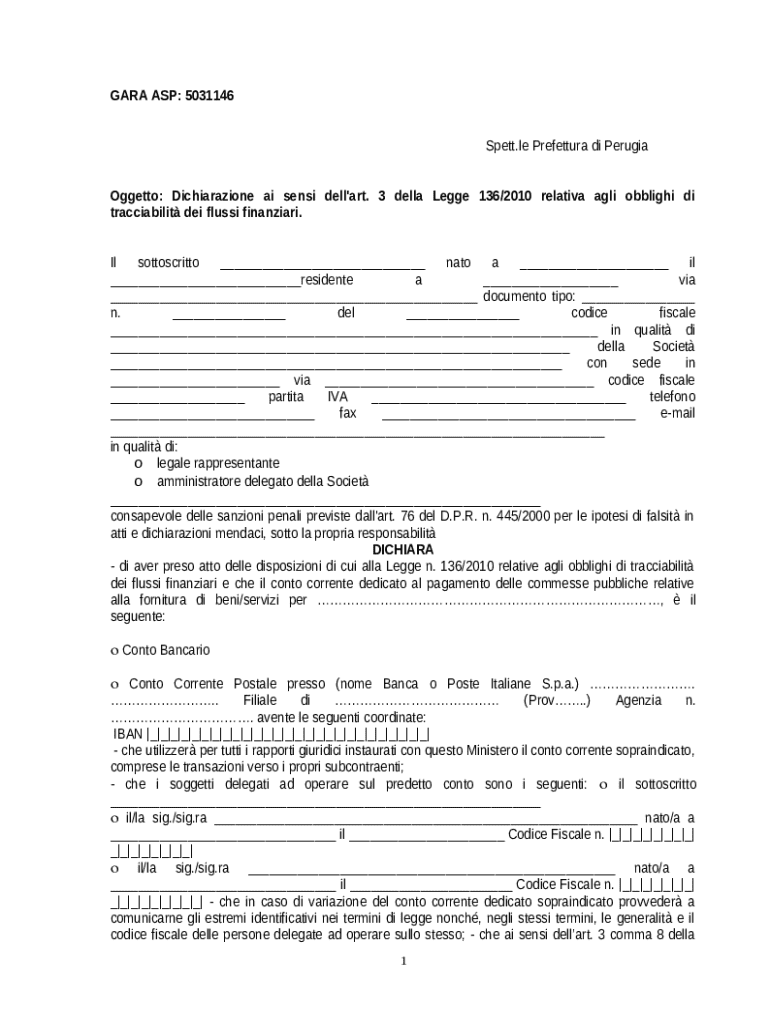

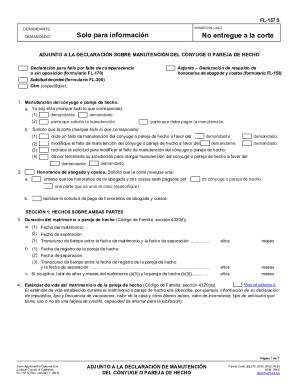

Understanding the tracciabilit dei flussi finanziari form

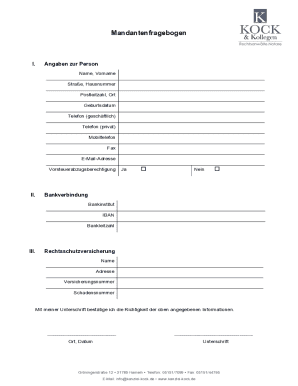

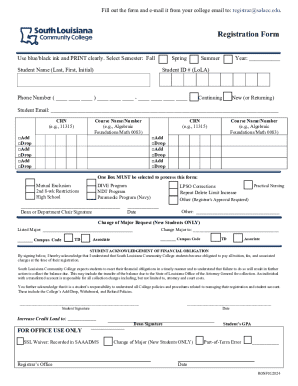

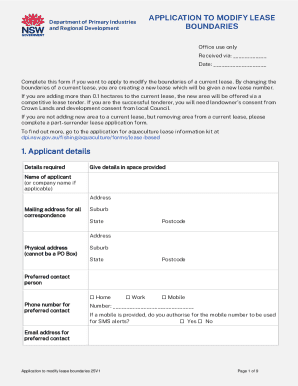

The tracciabilit dei flussi finanziari form is designed to capture key financial transactions and their underlying details. Its primary purpose is to ensure that all parties involved in financial transactions are aware of and accountable for the flows of money in and out of their accounts. This form is generally required to be filled out by businesses, non-profit organizations, and in some cases, individuals, particularly when dealing with significant financial activities.

Key elements of the form include various sections that collect personal information, details about sources of income, transaction specifics, and a declaration section where the individual can affirm the accuracy of the provided information. This comprehensive data collection is vital for regulatory scrutiny and helps to avoid potential legal issues stemming from misinformation.

Personal Information: Necessary identification data.

Financial Sources: Documentation of income and financial transactions.

Transaction Details: Precise reporting of monetary amounts and types.

Signature and Declaration: Acknowledgment of truthfulness.

Step-by-step guide to filling out the form

Before filling out the tracciabilit dei flussi finanziari form, it is essential to gather requisite documents and information. This preparation may include identification documents, financial statements, and any other relevant records that reflect your income sources and transaction history. Having a checklist of personal and financial details handy can streamline the process and reduce the likelihood of errors.

The detailed instructions for filling out the form are as follows:

Begin with filling in your name, address, and other relevant personal identifiers. Ensure accuracy to avoid complications.

Document the types of financial transactions you are reporting, including incomes and investments.

Accurately report amounts and the types of financial flows. Detail everything that contributes to your financial picture.

Finally, ensure you sign and date the form, affirming the truthfulness and accuracy of all reported information.

Utilizing pdfFiller for seamless document management

pdfFiller stands out with its robust features that facilitate the effortless management of forms like the tracciabilit dei flussi finanziari form. Users can take advantage of interactive editing tools that allow real-time modifications to any document. These features are particularly beneficial when immediate updates are necessary to maintain accurate records.

An additional advantage of using pdfFiller is its eSigning capabilities, which allow users to sign documents digitally. This not only speeds up the process but also ensures that signed documents are easily accessible and legally binding. Furthermore, pdfFiller promotes collaborative work environments by enabling users to share forms, engage with team members, and manage access permissions efficiently, making it ideal for organizations handling multiple forms.

Modify documents in real time.

Sign documents digitally for added convenience.

Share and collaborate effectively within teams.

Control who can view and edit documents.

Best practices for maintaining financial traceability

Maintaining accurate financial traceability requires diligence and regular updates. It is advisable to review the tracciabilit dei flussi finanziari form periodically, particularly after significant transactions. Keeping records up to date ensures that any changes in income or financial circumstances are duly documented, thus preventing discrepancies that could lead to regulatory challenges.

Establishing document retention policies is equally important. Depending on jurisdictional regulations, it might be necessary to keep certain financial documents for specified periods. Utilizing modern financial tools can further enhance tracking capabilities, with software solutions ranging from accounting systems to dedicated financial tracking apps that can integrate seamlessly into your overall workflow.

Review and revise the form regularly, especially following significant financial activities.

Establish guidelines for how long to keep financial records.

Incorporate software and platforms that assist in financial tracking.

Look for financial tools that can work together to streamline your management processes.

Common challenges and solutions

Filling out the tracciabilit dei flussi finanziari form can come with its set of challenges. Many individuals and businesses encounter common issues such as misreporting amounts, failing to include required information, or misunderstanding regulatory demands. These mistakes can lead to compliance problems and potential legal repercussions.

To overcome these challenges, it is essential to verify information before submission. Double-check amounts, ensure all required fields are filled, and stay informed about the regulatory landscape. Seeking assistance from legal advisors or financial consultants can provide additional peace of mind and enrich your understanding of compliance requirements.

Misreporting figures or omitting essential information can lead to issues.

Ensure that you understand all applicable regulations accurately.

Always double-check details before finalizing the form.

Utilize professional services when needed for clarity and compliance.

Navigating the legal aspects of financial flow traceability

Understanding the legal landscape regarding the tracciabilit dei flussi finanziari is essential for individuals and organizations alike. By being aware of your rights as well as your responsibilities, you can better navigate the complexities of financial compliance. Regulatory bodies often have strict regulations to protect against financial crime, which means that misreporting could lead to significant penalties.

Potential legal pitfalls include facing scrutiny from regulatory bodies for inadequate reporting, which may escalate to legal disputes. In case of an inquiry from authorities, having well-documented financial records can shield you from unwarranted penalties. This is why accurate reporting via the form is not just a best practice, but a necessity.

Become familiar with your legal protections and obligations.

Know the consequences of failing to report accurately.

Establish a clear process for addressing regulatory inquiries or disputes.

Maintain complete and accurate records to support your financial reporting.

Conclusion on the importance of accurate financial reporting

Utilizing the tracciabilit dei flussi finanziari form is critical for maintaining financial accountability and transparency. This form is not only a tool for compliance but also a framework that supports ethical business practices. As you engage in financial activities, understanding the importance of accurate reporting will empower you to build stronger financial relationships and protect your interests.

By leveraging tools like pdfFiller for efficient document management, teams and individuals can ensure that their financial records remain organized, compliant, and easily accessible. This seamless management system allows you to focus more on your core business activities, ensuring that financial operations run smoothly and transparently.