Understanding the Minnesota Housing Tax Credit Form: A Comprehensive Guide

Overview of the Minnesota Housing Tax Credit

The Minnesota Housing Tax Credit is designed to promote the development and rehabilitation of affordable housing across the state. It plays a pivotal role in ensuring low-income families and individuals have access to safe, stable, and affordable housing options. By offering significant financial incentives, the program encourages developers and property owners to create housing that meets the needs of those who may otherwise struggle to afford decent living conditions.

One of the most crucial aspects of the Minnesota Housing Tax Credit is its ability to stimulate economic growth in local communities. By investing in affordable housing, the program not only aids low-income families but also creates jobs and revitalizes neighborhoods. This multiplier effect significantly contributes to the overall well-being of the state's economy.

By incentivizing construction and rehabilitation, the program helps increase the number of affordable units available.

Supports job creation in construction and related industries, boosting local economies.

Directly assists families needing access to affordable housing, improving their quality of life.

Understanding the Minnesota Housing Tax Credit Form

Navigating the Minnesota Housing Tax Credit form can be daunting for many developers and property owners. The form is a critical component in applying for the tax credits that facilitate affordable housing projects. Understanding the various forms available, each tied to specific use cases, is essential for maximizing the benefits of this program.

The Minnesota Housing Tax Credit program encompasses several forms tailored to different housing tax credit categories, such as the Qualified Allocation Plan (QAP) and the allocation certification. Each form includes distinct eligibility requirements that applicants must meet to successfully qualify for the program.

Used primarily for new construction and rehabilitation projects, this form sets the parameters for funding allocation.

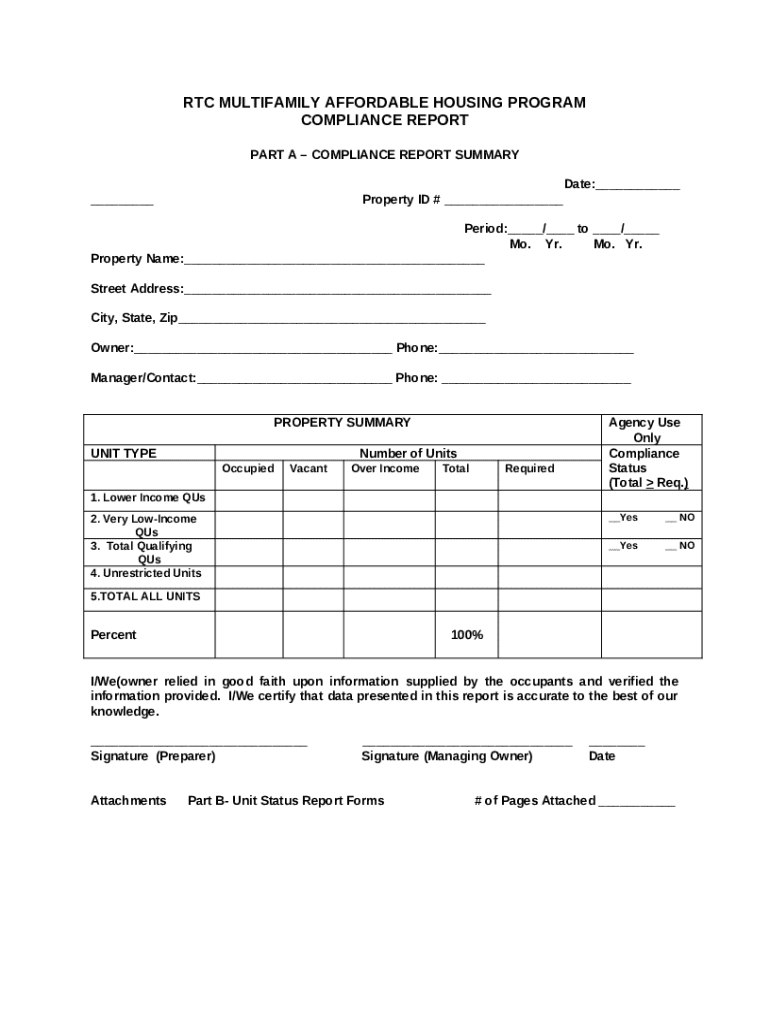

Required yearly to demonstrate continued compliance with affordable housing regulations.

Captures specifics about the development properties involved in the tax credit application.

Eligibility requirements vary widely depending on factors such as property location and income restrictions. Developers must verify that their projects meet these criteria before proceeding with the application to avoid costly delays.

Step-by-step guide to filling out the form

Successfully completing the Minnesota Housing Tax Credit form requires meticulous attention to detail and thorough preparation. Start by gathering all necessary information to facilitate a smooth application process.

Essential for identifying both individuals and entities responsible for tax obligations.

Includes documents showing household income levels, typically through pay stubs or tax returns.

Information regarding location, size, and specific features of the housing project.

Once you have gathered the required documents, the next step is filling out the application. Pay careful attention to each section:

Input your name, address, and contact details accurately to avoid processing delays.

Provide complete and accurate financial information to demonstrate eligibility.

Detail the specifics of the housing project, ensuring location and income levels are correctly represented.

Ensure that all required signatures are obtained before submission to verify authenticity.

Common mistakes during the application process can include omitting essential documentation or providing inaccurate information. Double-check all entries and seek assistance from professionals when necessary.

Submission process

Submitting your Minnesota Housing Tax Credit form correctly is just as important as filling it out accurately. Fortunately, there are several options for submission, allowing users flexibility in how they complete the process.

Utilize platforms like pdfFiller for easy electronic submission, allowing for quick processing.

You can submit forms via mail or fax, but be mindful of the time and potential for delays.

Make sure to note the submission deadlines, as missing them can mean losing your opportunity for tax credits. Each tax year may have specific timelines for when applications should be submitted, so it's essential to stay informed.

Post-submission considerations

Once your application for the Minnesota Housing Tax Credit is submitted, tracking its status is crucial to ensure timely approvals and avoid any misunderstandings. Most taxing authorities allow applicants to check their application status online or via a contact helpline.

Access online portals provided by the housing authority to get updates on your application.

Reach out to designated personnel at the local housing authority for any clarifications.

Be prepared to respond promptly to any requests for additional information from the tax authority. Clear communication can ease the process significantly and result in quicker approvals. Keeping your documents organized will facilitate swift responses to these requests.

Interpreting your tax credit award

Receiving an award letter for the Minnesota Housing Tax Credit marks an important step in the affordable housing development process. Understanding what is outlined in your award letter is essential to maintain compliance.

Review the amount awarded carefully, as it determines the financial support you will receive.

Read through any conditions attached to the award, as non-compliance can lead to losing benefits.

Once awarded, familiarize yourself with compliance obligations associated with the tax credit. This may include regular reporting on the status of your property and maintaining documentation in case of audits. Good record-keeping is critical for future tax purposes.

FAQs about the Minnesota Housing Tax Credit

Understanding the intricacies of the Minnesota Housing Tax Credit often leads to questions about eligibility, processing times, and general procedures. Below are some commonly asked questions that can guide applicants through the program.

Eligibility typically includes low-income families, individuals, and businesses involved in affordable housing development.

The timeline can vary, but applicants can generally expect a response within a few weeks to several months, depending on processing speed.

Many believe that the process is overly complex and not worth the effort, but with proper preparation, the application can be manageable and valuable.

Related tax credits and programs

In addition to the Minnesota Housing Tax Credit, several other housing credits and programs exist at both state and federal levels. Various initiatives aim to support affordable housing development and can work in conjunction with the Minnesota tax credit.

Provides similar benefits at a national level, offering credits to developers and property owners who create affordable rental properties.

A federal program assisting very low-income families, the elderly, and disabled individuals in affording housing.

Offers various funding opportunities aimed at economic growth that complement housing development efforts.

Leveraging multiple programs effectively can significantly enhance financial aid opportunities for developers, ensuring projects come to fruition and address housing needs within communities.

Tools and practical tips for effective document management

Navigating documentation for the Minnesota Housing Tax Credit can be challenging without the right tools. Honestly managing your documents for critical deadlines boosts the likelihood of a successful application and subsequent compliance. Using resources such as pdfFiller can simplify the process.

Utilizing pdfFiller allows seamless storage, editing, and organizing of your forms online, enhancing accessibility.

Working with multiple parties on your tax credit form becomes more efficient through eSigning and real-time edits.

Moreover, keeping your documents organized is essential for tracking financial and legal compliance. Implementing a system for arranging documentation with clear labels and categorized folders can save time and reduce stress, especially during audits or evaluations.