Get the free TC-69B

Get, Create, Make and Sign tc-69b

Editing tc-69b online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-69b

How to fill out tc-69b

Who needs tc-69b?

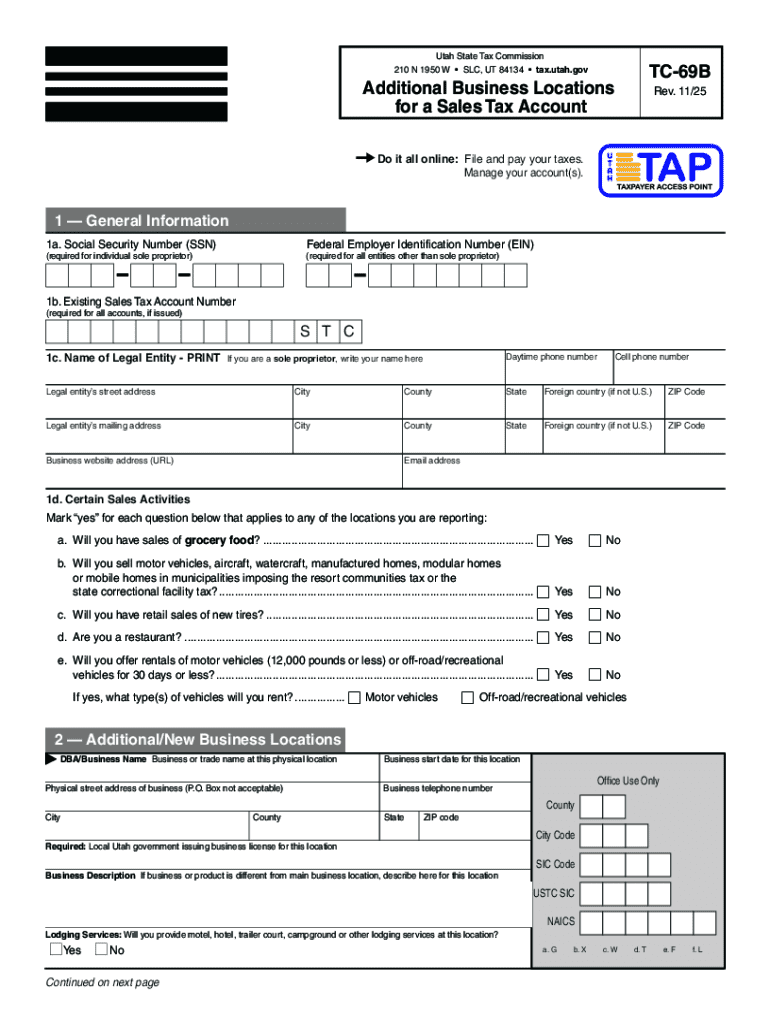

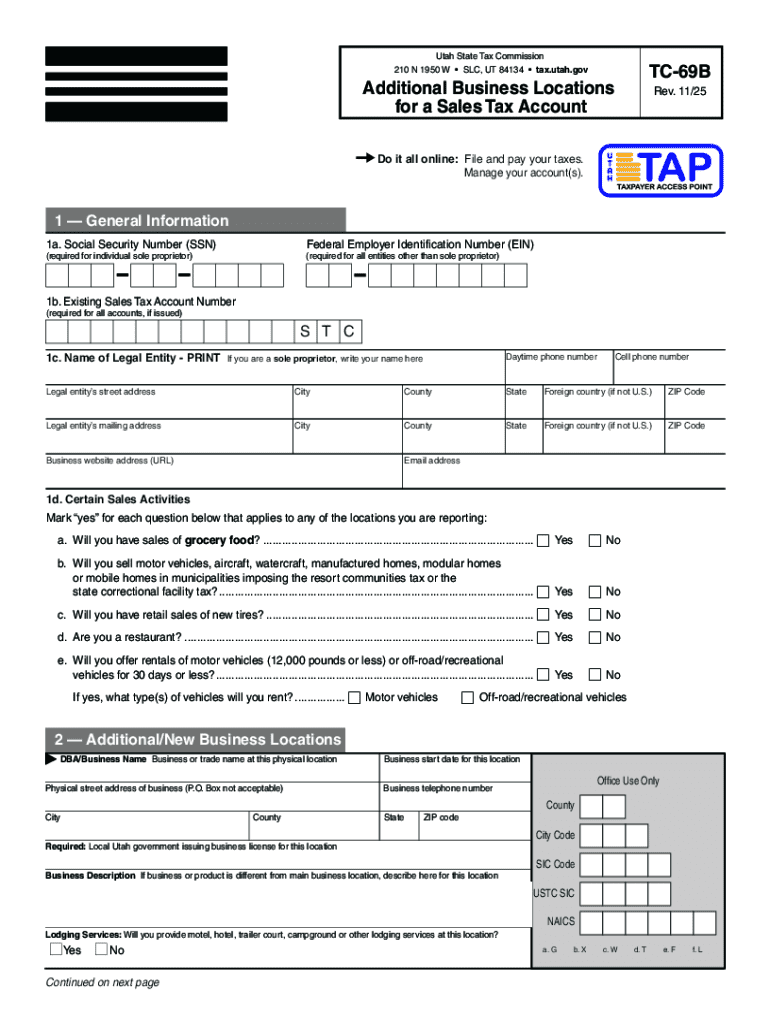

Understanding the tc-69b Form: A Comprehensive Guide

Overview of tc-69b Form

The tc-69b form is a critical document used primarily within the jurisdiction of tax proceedings in the United States. It serves to streamline various financial declarations by individuals and entities. By understanding its definition and purpose, users can ensure compliance with state tax laws while efficiently managing their financial submissions.

Anyone residing in Utah, especially Salt Lake City, or conducting business within the state, must familiarize themselves with the tc-69b form. It is essential for tax filings, particularly during state holidays when deadlines may be approaching. Inaccuracies in this form can lead to significant penalties.

Timely submission is paramount. Not only does delaying the submission lead to penalties, but it can also complicate future tax filings. Thus, understanding the tc-69b form is fundamental for both individuals and businesses.

Understanding the tc-69b format

The tc-69b form is available in several formats to cater to various user preferences. You can access it as a PDF, Word document, or even submit it directly online through e-services provided by the state. Each format offers unique advantages, such as easy editing in Word or direct submission online.

Key sections of the tc-69b form include:

Step-by-step guide to filling out the tc-69b form

Before you start filling out the tc-69b form, gather all necessary information to make the process smoother. Required documents often include previous tax returns, income statements, and any documentation related to deductions you're claiming. This preparation helps ensure you can accurately and fully complete the form.

Detailed instructions for each section include:

While filling out the form, avoid common pitfalls like accidentally omitting significant information or miscalculating figures. If you make a mistake, refer back to the section you were filling out, correct it, and ensure your final submission is accurate.

Editing and customizing the tc-69b form

Editing the tc-69b form is straightforward, especially when using platforms like pdfFiller. The step-by-step editing process allows you to easily select your document format and make necessary changes. To get started, upload the tc-69b form to the platform.

Once uploaded, you can add notes and comments directly on the document. This feature is especially useful for future reference or collaboration if you're working in a team. Best practices include:

eSigning the tc-69b form

Once you've filled out and edited the tc-69b form, the next step is to electronically sign it. This can be done easily through pdfFiller, where you can create a digital signature. Ensure that your signature meets state legality requirements to avoid any issues.

To ensure validity, it is crucial to follow these steps:

Managing your completed tc-69b form

Once you've completed and signed your tc-69b form, managing the document is equally important. Saving, downloading, and sharing should be your next actions. Utilizing cloud-based document management systems like pdfFiller allows you to store your forms securely and access them from anywhere.

Consider organizing your forms in folders to keep track of different submissions or tax years. This organization ensures you can retrieve your documents swiftly when needed, saving you time and effort.

Other advantages of cloud-based management include:

Frequently asked questions (FAQs) about the tc-69b form

Addressing common questions about the tc-69b form can ease many users' anxieties. For instance, if you encounter common issues such as how to rectify mistakes after submission, focus on understanding amendment processes available under Utah tax laws.

Key deadlines are important to consider. Always be aware of submission dates, especially around state holidays when many state operations may halt. To gain clarity, one can visit appropriate state e-services or contact local tax offices for guidance.

Conclusion: The benefits of using pdfFiller for your tc-69b form needs

In summary, utilizing pdfFiller for your tc-69b form needs offers numerous advantages. The platform empowers users to seamlessly edit their documents, sign them electronically, and manage submissions effortlessly. This streamlining of the document handling process is invaluable, especially for individuals and teams navigating complex forms in Utah.

By prioritizing efficiency and organization when dealing with the tc-69b form, users can ensure compliance with state tax laws, ultimately saving time and avoiding potential penalties. Transitioning to an efficient document handling platform like pdfFiller not only addresses these concerns but enhances the overall experience. Embracing this method ensures that your documents are managed correctly and securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tc-69b on a smartphone?

How do I complete tc-69b on an iOS device?

How do I edit tc-69b on an Android device?

What is tc-69b?

Who is required to file tc-69b?

How to fill out tc-69b?

What is the purpose of tc-69b?

What information must be reported on tc-69b?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.