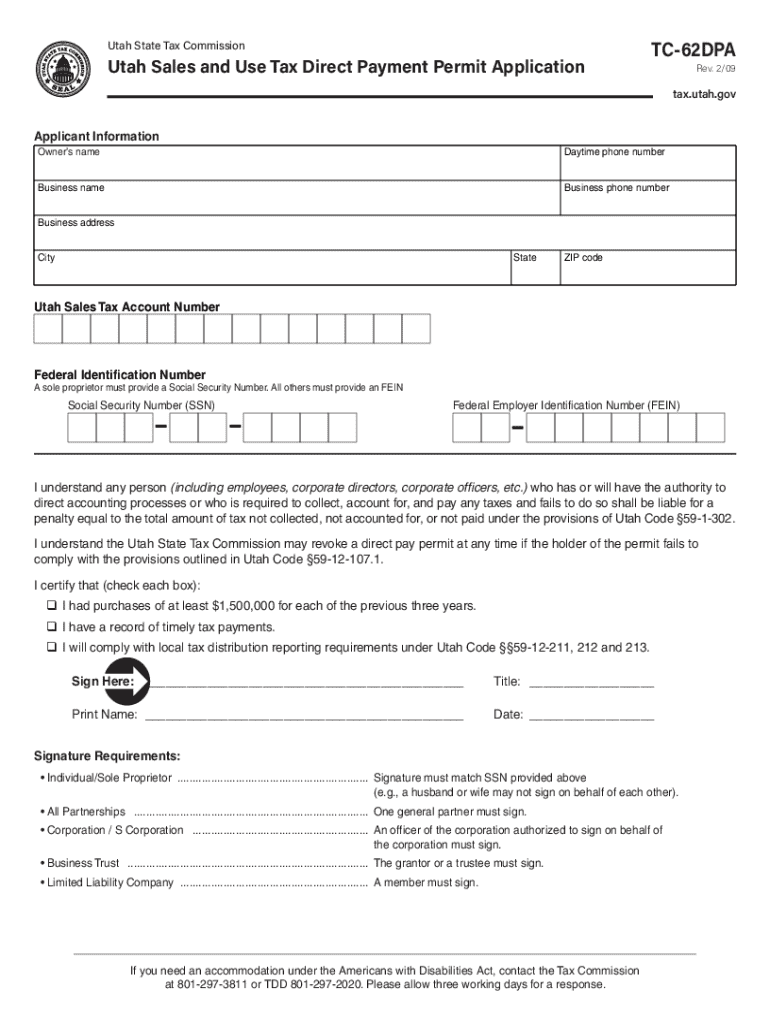

Get the free TC-62DPA, Utah Sales and Use Tax Direct Payment Permit Application. Forms & Publ...

Get, Create, Make and Sign tc-62dpa utah sales and

How to edit tc-62dpa utah sales and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-62dpa utah sales and

How to fill out tc-62dpa utah sales and

Who needs tc-62dpa utah sales and?

Understanding and Managing the tc-62dpa Utah Sales and Form

Understanding the tc-62dpa form

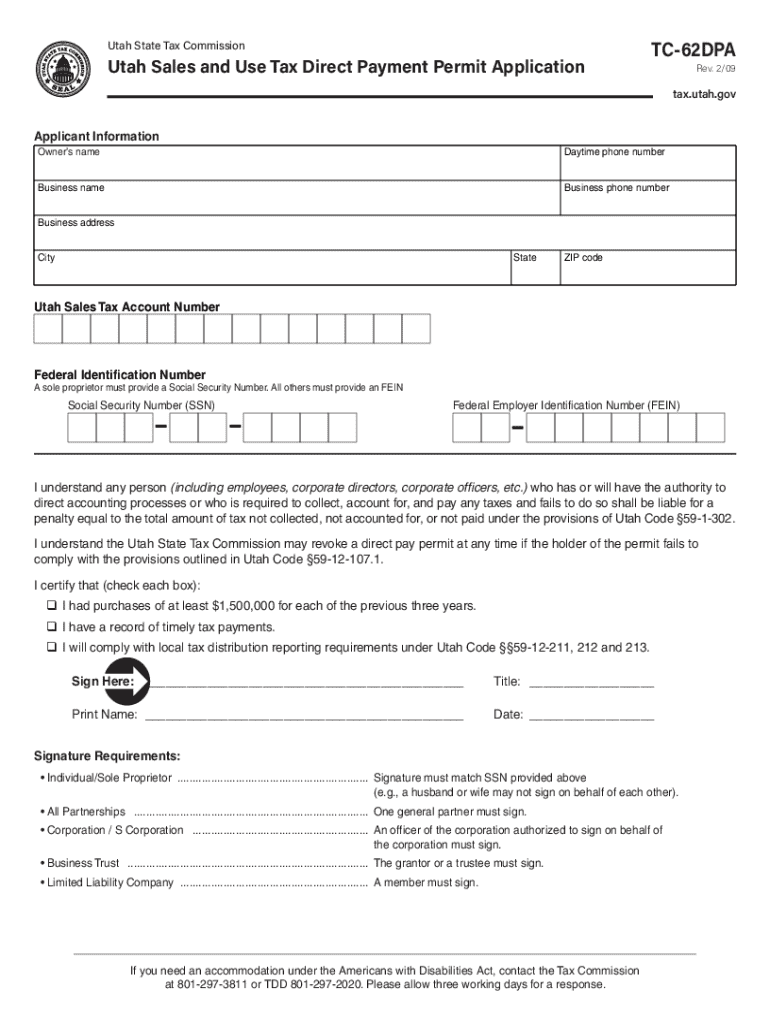

The tc-62dpa form plays a crucial role in managing sales transactions within Utah. Specifically, it serves as a Sales and Use Tax Direct Payment Permit application, allowing businesses and individuals to defer the payment of sales tax directly to vendors. This is particularly beneficial for businesses engaged in significant purchases, enabling them to manage cash flow more effectively.

Common scenarios requiring the tc-62dpa form include large-scale purchases of goods or services where sales tax liability is considerable. Real estate transactions, automotive sales, and patronage for businesses often necessitate this form to manage sales tax more efficiently.

Step-by-step guide to filling out the tc-62dpa form

Filling out the tc-62dpa form requires careful attention to detail. The initial step involves entering personal details, which includes information such as names, addresses, and contact details. Accuracy is paramount here; a small error can lead to delays in the sales tax payment process.

The second section focuses on sales information. This includes specifying the types of goods purchased and their costs. For instance, if you're acquiring commercial equipment or furniture for your office, enter the total cost along with any specifics that pertain to the items. A comprehensive listing enhances clarity and compliance.

Interactive tools for managing your tc-62dpa form

Utilizing pdfFiller for managing your tc-62dpa form enhances your experience with editing and collaboration features. Highlights of the platform include the ability to edit PDFs directly, add logos or branding, and personalize forms to align with your business identity. This ability to customize means your forms can reflect a professional look.

Collaboration tools facilitate team submissions, allowing for real-time editing and feedback. Users can share the form with multiple team members, ensuring everyone contributes effectively to the process. This collaborative feature aligns well with teams from various sectors like real estate or automotive.

Common mistakes to avoid

When filing out the tc-62dpa form, many users overlook essential sections, which can jeopardize the application process. Misinterpreting language in the form can also lead to confusion. Always ensure compliance with instructions provided on the form itself, double-checking each entry surrounding sales tax implications.

A solid strategy for avoiding common pitfalls includes creating a checklist of required information. For instance, ensure that all financial figures are accurate and that there are no typographical errors that could lead to discrepancies.

How to edit and update your tc-62dpa form

Editing the tc-62dpa form should be a straightforward task, especially with pdfFiller's tools. For small amendments, simply open the form and make adjustments. If significant changes are necessary, consider the legal considerations surrounding any modifications made to ensure compliance.

Moreover, it's essential to save changes effectively to maintain an accurate version history. This practice helps track any alterations and ensures that the most updated version of the form is being reviewed by stakeholders.

Ensuring compliance with Utah sales regulations

Understanding applicable laws when working with the tc-62dpa form is crucial. This directly influences how businesses manage their sales tax obligations and how they file taxes related to direct payment permits. Utilizing pdfFiller not only simplifies the editing process but also assists businesses in staying compliant with sales regulations.

It’s vital to keep abreast of regulatory changes that may impact your use of the tc-62dpa form. Utilizing the resources available through pdfFiller can provide insights into these changes, ensuring you remain compliant.

Real-life case studies

Analyzing successful transactions that utilized the tc-62dpa form provides useful insights. For example, a local automotive dealership effectively leveraged this form to manage multiple large-scale transactions, leading to improved cash flow and operational efficiency. Key takeaways from their success included adherence to submission timelines and accurate sales entries.

Conversely, outlining common pitfalls helps highlight areas for improvement. One small business initially struggled with the accuracy of their form submissions, leading to a delay in tax permit processing. After restructuring their approach and adopting checklist strategies, they successfully submitted future forms without issue.

Best practices for document management beyond the tc-62dpa form

Moving beyond the tc-62dpa form, an effective document management strategy promotes organizational efficiency. Maintaining a digital filing system that categorizes by form type or purpose can streamline retrieval processes and enhance team collaboration.

Secure storage options are critical in protecting sensitive documents. Utilizing pdfFiller's cloud-based solutions ensures that documents are not only easily accessible but also safeguarded against unauthorized access. This layered approach to document management is essential for compliance with regulations.

What’s hot in document management

The document management landscape is evolving rapidly, with trends focused on enhanced efficiency and collaboration. Solutions like pdfFiller are at the forefront, introducing features that prioritize user experience and ease of access. Current trends include a push for cloud-based solutions and integrated eSign capabilities, which streamline processes in a way that traditional methods cannot.

Furthermore, features that allow real-time collaboration, automatic updates, and compliance tracking are becoming standard in the industry. As these tools continue to develop, users are likely to experience even more efficiency in managing their tc-62dpa form and other critical documents.

Frequently asked questions (FAQs)

When it comes to the tc-62dpa form, users often have various inquiries regarding eligibility and submission procedures. One widespread question concerns the specific scenarios that necessitate this permit. Essentially, businesses needing to defer their sales tax payments to vendors will typically be the ones filling the tc-62dpa form.

Additionally, guidance is often sought on submission timelines—specifically, when one should expect feedback on their applications. Promptly addressing these questions ensures smoother experiences for users, particularly when deadlines are approaching.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tc-62dpa utah sales and without leaving Google Drive?

How do I make edits in tc-62dpa utah sales and without leaving Chrome?

Can I sign the tc-62dpa utah sales and electronically in Chrome?

What is tc-62dpa utah sales and?

Who is required to file tc-62dpa utah sales and?

How to fill out tc-62dpa utah sales and?

What is the purpose of tc-62dpa utah sales and?

What information must be reported on tc-62dpa utah sales and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.